- Why Bitcoin Will Continue to Grow

- Daniel Krawisz

- February 1, 2014

- The Value of Money is the Value of a Community

- The Network Effect for Currencies

- The Meaning of Bitcoin’s Upward Trend

- The End of the Trend

- Bitcoin Price Prediction: How Much Will BTC Be Worth In 2021 And Beyond?

- Bitcoin Price Prediction

- Bitcoin Price Changes

- Bitcoin Outlook: Where We Are Now

- Top Bitcoin Price Prediction for 2020

- LongForecast Price Prediction for 2020

- DigitalCoinPrice Price Prediction for 2020

- Bitcoin Price Prediction for 2021

- DigitalCoinPrice Price Prediction for 2021

- LongForecast Price Prediction for 2021

- Long-Term Bitcoin Price Prediction: 2022-2025

- DigitalCoinPrice Price Prediction for 2022-2025

- LongForecast Price Prediction for 2022-2025

- Vinny Lingham Price Forecast

- Tim Draper Price Vision for 2021

- John McAfee’s Bitcoin Price Prediction

- Stephen Perrenod’s Thoughts

- Conclusion: Bitcoin Price Prediction

- How Has The Price Of Bitcoin Changed In The Past?

- At the Dawn of Bitcoin

- Price Fluctuations in 2011-2012

- Bitcoin in 2013-2016

- Crypto trading insights: Changelly’s interview with a professional trader

- Bull Run in 2017

- Correction in 2018

- What Factors Affect The Price Of Bitcoin

- Supply and Demand

- Market Competition

- Key Things of When Trading Bitcoin

- Is Bitcoin a Good Investment?

- What Will Be Bitcoin Worth in 2030?

- How Much Does It Take to Invest in Bitcoin?

- Will Bitcoin Ever Die?

- How Many Bitcoin Tokens Are Left?

- Can Bitcoin crash?

Why Bitcoin Will Continue to Grow

Daniel Krawisz

February 1, 2014

The Value of Money is the Value of a Community

Currencies are unusual in that their usefulness as currencies is a result of their demand. The more deals that can potentially be made with one, the better it is. It is only indirectly because of a currency’s inherent properties that it can turn into a good currency. To an alien with no interest in human culture or technology, both dollars and bitcoins would be equally worthless, even though he would be able to see that bitcoins are a superior medium of exchange.

In economics, this is often called the network effect because it is the network of people using it that convinces everyone that the good has value. This can appear to lead to circular reasoning: everyone believes it has value because everyone else believes it has value because everyone else believes it has value… and so on. It is almost like a cartoon monkey that picks itself up by the end of its own tail!

However, a better physical metaphor might be the formation of crystals. A liquid can be supercooled into a state that can support crystals, but no crystals form because there are no initial crystals that the liquid particles can attach to. However, once a tiny impurity, or “seed” is introduced into the liquid, a crystal will form around it and grow quickly until the liquid has been absorbed.

By this metaphor, the supercooled liquid is the world as of a few years ago, ripe for a monetary revolution, and the seed is the initial bitcoin purchase. The fact that Bitcoin successfully transformed into something with value seems like a miracle. However, it was no miracle. It was a result of the dedication and faith of its community, whose members will not let go of the beautiful vision of a Bitcoin future. It might be better to use a word like “crystallization” to describe the formation of the initial “seed” of Bitcoin trading rather than a metaphor like “bootstrapping”, which depicts a physical paradox. 1

Thus, when people dismiss Bitcoin as valueless and call every upward price movement a bubble, they are really missing the point. An investment in bitcoins is an investment in the Bitcoin community. It was in late 2012 that I came to realize just how wonderfully fanatical this community was, and this was what convinced me to treat my bitcoins not as simply an utter speculation, but as something with very real prospects.

The Network Effect for Currencies

Social networks are a familiar and often-cited example of the network effect. Facebook and G+ both have a lot of nice features, but the feature that makes Facebook so much more useful is that all your friends are already on it. Thus, it is really the network that uses Facebook that makes it valuable.

This example can be confusing when analogized to currencies. Facebook and G+ have the property that either can be used at a low opportunity cost of using another. In other words, if I am already spending some time crafting the most narcissistic Facebook status update that I can think of, there is little additional effort to posting it on G+ too. Both Facebook and Google support chat protocols, so there is little additional effort to using a program such as Jitsi that can run both protocols and log me in to both services simultaneously. Thus, it is possible for a social network to succeed without diminishing the size of the others. It can expect to attract members without necessarily drawing them away from the others.

