- How Long Does It Take to Mine One Bitcoin?

- Table of Contents

- Bitcoin Block Rewards and Bitcoin Mining

- Mining Difficulty

- Mining Solo vs. Mining Pool

- Mining Hardware: ASICs vs. GPUs

- Hash Rate

- How Long Does it Take to Mine 1 Bitcoin? (Updated 2021)

- How Long Does it Take to Mine 1 Bitcoin? Understanding Bitcoin Block Rewards

- How much Bitcoin can you mine in a day?

- How to Mine 1 Bitcoin Over Time

- How Long Does it Take to Mine One Bitcoin? (2021)

- Most Bitcoin miners join a mining pool, sharing the risks and rewards; a single mining rig could take several years to mine one Bitcoin.

- In brief

- How long it takes to mine 1 BTC

- Can Bitcoin miners go solo?

- Bitcoin mining in 2020 and beyond

- Disclaimer

How Long Does It Take to Mine One Bitcoin?

Strictly speaking, it is impossible to set out to mine exactly 1 Bitcoin (BTC) in a given timeframe.

Table of Contents

Bitcoin Block Rewards and Bitcoin Mining

Strictly speaking, it is impossible to set out to mine exactly 1 Bitcoin (BTC) in a given timeframe: Bitcoin mining is best understood in terms of cryptocurrency block rewards, rather than in single units, like one Bitcoin (BTC).В

This is because new Bitcoin are only created (“mined”) each time a new block on the Bitcoin blockchain is validated.

Whichever Bitcoin miner is the first to validate a new block receives a block reward in the form of cryptocurrency, which is currently set at 6.25 Bitcoin (BTC).В

Mining Difficulty

A consistent factor that affects how long it takes to mine one Bitcoin is what is referred to as the network’s hashing difficulty algorithm, which is designed to self-adjust in order to maintain a consistent 10-minute block verification time.В

Mining Bitcoins is an “all or nothing” affair — miners receive either 6.25 BTC in 10 minutes or 0. Mining is structured as a race between miners, who compete to solve computationally intensive puzzles and become the first on the network to successfully validate a new block and pocket the reward.

Prior to May 11, 2020, the block reward on the Bitcoin network was twice as high (12.5 BTC) as it is now. On May 11, an event known as the Bitcoin halving took place, which decreased the cryptocurrency distributed to successful Bitcoin miners for each block by 50%.В

Mining Solo vs. Mining Pool

While it used to be possible to mine Bitcoin yourself on your home computer, those days are long gone — the amount of energy and equipment required is now far beyond what you can do on your personal laptop.В

However, even if you’re not ready to go all in and start a large-scale mining business solo, it is possible to accumulate fractions of one Bitcoin (BTC) over time if a group of Bitcoin miners combine their computing resources to form a mining pool or mining farm and then share the block rewards between themselves.В

Cloud mining services also enable their users to mine Bitcoin or other cryptocurrency without having to invest in costly mining hardware themselves.

If you’re really invested in mining crypto solo, it is possible — you just have to choose a cryptocurrency that is realistic for a solo miner to mine (and that, unfortunately, is no longer Bitcoin). It’s possible to mine this following list of cryptocurrencies solo, as their mining difficulty makes solo mining realistic:В Zcash, Ethereum, Monero, Dogecoin, Grin, Beam, Bytecoin, Vertecoin, Ethereum Classic and Aeon.

Mining solo might not be able to get you as high of a reward as you would get by mining in a pool or with cloud mining services, mining solo is still possible if you look outside of Bitcoin.

Mining Hardware: ASICs vs. GPUs

A strong reason to operate as a mining pool rather than as a lone Bitcoin miner is that the efficiency of Bitcoin mining depends to a great extent on the type of mining hardware that is used.В

Mining pools that invest in a large amount of expensive mining hardware stand the highest chance of becoming the first to validate a new block and pocket the newly-mined Bitcoin.

The most efficient mining rigs are expensive to set up and deploy ASIC (Application-Specific Integrated Circuit) chips, which are tailored to efficiently mine cryptocurrencies based on a specific hashing algorithm (in this case, Bitcoin’s SHA-256).В

Bitmain’s “Antminer” series is a famous example of specialized ASIC mining hardware that is used to mine Bitcoin, as well as Ethereum (ETH).

Alternatives to ASIC set-ups use GPUs for Bitcoin mining, which are less optimized for the coin’s hashing algorithm, and therefore face a greater challenge competing with ASIC mining rigs for block rewards on the Bitcoin network.

