- What is Bitcoin’s Price Correlation With Other Digital Currencies?

- Real-World Scenarios

- Bitcoin vs. Litecoin

- Bitcoin vs. Ether

- Bitcoin vs. Ether Classic

- Bitcoin vs. Ripple

- Events and Trends

- Summing It Up

- Cryptocurrency Correlation Study

- Correlation Tool – Show Correlation Over The Last…

- Correlation over time: SP500 vs. BTC (Rolling 180 days)

- Is Bitcoin An “Uncorrelated Asset”?

- Key Takeaways

- Is Bitcoin An “Uncorrelated Asset”?

- The Pearson Correlation Coefficient

- Cryptocurrency vs. Cryptocurrency

- Bitcoin vs. Ethereum

- Bitcoin vs. Gold

- Bitcoin vs. Stocks

- Gold vs. Stocks

- Conclusion & Disclaimer

- Beiträge aus dem Blog

- 7 Kommentare zu Cryptocurrency Correlation Study

What is Bitcoin’s Price Correlation With Other Digital Currencies?

What is bitcoin’s price correlation with other digital currencies?

By learning more about the price correlations between bitcoin and other top altcoins, you will be better prepared to incorporate these digital assets into a diversified portfolio.

While some liken diversification to not putting all your eggs in one basket, there is more to it than that. Ideally, diversification will smooth out the fluctuations in your portfolio, leaving you with consistent returns. By combining assets that do not move in tandem with each other, you can better your chances of increasing this result.

Knowing how different assets correlate with each other provides a road map you can use to diversify effectively. Through correlation coefficients, you can quantify how much using one asset will offset the price movements of another.

Correlations range between +1, for perfectly positively correlated, and -1, for perfectly negatively correlated.

As an example, suppose you have a very basic portfolio holding two stocks: ABC and XYZ. If a 10 percent increase in ABC coincides with a 10 percent drop in XYZ, the two stocks are perfectly negatively correlated, which will make them great counterparts for effective diversification.

Real-World Scenarios

While ideal situations like the one just mentioned rarely materialize in real life, you can frequently find assets that provide less-perfect diversification benefits. If two assets have a correlation of -0.5, combining them can be quite helpful in eliminating risk.

The graphic below shows some sample correlations and their diversification benefits.

Now that you have some background context, let’s delve into the major altcoins and their price relationship with bitcoin. One easy comparison to make involves Litecoin, an altcoin that is very similar to bitcoin.

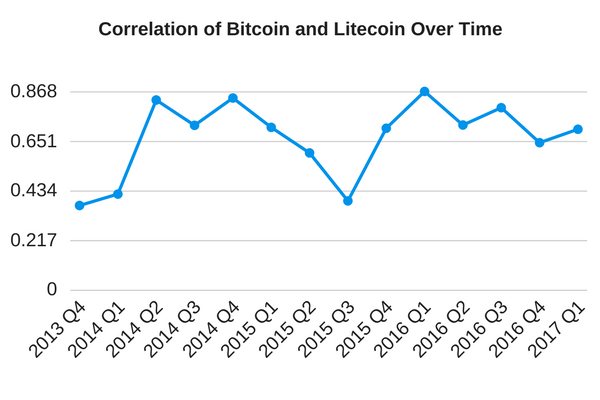

Bitcoin vs. Litecoin

Litecoin, which has repeatedly been described as the silver to bitcoin’s gold, has frequently displayed a strong correlation relative to the world’s most valuable digital currency, according to a Bitcoin Market Journal analysis using data from digital asset platform CryptoCompare.

As a result, the monthly price correlation between the two reached as much as 0.95 in November 2013, and surpassed 0.8 on several occasions.

However, this tight relationship has broken down on more than one occasion. A perfect example is the multiple times that Litecoin has failed to keep up with bitcoin’s sharp rallies.

It is also worth noting that while bitcoin has enjoyed monumental gains in the last decade, Litecoin has frequently failed to keep up. Bitcoin’s price has risen enough to provoke numerous stories about bitcoin millionaires who bought in at the right time, but stories about Litecoin millionaires have been less frequent.