However, for currencies the situation is different. Owning any one currency carries a high opportunity cost of owning any other. I cannot use the same money to buy an investment in bitcoins and in silver coins or Canadian dollars. If I want more of one, I necessarily must have less of another. If any one currency is acknowledged to be the winner over the rest, then there is no additional benefit for anyone to own other currencies.

While it is possible for two social networks to coexist, the world is not big enough for two currencies. Any initial disparity between two currencies, no matter how small, positively reinforces itself, and there is no reason to expect this effect to end until one currency is driven out of existence. As the price of currency A begins to rise relative to currency B, holders of currency B begin to see that their investment is looking less and less reasonable. As more people flee currency B, its decline accelerates until it has effectively ceased to be a currency.

This conclusion does not appear to be borne out by our everyday experience of different national currencies within each nation-state. This is explained by the fact that these states typically have legislation such as legal tender laws and capital controls that artificially reduces the usefulness of other currencies within their respective borders. There is no jurisdiction in which Bitcoin is legally privileged, so there is no group of people required to treat it differently than any other. Thus, there is no reason to expect Bitcoin ever to be in a stable equilibrium with national currencies, the way that they are in equilibrium with one another.

From these considerations, it follows that Bitcoin’s future is an all-or-nothing proposition. If Bitcoin is good enough to compete with other currencies despite their legal privileges, then it will overtake them. If not, then it is a bubble and eventually no one will want it but a few true believers.

It might be argued that Bitcoin could retain its uses on illegal markets, but there is no reason for a drug dealer to accept bitcoins as payment if there is no one who wants to use it as a store of value or as an investment. He must either want to keep it himself or have someone he can sell it to in order for him to use it. Thus, if Bitcoin fails as an investment, it fails as a payment system, even for purposes to which it is especially adapted.

The Meaning of Bitcoin’s Upward Trend

All things being equal, a larger network is better than a smaller one. This puts Bitcoin at a disadvantage with respect to national currencies. One would therefore expect Bitcoin to decline relative to dollars or euros. The fact that this is not the case tells us that all things are not equal. It shows us that Bitcoin is still good enough compared to the national currencies. It can grow anyway despite their advantages over it. The network effect means that the bigger Bitcoin gets, the better its prospects. The fact that Bitcoin has grown in the immediate past is strong evidence that it will continue to grow in the immediate future.

A possible objection is that Bitcoin’s demand is mostly investment demand rather than demand as a currency. Therefore, the objection goes, it is no longer the case that Bitcoin’s demand is self-promoting. However, a currency becomes more useful as a result of any kind of demand, not just demand as a currency. I would bet that most people who are invested in bitcoins today would be happy to get more by trading goods and services for them. They are also happy to serve as a facilitator for bitcoin trades via the dollar, which is effectively what happens when a merchant accepts bitcoins as payment and then immediately converts them to dollars. Thus, their investment demand enables more use of Bitcoin as a currency. By merely investing in Bitcoin, they enable more potential trades and make Bitcoin a better currency.

The interesting thing here is that we should expect the advantages of the national currencies over Bitcoin to decline as Bitcoin grows, and eventually to become disadvantages. Therefore, not only will Bitcoin’s expanding network further drive its growth, but the declining networks of its competitors will as well.

Based on this, my prediction for Bitcoin’s future growth is not just exponential growth, but faster than exponential growth. If it is successful I predict Bitcoin will take over the world faster than anybody expects, including myself. This prediction has been borne out in my own case: I am continually astonished by Bitcoin’s successes. Now one of my biggest fears in writing about Bitcoin is that my predictions will come true before I can publish them.

The End of the Trend

Predicting a change to Bitcoin’s growth trend requires thinking in terms of effects that are not relevant at present. This makes things difficult because it is hard to say what will become relevant first. It could be, for example, that Bitcoin’s growth will outpace its technology and the network will become congested enough that it hampers the adoption rate. If there was a concerted effort from governments around the world to destroy Bitcoin, this could greatly hamper Bitcoin’s growth as well—but at this point I doubt it could be stopped.

