- АО НК «Kazakh Invest»

- Фонд Инвестиционного Развития Казахстана

- «Фонд Инвестиционного Развития Казахстана»

- Коротко о КIDF

- Направления деятельности

- Совет директоров включает

- Активы под управлением

- Инвестиционная декларация

- Целевые партнеры

- Сумма инвестиций

- Фонд прямых инвестиций DBK Equity создан в Казахстане

- Первоначальная капитализация фонда составит 33,5 млрд тенге.

- Казахстанский фонд прямых инвестиций

- About us

- Our key strategy principles

- The way we operate

- Our Management

- Performance summary

- Contacts

- Institutional landscape

- AGENCIES

- INSTITUTIONS

- Other useful information

АО НК «Kazakh Invest»

Фонд Инвестиционного Развития Казахстана

«Фонд Инвестиционного Развития Казахстана»

Коротко о КIDF

Создан в 2019 году в соответствии с Указом Президента РК и зарегистрирован в Международном финансовом центре «Астана», который регулируется английским правом.

Привлечение инвестиций в развитие экономики Республики Казахстан, путем совместного инвестирования с зарубежными партнерами.

Направления деятельности

- прямые инвестиции в проекты/активы

- партнерства с аналогичными фондами

Совет директоров включает

- Премьер-Министр (Председатель);

- Первый Заместитель Премьер-Министра — Министр финансов;

- Министр иностранных дел;

- Управляющий МФЦА;

- Председатель Правления;

- Два независимых директора

Активы под управлением

Целевое значение — 370 млрд. тенге (порядка $1 млрд.)

Инвестиционная декларация

Целевые партнеры

Иностранные инвесторы (институциональные и отраслевые)

Сумма инвестиций

Не более суммы прямых инвестиций иностранного партнера

Источник

Фонд прямых инвестиций DBK Equity создан в Казахстане

Первоначальная капитализация фонда составит 33,5 млрд тенге.

В Казахстане создан Фонд прямых инвестиций. Проект презентовал исполняющий обязанности председателя правления холдинга «Байтерек» Айдар Арифханов.

«Разрешите представить вам Фонд прямых инвестиций DBK Equity, созданный нашими дочерними организациями холдинга «Байтерек: Казына Капитал Менеджмент и Банком Развития Казахстана. С самого начала создания холдинга приоритетной задачей являлось обеспечение синергии между институтами развития. Для этого холдингом сформированы пакетные предложения из инструментов поддержки дочерних организаций, способные дать универсальные решения для всех предпринимателей», – рассказал он.

Для субъектов среднего и крупного предпринимательства фонд предлагает долгосрочное кредитование, синдицированное кредитование, а также долевое финансирование (smart equity) и мезонинное финансирование через новый фонд БРК-ККМ. Ожидается, что данные инструменты поддержки позволят предпринимателям применять лучшие мировые практики по управлению бизнесом, что, в свою очередь, положительно скажется на экономике проекта. Более того, основной целью инструментов private equity является увеличение стоимости компании. В свою очередь, синергия между двумя институтами развития начинается от первоначального поиска проектов до проведения комплексной экспертизы проекта и принятия корпоративных решений.

«Сотрудничество Банка Развития Казахстана и Казына Капитал Менеджмент в рамках данного фонда позволит потенциальным проектам, не имеющим возможность получить дополнительные заёмные средства, успешно реализовать проект с применением инструмента private equity. В дальнейшем, при финансировании достаточного пула проектов, фондом будет рассмотрена возможность участия других партнёров, в том числе и международных инвесторов, что, в свою очередь, приведёт к привлечению частных инвестиций для поддержки несырьевого сектора экономики Республики Казахстан», – отметил Айдар Арифханов.

Капитализация фонда – 33,5 млрд тенге, доля участия ККМ – 2,99%, БРК через DBK Capital Structure – 97%, доля УК ТОО BV Management – 0,01%. Срок жизни фонда – 10 лет, инвестиционный период – 5 лет.

Следите за самыми актуальными новостями в нашем

Telegram-канале и на странице в Facebook

Источник

Казахстанский фонд прямых инвестиций

“Apart from providing a full-scale coordinated institutional and in-kind support, now the government stands ready to share equity risk with foreign investors.” Askar Mamin, Prime Minister, Investment Ombudsman of the Republic of Kazakhstan

About us

Who we are – a management company for a state owned Kazakhstan Investment Development Fund (KIDF or Fund). KIDF’s main objective is to facilitate direct investment into development of the country’s economy.

