- Best Bitcoin & Crypto Exchanges & Platforms

- Our Top Picks

- Best Exchange For

- Best Crypto Trading Platform

- eToro

- Simple exchange with many coins supported

- Best Bitcoin Exchange

- Coinbase

- Easy to use Bitcoin exchange site & app

- Best Exchange for Low Fees

- Coinbase Pro

- Lowest fees among trading platforms

- Chapter 1

- Introduction to Exchanges

- Chapter 2

- Best Crypto Exchange & Trading Platform

- eToro — (Best for Most Countries)

- Coinbase Pro — (Best for USA)

- eToro — (Best for UK)

- BitPanda Pro — (Best for Europe)

- Bitbuy — (Best for Canada)

- Chapter 3

- Best Place to Buy Crypto

- eToro — (Best for Most Countries)

- Coinbase — (Best for USA)

- eToro — (Best for UK)

- BitPanda — (Best for Europe)

- Bitbuy — (Best for Canada)

- Chapter 4

- Best Bitcoin Exchange and Trading Platform

- eToro — (Best for Most Countries)

- Coinbase — (Best for USA)

- BitPanda — (Best for Europe)

- eToro — (Best for UK)

- Bitbuy — (Best for Canada)

- Chapter 5

- Best Place to Buy Bitcoin

- Coinbase — (Best for USA)

- BitPanda — (Best for Europe)

- Bitbuy — (Best for Canada)

- Chapter 6

- Best Cheap Exchanges with Low Fees

- Coinbase Pro — (Best for USA)

- BitPanda Pro — (Best for UK)

- Bitbuy — (Best for Canada)

- Chapter 7

- Frequently Asked Questions

- What is the Best Crypto Trading App?

- What is the Biggest Crypto Exchange?

- What is the Safest Crypto Exchange?

- Are there Any Free Crypto Exchanges?

- Best Cryptocurrency Exchange for Beginners

- Best Cryptocurrency Exchange for Day Trading

- 1. Lowest Trading Fees and Transaction Fees

- 2. Liquidity

- Best Bitcoin Exchange for US in 2020

- Most Trusted Bitcoin Exchanges That Accept US citizens

- Binance

- Coinbase

- Kraken

- Bitstamp

- Poloniex

- Gemini

- Bitcoin & Cryptocurrency Exchange FAQs

- What is a cryptocurrency wallet?

- If I forget my password, will I lose my crypto forever?

- Is there any risk in leaving my crypto on an exchange? Why do some users insist on holding their crypto in their own wallets?

- What is margin trading?

- The exchange says it allows credit card purchases, but it is rejecting my transaction. Why?

- Which cryptoassets should I buy?

Best Bitcoin & Crypto Exchanges & Platforms

We can both agree on this:

Finding the best Bitcoin exchange platform is confusing.

Today we’ll show you how easy and fast it can be.

We’ve collected the best crypto exchanges & listed them for you below.

Our Top Picks

Best Exchange For

Best Crypto Trading Platform

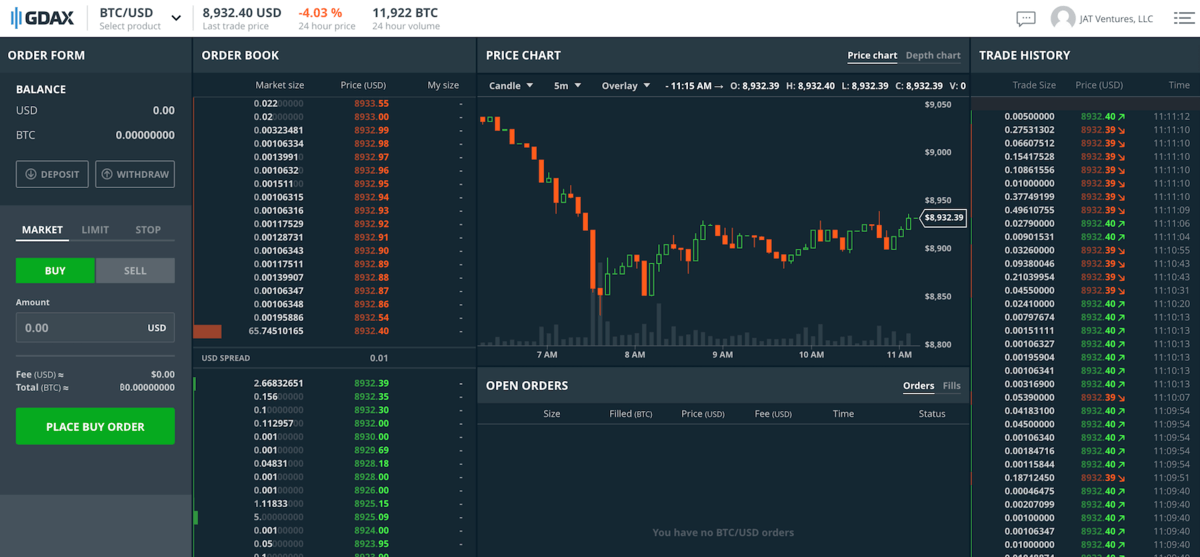

eToro

Simple exchange with many coins supported

eToro is a large crypto trading platform. It’s easy to use and supports dozens of different cryptocurrencies, including Bitcoin & Ethereum.