During a 2014 interview with Forbes, Litecoin creator Charlie Lee stated that “I’m sure there are Litecoin millionaires out there.” Since that time, the number of investors who have achieved millionaire status by investing in Litecoin may have surged. Given the lack of media attention to their success, it would be difficult to know with any degree of certainty.

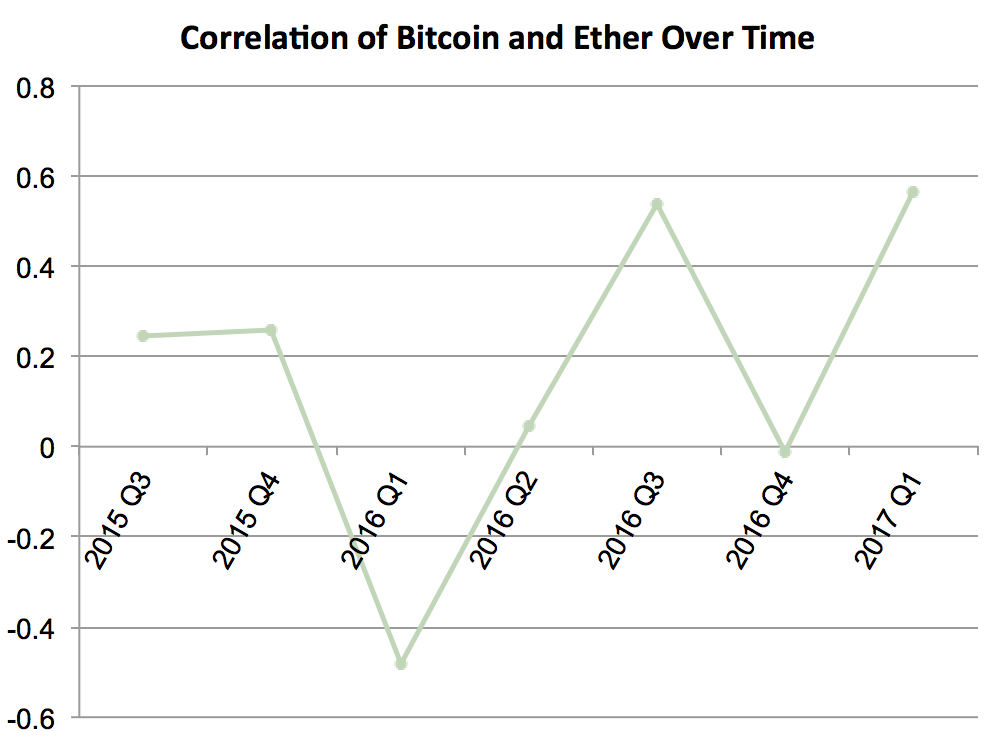

Bitcoin vs. Ether

Ether became the second-largest digital currency by market capitalization in early 2016 and has primarily retained that status since. Over the last few years, the correlation between bitcoin and ether has been all over the place.

At some points, these two follow each other very closely, and other times, the two digital currencies have almost no correlation at all. When their price relationship is examined on a monthly basis, the correlation coefficient of bitcoin and ether ranges from less than 0.1 to more than 0.5.

On a quarterly basis, the correlation between bitcoin and ether ranges between -0.02 and roughly 0.5.

