- Обратный отсчет халвинг биткоин

- What Is a Bitcoin Halving?

- Why Are Halvings Significant?

- How Many Bitcoin Halvings Have There Been Before?

- How Is Our Timer Calculated?

- Bitcoin Block Reward Halving Countdown

- What is a block halving event?

- Why was this done?

- Predictable monetary supply

- Who controls the issuance of Bitcoin?

- Past halving event dates

- Past halving price performance

- How to buy Bitcoin?

- Bitcoin Clock

- What is the Bitcoin Halving (Halvening)?

- What is the Significance of the Bitcoin Block Halving?

- Bitcoin Halving Chart

- Bitcoin Halving Schedule

- What Happens to Miners During Halvings?

- When is the 2024 Bitcoin Halving?

- Bitcoin Halving Dates History

- 2012 Halving

- 2016 Halving

- 2020 Halving

- Current Bitcoin Block Subsidy

- Bitcoin Halving Parties

- When Will All 21 Million Bitcoins be Mined?

- Is There an Ethereum Block Reward Halving Countdown?

- What is the Bitcoin Clock?

- Is the Halving Necessary?

- Why Our Estimates Are the Most Accurate

- What is the Current Bitcoin Block Reward?

- Обратный Отсчёт Халвинга Биткоина

- Что такое халвинг биткоина?

- Почему происходит Халвинг?

- Исторический график халвинга биткойна

Обратный отсчет халвинг биткоин

What Is a Bitcoin Halving?

In all their infinite wisdom, Bitcoin’s anonymous inventor Satoshi Nakamoto decided that only 21 million BTC would ever exist. They wanted new coins to be released gradually into the market — but at the same time, it was crucial for a generous supply of Bitcoin to start circulating sooner rather than later.

New BTC are given to Bitcoin miners as their Bitcoin block reward when they verify blocks of transactions. To begin with, the reward stood at 50 BTC per block. This would have been worth under a dollar back in 2009 — but at today’s rates (April 28), the price of Bitcoin would’ve gotten you a windfall of around $388,000.

Such generous terms wouldn’t last forever. Under Bitcoin’s rules, rewards would only stay this high for the first 210,000 blocks, and then they would be cut by 50%. By this point, half of the BTC that would ever exist — 10.5 million — were out in circulation.

For this upcoming Bitcoin halving (also known as halvening), the total number of Bitcoin mined by miners per block will be reduced from 6.25 BTC to 3.125 BTC.

Why Are Halvings Significant?

As rare as an eclipse, a World Cup and your best friend buying you a drink, the Bitcoin halving generates a lot of excitement in crypto circles. They are at the very core of the cryptocurrency’s economic models, because they ensure that coins will be issued at a steady pace, following a predictable decaying rate.

This controlled rate of monetary inflation is one of the main differences between most cryptocurrencies and traditional fiat currencies, which essentially have an infinite supply due to the monetary policy of central banks.

There will only ever be 32 Bitcoin halving events. Once the 32nd halving is completed, there will be no more new Bitcoin created, as its maximum supply of 21 million will have been reached.

If you’re interested in acquiring some Bitcoin yourself before the halving, see here for everything you need to know about the purchasing process.

How Many Bitcoin Halvings Have There Been Before?

The first-ever Bitcoin halving took place on Nov. 28, 2012 — slashing rewards to just 25 BTC. On this date, a single BTC would set you back about $12. But just look at where it was a year later. Dusting off the CMC archives, we can see that the price of Bitcoin stood at $1,031.95 on that date in 2013. That’s an annual rise of 8,500%, the types of returns that would cause most Wall Street investors to faint.

Let’s travel in time to the second halving in 2016, when rewards were about to tumble once again, this time to 12.5 BTC. On the date Bitcoin hit 420,000 blocks — July 9, to be exact — one coin cost $650.96. A year later, Bitcoin was already at $2,518.44. However, the real rise took place 5 months later, when on Dec. 17, 2017, Bitcoin ballooned to its all-time high of $20,089. It took just 526 days for growth of 2,990% to be realized.