Best Bitcoin Exchange

Coinbase

Easy to use Bitcoin exchange site & app

One of the most popular & trusted Bitcoin exchanges. Both its website and app are easy to use.

Best Exchange for Low Fees

Coinbase Pro

Lowest fees among trading platforms

Coinbase Pro has some of the lowest fees among trading platforms, along with an easy to use app.

Chapter 1

Introduction to Exchanges

Today, there are many different types of Bitcoin & crypto exchanges. So, we’ve determined the best exchanges for different types of traders.

Just click the section below that you want to learn about:

- Best Crypto Exchange & Trading Platform — exchanges that support trading and many coins

- Best Place to Buy Crypto — exchanges for buyers & investors, not traders

- Best Bitcoin Exchange & Trading Platform — exchanges for pure Bitcoin traders

- Best Place to Buy Bitcoin — exchanges best for buyers of Bitcoin, not traders

- Cheapest Crypto Exchanges with Low Fees — exchanges that don’t cost a fortune

We suggest using the exchanges listed below or doing research before buying from any exchange.

We do research on every crypto exchange we list & are very careful not to include scam exchanges.

Chapter 2

Best Crypto Exchange & Trading Platform

This section will discuss some of the best crypto exchanges and crypto trading platforms. In our view, this means exchanges that are good for making trades and support many different cryptocurrencies.

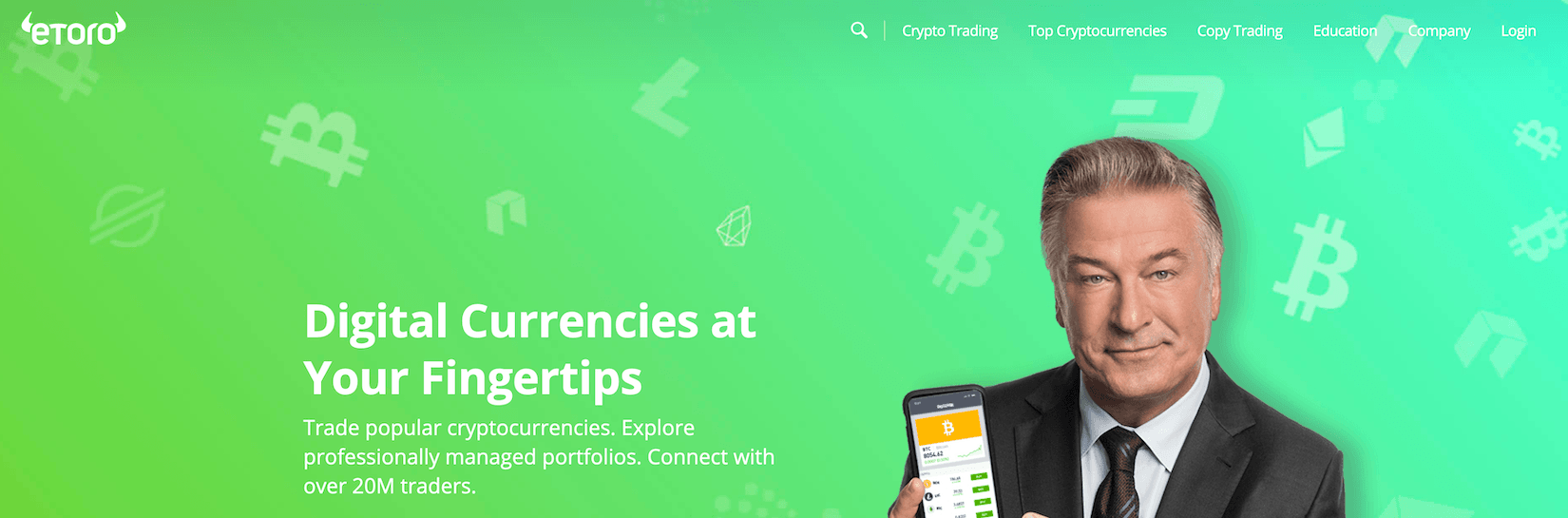

eToro — (Best for Most Countries)

eToro is one of the largest trading platforms worldwide. It features an easy-to-use trading interface with support for many cryptocurrencies.