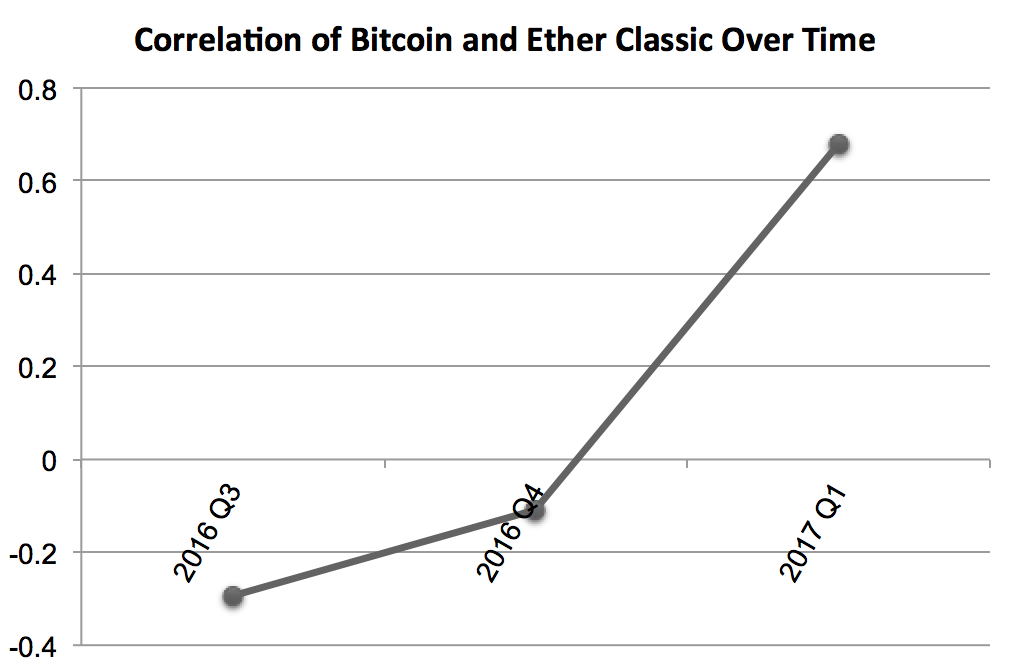

Bitcoin vs. Ether Classic

Ether classic is an alternative asset protocol or altcoin that was created in July 2016 when the Ethereum blockchain underwent a hard fork, a change in the platform’s rules. Not all users were willing to undergo the software upgrade needed to implement this hard fork, and the network split into two separate blockchains.

One of these blockchains was Ethereum, while the other was Ethereum Classic. The latter chain’s native token is ether classic. Just like its older brother ether, ether classic’s price relationship with bitcoin is all over the map.

At times, bitcoin and ether classic have very little correlation. However, analysis reveals that the two had a monthly correlation of roughly 0.6 or higher during three separate months.

