- Countries Where Bitcoin Is Banned or Legal In 2021

- Countries where Bitcoin is banned

- Countries where Bitcoin is legal

- Countries where Bitcoin is neither legal nor illegal

- China bans financial, payment institutions from cryptocurrency business

- Where is Bitcoin illegal? List of countries that banned BTC

- Where is Bitcoin illegal?

- Which countries have a banking ban on Bitcoin?

- Countries where Bitcoin is illegal as a payment tool

- Bitcoin ad banned for ‘misleading pensioners’

- ‘Insulting rates’

- Small font

- Bitcoin falls further as China cracks down on crypto-currencies

- Beijing cracks down

- Tesla snub

Countries Where Bitcoin Is Banned or Legal In 2021

If you are looking to buy, sell, or spend Bitcoin, you should check if it is legal in your country.

In fact, there are many countries with different cryptocurrency regulations. Some of them even single out Bitcoin, allowing it to be used as money, pay taxes, purchase goods, or trade it like a commodity.

In other countries, even the mere possession of Bitcoin can get you to prison. Others have not even bothered to regulate it yet, leaving Bitcoin and other cryptos in legal limbo.

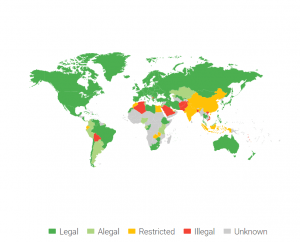

The legality of Bitcoin all over the world can be seen in this map:

Countries where Bitcoin is banned

Bitcoin and cryptocurrencies are generally welcomed in most parts of the world. Nevertheless, some countries have actually banned them or their use. Whether bans were imposed due to Bitcoins decentralized nature, the threat to their current financial system or just because proper regulations are yet to be approved, there are at least nine countries as of March 2019 which decided to do so. These are:

- Afghanistan

- Pakistan

- Algeria

- Bolivia

- Bangladesh

- The Republic of Macedonia

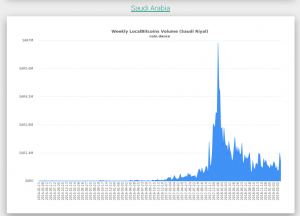

- Saudi Arabia

- Quatar

- Vanuatu

- Vietnam

In addition to the countries where BTC is banned, there are also countries where Bitcoin is somewhat restricted and cannot be traded or used for payment. In such states, banks and other financial service providers are prohibited from dealing with cryptocurrency exchanges and companies, and in more extreme cases the countries have even banned crypto exchanges (etc China).

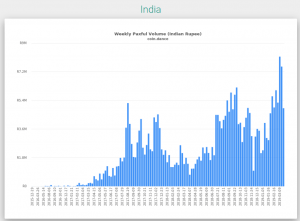

Note that despite the bans and restrictions, these laws have not eradicated Bitcoin or other cryptocurrency trades and their usage. Due to the nature of decentralized cryptocurrencies, it is simply impossible to ban them. Many individuals in those countries still make use of sites like Local Bitcoins, Paxful or Bisq to trade it with others, as indicated by the trading volumes on these platforms.

This just serves to prove that no government holds the power of truly ban Bitcoin unless they prohibit the usage of the internet for the entire nation.

Countries where Bitcoin is legal

On a positive note, research shows there are at least 111 states where Bitcoin and cryptocurrencies are recognized by law and are legal.

For instance, major countries like the United States and Canada hold a generally crypto-friendly attitude towards cryptocurrencies while also trying to enforce anti-money laundering laws and prevent fraud. Meanwhile, in the European Union, the member states are not allowed to launch their own cryptocurrency, but crypto exchanges are encouraged to be legalized and comply with the regulations.