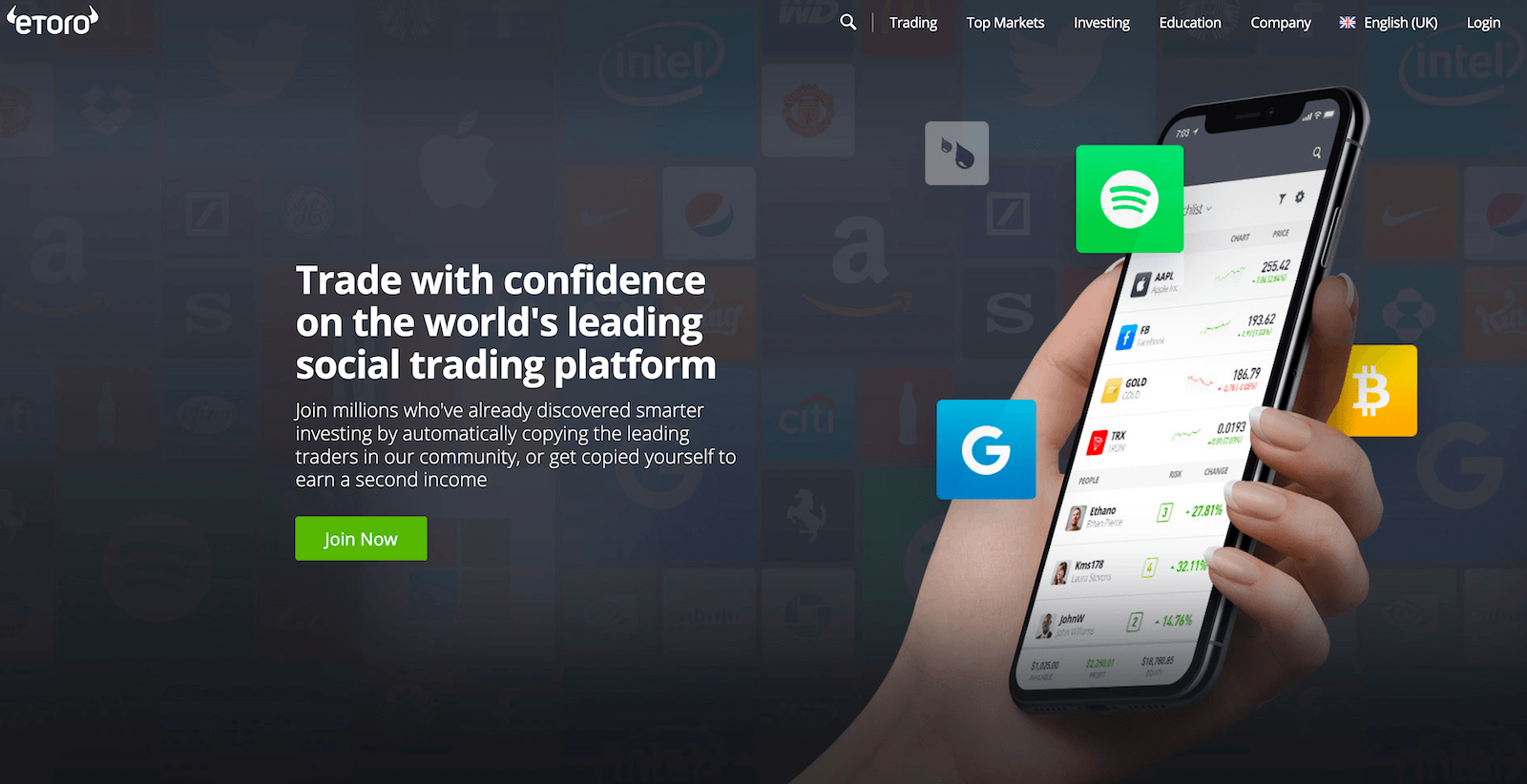

Coinbase Pro — (Best for USA)

Coinbase is the world’s largest Bitcoin (BTC) broker. They represent an easy and fast way for new users to purchase bitcoins and dozens of other crypto coins.

Deposits can be made via wire transfer, ACH, debit card, SEPA and many others. Coinbase supports Bitcoin, Ethereum, Litecoin and many other altcoins.

eToro — (Best for UK)

eToro is one of the largest trading platforms worldwide, and one of the most popular in the United Kingdom. It features an easy-to-use trading interface with support for many cryptocurrencies.