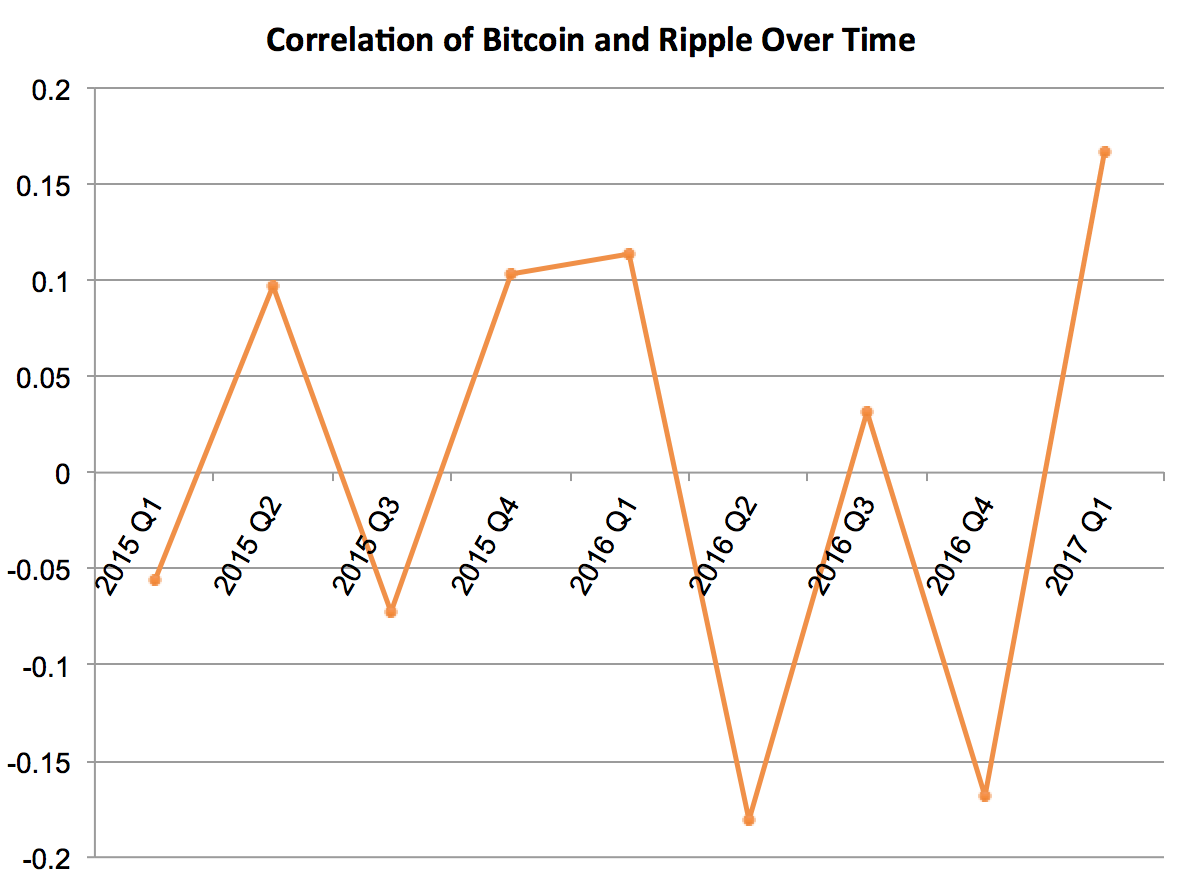

Bitcoin vs. Ripple

XRP, the token of global payments network Ripple, has a price relationship with bitcoin that has ranged between weak (in this case, 0.2 or less) and modest (between 0.2 and 0.5). During the 27 months spanning April 2015 through June 2017, the correlation between bitcoin and the XRP token was less than 0.2 for 16 months.

The price relationship between the two was between 0.2 and 0.5 during the remaining 11 months.

Events and Trends

While the aforementioned data may be helpful, keep in mind that the rules can change when markets respond to events or experience broad trends. In the first half of 2017, digital currencies drew broad interest, a development that coincided with their total value rising more than 500 percent, according to CoinMarketCap.

During this time, the digital currencies examined in this article all enjoyed sharp gains. Bitcoin’s price climbed roughly 200 percent, while ether, the second-largest crypto, rose more than 5,000 percent, CoinMarketCap figures show. XRP climbed more than 4,000 percent, while ether classic appreciated more than 1,500 percent during this time. Litecoin also pushed higher, gaining more than 600 percent.

When the broader crypto markets experience these bullish trends, correlations can rise significantly. While this may not seem like a problem when digital currencies are rising in value, it could be troubling if these digital assets all started losing value in tandem.

If the value of digital currencies all fall at once, the simplest solution may be to simply stay calm and ride out the storm. Do not panic and sell, as doing so is likely the key to suffering losses.

Summing It Up

Knowing the correlations that exist between different digital currencies can be quite helpful. Armed with this information, you can construct a well-diversified portfolio and increase your chances of successfully managing the price volatility of these assets.

Keep in mind that digital currencies are highly volatile, and some degree of price fluctuation is inevitable. However, this factor should not prevent you from putting the needed effort toward creating a well-diversified portfolio.

For more helpful information on investing in bitcoin, subscribe to Bitcoin Market Journal.

Источник

Cryptocurrency Correlation Study

Correlation Tool – Show Correlation Over The Last…

| BTC | ETH | XRP | LTC | XMR | DOGE | BNB | GOLD | SP500 | DOW | |

|---|---|---|---|---|---|---|---|---|---|---|

| BTC | 1 | |||||||||

| ETH | 0.71 | 1 | ||||||||

| XRP | 0.39 | 0.51 | 1 | |||||||

| LTC | 0.77 | 0.8 | 0.52 | 1 | ||||||

| XMR | 0.51 | 0.5 | 0.41 | 0.58 | 1 | |||||

| DOGE | 0.39 | 0.4 | 0.24 | 0.4 | 0.18 | 1 | ||||

| BNB | 0.6 | 0.58 | 0.47 | 0.62 | 0.58 | 0.21 | 1 | |||

| GOLD | 0.04 | 0.07 | -0.09 | 0.06 | -0.06 | 0.16 | -0.01 | 1 | ||

| SP500 | 0.2 | 0.17 | 0.23 | 0.15 | 0.21 | 0.09 | 0.18 | 0.21 | 1 | |

| DOW | 0.16 | 0.2 | 0.26 | 0.15 | 0.13 | 0.1 | 0.14 | 0.07 | 0.64 | 1 |

This is an interactive tool. You can click on the values in the table to see the trend or change the timeframe above the table.