As of January 2020, the most Bitcoin-friendly countries where BTC is legal are:

- Japan

- Gibraltar

- Malta

- Ukraine

- Switzerland

- The Netherlands

- Lithuania

- Estonia

- The United Kingdom

- Germany

- Bermuda

- Slovenia

- Singapore

- Georgia

- Belarus

- Hong Kong

Countries where Bitcoin is neither legal nor illegal

Some countries still haven’t made their minds what to do with Bitcoin. In such cases, the usage of BTC is legal in the sense that you can own it, but there are no clear rules or legal protection concerning its status. These countries are either already creating a legal framework for Bitcoin and cryptocurrencies, or have taken a wait-and-see approach. These “undecided” countries include:

- Albania

- Andorra

- Argentina

- Barbados

- Colombia

- French Guiana

- Gabon

- Jamaica

- Jordan

- Kazakhstan

- Kenya

- Kosovo

- Kyrgyzstan

- Malaysia

- The Maldives

- Mauritius

- Nigeria

- Panama

- Paraguay

- Peru

- Tunisia

- The United Arab Emirates

- Tanzania

- Uruguay

Fears of widespread cryptocurrency crackdowns have had a long-standing effect on Bitcoin.

Because of that, many people are wary of the trustless system and rely on traditional systems instead.

Regardless, a growing number of governments choose to embrace digital innovation and play a role in the industry. At the same time jurisdictions which oppose the emerging industry are at risk of being left behind. Ironically, these countries already are some of the poorest nations in the world, and widespread Bitcoin and cryptocurrency crackdowns seem to yield no favorable results to improve the situation. Quite the contrary; embracing the cryptocurrency businesses with favorable regulations present an excellent opportunity to bring in innovation, capital, tax revenue and improve the living standard for the whole population.

Источник

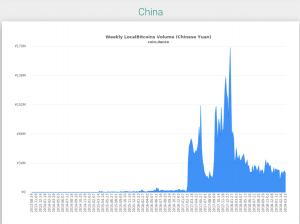

China bans financial, payment institutions from cryptocurrency business

China has banned financial institutions and payment companies from providing services related to cryptocurrency transactions, and warned investors against speculative crypto trading.

It was China’s latest attempt to clamp down on what was a burgeoning digital trading market. Under the ban, such institutions, including banks and online payments channels, must not offer clients any service involving cryptocurrency, such as registration, trading, clearing and settlement, three industry bodies said in a joint statement on Tuesday.

“Recently, crypto currency prices have skyrocketed and plummeted, and speculative trading of cryptocurrency has rebounded, seriously infringing on the safety of people’s property and disrupting the normal economic and financial order,” they said in the statement.

China has banned crypto exchanges and initial coin offerings but has not barred individuals from holding cryptocurrencies.

The institutions must not provide saving, trust or pledging services of cryptocurrency, nor issue financial product related to cryptocurrency, the statement also said.

The moves were not Beijing’s first moves against digital currency. In 2017, China shut down its local cryptocurrency exchanges, smothering a speculative market that had accounted for 90% of global bitcoin trading.

In June 2019, the People’s Bank of China issued a statement saying it would block access to all domestic and foreign cryptocurrency exchanges and Initial Coin Offering websites, aiming to clamp down on all cryptocurrency trading with a ban on foreign exchanges.

The statement also highlighted the risks of cryptocurrency trading, saying virtual currencies «are not supported by real value», their prices are easily manipulated, and trading contracts are not protected by Chinese law.

The three industry bodies are: the National Internet Finance Association of China, the China Banking Association and the Payment and Clearing Association of China.

Источник

Where is Bitcoin illegal? List of countries that banned BTC

You might be wondering… where is Bitcoin Illegal? Read further to find out everything you need to know.

Where is Bitcoin illegal?

There are many countries where Bitcoin is legal. However, the following list contains countries that have banned Bitcoin.

- Algeria – The country’s law clearly states that “the purchase, sale, use, and storage of any type of virtual currency is illegal”.

- Egypt – transactions made using Bitcoin are both immoral from a religious standpoint and illegal according to the country’s Islamic legislator.

- Morocco – Morocco also belongs to countries that banned Bitcoin (both holding and transacting with it). In recent times, however, it seems that the country is working towards a law that will allow the use of Bitcoin under certain conditions.

- Bolivia – The Central Bank of Bolivia has banned Bitcoin and all other cryptocurrencies since 2014.

- Ecuador – The government of Ecuador has banned the use of Bitcoin and other cryptocurrencies while introducing a local stablecoin tied to the US dollar.

- Pakistan – Bitcoin and other cryptocurrencies are deemed illegal in Pakistan and banks are not allowed to deal with or assist customers that are facing problems related to cryptocurrency.

- Nepal – The NRB (Nepal Rastra Bank) declared Bitcoin and other cryptocurrencies illegal in 2017.