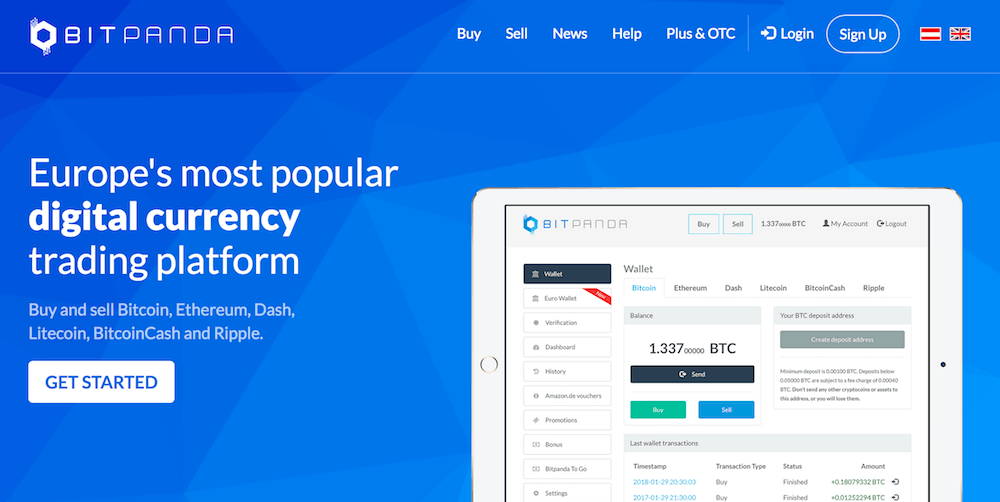

BitPanda Pro — (Best for Europe)

BitPanda is based in Europe and is a crypto exchange platform. You can deposit euro via NETELLER, Skrill, SEPA, credit card and many other payment methods.

Bitpanda supports Bitcoin, Litecoin, Ethereum and many other coins. Users from all of Europe are able to use Bitpanda. US users are not able to trade on Bitpanda at this time.

Bitbuy — (Best for Canada)

Bitbuy is based in Canada and is a crypto exchange platform. You can deposit euro via wire, Interac and bank transfer.

Bitbuy supports Bitcoin, Ethereum, Litecoin and many other coins. It has some of the lowest fees in Canada.

If none of the platforms above suit your needs, you can always use the exchange finder tool on our home page to find more exchanges.

Chapter 3

Best Place to Buy Crypto

The best places to buy crypto are different than the best crypto trading platforms. The platforms are focused towards traders, while the exchanges in this chapter are geared towards long-term buyers and investors.

eToro — (Best for Most Countries)

eToro is one of the largest crypto exchanges worldwide, and an easy way to buy cryptocurrency. It features an easy-to-use trading interface with support for many cryptocurrencies.

Coinbase — (Best for USA)

Coinbase is the world’s largest cryptocurrency broker. They represent an easy and fast way for new users to purchase bitcoins and dozens of other crypto coins.

Deposits can be made via wire transfer, ACH, debit card, SEPA and many others. Coinbase supports Bitcoin, Ethereum, Litecoin and many other altcoins.

eToro — (Best for UK)

eToro is one of the largest trading platforms worldwide, and one of the most popular in the United Kingdom. It features an easy-to-use trading interface with support for many cryptocurrencies.

BitPanda — (Best for Europe)

BitPanda is based in Europe and is a crypto exchange platform. You can deposit euro via NETELLER, Skrill, SEPA, credit card and many other payment methods.

Bitpanda supports Bitcoin, Litecoin, Ethereum and many other coins. Users from all of Europe are able to use Bitpanda.

Bitbuy — (Best for Canada)

Bitbuy is based in Canada and is an easy place to buy crypto. You can deposit euro via wire, Interac and bank transfer.

Bitbuy supports Bitcoin, Ethereum, Litecoin and many other coins. It has some of the lowest fees in Canada.

If none of the exchanges to buy crypto above suit your needs, you can always use the exchange finder tool on our home page to find more exchanges.

Chapter 4

Best Bitcoin Exchange and Trading Platform

eToro — (Best for Most Countries)

eToro is one of the largest Bitcoin trading platforms worldwide. It features an easy-to-use trading interface with support for many cryptocurrencies.

Coinbase — (Best for USA)

Coinbase is the world’s largest cryptocurrency broker. They represent an easy and fast way for new users to purchase bitcoins and dozens of other crypto coins.

BitPanda — (Best for Europe)

BitPanda is based in Europe and is a Bitcoin exchange platform. You can deposit euro via NETELLER, Skrill, SEPA, credit card and many other payment methods.

Bitpanda supports Bitcoin and has low fees. Users from all of Europe are able to use Bitpanda.

eToro — (Best for UK)

eToro is one of the largest Bitcoin trading platforms worldwide, and one of the most popular in the United Kingdom. It features an easy-to-use trading interface with support for many cryptocurrencies.