Hash Rate

The hash rate (or hashing power) of a cryptocurrency is a measure of the overall computing power involved in validating transactions on its blockchain at any given time.В

Higher hash rates indicate higher levels of participation in the network, which implies greater competition among miners to validate new blocks.В

A high hash rate makes the odds of each Bitcoin miner or Bitcoin mining pool’s success relatively lower. This makes mining Bitcoin in some sense “slower,” as the relative chances of receiving Bitcoin as a reward diminish for both solo miners and mining pools.В

It’s worth noting that while it may raise the competition for individual miners or pools, a high hash rate remains a positive thing for the overall health of the Bitcoin network. The high network participation signaled by a high hash rate increases the number of resources that would be needed for a bad actor to pull off a 51% attack, making the network more secure.

Источник

How Long Does it Take to Mine 1 Bitcoin? (Updated 2021)

Although we tend to take it for granted, when Satoshi invented Proof of Work (POW) mining he truly created a revolutionary new technology. Thanks to his contribution we can now mine Bitcoin and hopefully earn a nice reward for securing the network.

One question people sometimes ask though is, how long does it take to mine 1 Bitcoin? It’s a good question but as we’ll see, there’s not necessarily a straightforward answer.

In this article

How Long Does it Take to Mine 1 Bitcoin? Understanding Bitcoin Block Rewards

How long does it take to mine a Bitcoin?

Well, it’s not really possible to mine just 1 Bitcoin because each block reward is 6.25 BTC. It used to be 12.5 BTC until May 2020 when there was the halving and the block reward was cut in half.

So there’s not a way to mine just 1 Bitcoin. You either win the block reward and receive 6.25 Bitcoin or you get nothing. In fact, getting nothing is what happens 99.99999% of the time when you’re a miner.

There are more than

1 million ASIC miners (specialized devices built for mining BTC and other cryptos) securing the Bitcoin network, and only one ASIC at a time can win the block reward. So the odds of any single machine winning are one in a million.

How much Bitcoin can you mine in a day?

That’s why large Bitcoin mining farms have so many ASICs, to improve those odds. Given that a new block is produced every 10 minutes (equal to 144 blocks per day) a mining farm with ten or twenty thousand miners stands a decent chance of winning a couple of blocks per 24 hour period.

However, most people don’t have $50 million worth of Bitcoin mining rigs lying around their backyard so winning block rewards are out of the question. That being the case, there is a way to win 1 Bitcoin over time.

How to Mine 1 Bitcoin Over Time

A Bitcoin mining pool is a collaborative effort whereby all of the miners in the pool combine their hash power and then split the reward. How this works is that no matter which ASIC miner in the pool actually wins the block reward, that reward is split up and distributed proportionally to all of the miners based on how much hash power (mining “power” from mining devices like ASICs) they’re contributing.

That’s why joining a mining pool is the best way to mine a Bitcoin. You won’t get a Bitcoin all at once, at least not without a huge number of ASICs, but you can gradually accumulate a Bitcoin over time.

For example, with five or ten ASICs you may be able to mine 0.01 BTC a day and then in 100 days you would have mined a full Bitcoin. Of course how much time it takes you to mine a Bitcoin will depend on a variety of factors.

Most notably, how difficult is mining at this moment? You can check Bitcoin’s hash rate to determine difficulty. The higher the hash rate, the more difficult it is to mine (more competition and less profit). However, the hash rate frequently changes as new miners join the network and old ones drop off.

How long it takes to mine one Bitcoin can also be affected by something as simple as maintenance. ASICs are typically run 24/7 with no downtime, meaning that they’re prone to failure. To maximize profits you’ll need to have a way to fix your machines and get them running again quickly.

Источник

How Long Does it Take to Mine One Bitcoin? (2021)

Most Bitcoin miners join a mining pool, sharing the risks and rewards; a single mining rig could take several years to mine one Bitcoin.

Bitcoin miners help to keep the network running (Image: Shutterstock)

In brief

- Bitcoin mining is a process that sees high-powered computers compete to discover a Bitcoin block and earn rewards for doing so.

- Miners generally use specialized equipment such as ASIC mining rigs.

- Going solo can be slightly more efficient for miners, but is also riskier since the rewards come less frequently.

Bitcoin (BTC) uses the Proof of Work (PoW) consensus algorithm as the basis of its security. This means that like many other cryptocurrencies, a network of cryptocurrency miners is used to discover blocks and add pending transactions to them, to render them irreversible.

The block discovery process, which takes approximately 10 minutes per block, also results in the minting of a fixed number of new Bitcoin per block. This is currently set at 6.25 BTC per block, but halves approximately every four years (210,000 blocks), reducing the number of Bitcoin minted with each newly discovered block.

This BTC is provided as an incentive to the miner (or miners if using a mining pool ) that discovered the block.

How long it takes to mine 1 BTC

Although it takes 10 minutes to discover each block and each block yields a 6.25 BTC reward for the miner that successfully discovered it, it’s important to understand that the entire Bitcoin mining network is essentially competing in this block discovery process.

This means that only a single miner in the entire mining network will actually successfully discover the block—and since there are potentially tens of thousands of Bitcoin miners in operation, the odds of single-handedly discovering a block is quite low.