For now at least, Bitcoin’s present trend is self-reinforcing with no equilibrium in sight.

Crystallization implies a transition from liquid to solid, which is not appropriate for Bitcoin. An even better physical metaphor would be the more general concept of spontaneous symmetry breaking, which includes not just crystallization but all kinds of other processes without a transition from liquid to solid. However, unfortunately not enough people understand what that is to make it a good metaphor. ↩

Источник

Bitcoin Price Prediction: How Much Will BTC Be Worth In 2021 And Beyond?

Bitcoin is probably the most famous cryptocurrency in the world that is recognized both inside and outside the community. Many people still feel FOMO (fear-of-missing-out) regarding the purchase at the end of 2018, when the digital currency price decreased by $3,000. Yet, the market has a highly volatile nature, and the cryptocurrency prices can change dramatically within the next few months.

Changelly has been on the market for over five years now and managed to witness all the essential events. In this article, we are going to provide a Bitcoin price prediction for the next several years and try to find whether it is a good investment or not. Here we go.

Bitcoin Price Prediction

It is important to note that price predictions over cryptocurrencies should be seen as recommendations rather than call to action. As we mentioned earlier, the cryptocurrency market is incredibly volatile, so that no one will ever tell the exact price for the next several years. However, the first digital coin has been here for over a decade, and some experts can provide comprehensive predictions based on the currency’s price trend.

In this article, we will observe a range of price predictions provided by different enthusiasts and evangelists. What investment decisions to make? Stay tuned!

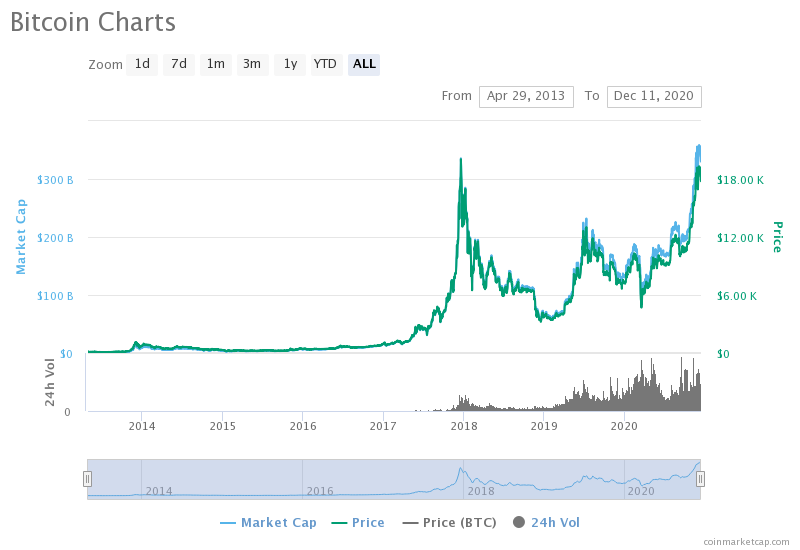

Bitcoin Price Changes

This November, the price fluctuations made users believe that the cryptocurrency could achieve an all-time-high rate (the previous historical high level was on December 17, 2017, with the price of $20,089 per 1 ₿). The year is not over and, perhaps, the coin can show us its record at the end of December.

Bitcoin Outlook: Where We Are Now

Top Bitcoin Price Prediction for 2020

This year is almost over. In this regard, it is interesting to check whether predictions for 2020 came true or not.

LongForecast Price Prediction for 2020

According to LongForecast, price should have varied in the range between $6871-9757 in January. Throughout 2020, the Bitcoin price was supposed to reach $9,306 by December 2020.

DigitalCoinPrice Price Prediction for 2020

According to another price prediction website digitalcoinprice.com, the price in 2020 was supposed to vary between $18,359 and $42,293. As of December 2020, we can say that this prediction has not met the expectations.

Bitcoin Price Prediction for 2021

It seems that everyone in the world wishes the next year to be better than in 2020 – not so bearish. We do hope that 2021 can bring the day of crypto mass adoption one step closer to us. This year was definitely the year of decentralized finance (DeFi). The main theme of 2021 (in terms of crypto) is still unknown, but we are sure that the crypto industry will reveal features and technological solutions. And the major cryptocurrency will take an essential part in its never-ending development.

