- China will likely ban all bitcoin mining soon

- Country’s top financial regulator homes in on the source.

- reader comments

- Share this story

- Further Reading

- Further Reading

- Will china ban bitcoin

- Top Chinese Fintech Magazine Lists Reasons Behind China’s Crypto Mining Ban

- Top Chinese Fintech Magazine Lists Reasons Behind China’s Crypto Mining Ban

- China bans financial, payment institutions from cryptocurrency business

- Is Bitcoin Banned in China?

- Chinese Government Concerned About Fraud

- China May Try to Block All Bitcoin Transactions in the Country

- Broad Clampdown Includes P2P & OTC Platforms

- Blocking Access to Bitcoin Exchanges Abroad

- Blocking External Bitcoin Network Nodes

- Bitcoin Miners Will Be Affected Too

China will likely ban all bitcoin mining soon

Country’s top financial regulator homes in on the source.

Tim De Chant — May 24, 2021 4:12 pm UTC

reader comments

Share this story

Bitcoin took investors on another rollercoaster ride over the weekend after a top regulator in China announced a crackdown on mining, a new tack in the country’s ongoing fight against the cryptocurrency.

The government will “crack down on bitcoin mining and trading behavior and resolutely prevent the transfer of individual risks to the society,” said the statement, which was issued by the Financial Stability and Development Committee of the State Council, the country’s cabinet equivalent. The committee is chaired by Vice Premier Liu He, who acts as President Xi Jinping’s top representative on economic and financial matters.

“The wording of the statement did not leave much leeway for cryptocurrency mining,” Li Yi, chief research fellow at the Shanghai Academy of Social Sciences, told the South China Morning Post. “When all mining activities are banned in China, it will be a turning point for the fate of bitcoin, as a large chunk of its processing power is taken out of the picture.”

The Chinese government isn’t just worried about financial stability, either. A commentary piece in Xinhua News, the Communist Party’s official media outlet, elaborated on the government’s stance, voicing concerns about bitcoin’s role in money laundering, drug trafficking, and smuggling. It also mentioned bitcoin’s profligate energy use. Last week, China warned financial institutions not to participate in crypto-transactions or related services.

Further Reading

China’s hardening stance toward bitcoin comes as the highest-valued cryptocurrency is under increasing scrutiny for its outsize carbon footprint. Fewer than two weeks ago, Elon Musk announced that Tesla would no longer be accepting bitcoin to buy one of its electric vehicles. When Tesla’s bitcoin purchase policy was announced, the bitcoin cost of a Model 3 produced about 400 metric tons of carbon dioxide, compared with just 8.85 metric tons to make and drive the car over its lifetime. When Musk canceled the policy—a decision apparently influenced by Ars’ coverage—the Model 3’s bitcoin carbon footprint had swelled to more than 500 metric tons. “We are concerned about rapidly increasing use of fossil fuels for Bitcoin mining and transactions,” he wrote in a tweet.

The bitcoin network demands a staggering amount of energy. Today, it uses as much power as the Netherlands to maintain its normal operations. That load must be particularly obvious to the Chinese government, since a recent Nature Communications paper estimated that 75 percent of all bitcoin mining happens in China.

Further Reading

China’s warning to bitcoin miners is certain to push many operations out of the country. At least one bitcoin observer said that he anticipates miners pushed out of China will set up operations in Mongolia, Kazakhstan, and Afghanistan.

Источник

Will china ban bitcoin

Рейтинг фиатных валют

Выигравшие и проигравшие

API для торговли криптовалютой

Виджеты для сайта

Top Chinese Fintech Magazine Lists Reasons Behind China’s Crypto Mining Ban

Top Chinese Fintech Magazine Lists Reasons Behind China’s Crypto Mining Ban

CaiXin Magazine, a leading Chinese financial and business media outlet, listed the reasons behind Beijing’s decision to ban Bitcoin mining and trading. These were shared by blockchain journalist Colin Wu (@WuBlockchain), who reports exclusively on China’s blockchain developments.

