- Whales

- Contents

- What is a Bitcoin whale? [ edit ]

- Market Manipulation [ edit ]

- Crypto Whales News [ edit ]

- Bitcoin Whales and How They Make Market Waves

- What is a Bitcoin Whale?

- Rinse and Repeat

- Utilizing Buy and Sell Walls

- OTC Markets and Dark Pools

- The Infamous Bear Whale

- Whales Are Often Blamed for Big Market Shake Outs

- Bitcoin whales: what are they – and how are they affecting the cryptocurrency’s price?

- What is a bitcoin whale?

- How do whales impact bitcoin’s price?

- What does the future hold for bitcoin?

- Whale who sold Bitcoin before 2020 crash cashed out $156M before this week’s 20% dip

- Related Articles

Whales

Enjoyed the article? Share:

Bitcoin Whales are considered market players with significant funds that are able to move the cryptocurrency market. The large players being referred to are institutions such as Hedge Funds and Bitcoin Investment Funds. Some of these funds have announced their presence in the water.

The term “whale” is frequently used to describe the big money Bitcoin players that show their hand in the Bitcoin market. The ocean as a metaphor for the market is apt, since one can then extend it to include the big fish and the small fish; sharks; rallies as feeding frenzies; waves as market moves; and so forth. It may be, however, that the term “whale” has been applied to the wrong class of investor because the players described below are truly the biggest creatures in the ocean.

Contents

What is a Bitcoin whale? [ edit ]

The emergence of cryptocurrencies and the trading of this new asset class has created a bunch of slang words, that are especially used in social media sites such as Reddit. Besides the very popular expression hodl, the term whales is another slang word used in cryptocurrency trading. When markets are highly volatile big players, referred as whales, are usually considered as the source behind the market volatility. The analogy to the size of the whale, the biggest animal of the ocean, is the explanation for the use of this expression in such events. Hence a whale is a market actor that trades with significantly more money than the average investor, and is therefore able to move the price of cryptocurrencies.

The most noticeable Bitcoin whales:

- Pantera Capital

- Bitcoins Reserve

- Binary Financial

- Coin Capital Partners

- Falcon Global Capital

- Fortress

- Bitcoin Investment Trust

- Global Advisors Bitcoin Investment Fund

These funds typically manage hundreds of thousands of bitcoins, which they strategically and covertly put through the exchanges via special arrangement – out of sight and obscured from regular retail traders.

With their large capital mass, institutions can move the market at will. It is here where the metaphor of a Bitcoin Whale comes into its own because any other inhabitant of the ocean must simply get out of the way, or be moved forcefully. Additionally, no current is strong enough to deflect the whale from its course, so its intention becomes the way.

Market Manipulation [ edit ]

Whales are often criticized for manipulating the price of a certain coin in order to later on sell it higher or buy it cheap. Various coins such as NEO or Vechain were already affected by this trading behaviour of large market actors. [1] . Bitcoin whales are a very important part of the market. It is the mass movements of their coins that can have a huge impact on the price of BTC. There are even Telegram channel created by Bitcoin Whales.

Crypto Whales News [ edit ]

Nobuaki Kobayashi is an attorney from Tokyo, who also just happens to be the bankruptcy trustee for the no-longer-operational Mt. Gox — the Tokyo-based exchange which filed for bankruptcy protection after losing 850,000 Bitcoins.

On Wednesday, Kobayashi disclosed that he has sold off roughly $400 million worth of Bitcoin (BTC) and Bitcoin Cash (BCH). He claims the process began last September — which also happens to be when the cryptocurrency market really started to heat up.

Kobayashi is still holding another $1.9 billion worth of Bitcoins and Bitcoin Cash, which he is also considering selling in an effort to pay off Mt. Gox’s creditors. For reference, that means Kobayashi still holds roughly 179,245.37 BTC — though that may be unevenly divided with Bitcoin’s unwanted step-brother, Bcash.

Источник

Bitcoin Whales and How They Make Market Waves

Sometimes when there’s a huge drop in bitcoin’s price traders called “bitcoin whales” are blamed for dumping on the market. Bitcoin whales are individuals or groups who hold vast quantities of bitcoins and can sometimes sway the market towards their preferential price. These market movers have been around since the early days – ‘shaking out weak hands’ many times over the years – but have also failed their missions at times as well.

What is a Bitcoin Whale?

If you trade bitcoins or altcoins, you’ve probably heard the term “whale” before as the name is used to describe big cryptocurrency holders. The term is used this way because whales are the biggest creatures in the ocean and they can overpower smaller fish with their large size. Bitcoin whales are looked at similarly because their extensive holdings can affect large schools of smaller traders with just a few successful trading methods. Additionally the smaller the market and less liquidity means whales can devastate smaller altcoin markets way more easily than bitcoin. We also assume that Satoshi Nakamoto may be the biggest whale of all as the creator allegedly owns 1 million bitcoins.

Rinse and Repeat

Utilizing Buy and Sell Walls

OTC Markets and Dark Pools

Sometimes whales don’t purchase or sell on traditional exchanges because their holdings or orders could cause a stir in the market. For cryptocurrencies over the counter trading (OTC) or “dark pools” is where big buyers and institutional traders can purchase vast amounts of bitcoins without being seen by the public eye. Dark pools are similar to OTC trading as they are usually found on exchanges that enable ‘off the record’ trades which ensures a whale’s moves are more private. Typically OTC markets and dark pools only allow traders who purchase an abundant amount of bitcoin at one time and set minimums for entry.