We aid foreign enterprises in expansion of their operations into Kazakhstan.

We contribute equity capital alongside your investments.

KIDF Management Company operates within a framework of Astana International Financial Center (AIFC).

KIDF is one of the vehicles of the state infrastructure aimed to improve attractiveness of investment climate in the country. Within that ecosystem the state provides foreign investors with a combination of the following support:

- secure legal framework via Common Law on AIFC

- in-kind contributions like

- land rights, infrastructure and access to resources through regional government’s offices

- tax preferences (VAT, corporate income, land and property tax exemptions) through state agencies

- reasonably priced debt in local and foreign currency (match currency exposure of an asset being created/developed) through development institutions

- and, in the end, sharing equity investment risks with cash equity co-funding through KIDF

Our key strategy principles

The core principles of KIDF strategy are defined in the Concept and subsequent Decree of the President (number 829 dated January 30, 2019). At the same time the strategy is continuously evolving through resolutions of the Board to capture dynamics of rapidly changing market environment (currently it is being updated to take into account COVID-19 impact on world investment activity and marketplace). Below are some key principles underlining KIDF’s strategy that will stand for good.

Economic development is prioritized with quantifiable impact on sustainable growth in GDP and jobs creation, as well as with quality contribution to enabling environment for private sector development.

To meet the government defined mandate, KIDF funds shall be invested:

- along with and in size equal to or less than foreign direct investments coming in cash form

- within the country and be used strictly for creation/development/recovery of assets within the country

- via pure equity instruments on risk-return basis

- with preference to transactions registered within AIFC framework

KIDF evaluates every project in terms of its individual a) financial performance and b) economy development effect (contributions to GDP, jobs, taxes) as compared to other projects in the review process (active pipeline) as well as its impact on KIDF’s invested portfolio (sector exposure, return and risk, expected cash flow pattern).

Joining a foreign investor, KIDF can take part in the following types of investment projects depending on a project stage:

- Greenfield (with involvement of local government offices)

- Brownfield (developing/expanding existing operations)

- Recovery of distressed state-owned assets (portfolios of Distressed Asset Fund, Investment Fund of Kazakhstan)

KIDF operations shall rather supplement than compete with other institutions and investors in the market.

KIDF will consider a foreign business/company as a prospective partner if it meets the following criteria:

- recognizable name/brand in its own market

- sound balance sheet and sustainable operations in the segment of assumed project/development

- positive track record in developing and execution of similar scale projects

- sufficient capacity and resources to develop an assumed project in Kazakhstan

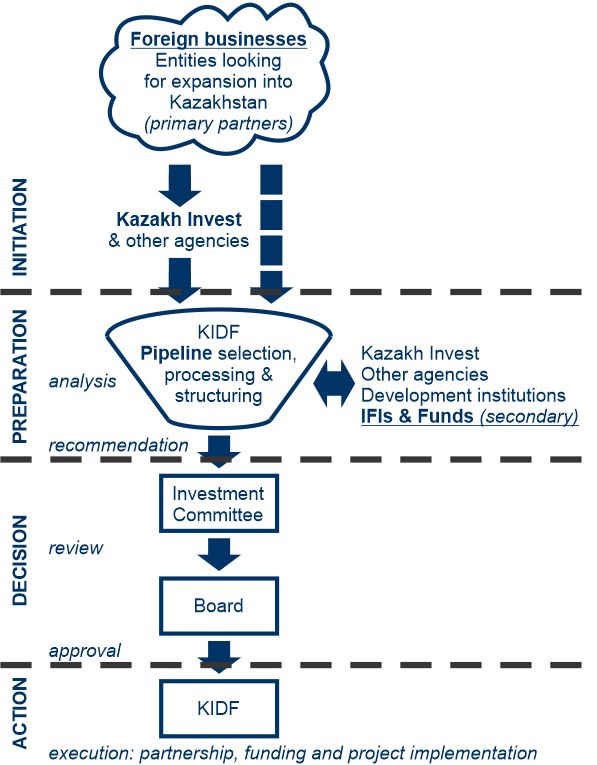

The way we operate

We source our project pipeline primarily via Kazakh Invest (a state investment promotion agency). Kazakh Invest scouts around the world for entrepreneurs and businesses with a recognizable product/service brand, good corporate governance, effective business processes and practices, positive track record, and capability for growth in the region.

When a potential investor indicates an interest in expanding its business into Kazakhstan, a whole set of state agencies and institutions elaborate on feasibility of a prospective development and applicable government support measures necessary to improve economic performance for an investor, if needed.