Correlation over time: SP500 vs. BTC (Rolling 180 days)

Is Bitcoin An “Uncorrelated Asset”?

- We investigated the correlation between the returns of some Cryptocurrencies, gold and big stock indices (S&P 500 and Dow Jones).

- The Pearson correlation coefficient shows the extend to which two data sets (in this case: daily returns) are related.

- It takes values between -1 and 1:

1 positive correlation (if one goes up, the other one goes up as well) 0 not correlated -1 negative correlation (if one goes up, the other one goes down)

Key Takeaways

- Gold is not correlated with any of the other data sets including Bitcoin

- Cryptocurrencies amongst each other are positively correlated

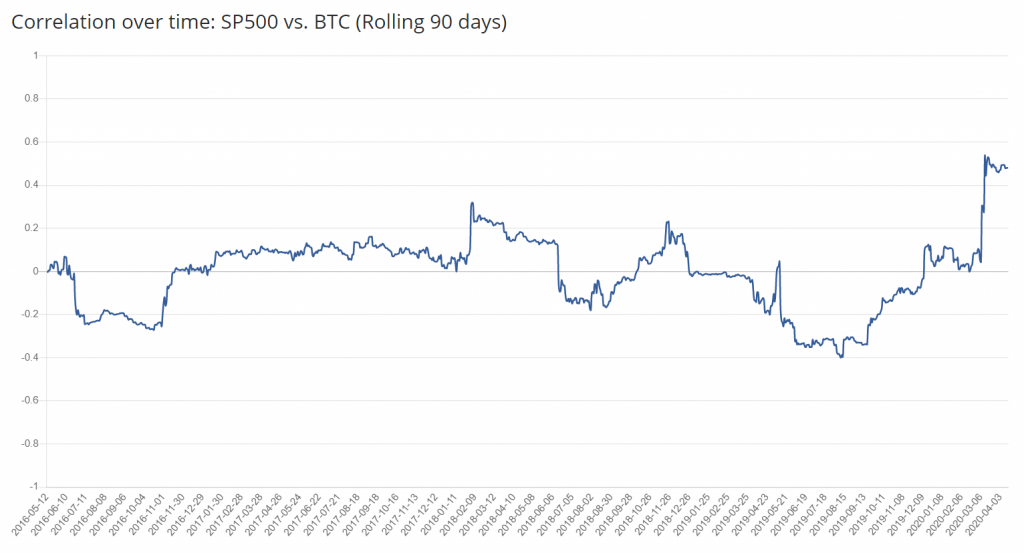

- Bitcoin and the S&P 500 showed no correlation until the Coronacrisis hit both stocks and Bitcoin hard, resulting in a growing correlation. With a coefficient of about 0.4 over the last 180 days, it is still very weak.

Is Bitcoin An “Uncorrelated Asset”?

Some bitcoiners like to say “Bitcoin is an uncorrelated asset”, implying that its price movement is completely decoupled from the price movement of other asset classes. Investing in combinations of uncorrelated assets can reduce the overall risk in a portfolio and event boost the overall return. But is that really the case? With this tool, data is analyzed with the aim to back up or dismiss the claim.

The Pearson Correlation Coefficient

The Pearson correlation coefficient is a beneficial mechanism to measure this correlation and assess the strength of a linear relationship between two data sets. It takes values between -1 and 1. -1 is a strong negative correlation, 0 implies no correlation at all (uncorrelated) and +1 stands for a strong positive correlation.