For this reason, the vast majority of Bitcoin miners work together as part of a mining pool, combining their hash rate to stand a better chance of discovering a block. Then, regardless of which miner in the pool actually discovers the block, the rewards are distributed evenly throughout the pool.

Consequently, a miner that contributes 1% of a pool’s hash rate, will also receive 1% of the block rewards it accrues.

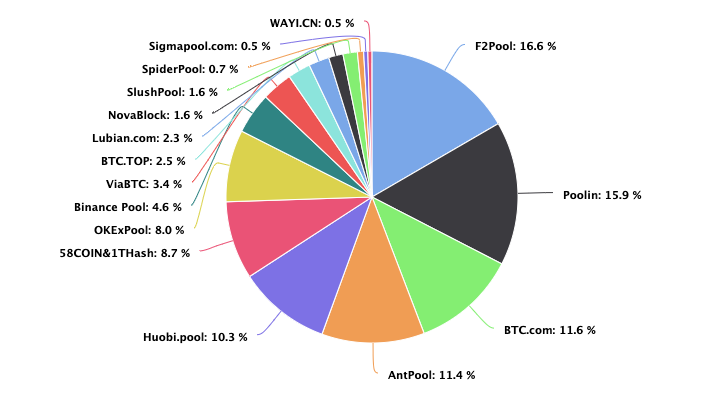

F2Pool is currently the largest pool by hash rate share, contributing around 26.73 EH/s of the total Bitcoin hash rate of 134.6 EH/s. This 19.9% hash rate share essentially means that around 19.9% of all newly minted BTC are mined by this pool—equivalent to 179.1 BTC per day (out of a total of 900 BTC distributed to all miners per day).

An individual miner that contributes 1% of the pool’s hash rate (

267 PH/s) would earn approximately 1.79 BTC per day. This means a miner would need close to 149.2 PH/s of hash rate to mine an average of 1 BTC per day at current difficulty levels.

Before the decade is over, only 225 #BTC will be minted per day and enter the market as fresh supply. Compared to the start of 2020, when 1800 were created daily, this means a

90% loss in new supply.

To put this into perspective, this is the equivalent of running 2,331 of the latest 64TH/s Antminer S17e ASIC miners, which were released in November 2020. This setup would likely cost somewhere in the order of $1.86 million, assuming an average unit cost of $799/ea. This would also prove somewhat challenging, since the Antminer S17e is currently sold out (as of December 2020), and is only available at a markup via resellers.

For those with a smaller budget, it would take a single Antminer S19 Pro (an older generation, but widely available unit) a total of 1,356 days to generate 1 BTC in rewards when working with a mining pool—that’s the equivalent of generating 0.00073 BTC/day in rewards, or around $13.28/day at current prices ($18,200/BTC).

To calculate how long it would take another mining rig to generate 1 BTC in rewards, you can simply plug its hash rate into the following equation: 1 / (hash rate (in PH/s)) * 0.0066. This result will produce the number of days it will take to generate 1 BTC in rewards at current difficulty levels.

Can Bitcoin miners go solo?

Although most Bitcoin miners tend to focus their efforts as part of a mining pool, it’s also possible to go it alone.

Unlike Bitcoin mining pools, which essentially guarantee smaller regular payouts and eliminate most of the risks involved with Bitcoin mining, solo mining is more of a gamble—but can also be more rewarding. Since solo miners don’t need to pay any mining pool fees, the overall mining profitability can be slightly higher than working with a pool, particularly for those running a sizeable mining operation.

Statistically speaking, a solo miner looking to generate 1 BTC per day would need to contribute just over 0.11% of the total Bitcoin hash rate. As we previously mentioned, this is equivalent to around 149.2PH/s or the combined output of 2,334 Antminer S17e mining units. On average this mining operation would discover a block yielding a 6.26 BTC reward every 6.25 days, which averages out to 1 BTC/day.

Because even gigantic mining operations with over 2,000 rigs would take almost a week to discover a single block, miners with just a few machines would likely go years without discovering a block, making the practice extremely risky in most cases.

Bitcoin mining in 2020 and beyond

Previously one of the largest Bitcoin mining pools by hash rate, the OKEx pool saw a 99.5% drop off in activity between October and November 2020, after the exchange halted withdrawals following reports that a crucial private key holder could not be reached.

The OKex pool has since seen its SHA256 hash rate recover considerably, and currently sits at 196.8 PH/s with over 3,400 active miners—a more than tenfold increase over its November lows.

With massive institutional investors like Grayscale, PayPal, and Cash App now buying up more than 100% of all newly-issued Bitcoin, and increasing sums of BTC locked up as wrapped tokens on other blockchains (such as Ethereum and Tron), demand for Bitcoin has increased considerably in 2020.

As a result, the price of Bitcoin has been driven up by more than 150% since the start of the year, reaching new all-time highs value on some platforms.

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.

Источник