We will observe the most popular and trusted Bitcoin price prediction websites in order to compare price forecasts for 2021.

DigitalCoinPrice Price Prediction for 2021

DigitalCoinPrice provides quite an optimistic price forecast for the next year. According to its algorithm, the ₿ price will meet an uptrend, which can be reflected in bitcoin’s value in general. The source predicts the price in 2021 to vary from $37,914.74 and up to $54,238.29. Such a prognosis makes the current prices look lucrative for long term investment.

LongForecast Price Prediction for 2021

On the contrary, LongForecast gives a more realistic price prediction for 2021. In this regard, LongForecast expects the prices to vary from $15,881 up to $33,379 during the year.

Long-Term Bitcoin Price Prediction: 2022-2025

Predicting the price of such a volatile entity as cryptocurrency is quite difficult. However, there are several predictions and opinions about the long-term price.

DigitalCoinPrice Price Prediction for 2022-2025

The DigitalCoinPrice price predictions tend to be positive (sometimes suspiciously positive). The service provides the following price predictions for the next several years. We took the maximum price BTC could gain in 2022-2025

In 2022

1 ₿ = $60,345 average

In 2023

1 ₿ = $68,478 average

In 2024

1 ₿ = $50,786 average

In 2025

1 ₿ = $48,019 average

LongForecast Price Prediction for 2022-2025

LongForecast provides price forecasts for the next five years. The price forecast is quite positive, but we might meet some decline in price in the middle of 2022. The algorithm suggests ₿ may cost $18,968 in July 2022, but the price will go up to $30,575 in October. In 2023, the price might suffer from strong fluctuations, resulting in BTC price decrease – the value of the main cryptocurrency can probably vary from $13,530 to $26,136.

Yet, 2024 can get back the cryptocurrency’s price back to the top. According to the prediction for 2024, the price might gain the mark of $47,132 per coin. 2025 will continue to hold price at a high level. There is a chance the coin will cost $46,232 at the beginning of 2025.

Vinny Lingham Price Forecast

Vinny Lingham, a co-founder of Civic, claims that the price can range from $100,000 to $1M by 2030.

Tim Draper Price Vision for 2021

Will Bitcoin keep rising? Here is a bullish scenario. A billion investor, Tim Draper, says that it will hit $250,000 by 2022. According to his words, people would be able to buy coffee for digital currencies in 2021.

John McAfee’s Bitcoin Price Prediction

Bitcoin is a real shitcoin, said McAfee antivirus creator John McAfee. He wrote that the future lies with altcoins in his Twitter account since they bypass the first cryptocurrency in technical specifications.

Whichever Bitcoin Maximalist came up with the term «Shitcoin» for all other coins;

But we all know that the future of Crypto rests with the Alt Coins.

Old, clunky, no security, no smart contracts, no DAPs ….

Is the true Shitcoin.

Earlier, he abandoned his $1 million forecasts for Bitcoin, calling it a trick to attract users.

Stephen Perrenod’s Thoughts

Analyst Stephen Perrenod believes that the assumption of multiple increases in the price of the first cryptocurrency will occur.

In his blog, the expert proposed a new model for calculating the future exchange rate. Unlike the previous ones, it takes into account not only the shortage of coins that will arise due to the limited issue and halving but also their residual supply.

Based on this, the analyst concluded that, with constant demand, the coin would rise in price against the background of diminishing inflation and rise to the $77,500 target within a decade. However, this figure may increase significantly, possibly even up to $100,000 if the value of the US dollar decreases, Perrenod added.

Conclusion: Bitcoin Price Prediction

We are looking forward to the future, but no one can tell you the exact price even for a week (we predict, but we are no future-tellers). However, all the price forecasts mentioned above are based on algorithms and mathematical and statistical prediction methods. The current uptrend might last for the next month or might pivot within hours. In this regard, it is vital to be aware of the movements and DYOR (do your own research) before investing in any digital assets.

How Has The Price Of Bitcoin Changed In The Past?

The history of the first cryptocurrency is full of ups and downs. It is important to understand the background of the currency in order to predict its behavior in the future. Let’s take a closer look at the bitcoin value trend over the past ten years.

At the Dawn of Bitcoin

The events that were saturated in 2010 gave an impetus to the first serious growth. It all started with the launch on February 6 of the BitcoinMarket.com crypto exchange, where 1 coin initially cost $0.003.