«Caixin magazine, which is most recognized by Chinese financial officials, disclosed some of the reasons why Beijing wants to crack down on Bitcoin mining and crypto: 1. Chinese listed companies do not do their own business, they buy mining machines and build mines.»

Earlier this month, China banned financial institutions and payment companies from providing crypto-based services, warning investors against trading digital assets like Bitcoin. Individuals can still hold Cryptocurrency, but exchanges and initial coin offerings have been barred.

China Bans Crypto Trading And Payment Services

According to the State Council’s Financial Stability and Development Committee, China will crackdown on Bitcoin mining and trading activities to fend off financial risks. The crackdown will include illegal activities in the securities markets.

Vice Premier Liu He chaired a meeting in which the committee stated that they would maintain the stability of stock, bond, and forex markets. Liu is the most senior Chinese official to order the crackdown against bitcoin publicly. It marks a first wherein the state council has stepped in to target crypto mining activities.

This follows a statement issued by three Chinese industry bodies: the National Internet Finance Association of China, the China Banking Association, and the Payment, and Clearing Association of China, who stated that the speculative trading of crypto infringes on the safety of people’s property and is disruptive to the normal economic and financial order.

According to some estimates, China accounts for 70% of the world’s crypto supply, contributing to big business but hardly reflects on the nation’s overall economy. As Bitcoin and Ethereum continue to fall, the Chinese government and financial regulators cannot figure out regulatory measures for the crypto industry.

Reasons From Sources Close To Top Financial Execs

CaiXin’s article has feedback from the sources close to the People’s Bank of China and other government agencies. The top financial brass has issues because Chinese listed crypto companies do not run their own business.

They buy mining machines and build mines instead. Beijing is also unhappy with Inner Mongolia’s reduction of energy consumption. It’s not up to Beijing’s standards and hence is at the receiving end of the mining crackdown.

The crypto-mining economy does not contribute to China’s real economy while seizing the production capacity of other chip-making facilities. The crypto sector is a bubble, according to top aides in Beijing.

There is also a greater risk posed to the older generation, who have less experience in crypto-trading. Regulators want to cancel mining and Bitcoin altogether, but that is not feasible. Caixin also pointed out that the existing regulatory measures are inadequate.

The volatile crypto market has resulted in substantial financial regulations and the entry of many interested participants into the crypto market. While some regulatory authorities believe that crypto is based on hype, there are instances where digital assets have been noted to be a frontier of innovation.

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Источник

China bans financial, payment institutions from cryptocurrency business

China has banned financial institutions and payment companies from providing services related to cryptocurrency transactions, and warned investors against speculative crypto trading.

It was China’s latest attempt to clamp down on what was a burgeoning digital trading market. Under the ban, such institutions, including banks and online payments channels, must not offer clients any service involving cryptocurrency, such as registration, trading, clearing and settlement, three industry bodies said in a joint statement on Tuesday.

“Recently, crypto currency prices have skyrocketed and plummeted, and speculative trading of cryptocurrency has rebounded, seriously infringing on the safety of people’s property and disrupting the normal economic and financial order,” they said in the statement.

China has banned crypto exchanges and initial coin offerings but has not barred individuals from holding cryptocurrencies.

The institutions must not provide saving, trust or pledging services of cryptocurrency, nor issue financial product related to cryptocurrency, the statement also said.

The moves were not Beijing’s first moves against digital currency. In 2017, China shut down its local cryptocurrency exchanges, smothering a speculative market that had accounted for 90% of global bitcoin trading.

In June 2019, the People’s Bank of China issued a statement saying it would block access to all domestic and foreign cryptocurrency exchanges and Initial Coin Offering websites, aiming to clamp down on all cryptocurrency trading with a ban on foreign exchanges.