Which countries have a banking ban on Bitcoin?

The following countries do not allow their residents to buy and/or sell cryptocurrency using their bank accounts.

- Cambodia – following statements made by the country’s legal authorities, using and storing cryptocurrency is not allowed, unless a special license is acquired.

- Bangladesh – according to the National Bank of Bangladesh, everyone that uses, stores or exchanges cryptocurrency will be arrested and face jail time.

- China – The country’s stance towards Bitcoin very contradictory. While the country seems to be pro-blockchain technology and has the largest portion of Bitcoin miners (more than 51%), it is still illegal to use and exchange Bitcoin and other cryptocurrencies.

- Colombia – The Superintendencia Financiera pursued all banks to not work with or provide assistance to anyone that is involved with virtual money exchanges. There is, however, no law in place that restricts the use of Bitcoin and other cryptocurrencies.

- India – In February 2018, the Reserve Bank of India (RBI) imposed a ban on the sale or purchase of Bitcoin and other cryptocurrencies, following the budget speech of Finance minister Arun Jaitley.

- Jordan – The Central Bank of Jordan (CBJ) restricts financial institutions/companies and other payment service companies to exchange cryptocurrencies. However, merchants and small businesses are not prohibited from accepting Bitcoin as a payment method.

- Iran – Iran has informed banks to cut ties with customers that use their accounts to buy and sell cryptocurrencies.

- Taiwan – Buying and selling cryptocurrency is not allowed in Taiwan, as is the use of Bitcoin ATMs.

- Saudi Arabia – The government of Saudi Arabia has banned (implicitly) the usage of bank accounts for cryptocurrency purchases as it finds that the latest is a high-risk investment.

- Canada – As of 2018, both the Bank of Montreal (BMO) and the Toronto Dominion (TD) have imposed a banking ban for anyone participating in cryptocurrency purchases using credit cards or debit cards. Reports tend to be quite vague though, as several banks and financial institutions still allow their customers to buy and sell their cryptocurrency.

Countries where Bitcoin is illegal as a payment tool

Meanwhile, in Vietnam and Indonesia, the use of cryptocurrencies as a form of payment has become illegal.

Источник

Bitcoin ad banned for ‘misleading pensioners’

An ad for a cryptocurrency exchange has been banned for “irresponsibly” promoting investments in Bitcoin.

The Advertising Standards Authority (ASA) said the campaign had targeted pensioners who were «unlikely to know» much about the topic.

The watchdog drew attention to use of the phrase “there is no point in keeping your money in the bank”.

And it said a disclaimer printed in small print was «insufficient to counteract the overall message».

‘Insulting rates’

The full-page spread contained a photograph of a Coinfloor customer with a personal testimony about how she had invested part of her pension into Bitcoin via the platform.

“Today there is no point keeping it in the bank – the interest rates are insulting,” it read.

“That is why when I received my pension, I put a third of it into gold, a third of it into silver and the remainder into Bitcoin.

“To me, Bitcoin is digital gold and it has allowed me to take the steps to secure the cash I already have.”

The ASA upheld two complaints submitted to it claiming that the as was:

- misleading because it had failed to make clear the risks associated with Bitcoin investments

- socially irresponsible because it had suggested that purchasing Bitcoin was a good or secure way to invest one’s savings or pension

Small font

In its defence, Coinfloor said the ad represented the perspective of a customer rather than the company’s own view.

And it noted the disclaimer — which it claimed to have been given sufficient prominence — had mentioned that investing in cryptocurrencies involved significant risk and could result in losses.

However, the regulator said the small font size and low positioning of the text meant the details had not been displayed clearly enough.

Coinfloor is unregulated in the UK, so consumers could not seek recourse to services such as the Financial Services Compensation Scheme or the Financial Ombudsman Service, the watchdog noted.

The Northamptonshire Telegraph, in which the advert appeared, said it would not publish the ad again unless it was suitably changed.

Источник

Bitcoin falls further as China cracks down on crypto-currencies

The price of Bitcoin fell below $34,000 (ВЈ24,030) for the first time in three months on Wednesday, after China imposed fresh curbs on crypto-currencies.

Beijing banned banks and payment firms from providing services related to crypto-currency transactions.