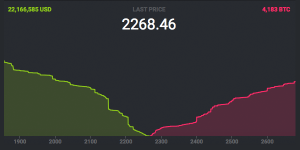

The Infamous Bear Whale

Back in October of 2014, there was an event where a massive bitcoin whale liquidated 30,000 bitcoins for $300 a piece. Many traders and speculators thought it would wreck the market at the time but instead, the order was ripped through by buyers and bitcoin’s price subsequently rose to $375. The event was remembered forever, and the trader will forever be known as the “bear whale.” The 30,000 BTC order was also recorded on video alongside many memes and graphics depicting the epic slaying of this gigantic whale. Many bitcoiners felt victorious that day in October because a whale of that size failed to sway the market.

Whales Are Often Blamed for Big Market Shake Outs

Whales have been discussed in the bitcoin space for quite some time, and they are usually blamed for unexplainable market phenomenon. Further, there are a lot of conversations across bitcoin forums asking the question — How many bitcoins does it take to be a whale? It seems the answer varies from 1,000 bitcoins to 10,000 bitcoins according to multiple threads on Bitcointalk.org and Reddit. Many people believe that whales can still affect the market due to bitcoin’s relatively small market capitalization where multi-million dollar orders can still shake things up. As bitcoin markets become stronger and gain more liquidity, speculators believe it now takes bigger bitcoin whales to shift the trading waters.

What do you think about bitcoin whales? Do you think large holders can still sway the market? Let us know what you think in the comments below.

Images via Shutterstock, Pixabay, Bitstamp, and Christopher Steininger.

Источник

Bitcoin whales: what are they – and how are they affecting the cryptocurrency’s price?

What is a bitcoin whale?

A bitcoin whale is a term that refers to individuals or entities that hold large amounts of bitcoin, according to Investopedia. There are around 1,000 individuals who own 40% of the market.

Whales have the potential to manipulate the currency valuations and, given bitcoin’s fluctuations in recent weeks, they are increasingly under the spotlight.

The Telegraph reported recently that, according to industry data, around 13% of all Bitcoin, or around $80 billion, sits in just over 100 individual accounts. It added that the top 40% of all bitcoin (approximately $240 billion) is held by just under 2,500 known accounts, out of roughly 100 million in total.

How do whales impact bitcoin’s price?

The number of addresses holding more than 1,000 bitcoin is at 2,334, a new all-time high, according to CoinDesk.

Single trades made by such whales can lead to huge changes to the price of bitcoin – swamping any movements by smaller investors, The Sun reported.

Bitcoin reached a record high of $41,973 on January 8. However, on January 22, Insider reported that the cryptocurrency was on course for its biggest weekly price fall since September. It recovered to around $32,170 by January 23.

Back in November 2020, CoinDesk studied data from crypto exchange OKEx to provide a possible explanation of how whales were able to influence prices as the cryptocurrency soared. «During that bitcoin run-up, institutions and whales were able to buy dips and oftentimes sell when prices went up. That left the majority of the retail investors scrambling to chase the rally,» the report said.

David Gerard, author of Attack of the 50 Foot Blockchain and a known crypto-skeptic, was quoted in The Telegraph report as saying: «The big players can easily move the price» because the bitcoin trading market is very thin. Any one of them could crash it.»

There is not a lot of available volume to trade, he said, adding that there were all kind of «trading shenanigans,» which would not occur in regulated markets.

What does the future hold for bitcoin?

Biden’s pick for treasury secretary, Janet Yellen, recently suggested lawmakers curtail cryptocurrencies like bitcoin due to concerns they are mainly used for illegal activities.

However, a Biden administration could be friendly to crypto, according to Yahoo Finance, given its pick of crypto expert Gary Gensler as SEC chairman.

Insider published an op-ed in January 2020, stating that the federal government’s signals around cryptocurrency have been confusing.

The article was written by James Ledbetter, chief content officer at Clarim Media and editor and publisher of FIN. It stated: «If the US wants to keep up with the global development of digital currencies, Biden’s team must clearly answer some basic questions, like which ones will be regulated as securities, and will a Bitcoin-based ETF be approved?»

It remains to be seen whether these questions will be answered by the administration any time soon, however.

Источник

Whale who sold Bitcoin before 2020 crash cashed out $156M before this week’s 20% dip

Bitcoin ( BTC ) lost 20% in a day partly thanks to the actions of a single whale, new research suggests.

Data from on-chain analytics firm Santiment on Feb. 23 showed that BTC/USD dipped to $47,400 after Bitcoin’s second-largest transaction of 2021 took place.

Import chart for suspect whale sell-off address. Source: Santiment/ Twitter Bitcoin whale addresses vs. BTC/USD chart. Source: Dovey Wan/ Twitter

Related Articles

Welcome to Cointelegraph Market’s weekly newsletter. This week we will identify emerging-sector trends across the cryptocurrency landscape in order to broaden your.

As Wilson Chandler tells it, despite being a NBA star with a decade-plus pro career and nearly $80 million in career earnings, the 6’8 combo forward still got his start in.

Thailand’s Securities and Exchange Commission has approved guidelines prohibiting crypto exchanges in the country from supporting four different types of tokens in certain.

We encourage you to use comments to engage with users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

- Enrich the conversation

- Stay focused and on track. Only post material that’s relevant to the topic being discussed.

- Be respectful. Even negative opinions can be framed positively and diplomatically.

- Use standard writing style. Include punctuation and upper and lower cases.

- NOTE : Spam and/or promotional messages and links within a comment will be removed

- Avoid profanity, slander or personal attacks directed at an author or another user.

- Don’t Monopolize the Conversation. We appreciate passion and conviction, but we also believe strongly in giving everyone a chance to air their thoughts. Therefore, in addition to civil interaction, we expect commenters to offer their opinions succinctly and thoughtfully, but not so repeatedly that others are annoyed or offended. If we receive complaints about individuals who take over a thread or forum, we reserve the right to ban them from the site, without recourse.

- Only English comments will be allowed.

Источник