KIDF takes part in a foreign investor’s initiatives in Kazakhstan in case that investor sees a benefit in sharing equity risk with the state. KIDF joins a prospective transaction near financial closure stage.

* Please note that we deal with institutional investors and IFIs on a deal-by-deal basis (a particular project/transaction/investment funding participation).

Our Management

The Board of directors holds an exclusive right to take investment decisions.

Committee for strategy, budget and remuneration

Committee for Audit and Risk Management

Chief Executive Officer of Kazakhstan Investment Development Fund (KIDF) Management Company Ltd.

Performance summary

Up to March 2020 the Board has had approved investments into four (4) development projects, utilizing available KIDF funds of 105bn tenge (kzt). The covered sectors are tourism, infrastructure, and agriculture processing. Three (3) projects are being invested and one (1) is being structured for financial closure.

EXPECTED RETURNS BY ASSET CLASS

| Asset class | Cash | Fixed Income | Quasi Equity | Equity | Total | |

|---|---|---|---|---|---|---|

| Expected horizon | m usd @420kzt/$ | 4,6 | 110,5 | 20,0 | 98,2 | 233,3 | |

EXPECTED IMPACT INDICATORS

New jobs to be crated:

- 1695 – full-time direct

- 3000 – tenant businesses

- 2500 – seasonal for agriculture

Reaching optimal capacity by 2025 the invested entities are expected to contribute annually:

- 79.2bn tenge contribution to GDP through revenues

- 6.2bn tenge of full-time salaries

- 5.5bn tenge of taxes (corporate and individual)

Contacts

If you are a business/corporation looking into establishing your operations in the country, please send requests and business proposals to Kazakh Invest and copy KIDF at +77172588888 | info@kidf.kz | Linked-in | Facebook | Instagram or 55/15 Mangilik El, Block C-2.3, 1st floor, Nur-Sultan city, Kazakhstan 010017

If you are an institutional investor looking into diversifying your portfolio to the region, please contact

- Baiterek and its subsidiary Kazyna Capital Management, performing a «fund of funds» function for partnering with IFIs and other funds, at www.kcm-kazyna.kz

- Samruk-Kazyna at +77172554071, +77172554033 | ir@sk.kz

- AIFC at 88000800801 | info@aifc.kz

If you are a global GP or asset manager looking into fund management:

Institutional landscape

There is a number of state institutions and agencies interacting with a foreign investor. Below you will find a brief description of state agencies and entities with respective utility for investment industry and key data as of the end of 2018.

AGENCIES

Committee for Investments of Ministry of Foreign Affairs (CIMFA)

State investment policy agency

Purpose – Policy development and implementation

Kazakh Invest

CIMFA promotion agency

Purpose – Countrywide project pipeline, One-window service provider for foreign investors

Regional Governors Offices

Regional government authorities (+Nur-Sultan and Almaty cities)

Funded from local tax collections and the state budget

Purpose – In-kind contribution of land and infrastructure, tax preferences

Astana International Financial Center

Purpose – legal framework (Common Law), regulator of registered companies, Astana Stock Exchange operator, full-scale support services to foreign citizens employed by entities registered in AIFC framework

INSTITUTIONS

Kazakhstan National Fund (KNF)

Sovereign wealth fund

Funded from surplus carbon and mineral resources tax revenues

Purpose – Accumulation and Stabilization (invests outside Kazakhstan in secure liquid assets)

$59.9bn in Assets

Managed by the country’s Central bank

Samruk-Kazyna

A group of state-owned industrial assets

Funded from dividends and KNF

Purpose – Governance and management (a source of off-take contracts for local suppliers of products and services to a variety of industries)

$67.2bn in Assets

$30.2bn Debt ($1.2bn State)

Baiterek

A group of development institutions

Funded from dividends and KNF

Purpose – Private sector development (debt funding, export financing and insurance)

$12.2bn in Assets

$8.9bn Debt ($4.2bn State)

KazAgro

A group of development institutions

Funded from dividends and KNF

Purpose – Agricultural sector development (debt funding)

$4.2bn in Assets

$3.7bn Debt ($2.5bn State)

Kazakhstan Investment Development Fund

State PE/VC fund

Funded from KNF

Purpose – Facilitating Foreign Direct Investment through equity risk sharing (equity funding) of business development

$0.25bn in Assets (target $1bn)

