- Margin Trading Bitcoin

- The Best Bitcoin Derivatives To Trade

- Margin Trading Bitcoin

- The Best Bitcoin Derivatives To Trade

- Leverage Your Bitcoin Trades

- The Best Bitcoin Trading Platforms

- Bitfinex.com Leverage trading exchange

- Evolve.Markets Bitcoin Powered Trading

- Deribit.com Bitcoin Futures & Options

- SimpleFX.com Forex Trading Platform

- What Are Bitcoin Derivatives?

- Bitcoin Leverage Trading

- Leverage enables you to get a much larger exposure to the market you’re trading than the amount you deposited to open the trade.

- How does leverage work?

- Benefits of using leverage

- Bitcoin Leverage Trading

- Overbit allows you to magnify your Bitcoin exposure to the market with up to 100x leverage

- Margin Trading using Bitcoin

- Benefits of Trading Bitcoin

- Make profits when Bitcoin goes up or down

- Trading Bitcoin with leverage

- How Bitcoin leverage works

- Why trade Bitcoin with Overbit

Margin Trading Bitcoin

The Best Bitcoin Derivatives To Trade

Margin Trading Bitcoin

The Best Bitcoin Derivatives To Trade

Leverage Your Bitcoin Trades

The Best Bitcoin Trading Platforms

Bitfinex.com Leverage trading exchange

No US Individuals Allowed

3x Leverage on Bitcoin and Altcoins

Earn Passive BTC by Funding Traders

New Markets: Tezos Margin Trading

Evolve.Markets Bitcoin Powered Trading

100x Max Leverage for Crypto

Trade Bitcoin w/ MT5

New Markets: XTZUSD & XAUBTC

Deribit.com Bitcoin Futures & Options

U.S. IP Addresses Blocked

100x Bitcoin Futures

Lowest Trade Fees

SimpleFX.com Forex Trading Platform

U.S. IP Addresses Blocked

Bitcoin CFDs with 5x Leverage

Forex, Stocks, CFDs 1:1500

BTCCNY, BTCUSD, BTCEUR, BTCJPY

What Are Bitcoin Derivatives?

Derivatives Trading Lets You Bet On The Future Price Of Bitcoin

A derivative is a contract that ‘derives’ its value from the performance of an underlying asset sometime in the future. A bitcoin derivatives market is where you can buy or sell bitcoin futures contracts if you are confident in which direction the bitcoin markets will move. Most derivatives have a settlement date on which all contracts are finalized and your position is liquidated. Bitcoin derivative markets allow traders to leverage their position and make a profit whether the price of bitcoin goes up or down.

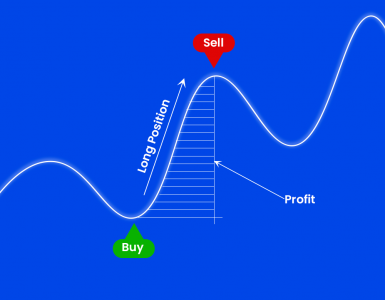

In a ‘Long’ position you are borrowing fiat currency such as USD to buy bitcoin with a goal of selling that bitcoin at a higher price.

In a ‘Short’ position you are borrowing bitcoins to sell for a fiat currencies with the goal of buying bitcoins back at a lower price.

When your trade ends the loan is repaid and you keep all the profits.

Источник

Bitcoin Leverage Trading

Leverage enables you to get a much larger exposure to the market you’re trading than the amount you deposited to open the trade.

How does leverage work?

Leverage is a key feature of a PrimeXBT trading platform, and can be a powerful tool for a trader. You can use it to take advantage of comparatively small price movements, ‘gear’ your portfolio for greater position size, and to make your capital grow faster.

Leverage works by using a deposit, known as margin, to provide you with increased exposure. Essentially, you’re putting down a fraction of the full value of your trade – and PrimeXBT is providing you the rest. Our products allow traders to gain exposure to major cryptocurrencies, such as Bitcoin and Ethereum and others, without tying up lots of capital.

PrimeXBT is an advanced, award-winning margin trading platform offering a wide variety of Bitcoin-based CFDs with added leverage and both long and short positions on stock indices, commodities, forex, and cryptocurrencies.

Our products allow traders to access a vast array of trading instruments and build a diverse trading portfolio, without tying up lots of capital.