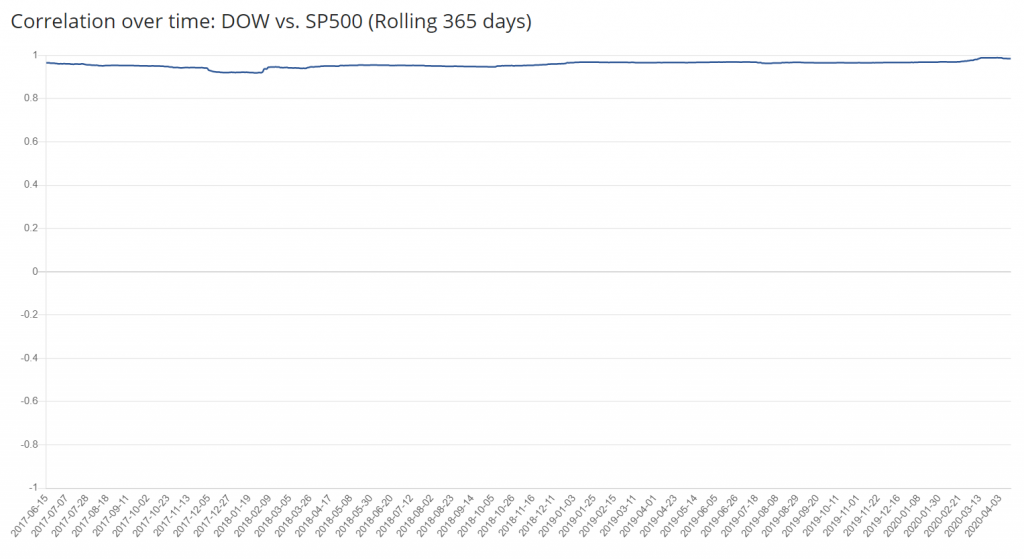

Looking at this study, a coefficient of 1 essentially equates: if one asset goes up, the one we are comparing it to tends to go up, as well. This also happens vice versa. A good example for a coefficient of almost 1 is the comparison between the S&P 500 and the Dow Jones stock index. Both track the performance of blue-chip stocks. Consequently, it comes as no surprise that the correlation chart for S&P vs. Dow Jones looks like the following:

Cryptocurrency vs. Cryptocurrency

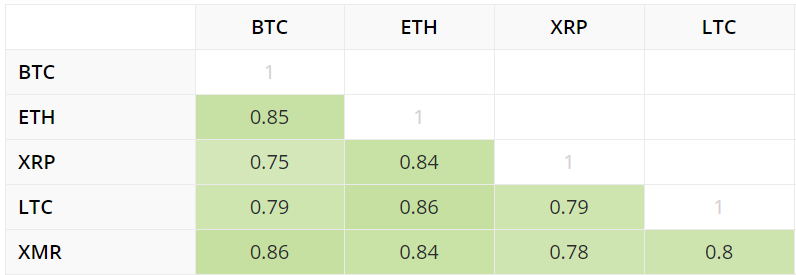

How do cryptocurrencies correlate with each other?

In order to have sufficient data at hand, we took 5 coins with a long price history into consideration. They display a strong positive correlation. This is no news to anyone who followed the market over the last couple of years.

It is, however, noteworthy that this has not always been the case.

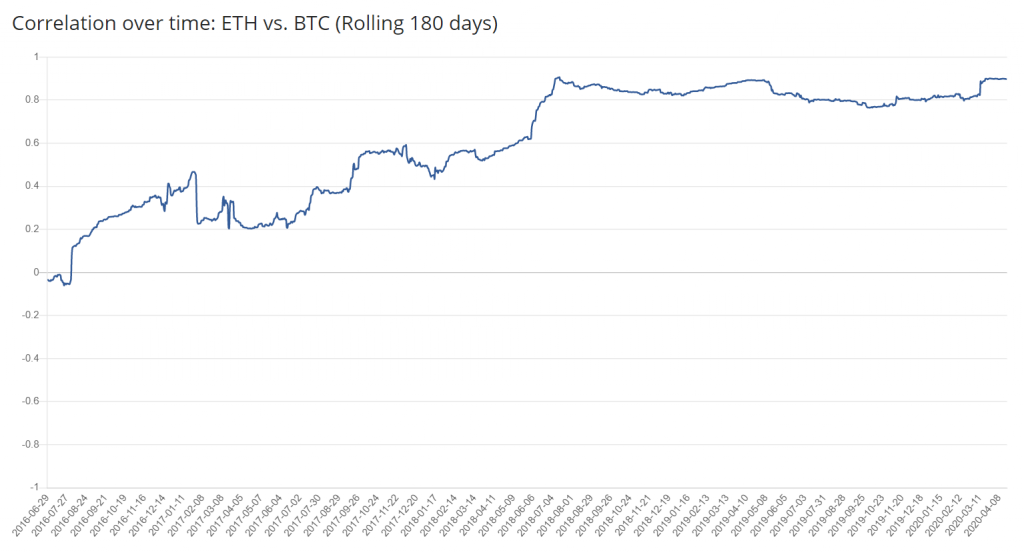

Bitcoin vs. Ethereum

Assessing the development of the correlation coefficient between BTC and ETH since 2016 with a 180-day rolling window, the analysis returns something like this:

We started with almost no correlation. There were times in between when it seemed like they moved uncorrelated. But the trend clearly indicates a growing relationship between Bitcoin and Ethereum.

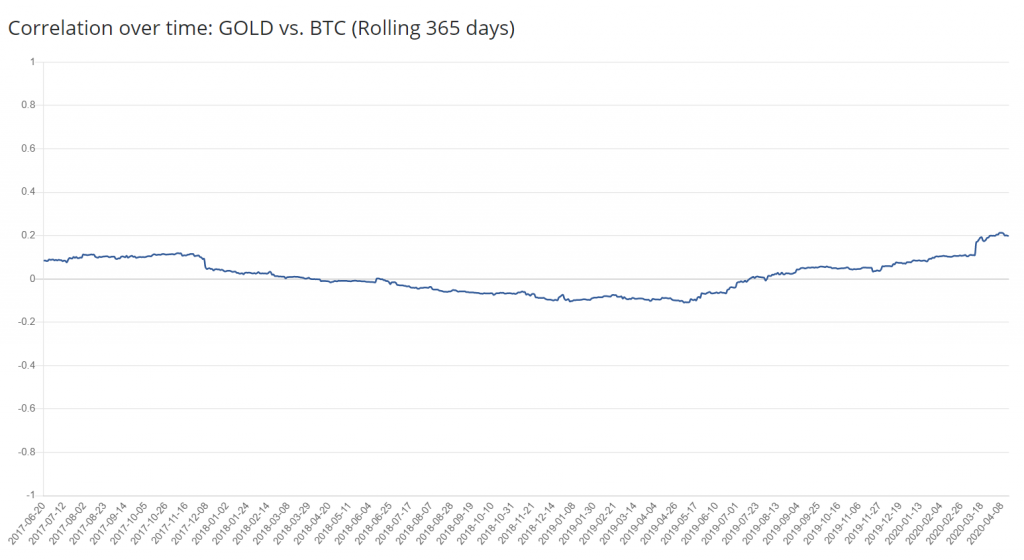

Bitcoin vs. Gold

There is no correlation whatsoever between the price movements of Gold and Bitcoin.