This was followed by the first online purchase of a physical product with payment by first digital currency. On May 22, 2010, that same legendary story happened with pizza’s purchase for 10,000 ₿. Jacksonville, Florida resident Laszlo Hanyecz ordered two pizzas from Papa John’s through the Bitcointalk forum, transferring these coins to the user who started the delivery. According to various estimates, at that moment, Hanyecz paid only $25–40 for his order.

A truly significant event took place on July 11. Then the first cryptocurrency was mentioned on the popular news resource Slashdot, which provoked a 10-fold increase in its price over the next five days, from $0.008 to $0.08 for 1 ₿. On the same days (07.17.10), the Mt.Gox exchange was launched, which subsequently was destined to have a fatal influence on the cryptocurrency markets repeatedly.

After several months of fluctuation in the range of $0.06–0.07 in October, coin’s cost began to overgrow. Within a month (November 6), the BTC rate reached $0.35 on the Bitcoin Market and $0.5 on Mt.Gox. At this point, the coin was worth 16.67 times more expensive than at the beginning of the year, and its capitalization reached $1 million.

Price Fluctuations in 2011-2012

After the rapid growth to $0.5 and the same rapid decline to $0.15, the coin continued to consolidate in the price range of $0.2-0.3 until the beginning of January 2011. Then the rate continues to move upwards, and on February 9, 1 ₿ at the cost of $1.

The growing popularity facilitates this due to its mention in the Hacker News and Twitter, an increase in the number of miners, as well as the launch of the Darknet site Silk Road, where BTC has become the main payment system.

In mid-April, when an essay was published in TIME magazine, its course finally broke the $1 mark and rose upwards so that it will never return to it.

On June 2, 1 ₿ was already worth $10. Over the next six days, a jerk was made to

$32 (June 8). After another four days, the exchange rate again fell to $10 and then jumped sharply to $25.

On June 19, the Mt.Gox crypto exchange was hacked, as a result of which hackers stole and made publicly available data from more than 61 thousand exchange customers.

Despite the relatively small losses, the news about this hack took effect, causing the coin to fluctuate seriously on other exchanges.

Then, in the first week of August, the cost dropped from $15 to $6. After a quick recovery to $12, the summer Bull run’s correction lasted until November, ending at around $2.5.

For the next year and a half, the price was in the accumulation stage with a gradual increase to $14. The only serious depreciation during this period (from $16 to $7) occurred in August 2012.

Bitcoin in 2013-2016

In mid-January 2013, a new cycle of rapid growth in coin’s cost began, which reached its peak on April 11; for 1 ₿ is equal to $266.

The bull run starts at the same level in November and by the end of the month. The price reaches $1240. This happens against the backdrop of positive news about the acceptance of tuition at one of the universities in Cyprus. Also, the announced support for payments by Zynga, a giant in the field of online game development, has a positive effect.

Started in late 2013, the corrective downward movement of the course became the longest (at that time) in history. Cryptocurrency winter lasted 411 days until mid-January 2015. During this time, the asset fell 86% from $1240 to $160.

Crypto trading insights: Changelly’s interview with a professional trader

On February 28, the owner of Mt.Gox, Mark Karpeles, announced at a press conference about the bankruptcy of the exchange and the loss of 744.4 thousand customer “due to system deficiencies.” At this point, on the exchange itself, the BTC price dropped to $100.

In early January 2015, the Bitstamp crypto exchange announced the hacking and theft of 19 thousand ₿. At this point, the rate drops to $170, but after the resumption of the work of the exchange, it begins to recover, reaching $300 in late January. Then begins a long period of consolidation in the range of $200-300.

In early August, hackers broke into the Bitfinex exchange and stole 120,000 ₿. The price drops below $500 for a short time, and then, until the end of October, the exchange rate flies around $600.

Then, by the end of the year, steady growth is observed at up to $1,000.

Bull Run in 2017

In early January 2017, the cost for the first time since the end of 2013 reached $1,150 but then fell to $750 during the week. By mid-March, the course is storming heights, briefly reaching $1,300-1,350. By the end of March, the price of BTC drops to $900, but within a month, it finally breaks the level of $1,350. In the last weeks of May, the coin is trading at $2,500-2,600, then adjusted to $1,800, so that in the first decade of June, it comes close to $3,000.