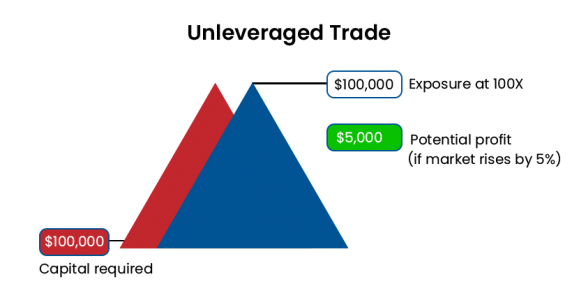

For example, you want to buy 10 Bitcoins at a price of $10,000.

To open such trade with a traditional exchange, you would be required to pay 10 x $10,000 for a position of $100,000 (ignoring any commission or other charges). If the Bitcoin price goes up by 5%, your 10 Bitcoins are now worth $10,500 each.

If you choose to sell, then you’d have made a $5,000 profit from your original $100,000 investment.

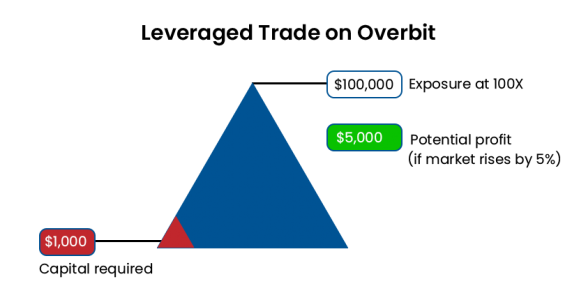

Here you’d only have to pay 1% of your $100,000 position, or $1,000 to open such trade. If the Bitcoin price rises by 5%, you would still make the same profit of $5,000, but at a considerably reduced cost.

That means that profits can be hugely multiplied.

Benefits of using leverage

- Magnified profits. You only have to put down a fraction of the value of your trade to receive the same profit as in a conventional trade with any other exchange.

- Gearing opportunities. Using leverage can free up capital that can be committed to other investments. The ability to increase the amount available for investment is known as gearing.

- Gaining from the market fall. Using leveraged products to speculate on market movements enables you to benefit from markets that are falling, as well as those that are rising.

- Products and Tools

- PrimeXBT Platform

- Turbo Platform

- Covesting Module

- All Trading Assets

- Long/Short Trading

- Copy Trading

- Cryptocurrency Trading

- Bitcoin Leverage

- Litecoin Leverage

- Ripple Leverage

- Ethereum Leverage

- EOS Leverage

- BTC/USD Chart

- ETH/USD Chart

- LTC/USD Chart

- XRP/USD Chart

- Forex Trading

- EUR/USD Chart

- GBP/USD Chart

- USD/CAD Chart

- USD/JPY Chart

- AUD/USD Chart

- ETH/BTC Chart

- LTC/BTC Chart

- XRP/BTC Chart

- Indices Trading

- NASDAQ Trading

- Hang Seng Trading

- Japan NIKKEI Index

- FTSE 100 Index

- ASX 200 Index

- DAX 30 Index

- SP500 Index

- NASDAQ Chart

- SP500 Chart

- Commodities Trading

- Natural Gas Trading

- Crude Oil Trading

- Gold Trading

- Brent Chart

- Crude Oil Chart

- Natural Gas Chart

- About

- About Us

- Security

- Fees and Conditions

- Press and Media

- Help Center

- Legal Terms

- Privacy Policy

- Cookie Policy

- Risk Disclosure

- Blog

- Platform announcements

- Technical analysis

- Price prediction

- Market research

- Interesting

- Education

PrimeXBT products are complex instruments and come with a high risk of losing money rapidly due to leverage. These products are not suitable for all investors. You should consider whether you understand how these products work and whether you can afford to take the high risk of losing your money. Seek independent advice if necessary.

This website products and services are provided by PrimeXBT Trading Services LLC

PrimeXBT Trading Services LLC is incorporated in St. Vincent and the Grenadines as an operating subsidiary within the PrimeXBT group of companies. PrimeXBT Trading Services LLC is not required to hold any financial services license or authorization in St. Vincent and the Grenadines to offer its products and services.

PRIMEXBT DOES NOT ACCEPT ANY USERS OR RESIDENTS FROM UNITED STATES OF AMERICA, JAPAN, SAINT VINCENT AND THE GRENADINES, CANADA, ALGERIA, ECUADOR, IRAN, SYRIA, NORTH KOREA OR SUDAN, UNITED STATES MINOR OUTLYING ISLANDS, AMERICAN SAMOA, RUSSIAN FEDERATION AND THE COUNTRIES OR TERRITORIES WHERE ITS ACTIVITY SHALL BE ESPECIALLY LICENSED, ACCREDITED OR REGULATED BY OTHER WAYS. YOU SHALL CHECK YOUR APPLICABLE LAW AND BE FULLY RESPONSIBLE FOR ANY NEGATIVE IMPACT ARISEN FROM YOUR RESIDENCE COUNTRY REGULATIONS. IF YOU ARE TRAVELLING TO ANY OF THESE COUNTRIES, YOU ACKNOWLEDGE THAT OUR SERVICES MAY BE UNAVAILABLE AND/OR BLOCKED IN SUCH COUNTRIES.