Bitbuy — (Best for Canada)

Bitbuy is based in Canada and is a Bitcoin exchange platform. You can deposit euro via wire, Interac and bank transfer.

Bitbuy supports Bitcoin and has some of the lowest fees in Canada. The liquidity on the platform is strong, meaning it’s easy to make trades at good prices.

If none of the Bitcoin trading platforms above suit your needs, you can always use the exchange finder tool on our home page to find more exchanges.

Chapter 5

Best Place to Buy Bitcoin

Coinbase — (Best for USA)

Coinbase is the world’s largest cryptocurrency broker. They represent an easy and fast way for new users to purchase bitcoins.

BitPanda — (Best for Europe)

BitPanda is based in Europe and is an easy place to buy bitcoin. You can deposit euro, GBP and other currencies via NETELLER, Skrill, SEPA, credit card and many other payment methods.

Bitcoin can be purchased quickly with low fees from all European countries.

Bitbuy — (Best for Canada)

Bitbuy is based in Canada and is a crypto exchange platform. You can deposit euro via wire, Interac and bank transfer.

Bitbuy supports Bitcoin, Ethereum, Litecoin and many other coins. It has some of the lowest fees in Canada.

If none of the Bitcoin exchanges above suit your needs, you can always use the exchange finder tool on our home page to find more exchanges.

Chapter 6

Best Cheap Exchanges with Low Fees

Coinbase Pro — (Best for USA)

Coinbase Pro is one of the world’s largest cryptocurrency exchanges by volume. Among exchanges, Coinbase Pro has some of the lowest fees.

BitPanda Pro — (Best for UK)

BitPanda Pro is based in Europe and is an easy place to buy cryptocurrency for cheap fees.

Trades can be executed quickly for low prices on Bitpanda Pro.

Bitbuy — (Best for Canada)

Bitbuy is based in Canada and is a crypto exchange platform. You can deposit euro via wire, Interac and bank transfer.

Bitbuy supports Bitcoin, Ethereum, Litecoin and many other coins. It has some of the lowest fees in Canada.

If none of the cheap exchanges above suit your needs, you can always use the exchange finder tool on our home page to find more exchanges.

Chapter 7

Frequently Asked Questions

What is the Best Crypto Trading App?

Most of the exchanges on our list above all have apps on both the iOS App Store and the Android Play Store.

The most popular crypto trading apps are:

What is the Biggest Crypto Exchange?

Based on volume, Coinbase and Binance usually have the most volume for Bitcoin on average.

Coinbase usually trades around $500 billion per 24 hours, while Binance usually trades around $3 billion every 24 hours, just on its main dollar pairs.

What is the Safest Crypto Exchange?

There is no such thing as a «safe» exchange.

Many cryptocurrency exchanges have been hacked. While small amounts of crypto can be stored on exchanges, users should do their best to withdrawal crypto from the exchange to their own wallet.

Besides the risk of hack, the exchanges on this list are at least trustworthy, meaning the won’t run away with your money. However, that doesn’t mean unexpected events can’t happen like with Mt Gox.

Are there Any Free Crypto Exchanges?

Robinhood is the only «free» crypto exchange. However, they don’t allow you to withdrawal your coins out of the app. As far as exchanges that allow you to withdrawal crypto and are free? We don’t know of any right now.

Best Cryptocurrency Exchange for Beginners

The best crypto exchange and platform for beginners is probably Coinbase.

This is for a few reasons:

- It has the best user interface and is very easy to use

- The verification process is fast so you can buy almost instantly

- It has excellent mobile apps for iPhone and Android

- It’s a regulated exchange and its cash holdings are FDIC insured

Best Cryptocurrency Exchange for Day Trading

Binance is likely the best exchange for day trading for a few reasons.

1. Lowest Trading Fees and Transaction Fees

Day traders make a lot of trades. Binance has the lowest fees among all exchanges (like Bittrex, Poloniex, etc.).

2. Liquidity

Binance has the most liquidity of any exchange. You can get in and out of digital currency fast at good prices.

We Help The World Buy Bitcoin

Disclaimer: Buy Bitcoin Worldwide is not offering, promoting, or encouraging the purchase, sale, or trade of any security or commodity. Buy Bitcoin Worldwide is for educational purposes only. Every visitor to Buy Bitcoin Worldwide should consult a professional financial advisor before engaging in such practices. Buy Bitcoin Worldwide, nor any of its owners, employees or agents, are licensed broker-dealers, investment advisers, or hold any relevant distinction or title with respect to investing. Buy Bitcoin Worldwide does not promote, facilitate or engage in futures, options contracts or any other form of derivatives trading.