It’s fair to say that the jury is still out on whether this upcoming halving will be followed by the type of growth that followed the previous halvings. Either way, it’ll take 12 to 18 months to know if Bitcoin can pull it off again.

How Is Our Timer Calculated?

You may notice our countdown has a different estimation than other Bitcoin halving countdowns, and the obvious question is, «»Why?»»

Instead of using the commonly quoted average Bitcoin block time (10 minutes), we are using live blockchain statistics to obtain an estimation of the current average Bitcoin block time, and then using this number for our calculations. We believe that this makes our countdown more accurate, and any fluctuations that you may see speak to the precision of our way of measurement.

The Bitcoin Halving timer on CoinMarketCap is calculated using the following formula:

Источник

Bitcoin Block Reward Halving Countdown

What is a block halving event?

As part of Bitcoin’s coin issuance, miners are rewarded a certain amount of bitcoins whenever a block is produced (approximately every 10 minutes). When Bitcoin first started, 50 Bitcoins per block were given as a reward to miners. After every 210,000 blocks are mined (approximately every 4 years), the block reward halves and will keep on halving until the block reward per block becomes 0 (approximately by year 2140). As of now, the block reward is 6.25 coins per block and will decrease to 3.125 coins per block post halving.

Why was this done?

Bitcoin was designed as a deflationary currency. Like gold, the premise is that over time, the issuance of bitcoins will decrease and thus become scarcer over time. As bitcoins become scarcer and if demand for them increases over time, Bitcoin can be used as a hedge against inflation as the price, guided by price equilibrium is bound to increase. On the flip side, fiat currencies (like the US dollar), inflate over time as its monetary supply increases, leading to a decrease in purchasing power. This is known as monetary debasement by inflation. A simple example would be to compare housing prices decades ago to now and you’ll notice that they’ve increased over time!

Predictable monetary supply

Since we know Bitcoin’s issuance over time, people can rely on programmed/controlled supply. This is helpful to understand what the current inflation rate of Bitcoin is, what the future inflation rate will be at a specific point in time, how many Bitcoins are in circulation and how many remain left to be mined.

Who controls the issuance of Bitcoin?

The network itself controls the issuance of Bitcoins, derived by consensus through all Bitcoin participants. Ever since Bitcoin was first designed, the following consensus rules exist to this day:

- 21,000,000 Bitcoins to ever be produced

- Target of 10-minute block intervals

- Halving event occurring every 210,000 blocks (approximately every 4 years)

- Block reward which starts at 50 and halves continually every halving event until it reaches 0 (approximately by year 2140)

Any change to these parameters requires all Bitcoin participants to agree by consensus to approve the change.

Past halving event dates

- The first halving event occurred on the 28th of November, 2012 (UTC) at block height 210,000

- The second halving event occurred on the 9th of July, 2016 (UTC) at block height 420,000

- The third halving event occurred on the 11th of May, 2020 (UTC) at block height 630,000

Past halving price performance

It is always a debate on what Bitcoin will do in terms of pricing for a halving event. Some people believe that the halving is already priced in by the market and thus there’s no expectation for the price to do anything. Others believe that due to price equilibrium, a halving of supply should cause an increase in price if demand for Bitcoins is equal or greater than what it was before the halving event. Below is a chart showing past price performance of the two halving events:

How to buy Bitcoin?

Coinbase is one of the largest cryptocurrency exchange in the world, serving over 102 countries, 30 million+ customers and over 150 billion in trading volume. Funds are protected by insurance and secure storage. You can also earn up to $158 worth of cryptocurrencies. Click below to find out more:

Источник

Bitcoin Clock

2024 Block Halving ETA:

2024 Halving Date ETA:

What is the Bitcoin Halving (Halvening)?

New bitcoins are issued by the Bitcoin network every 10 minutes. For the first four years of Bitcoin’s existence, the amount of new bitcoins issued every 10 minutes was 50. Every four years, this number is cut in half. The day the amount halves is called a «halving» or «halvening».