PRIOR TO TRADING WITH MARGIN YOU SHOULD CAREFULLY CONSIDER THE TERMS AND CONDITIONS OF THIS WEB-SITE, TO THE EXTENT NECESSARY, CONSULT AN APPROPRIATE LAWYER, ACCOUNTANT, OR TAX PROFESSIONAL. IF ANY OF THE FOLLOWING TERMS ARE UNACCEPTABLE TO YOU, YOU SHOULD NOT USE THE WEB-SITE, AND TO THE EXTENT PERMITTED BY LAW, YOU AGREE NOT TO HOLD ANY OF THE COMPANY AND ITS RESPECTIVE PAST, PRESENT AND FUTURE EMPLOYEES, OFFICERS, DIRECTORS, CONTRACTORS, CONSULTANTS, EQUITY HOLDERS, SUPPLIERS, VENDORS, SERVICE PROVIDERS, PARENT COMPANIES, SUBSIDIARIES, AFFILIATES, AGENTS, REPRESENTATIVES, PREDECESSORS, SUCCESSORS AND ASSIGNS LIABLE FOR ANY LOSSES OR ANY SPECIAL, INCIDENTAL, OR CONSEQUENTIAL DAMAGES ARISING FROM, OR IN ANY WAY CONNECTED, TO THE TRADING WITH MARGIN, INCLUDING LOSSES ASSOCIATED WITH THE TRADING WITH MARGIN.

PLEASE NOTE THAT COMPANY IS IN THE PROCESS OF UNDERTAKING A LEGAL AND REGULATORY ANALYSIS OF BITCOIN TRADING WITH MARGIN. FOLLOWING THE CONCLUSION OF THIS ANALYSIS, COMPANY MAY DECIDE TO AMEND THE INTENDED FUNCTIONALITY IN ORDER TO ENSURE COMPLIANCE WITH ANY LEGAL OR REGULATORY REQUIREMENTS TO WHICH COMPANY IS SUBJECT. WE SHALL PUBLISH A NOTICE ON OUR WEBSITE OF ANY CHANGES THAT WE DECIDE TO MAKE MODIFICATIONS TO THE FUNCTIONALITY AND IT IS YOUR RESPONSIBILITY TO REGULARLY CHECK OUR WEBSITE FOR ANY SUCH NOTICES. ON THE CONCLUSION OF THIS ANALYSIS, WE WILL DECIDE WHETHER OR NOT TO CHANGE THE FUNCTIONALITY OF THE WEB-SITE.

The company does accept only participants:

- he/she/it is of an age of majority (at least 18 years of age), meets all other eligibility criteria and residency requirements, and is fully able and legally competent to use the Website, enter into agreement with the PrimeXBT and in doing so will not violate any other agreement to which he/she/it is a party;

- he/she/it has necessary and relevant experience and knowledge to deal with margin trading, cryptocurrencies and Blockchain-based systems, as well as full understanding of their framework, and is aware of all the merits, risks and any restrictions associated with margin trading, cryptocurrencies and Blockchain-based systems, as well as knows how to manage them, and is solely responsible for any evaluations based on such knowledge;

- Is not a foreign or domestic PEP.

- he/she/it will not be using the Website for any illegal activity, including but not limited to money laundering and the financing of terrorism;

Keep in mind that trading with margin may be subject to taxation. You are solely responsible for withholding, collecting, reporting, paying, settling and/or remitting any and all taxes to the appropriate tax authorities in such jurisdiction(s) in which You may be liable to pay tax. PrimeXBT shall not be responsible for withholding, collecting, reporting, paying, settling and/or remitting any taxes (including, but not limited to, any income, capital gains, sales, value added or similar tax) which may arise from Your participation in the trading with margin.

Content, research, tools, and coin symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular asset or to engage in any particular investment strategy. The projections or other information regarding the likelihood of various investment outcomes are hypothetical in nature, are not guaranteed for accuracy or completeness, do not reflect actual investment results, do not take into consideration commissions, margin interest and other costs, and are not guarantees of future results. All investments involve risk, losses may exceed the principal invested. You alone are responsible for evaluating the merits and risks associated with the use of our systems, services or products.