Other useful information

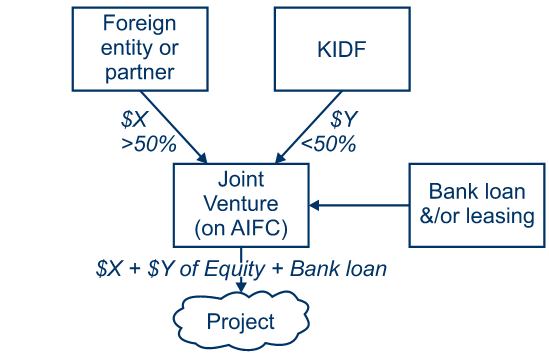

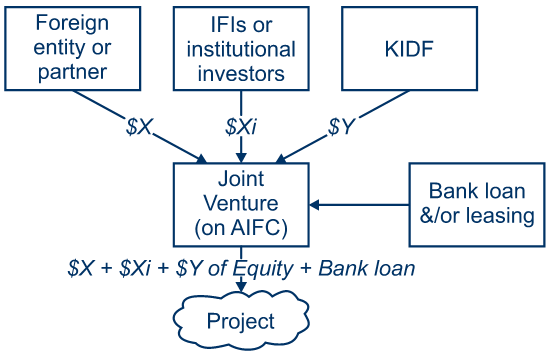

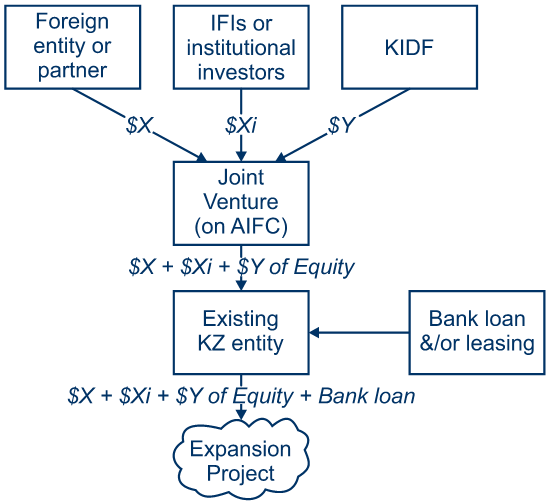

TYPES OF TRANSACTION STRUCTURES

There are different ways KIDF can participate in a particular project. No two deals are alike – we approach and execute each transaction in a unique manner. Below are the general guidelines of how a transaction might look like.

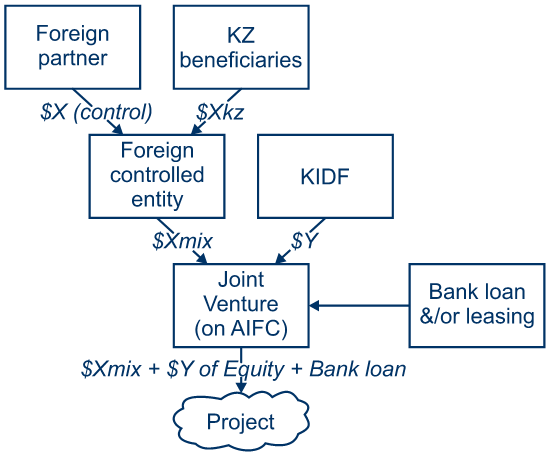

Given KIDF’s constraint to invest no more than a foreign investor, for all sample structures below the following equity contribution holds true: $X > $Y. KIDF participates as non-controlling co-investor through a joint venture registered on AIFC.

Example 1. A foreign company invests into greenfield project in Kazakhstan. A Joint Venture is the owner of a project or an asset to be developed. It finances the assumed development both with equity from its shareholders and debt.

Example 2. A foreign company invests into greenfield project in Kazakhstan. An institutional investor or IFI can participate as a minority stakeholder in a Joint Venture. An institutional investor or IFI and KIDF coordinate corporate governance and exit strategy.

Example 3. A foreign company invests into its business expansion based on an existing asset in Kazakhstan. KIDF will cooperate with foreign parties to define and negotiate their participation terms with a local company’s stakeholders. A sum of KIDF’s and IFI investments ($Y + $Xi) shall not exceed investment of a foreign company ($X).

Example 4. A foreign company invests into its business expansion through a subsidiary that has local partners (entities registered in Kazakhstan, individuals with Kazakhstan citizenship or origins). A foreign partner shall have a control over its subsidiary. KIDF will account only for foreign partner’ contributions as a qualifying foreign equity capital against which KIDF will coinvest on its part.