The statement also highlighted the risks of cryptocurrency trading, saying virtual currencies «are not supported by real value», their prices are easily manipulated, and trading contracts are not protected by Chinese law.

The three industry bodies are: the National Internet Finance Association of China, the China Banking Association and the Payment and Clearing Association of China.

Источник

Is Bitcoin Banned in China?

Shobhit Seth is a freelance writer and an expert on commodities, stocks, alternative investments, cryptocurrency, as well as market and company news. In addition to being a derivatives trader and consultant, Shobhit has over 17 years of experience as a product manager and is the owner of FuturesOptionsETC.com. He received his master’s degree in financial management from the Netherlands and his Bachelor of Technology degree from India.

Earlier this month, the People’s Bank of China (PBOC) which is the central regulatory authority that regulates financial institutions and drafts the monetary policy of the country, issued a statement that “it would block access to all domestic and foreign cryptocurrency exchanges and ICO websites.”

As per the news, China aims to clamp down on “all cryptocurrency trading with a ban on foreign exchanges.”

China has recently been issuing regular advisories and taking steps to deter the use of cryptocurrency in the country. The recent development can completely eliminate cryptocurrency trading and mining activities in the world’s most populous nation.

Chinese regulatory authorities had imposed a ban on initial coin offerings (ICO), a cryptocurrency-based fundraising process, and termed it illegal in China in September 2017. That ban triggered an instant 6% decline in bitcoin prices. Following the ban, the Shanghai-based BTCC bitcoin exchange was forced to close its Chinese trading operations. (For more, see China Intensifies Crackdown On Bitcoin Mining.)

These regulatory actions by China are aimed at controlling the increasing mania involving decentralized, non-regulated cryptocurrencies which have recently soared to astronomical valuations. However, despite the ICO ban and momentary decline, cryptocurrency trading continued in China, as many participants switched to foreign exchanges, like those based in Hong Kong and Japan, to deal in virtual currencies. (See more: China’s Cryptocurrencies Have Gone Underground.)

In a series of measures, the PBOC is tightening regulations on domestic dealers engaged in foreign cryptocurrency transactions and ICOs. It has also forbidden China-based financial institutions from any dealing and funding in cryptocurrency linked activities.

Chinese Government Concerned About Fraud

The recent announcement effectively puts a ban on the use of cryptocurrencies in China, and comes as the People’s Bank of China is seeing increasing turnover in overseas transactions leading to regulatory compliance evasion. (See also: China To Crack Down On International Cryptocurrency Trading By Its Citizens.)

This leaves room for a lot of risk for the monetary system due to the unlawful issuance of cryptocurrencies, which may also involve multi-level marketing and Ponzi schemes to scam less crypto-savvy citizens out of their hard-earned money.

The PBOC views virtual currencies as illegal, since they are not issued by any recognized monetary institution, don’t hold any legal status that can make them equivalent to money, and hence advises against their circulation as a currency.

However, realistic implications of the ban still remain uncertain, and it’s unlikely they will effectively eliminate cryptocurrency trading completely. China is home to a large number of bitcoin mining farms as a lot of regions offer cheap subsidized electricity, making mining a profitable venture.

Many agree that the ban by Chinese authorities will have a negative impact on the overall digital currency market. Stricter regulations by the PBOC will «definitely weigh on the cryptocurrency universe,» said Wayne Cao, who runs a company that recently offered 10 billion tokens in an ICO.

In January 2018, Bobby Lee, CEO and co-founder of BTCC (which closed its China operations), expressed hope that “It’s only a matter of time before China lifts the crypto exchange ban.” During an interview with CNBC, Lee said the resilient nature of cryptocurrencies will enable them to spring back following more regulations.

Questions remain on the effectiveness of the regulations because taming the decentralized, regulation-free blockchain-based virtual currency market will remain a big challenge for any real-world regulator. (See also, Which Countries Benefit From China’s Crackdown On Bitcoin Mining?)