The course growth is facilitated by the rapid increase in the number of network users and bitcoin recognition as a legal tender by many companies and financial institutions around the world. An important role was also played by the opportunity given to holders to receive Bitcoin Cash (BCH) coins for free due to a hard fork on August 1.

Then, on the news of the launch of BTC futures by major US exchanges, almost recoilless rapid growth begins, and on December 7, the coin is trading at $16,500.

Correction in 2018

Throughout 2018, a correction of the rapid bull run of 2017 has been observed. The maximum rate in 2018 was a mark of $17,000. The subsequent fall is again accompanied by a fling of negative news from Korea, where authorities have advocated banning the anonymous trading of cryptocurrencies.

The fall in the rate continues until the beginning of February and reaches a minimum of the 6th day ($6000). Unfortunately, the breakdown of the bearish trend does not occur, and from this mark, the exchange rate rises again and drops to $5,800 by the end of June. Over the next 4.5 months, the Bitcoin chart continues to draw a triangle that has already become obvious to many, with a lower face in the region of $6,000.

After a slight rebound, the price continues to move down and on December 15 reaches an annual minimum of $3,200. Then, within 3 days, the price again returns to the region of $4,200.

Until the beginning of February 2019, the price continued to move in a downward corridor, for which the resistance became the level of $3,300.

On April 2, a breakdown of the level of $4,200 takes place and within a few hours, the price reaches $5,100. Subsequently, the news appears that the reason for this was the purchase by one buyer on several exchanges of 20 thousand ₿ at once. Many consider this a signal of the return of major players.

The rise in 2019 happened in June. The highest price was $13,275. The price increase may be due to the launch of bitcoin futures. This type of trading became popular in 2019. Since then, the price has been falling throughout the year.

What Factors Affect The Price Of Bitcoin

There are many factors that might affect the price. The crypto news, as well as news outside the world of cryptocurrencies, may influence the state of the price. Back in spring 2020, when the whole world was put on quarantine due to the COVID-19 situation, the price decreased together with the rest of the stock markets.

Moreover, the king of digital coins met its third halving this year. This means that the block reward was cut from 12.5 ₿ per block to 6.5 ₿ per one mined block. Such an important event also has an impact on BTC price.

Supply and Demand

There are 21,000,000 ₿. The circulating and total supplies are the same 18,567,418 ₿ (as of December 10, 2020).

Market Competition

Bitcoin is currently the leading cryptocurrency in the industry in terms of capitalization and monthly volume. The second place by its criteria takes Ethereum (ETH).

Key Things of When Trading Bitcoin

Unlike the regular stock markets, the cryptocurrency market is open 24/7. A trader should do the research to figure out the right time to day trade coins. For a more comprehensive answer, we suggest you read the article Invest in Bitcoin: how, where and when.

Is Bitcoin a Good Investment?

Considering all the factors mentioned above, the answer to the question will be positive. It is the first and major cryptocurrency in the industry. Many digital assets are Bitcoin forks, so in that way, ₿ will always be a relevant investment option.

What Will Be Bitcoin Worth in 2030?

There is no definitive answer to such a question. According to different price prediction services, Satoshi’s coin might gain an all-time-high next year. Consequently, the price will grow and meet the downtrend occasionally. There is a possibility that the price in 2030 will be over $30,000 per coin.

How Much Does It Take to Invest in Bitcoin?

As of now, the price of one ₿ is $31,887. However, if you want to invest in the first cryptocurrency, you can easily buy 0,004 BTC. For example, you invest $150 and get 0.00751 BTC. Mind also that you can instantly buy the coins with your credit card, bank transfer, or Apple Pay on Changelly.

Can’t load widget

Will Bitcoin Ever Die?

Obviously, there are also two possibilities: ₿ will either die or not in the future. The current BTC trend promises a bright future for the first cryptocurrency. However, you never know what brings tomorrow. As of now, it is doubtful that BTC will die in the near future.

How Many Bitcoin Tokens Are Left?

The coin has a maximum supply of 21,000,000 ₿. As of December 10, 2020, there are 18,566,543 ₿ in circulation, which means there are 2,433,457 ₿ of ‘spare tokens.’

Can Bitcoin crash?

The price can correct soon, but we are not sure it’s going to crash in the nearest future.

Источник