In 2012, the amount of new bitcoins issued every 10 minutes dropped from 50 bitcoins to 25. In 2016, it dropped from 25 to 12.5. In the most recent May 11, 2020 halving, the reward dropped from 12.5 to 6.25 BTC per block.

In the 2024 halving, the reward will drop from 6.25 BTC per block to 3.125 BTC.

What is the Significance of the Bitcoin Block Halving?

The halving decreases the amount of new bitcoins generated per block. This means the supply of new bitcoins is lower, making buying more expensive.

In normal markets, lower supply with steady demand usually leads to higher prices. Since the halving reduces the supply of new bitcoins, and demand usually remains steady, the halving has usually preceded some of Bitcoin’s largest runs.

In the image below, the vertical blue lines indicate the previous three halvings (2012-11-28, 2016-7-9 and 2020-5-11). Note how the price has jumped significantly after each halving.

Bitcoin Halving Chart

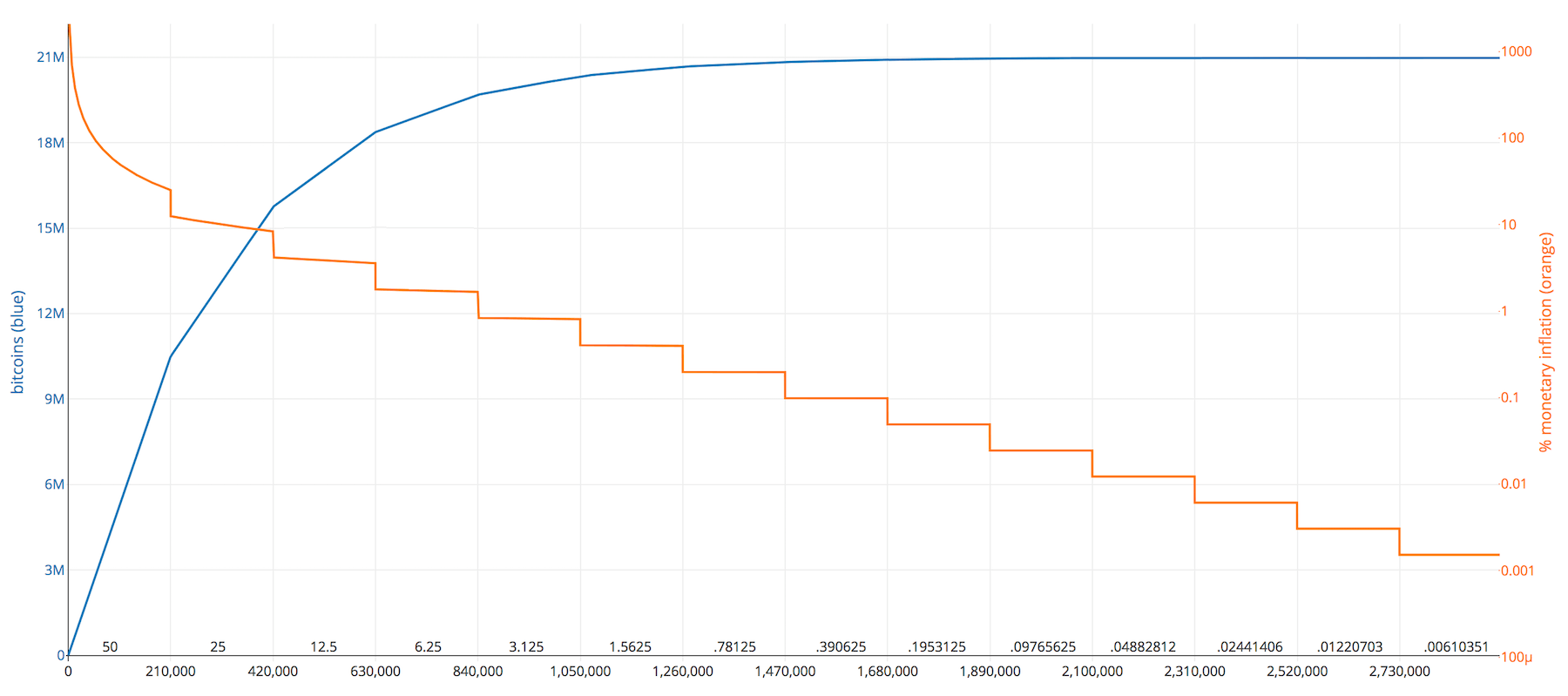

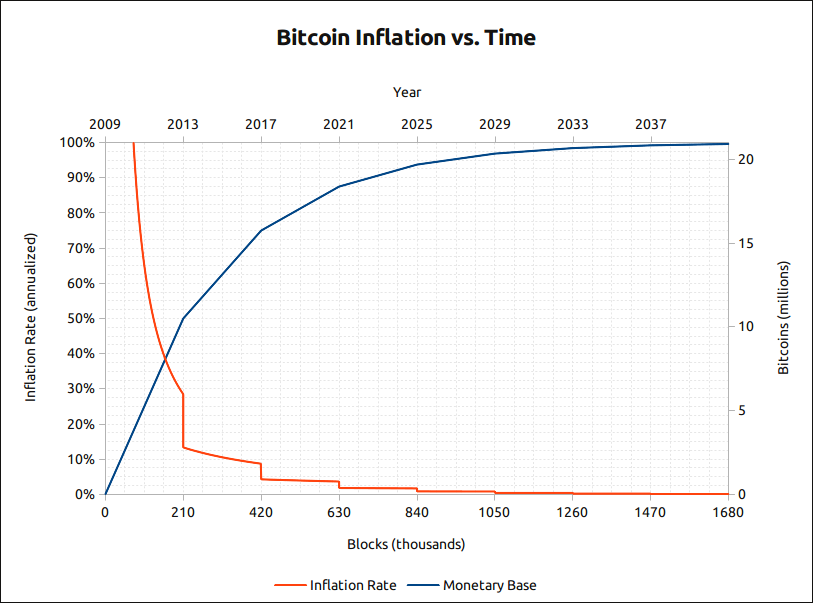

In the image below, you can see Bitcoin’s inflation rate during each period.

Each halving lowers Bitcoin’s inflation rate. The orange line is Bitcoin’s inflation rate during a given period, while the blue line is the total number of bitcoins issued.

Bitcoin Halving Schedule

The Bitcoin halving is scheduled in block height, not date.

The halving happens every 210,000 blocks. The 2024 halving will happen on block 840,000.