Investing in cryptocurrencies and other Initial Coin Offerings («ICOs») is highly risky and speculative, and this article is not a recommendation by Investopedia or the writer to invest in cryptocurrencies or other ICOs. Since each individual’s situation is unique, a qualified professional should always be consulted before making any financial decisions. Investopedia makes no representations or warranties as to the accuracy or timeliness of the information contained herein.

Источник

China May Try to Block All Bitcoin Transactions in the Country

The Chinese authorities may be moving toward a broad clampdown on Bitcoin, including peer-to-peer (P2P) exchanges and over-the-counter (OTC) trading platforms. Using the Great Firewall to block IP addresses, access to foreign bitcoin exchanges could be blocked and the Bitcoin transaction network could be disrupted within the country. Bitcoin miners are also worried that their operations could be restricted.

Broad Clampdown Includes P2P & OTC Platforms

Chinese authorities have reportedly informed several industry executives at a closed-door meeting in Beijing on Friday that they are “moving toward a broad clampdown on bitcoin trading,” according to the Wall Street Journal on Monday. Citing people familiar with the matter, the news outlet wrote:

Regulators have decided on a comprehensive ban on channels for the buying or selling of the virtual currency in China that goes beyond plans to shut commercial bitcoin exchanges.

“Until last week, many entrepreneurs in China’s Bitcoin circles had thought authorities might shut down only commercial trading activity while tolerating peer-to-peer, or over-the-counter, bitcoin platforms, which enable buyers and sellers to find each other and trade directly,” the publication further detailed.

Last week, Bitkan suspended its OTC cryptocurrency trading service. The suspension, which began on September 14, affects the platform’s mobile app and site for BTC and BCC OTC services, the company announced.

Blocking Access to Bitcoin Exchanges Abroad

The Wall Street Journal also noted on Monday that, according to “people familiar with the matter”:

A broader clampdown will likely include blocking mainland access to websites of foreign bitcoin exchanges such as Coinbase in the U.S. and Bitfinex in Hong Kong.