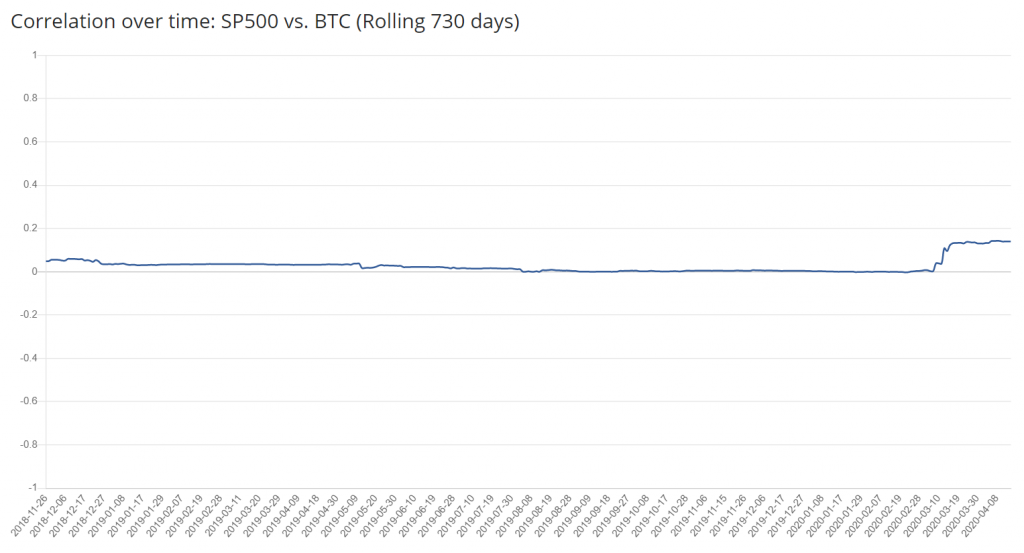

Bitcoin vs. Stocks

Not taking the recent Corona-induced crash into account, it is evident that the Bitcoin price movement is equally uncorrelated with the stock market. Even though Bitcoin and the S&P 500 both took a hit in March 2020, resulting in a growing correlation, it is still relatively weak.

If we disregard these short term trends and look at the 2-year rolling window since 2016 the BTC / S&P 500 coefficient it looks like follows.

Bitcoin and stocks are completely uncorrelated! Incidentally, the chart for ETH vs. S&P 500 looks the same.

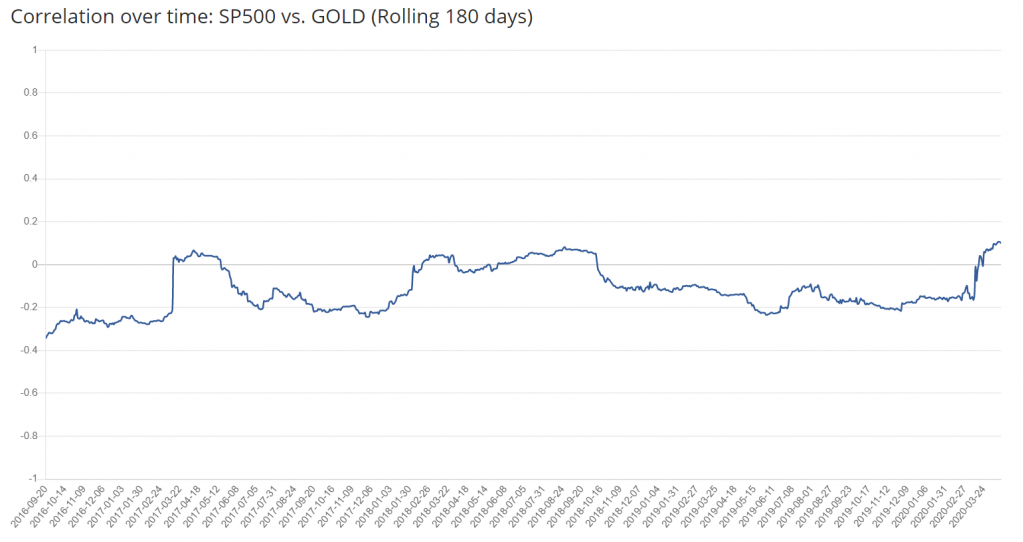

Gold vs. Stocks

We find the same case again: there is no correlation to be found.

Conclusion & Disclaimer

- Based on the data it becomes obvious that Bitcoin is an uncorrelated asset as gold is.

- So are all other cryptocurrencies, except among themselves.

- Being an “uncorrelated asset” does not mean that Bitcoin must go up if stocks go down. That would constitute a negative correlation.

- Prices which are moving in the same direction for a couple of days are not indicators for an existing positive correlation. In order to get significant results, longer timeframes need to be assessed.

- Here, the statistical significance of all the correlation coefficients was not calculated. Nonetheless, the stronger ones are significant with an α = 0,05 significance level and N > 90 days.

- These insights are not investment advice!

- Thank you to @keledoro for helping with the calculation.

Über Holger

Beiträge aus dem Blog

25. Mai 2021 // Miscellaneous

3. Mai 2021 // Data

29. Januar 2021 // Funny

28. Januar 2021 // Daten

11. Dezember 2020 // Kryptowährungen

9. September 2020 // Data

7 Kommentare zu Cryptocurrency Correlation Study

Sehr guter Überblicken, danke Holger

Nice work, could you add Bitcoin Cash?

In a couple of years. Need more than 2,5 years of price history

Great work, super usefull information. Thanks for sharing

Since you are really into correlation also check this https://coinmetrics.io/correlation-charts/

Can I write a scientific paper based on your analysis?

Источник