Источник

Bitcoin Leverage Trading

Overbit allows you to magnify your Bitcoin exposure to the market with up to 100x leverage

Margin Trading using Bitcoin

Bitcoin is the first digital asset to use peer-to-peer technology to facilitate instant payments. The brainchild of a pseudonymous entity called Satoshi Nakamoto, Bitcoin is a cryptocurrency with an interconnected network (nodes) of independent individuals and companies processing the confirmation of transactions and creating new Bitcoins in the process we know as mining.

Bitcoin, unlike fiat, has a finite supply. There will only ever be 21 million Bitcoins in total supply which means even as demand rises; supply will remain constant. Once every four years, miners’ rewards are slashed in half through a process called Bitcoin halving. Bitcoin’s in-built deflationary feature factors in helping keep the supply in check until the last Bitcoin is mined around the year 2140.

Benefits of Trading Bitcoin

Bitcoin is the most liquid cryptocurrency with the largest market capitalization and is traded across more than 2,000 exchanges. The popularity of Bitcoin also makes it the coin with the most prominent trading pairs. Virtually all of the other coins have Bitcoin as their base trading pair, making it the most versatile trading pair.

The Bitcoin market is open 24 hours a day, 7 days a week including public holidays. Bitcoin is decentralised and there is no single organisation or government that can control it. However, Bitcoin is susceptible to market sentiments, opinions and regulatory speculation. This does make the currency quite volatile and quite responsive to positive and negative news and rumours.

Bitcoin is a transparent currency and open to anyone from anywhere in the world to own it. Unlike fiat money, you can see the movements of Bitcoin on the blockchain. Traders often speculate on those movements in order to determine the sentiment of the wider Bitcoin holders – whether they are moving funds on exchanges to sell them or off exchanges to hold their Bitcoins.

Make profits when Bitcoin goes up or down

Go long or go short on Bitcoin when the price is rising or falling using the Overbit platform. Profit from trading both ways.

Trading Bitcoin with leverage

Overbit allows you to trade Bitcoin with leverage. This means you can trade Bitcoin to make profits when the market goes up or down. With leverage you get exposure to a lot more of the Bitcoin price movement than the amount you deposit. Let’s look at an example. Say the Bitcoin price is 40,000 USD and you expect it to rise to 45,000 USD within a few days. You wish to buy 1 BTC with 75X leverage. Your margin requirement is 1/75 * 40,000 USD = $533 USD.

When Bitcoin rises to 45,000 USD, you can close your position and profit $5,000. The amount you risked would have been $533. Similarly, if Bitcoin falls in price, you could lose the entire $533.

A similar example can be applied if you are expecting Bitcoin to fall in price. If Bitcoin is trading at 40,000 USD and you expect it to go down to $35,000 – you could short (sell) the market. At 75X leverage, your margin requirement is 1/75 * 40,000 USD = $533 USD.

If the Bitcoin price gets to $35,000 and you close the position, your profit will be $5,000 USD. However, if Bitcoin simply rises by $533, you will lose your entire $533 that you risked for this trade.

You can get a more accurate calculation of the margin requirement and your liquidation price (the price at which you would get liquidated if the position is against you) on the deal ticket window.

How Bitcoin leverage works

With a Bitcoin leveraged trade, you can get up to 100X the exposure of the capital you deposit.

Why trade Bitcoin with Overbit

Overbit is a world-class exchange with a deep and liquid order book from our multiple global liquidity partners. Our traders enjoy fair market prices consolidated from the world’s top exchanges and are free from price manipulation. This means no single trader can manipulate the Overbit price with large positions. At Overbit, you can trade crypto and FX using your Bitcoin or USDT without the need of taking delivery of assets.

We provide a wide range of features in leverage trading. On Overbit, you can trade and enjoy up to 100X leverage on your crypto assets and 500X leverage on your FX assets. However, in order to limit your risk exposure, we employ advanced risk management measures. We allow you to open each position with your own margin preference (isolated margin or cross margin).

Overbit recognizes and rewards community efforts by running one of the best affiliate programs from any crypto exchange. Users get rewarded in BTC or USDT for referring friends. This is unarguably the most rewarding cryptocurrency affiliate program in the world. As a way to incentivize the continued use of our exchange, we operate a tiered reward program. Traders get rewarded in Tier Points (TP) for trading. Once you reach 1,000 TP, you can swap for BTC or USDT.

You never have to worry about the security of your funds on our exchange as we employ military-grade security to ensure customers’ funds are always safe. We segregate user funds to ensure they are protected, and stored in multi-signature cold wallets. If you ever need support service, we offer 24/7 live chat support to all users.

Источник