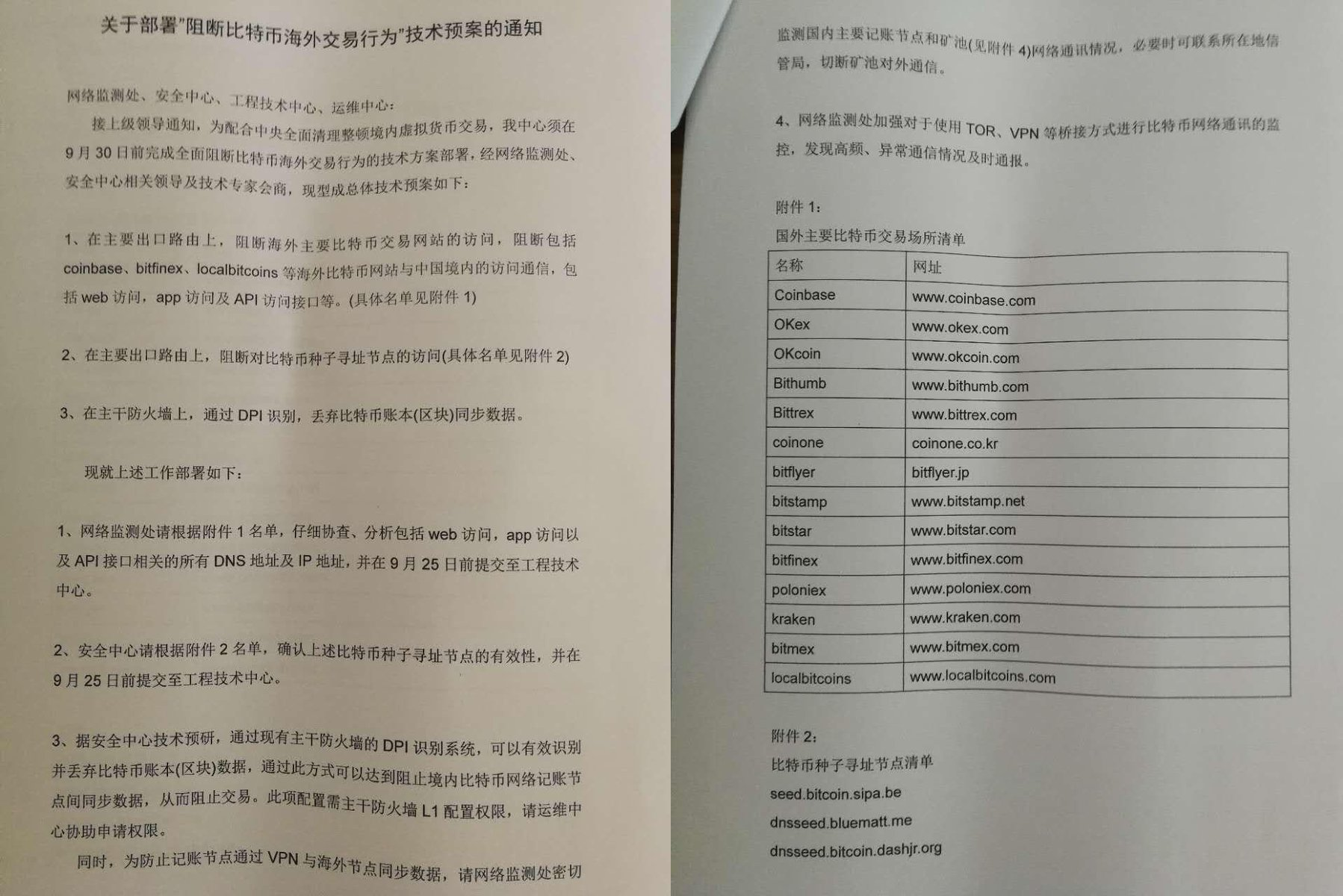

This concurs with a document which surfaced last week detailing how the Chinese government will try to block access to bitcoin exchanges and other important services that reside outside of the country. While the document is unverified, Sina claimed that it is authentic.

The bitcoin exchanges specifically named in the document include Coinbase, Okcoin, Bithumb, Bittrex, Coinone, Bitflyer, Bitstamp, Bitfinex, Poloniex, Kraken, Bitmex, and Localbitcoins.

Blocking External Bitcoin Network Nodes

The document also indicated an attempt to disrupt the basic P2P network routing of Bitcoin itself inside the country, which could disrupt the flow of bitcoins across the border. The government will monitor the network communication between domestic nodes and pools to prevent domestic nodes from syncing with nodes abroad. In addition, Bitcoin network communication bridges will be monitored including Tor and Virtual Private Networks (VPNs).

Bitcoin Miners Will Be Affected Too

While China’s bitcoin trading volume has fallen, its mining market share remains the largest in the world. The same aforementioned entrepreneur told the Wall Street Journal:

Until now, Chinese miners considered themselves immune from Beijing’s evolving stance on bitcoin trading. One entrepreneur said miners are now worried about authorities moving to limit their operations.

“With the tightening of the monitoring policy of bitcoin, the mining business is also affected,” a 21st Century Economic News reporter wrote on Tuesday. A Shenyang mining equipment dealer told the reporter that mining equipment does not sell well right now because of the current panicked market sentiment. With the domestic bitcoin trading platforms closing down and the prospect of overseas trading channels blocked, “mining business will be hit hard,” he said.

Do you think China will crackdown on all of the above bitcoin trading channels and harm their own mining industry? Let us know in the comments section below.

Images courtesy of Shutterstock, Asian Correspondent, and Sina

Need to calculate your bitcoin holdings? Check our tools section.

Источник