What Happens to Miners During Halvings?

Many always speculate that miners will shut down after the halving. The reality is most miners are very smart and price in the halving, so they don’t end up shutting down any miners.

When is the 2024 Bitcoin Halving?

The 2024 halving will likely occur between February 2024 and June 2024. Our most updated estimate is displayed at the top of this page.

Bitcoin Halving Dates History

This section will take a look at the previous two halvings.

2012 Halving

The 2012 block halving was the first halving and happened on November 28th, 2012. The halving block was mined by SlushPool by someone using a Radeon HD 5800 miner.

- New BTC Per Block Before: 50 BTC per block

- New BTC Per Block After: 25 BTC per block

- Price on Halving Day: $12.35

- Price 150 Days Later: $127.00

2016 Halving

The second halving occurred on July 9th, 2016.

- New BTC Per Block Before: 25 BTC per block

- New BTC Per Block After: 12.5 BTC per block

- Price on Halving Day: $650.63

- Price 150 Days Later: $758.81

2020 Halving

The third halving occurred on May 11, 2020.

- New BTC Per Block Before: 12.5 BTC per block

- New BTC Per Block After: 6.25 BTC per block

- Price on Halving Day: $8821.42

- Price 150 Days Later: $10,943.00

Current Bitcoin Block Subsidy

The current Bitcoin block subsidy is 6.25 bitcoins per block. When block 840,000 is hit in 2024, the subsidy will drop to 3.125 bitcoins (BTC) per block.