Buy Bitcoin Worldwide does not offer legal advice. Any such advice should be sought independently of visiting Buy Bitcoin Worldwide. Only a legal professional can offer legal advice and Buy Bitcoin Worldwide offers no such advice with respect to the contents of its website.

Buy Bitcoin Worldwide receives compensation with respect to its referrals for out-bound crypto exchanges and crypto wallet websites.

Wallabit Media LLC and/or its owner/writers own Bitcoin.

Источник

Best Bitcoin Exchange for US in 2020

For new users looking to enter the world of Bitcoin and cryptocurrency, there is a plethora of options to go about obtaining and trading these digital assets. Exchanges are the main way for users to buy and sell crypto and there are dozens of different places to do so. In this guide, we will highlight the largest and most reputable exchanges and dive in to the pros and cons of each. Each investor has different needs and preferences, so this will help determine which each may be right for you.

Some of the main factors to keep in mind when choosing an exchange are:

- Fees

- US Dollar Deposits

- History of Security

- Customer Service

- Number of Coins Available

Most Trusted Bitcoin Exchanges That Accept US citizens

| Bitcoin Exchange | 30-day Volume ($) | Fiat Deposits | # of Coins | Mobile App | Margin Trading | Credit Cards |

|---|---|---|---|---|---|---|

| Binance | 24.1B | No | 100+ | Yes | No | Yes |

| Coinbase | 2.1B | Yes | 12 | Yes | No | No |

| Kraken | 1.7B | Yes | 20 | No | Yes | No |

| Bitstamp | 1.2B | Yes | 5 | Yes | No | Not US |

| Poloniex | 303M | No | 65+ | Yes | Yes | No |

| Gemini | 292M | Yes | 6 | Yes | No | No |

Binance

Binance

- Lowest Trading Fees

- Most Coins

- Largest Volume

- No KYC Necessary

- No Fiat Deposits

- No Margin

- Regulatory Risk

Binance Fee Table

| Deposit | Free |

| Trading | 0.1% |

| Credit Card | 3.5% or $10 (whichever is higher) |

| Withdraw | Varies by asset |

Binance is one of the largest exchanges in the world by total daily volume. It is by far the largest of any exchange available to US investors. This is quite impressive as it launched several years later than all of its competitors in mid-2017. It was originally started by a team out of Shanghai, led by its famous CEO Changpeng Zhao, or CZ. However, recently it has moved its headquarters to Malta where finance and crypto regulations are much less stringent.

Binance is a popular exchange because it has a simple to understand, low fee structure. It has one of the lowest fees for US investors and offers the most cryptocurrencies to trade out of any major exchange with well over 100. If investors trade using its own cryptocurrency BNB, they will receive an additional fee discount. Additionally, its large daily volume ensures efficient markets, so traders are always able to easily buy and sell even relatively obscure coins. It is also one of the only large exchanges that does not require customers to provide their identity and other financial details. Most customers only need an email address to start trading.

Additionally, there is no margin trading. There is a mobile app, but it is not as user friendly as some of its competitors.

Coinbase

- Great History of Security

- FDIC Insured

- Good for Beginners

- Coinbase Pro for Advanced Trading

- High Fees (You can get lower using Coinbase Pro)

- Slow Customer Support

- No Credit Crad or Margin

Coinbase Fee Table

| Deposit | Free (ACH) or $10 Wire Transfer |

| Trading via Coinbase | US Bank Account 1.49% Coinbase USD Wallet 1.49% Credit/Debit Card — 3.99% |

| Trading via Coinbase Pro | Taker Fee .05% — .025% Maker Fee 0.00% — 0.15% |

| Withdraw | Free (ACH or Paypal) or $25 (Wire Transfer) |

Coinbase is the most successful crypto exchange that is based in the US, in terms of profitability and average volume. Founded in 2014 by ex-Airbnb staff, Coinbase has its headquarters in San Francisco and offers a website and mobile app to trade cryptocurrencies.

Its simplistic, user-friendly interface makes it a great option for investors just learning about the crypto ecosystem. However, it also boasts Coinbase Pro (formerly GDAX), a more complex platform that is geared for sophisticated traders and institutions. The Coinbase Pro product offers lower fees and several more cryptocurrency trading options. Coinbase has a transparent and reputable past with security. It has never had any major security incidents and insures deposits of US Dollars and cryptocurrencies.

However, Coinbase has some of the highest fees when trading in USD pairs. This is a significant downside for investors that are looking to buy or sell in large volumes. Additionally, Coinbase does not have that best track record when it comes to customer service. Many customers in the past have complained about response times and getting locked out of accounts without explanation, though this has improved markedly in the last 2 years. More serious traders will also be disappointed that there is no margin trading and no credit cards purchases allowed anymore.