It also warned investors against speculative crypto trading on Tuesday.

It follows falls in Bitcoin of more than 10% last week after Tesla said it would no longer accept the currency.

On Wednesday afternoon, Bitcoin recovered some ground, although it was still down -10.4% at $38,131.

Meanwhile, other digital currencies such as Ether, which acts as the fuel for the Ethereum blockchain network, and Dogecoin lost as much as 22% and 24% respectively.

At the same time, Tesla shares fell more than 3% on Wall Street, possibly because of the electric carmaker’s exposure to Bitcoin.

The firm, owned by Elon Musk, still holds around $1.5bn worth of the crypto-currency.

Beijing cracks down

Crypto-currency trading has been illegal in China since 2019 in order to curb money-laundering. But people are still able to trade in currencies such as Bitcoin online, which has concerned Beijing.

On Tuesday, three state-backed organisations, including the National Internet Finance Association of China, the China Banking Association and the Payment and Clearing Association of China issued a warning on social media.

They said consumers would have no protection if they were to incur any losses from crypto-currency investment transactions.

They added that recent wild swings in crypto-currency prices «seriously violate people’s asset safety» and are disrupting the «normal economic and financial order».

Neil Wilson of Markets.com said: «China has for some time been putting pressure on the crypto space, but this marks an intensification — other countries might follow now as central banks make strides towards their own digital currencies.

«Until now, Western regulators have been pretty relaxed about Bitcoin, but this might change soon.»

Tesla snub

In March, Tesla boss Elon Musk announced unexpectedly that the electric carmaker would allow customers to buy cars using Bitcoin.

But last week, he did a U-turn and suspended vehicle purchases using Bitcoin because of environmental concerns.

His fears centre on Bitcoin mining — the energy-intensive process through which the digital currency is generated, using high-powered computers. It often relies on electricity generated with fossil fuels, particularly coal.

«We are concerned about rapidly increasing use of fossil fuels for Bitcoin mining and transactions, especially coal, which has the worst emissions of any fuel,» Mr Musk wrote.

«Cryptocurrency is a good idea. but this cannot come at great cost to the environment.»

He said the electric carmaker did not intend to sell any of its Bitcoin and intended to reinstate crypto-currency transactions once mining shifted to using more sustainable energy sources.

Although the digital currency cannot be traded in China, more than 75% of Bitcoin mining around the world is done in China.

For anyone who has followed the crypto-currency scene for a while, the events of recent weeks are a familiar story.

Some random event — say, a tweet from Elon Musk announcing Tesla will accept crypto-currency payments — sends Bitcoin to new highs, and people begin to say it’s winning mainstream acceptance.

Then another random event happens, perhaps a change of course from the Tesla tycoon. It comes tumbling down again, and talk of it going mainstream fades into the background.

Last month, in a chatroom on Clubhouse (another phenomenon that seems to be swinging from boom to bust) I expressed some scepticism about crypto-currencies.

Up popped a senior figure from London’s thriving fintech scene: «Rory, Rory,» he chided me, «crypto is becoming an accepted asset class.»

With big City institutions taking an interest, that had a ring of truth — back in April, at least.

But this week, the weather had changed, with the Financial Times reporting «new doubts among institutional fund managers over the future of crypto-currencies as an asset class».

My mind went back to 2013, when I had first taken an interest in Bitcoin. In a report for Radio 4’s PM programme, I had bought a pizza for 0.5 BTC, a tortuous process which had not seemed worth the ВЈ30 it cost back then — of course, at today’s exchange rate, that was a ВЈ14,000 pizza.

I had also written a blog post headlined «The Bitcoin Bubble», in which I tried to mine some lessons from a period when the price of the cryptocurrency shot up from $15 to $276 and then hurtled lower again.

I ended a piece in which I compared the cryptocurrency with 17th-Century Dutch tulips or London houses in the 1980s with this thought: «Unless and until Bitcoin can be used to buy a sandwich, or be accepted by your friends when you pay them back for a restaurant meal, then it is likely to remain just a playground for geeks and gamblers.»

Eight years on, it is still virtually impossible to buy a sandwich with Bitcoin.

And why would you want to, when there’s a good chance you’ll be mocked a few years later — as I’ve been for my transaction — for giving away an asset that goes on to soar in value?

Источник