Bitcoin Halving Parties

Thousands of Bitcoiners across the world celebrated the 2016 halving. There were parties in major cities and countries like Melbourne, Australia, Montreal, Canada, NYC, USA, London, UK, Dublin, Paris and dozens of other cities. People often sell, exchange & buy bitcoins with each other at these events.

Here is a video from the 2016 HODL halving party in Tel Aviv:

When party events are posted, we’ll keep track of them here!

When Will All 21 Million Bitcoins be Mined?

All 21 million bitcoins (BTC) will be mined by 2140. But more than 98% will be mined by 2030.

Is There an Ethereum Block Reward Halving Countdown?

Ethereum’s block reward does not halve like Bitcoin’s, so there is no countdown.

What is the Bitcoin Clock?

The Bitcoin clock has been around since 2011. In 2018, the owner let the domain expire. We revamped the site and restored it to its original vision.

Is the Halving Necessary?

The halving is necessary. This is how Bitcoin controls its supply. Once the block subsidy expires, transaction fees will pay miners for securing the network.

Why Our Estimates Are the Most Accurate

Most of the other halving date estimators use 10 minute blocks to calculate the estimated halving date.

Blocks, however, have been mined at less than 10 minute intervals for almost all of Bitcoin’s history.

Our calculator uses data from BTC.com to get the average block time for the past two months. It then uses this block time (currently 10.3125 minutes between blocks as of March 25, 2020) to estimate the halving date.

While most of the other sites estimate the halving for late-May, the more likely outcome is an early-May reward halving.

What is the Current Bitcoin Block Reward?

Currently, there are 6.25 new bitcoins issued per block.

Bitcoin Clock — a project by Buy Bitcoin Worldwide.

Источник

Обратный Отсчёт Халвинга Биткоина

Bitcoin(BTC) Вознаграждение за биткойн-блок делится пополам каждые 210,000 блоков. После этого вознаграждение будет сокращено с 6.25 BTC до 3.125 BTC.

- Текущая высота блока: 687242

- Осталось блоков: 152758

- Халвинг: 840000

- Расчетное время:

Что такое халвинг биткоина?

Халвинг биткойна также называют половинным вознаграждением за биткойн, где вознаграждение за майнинг каждого нового блока уменьшается вдвое каждые 4 года. Это означает, что награда за каждый вновь добытый блок уменьшается вдвое после деления пополам. Когда Биткойн появился в 2009 году, его награда за блок составляла 50 BTC. Награда за блок рассчитывается примерно каждые 4 года в зависимости от времени блока и, наконец, достигает конечного общего запаса в 21 миллион.

До сих пор биткойны имели три халвинг, в ноябре 2012 года и июле 2016 года июле Май 2020 года соответственно. четыр предстоящее сокращение ожидается в мае 2024 года. К этому времени вознаграждение уменьшится с 6.25 до 3.125 BTC.

Почему происходит Халвинг?

Согласно теории спроса и предложения, если товар имеет бесконечное количество в обращении, инфляция имеет тенденцию происходить, и она может стать бесполезной. Так же как и биткойн. Использование халвинга, чтобы ограничить его количество и циркуляцию может увеличить дефицит и сделать его более ценным. Суть биткойна, делимого пополам, заключается в увеличении его стоимости.

Исторический график халвинга биткойна

Сатоши Накамото опубликовал «Электронную систему наличных денег в одноранговой сети» и впервые представил концепцию Биткойн.

Сатоши Накамото добыл блок генезиса и отметил, что биткойны появились. В то время награда за блок составляла 50 BTC.

Сатоши Накамото утверждает, что биткион делится пополам каждые 21 000 блоков, пока не будет добыт весь 21 миллион биткойнов, по оценкам в 2140 году.

Первый биткойн халвинг. Награда за блок была уменьшена до 25 BTC

Второй биткойн халвинг. Награда за блок была уменьшена до 12.5 BTC

Tрет биткойн халвинг. Награда за блок была уменьшена до 6.25 BTC

Предстоящее третье сокращение ожидается в мае 2024 года. Это означает, что после этого сокращения вознаграждение за блок сократится до 3.125 BTC

Источник