FREQUENTLY ASKED QUESTIONS

Below we list quick answers to the most common questions asked by our prospective partners.

Q – What does economic development/impact mean and what kind of projects qualifies for this requirement under KIDF mandate?

A – Economic development is an improvement in economic well-being of a society, usually measured by positive changes in quantitative characteristics such as new jobs created, increase in tax revenues and qualitative characteristics such as localization, growth in skills of local population, etc. A typical project that creates new jobs or produces for export or substitutes import or brings new technologies and know-how qualifies for economic impact requirement.

Q – How does KIDF define a strategic investor?

A – KIDF’s ideal strategic co-investor is a global industry player with revenues over $1bn or a regional leading player with substantial track record and expertise in selected industry.

Q – Can KIDF invest in a project purely with an institutional investor or IFI?

A – It is a strong requirement by KIDF’s mandate for all projects to have a strategic investor (the one with substantial positive track record of investment and operations in the industry) with a long-term view (no plans to sell its stake).

Q – Does a technology, engineering or equipment supplier qualify for a foreign partner/investor requirement under KIDF mandate?

A – Equity participation (particularly one with a defined exit) of such partners will be considered as a part of product/services promotion vehicles. Thus, such partnerships would not qualify under KIDF mandate. Again, KIDF coinvests only with entities that have substantial track record in a product or service of a joint venture being created.

Q – Does KIDF account for in-kind equity contributions (intellectual property rights, engineering and consulting services, technical assistance, equipment, land, buildings, etc) made by foreign investor as its share in an ownership structure of joint venture?

A – KIDF’s approach to calculation of respective shares of partners in a joint venture is to account only for pure cash investment made by foreign investor and KIDF.

Q – Does a foreign entity with ultimate beneficiaries from Kazakhstan qualify for a foreign partner/investor requirement under KIDF mandate?

A – A foreign partner has to be a leading industry player with expertise and history. Structuring of local capital through an entity in foreign jurisdictions would not qualify as a foreign direct investment under KIDF mandate.

Q – What currency does KIDF use in an investment agreement and for calculation of minimum expected rate of return?

A – KIDF uses tailored approach to every case as to match a currency structure of an expected cash flow. Therefore, KIDF is quite flexible on currency choice for transaction documentation and actual wire transfer in financing scheme.

Q – What is the average and maximum investment horizon for KIDF?

A – As per current Investment Policy Statement the maximum term for KIDF investment is 20 years for infrastructure projects and 10 years for other projects. We expect the average numbers for portfolio to be close to (15) and (7) years respectively. KIDF prefers to invest in partnerships that develop into sustainable operations over the long run.

Q – What is the maximum and minimum threshold for investment projects that KIDF can participate in?

A – KIDF’s minimum exposure is $5m. Given IPS constraint that KIDF’s share in equity cannot exceed the one of foreign partner, it implies a minimum project size of at least $10m for pure equity financed project and approximately not less than $25m for a project with debt financing. The maximum amount of KIDF contribution in one project is limited to 20% of its capitalization (current level is $265.2m consequently $52.5 m is a maximum exposure). Meanwhile, it would reach $200m per project once a target capitalization of $1bn is achieved.

Q – What level of cost would a foreign investor expect to be associated with KIDF funding?

A – KIDF provides funding on equity basis. Which means that KIDF would be a partner with full shareholder rights in a business being created. Thus, KIDF would expect to receive its share of earnings of a joint venture, yielding the same return as a foreign investor would earn. KIDF would not consider participation in projects where a rate of return on KIDF’s invested capital would be lower than a required rate of return on equity investment in a particular industry (defined as cost of equity in international practice and derived from publicly available market data). An investment in a project yielding a rate of return below associated cost of equity would require KIDF to record a loss and respective impairment in its financial statements under International Financial Reporting Standard 9.

Q – What purposes can KIDF funds be used for?

A – KIDF funds, in combination with a foreign partner’s contributions and debt, can be applied to engineering, materials, construction, equipment and working capital in a development project. KIDF funds CANNOT be used for a purchase of interest/stakes/shares in or repayment of debt of other entities (no cash-out of project being invested).

Q – At what stage KIDF can join a project?

A – KIDF can participate in discussions at any stage, but KIDF will summarize its corporate decisions on a project only when it will be near debt financing closure (i.e. the project has a land plot, permissions, project documentation, binding debt financing terms).

Our executive office team would be happy to answer all additional inquiries you might have on KIDF policies and operations (please, refer to Contacts section).

Источник