Kraken

Kraken Pros:

- Margin Trading

- Oldest Exchange in US

- Can Trade Tether for USD

- No Mobile App

- No Credit Card

- Past Maintenance Issues

Kraken Fee Table

| Deposit | Free |

| Deposit | $5 |

| Trading | 0.14% — 0.26% (under $100k) |

| Withdraw | $5 |

Kraken is the oldest US-based crypto exchange with its headquarters in San Francisco. Its founder, Jesse Powell, started it in after witnessing the failures of the now-infamous Mt. Gox exchange, with trading first going live in 2013. Kraken is the third largest in terms of trading volume of all exchanges on this list.

Kraken has several unique advantages over its competitors. It is the only exchange for US investors that offers both fiat deposits and margin trading. Investors can link their bank account and trade in US Dollars, which is very useful for frequent traders. Margin trading allows investors on Kraken to borrow money in order to place larger trades. This leveraging enables savvy investors to magnify gains, though it is very risky and should only be done by experienced traders.

Additionally, Kraken is one of the only exchanges in the world that allows investors to redeem Tether for US Dollars. Tether is the largest stablecoin (i.e. a cryptocurrency pegged to the dollar). Tether is popular among traders because it allows them to realize their gains on crypto-only exchanges. Thus, Kraken can be useful for traders who use multiple exchanges and want an efficient way to cash out into US Dollars.

On the other hand, Kraken is the only major exchange for US investors that does not offer a mobile app, making it less convenient and accessible. Additionally, over the past two years, Kraken has experienced long periods of outages where its site would be down for days at a time. Though there were no issues with lost funds or hacks, it was a serious problem for investors trying to trade during periods of extreme market volatility.

Bitstamp

- One of the Oldest Exchanges Globally

- FDIC Insured

- Good History of Security

- Limited Number of Cryptocurrencies

- US Customers Have Higher Fees

- No Credit Cards for US Customers

Bitstamp Fee Table

| Deposit | 0.05% or $7.50 (whichever is higher) |

| Trading | 0.24% — 0.25% (under $100k) |

| Withdraw | 0.09% or $15 (whichever is higher) |

Bitstamp is one of the oldest and most reputable crypto exchanges in the world. Historically, it has mainly been focused on the European market. It was originally based in Slovenia and later moved to Luxembourg. Now, it also has operations in London and New York.

It is still one of the largest and best exchanges to use for European citizens due to its low fees. It provides access for US citizens, though its services are more limited, and fees are higher. For instance, it does allow credit card purchases for US citizens. Deposit and withdraw fees are some of the highest in the market, particularly for retail investors make smaller investments. Also, it only offers a few of the most popular cryptocurrencies.

However, it can still be a great option for some US investors. It has a stellar security record and has been around longer than almost any other exchange in the world. It allows US Dollar deposits and all deposits are FDIC insured. Also, Bitstamp has an easy to use interface and its trading fees are modest.

Poloniex

- Lots of Cryptocurrencies

- Low Fees

- Margin Trading

- Ability to Lend & Earn Interest

- No Fiat Deposits

- Lower Volumes

- No Credit Cards

Poloniex Fee Table

| Deposit | Free |

| Trading | 0.08% — 0.20% (under $1M) |

| Withdraw | Varies by asset |

Poloniex was started in 2014, like so many of its competitors. Poloniex is US-based with its headquarters in Boston. It is very popular with experienced crypto traders, as it offers more advanced features and a significant amount of cryptoassets to trade. For users just trying to buy their first Bitcoin, it would not be the optimal place to start.

Poloniex has very low fees. It is free to deposit, but they only accept deposits of crypto. Investors cannot link a bank account or purchase with a credit card. It trades over 65 different cryptocurrencies, which is the most for an exchanged based out of the US. However, despite the vast amount of assets it offers, Poloniex experiences much lower volumes than its competitors on the list. For reference, it often has daily volumes that are 10 times smaller than a leading exchange like Binance.

Poloniex also offers investors features they cannot find many other places. For example, they are the only exchange to offer margin trading besides Kraken. However, a vital difference is that it also allows users to take both sides in the margin trading. In other words, users can borrow assets and also lend their own assets, earning interest in the process. Because it offers risky trading services and relatively obscure coins, Poloniex is best suited for experienced crypto investors.

Poloniex is now owned by Circle, which is a subsidiary of Goldman Sachs.

Gemini

- Great for Institutional Investors

- FDIC Insured

- No Deposit or Withdraw Fees

- Limited Number of Crytoassets

- High Trading Fees for Retail Investors

- No Margin

Gemini Fee Table

| Deposit | Free |

| Trading | 0.25% — 1.50% (under $50k) |

| Withdraw | Free |

Gemini is known as one of the best exchanges for institutional investors. It was started in 2014 by the Winklevoss brothers – the infamous Harvard twins involved in the founding of Facebook. Gemini is based out of New York, which is notable for two reasons. First, New York is notoriously stringent with crypto regulations and licenses for exchanges. Additionally, running out of New York allows Gemini to more easily capture the Wall Street and institutional money looking to enter the crypto world.

Gemini has built a trustworthy reputation in an attempt to make crypto credible in the eyes of the traditional financial system. All US Dollar deposits are FDIC insured. Also, being based in New York subjects them to stronger regulatory oversight, giving investors greater peace of mind.

Their supplementary services besides buying and selling crypto are also catered to institutions. For example, they offer custody services which many large funds need for compliance. They also have a large OTC (over-the-counter) desk and gear their service towards investors trading millions of dollars a week. However, they currently do not offer margin trading.

Though it may not be the cheapest place for retail investors. It does offer an easy to use mobile app. It has relatively high trading fees, though deposits and withdraws are free. It also offers its own stablecoin called the Gemini Dollar.

Bitcoin & Cryptocurrency Exchange FAQs

What is a cryptocurrency wallet?

A wallet is the place where you store your crypto. It is like an account from which you can send or receive crypto. A very important difference though is that different Cryptocurrencies will usually need different crypto wallets. For instance, you cannot store Bitcoin in an Ethereum and send BTC to an ETH wallet will result in lost funds.

A wallet address is sort of like an account number. It is a long string of numbers and letters, known as a public key. It also has a corresponding QR code. You can use either to send or receive crypto. Each exchange will have a wallet for each cryptoasset traded. Exchanges will take of all the wallet logistics when trading within their platform. The only time investors need to take precaution is when depositing or withdrawing.

If I forget my password, will I lose my crypto forever?

When using any of the exchanges above, you will not lose your assets if you lose your password. All the above exchanges custody the assets on your behalf, much like a bank. Exchanges allow for resetting passwords and a customer support team like any other website.

You are only at risk for losing your crypto when using a self-custodial wallet service. These are separate applications and websites apart from the above exchanges. If you are using a decentralized exchange, you may be a risk, as well. Always look into the custody arrangements of an exchange before trading on it.

Is there any risk in leaving my crypto on an exchange? Why do some users insist on holding their crypto in their own wallets?

Like trading any financial asset, there are some inherent risks. When an exchange has custody of your assets, they are responsible for keeping them safe. There is always the possibility that something goes wrong, and you are unable to withdraw your assets or money. This is known as counter-party risk. Counter-party risk is common throughout the traditional financial system, but this risk is more pronounced in the crypto ecosystem. This is mostly because there is less regulatory oversight and most businesses are brand new – meaning they lack the reputation and trustworthiness of decades old financial firms.

In the past few years, several crypto exchanges have been hacked. Some exchanges have engaged in fraudulent accounting activity. In both scenarios, investors holding crypto on the exchanges have lost their money.

By withdrawing your cryptoassets and storing them in a private, self-custodial wallet, you can significantly lower the chance of losing your money. However, it is more complex and only recommended for advanced users. For new users, the best option would be to use a reputable exchange that also insures assets while learning the proper process to store them privately.

What is margin trading?

Margin trading is when an investor borrows money to make larger trades. There will be a margin fee associated that an investor must pay back, just like interest on a loan. Trading on margin allows investor to make considerable larger profits, but also can result in much larger losses. In some unfortunate scenarios, it can even lead to investors losing everything and still owing money to the lender. Exchanges that allow margin trading will monitor positions closely and usually automatically close out positions and take their fee on losing trades.

Margin trading can take place on different scales. Some exchange allows traders to borrow up to 1.5 or 2 times their holdings. Some exchanges even allow 10 times or more. In almost all scenarios, traders must put up some form of collateral.

The exchange says it allows credit card purchases, but it is rejecting my transaction. Why?

This is quite a common problem. Even though an exchange may allow credit card purchases, transactions might not go through. The usual reason is because the user’s bank or card issuer prohibits any purchases from crypto merchants. Many of the major banks and financial institutions have a policy not to allow crypto purchases. Check with your bank or issuer first before contacting an exchange’s customer support team.

Which cryptoassets should I buy?

Crypto investments can be extremely risky. Each investor’s financial goals and overall portfolio varies widely. Thus, the type of cryptoasset and proper allocation percentage will vary widely, too. All cryptoassets differ greatly in their technology, functionality, and market position. It is important to thoroughly research any investments and consult a professional financial advisor before making any investments. Exchanges do not provide investment advice, only the ability to buy and sell.

Источник

Binance

Binance