- How to Invest in Bitcoin

- Why Bitcoin Is Gaining Traction

- Why Invest in Bitcoin?

- Bitcoins Are Popular

- Bitcoins Are Scarce

- Bitcoins Are Useful

- Bitcoins Are Profitable

- Bitcoin’s Price

- How to Invest in Bitcoins and Where to Buy It

- Where You Can Buy Bitcoin

- P2P Exchanges

- Changelly

- Binance

- How to Secure Bitcoins

- Exodus

- TREZOR

- Ledger Nano X

- When Is the Right Time to Buy?

- Understanding the Various Ways to Invest in Bitcoin

- Investment Types

- Buying Standalone Bitcoin

- Greyscale’s Bitcoin Investment Trust (GBTC)

- Amplify Transformational Data Sharing ETF (BLOK)

- Bitwise 10 Private Index Fund

- Investment Strategies

- Buy and ‘Hodl’ Bitcoin

- Long Positions on Bitcoin

- Short Positions on Bitcoin

- Understanding Risk if You Invest in Bitcoin

- Bitcoin Is a Volatile Asset

- Exchanges May Have Glitches and Hacks

- The Bottom Line

How to Invest in Bitcoin

As the overall popularity of cryptocurrencies grows, more and more people decide to invest in Bitcoin – not only the most famous crypto, but also arguably the one that has proven to be the safest investment. Although Bitcoin’s dominance rate has gone down in recent years, the fact that it is the only coin that has a dominance index attached to its name speaks volumes.

In this article, we will talk about Bitcoin’s price and whether BTC is worth investing in or not. We will also touch on some entry strategies and briefly talk about how profitable Bitcoin mining is in 2020. Without further ado, let’s dive in!

Why Bitcoin Is Gaining Traction

BTC price has slumped for a bit in early 2019 and stagnated in late 2019 and early 2020, but now it’s rising again. It is hard to pinpoint exactly why Bitcoin’s position is strengthening now, but one of the main reasons experts cite is Hype and FOMO. It’s simple: the more people buy Bitcoin, the higher its price rises. And the higher its price, the more people rush to buy it, out of fear of missing out on potential future profits. It is no secret that a lot of people consider crypto to be a speculative asset, and they only take interest in it to seek out short-term profits.

Why Invest in Bitcoin?

Why invest in Bitcoin and not fiat, stocks, or other cryptocurrencies? There are a few reasons why you should choose BTC.

Bitcoins Are Popular

As we have mentioned above, due to its popularity Bitcoin is often the first cryptocurrency people learn about. As a result, more people want to invest in it. Unlike stocks, cryptocurrency prices do not depend on the success of the company behind them (as they are mostly decentralized) or the economy of any country – they are based on supply and demand. Not only are higher transaction volume and public attention a sign that the cryptocurrency has a promising future, but they also often guarantee high liquidity, which is one of the key factors in choosing what asset to invest in.

Bitcoins Are Scarce

Unlike fiat, Bitcoin, just like other cryptocurrencies, has a limited supply. There will only ever be 21 million BTC. Therefore, it can be considered a finite resource like gold, silver, etc. Because governments can technically create (print) an infinite amount of fiat currencies, some investors consider gold, Bitcoin, and other limited resources a more profitable investment as their scarcity means they will not depreciate in value as quickly or as easily. Additionally, a limited supply means that according to the basic rules of economics, a growing demand for BTC will be accommodated not by higher production volume, but by higher prices.

Bitcoins Are Useful

As time goes by, Bitcoin becomes more and more integrated into our daily lives. It can be withdrawn from ATMs, it can be stored digitally, it can be used to pay for goods and services – according to coinmap.org, there are currently over 18k businesses accepting Bitcoin worldwide. Moreover, it is being recognized by established companies like PayPal, and the growing adaptability is a sign for many experts that Bitcoin is here to stay, making it a worthwhile investment.

Bitcoins Are Profitable

High volatility is both one of the main advantages and disadvantages of the crypto market. Prices can soar one day, and then crash the next one. However, not all cryptocurrency price movements are that extreme. For established coins like Bitcoin, the increased volatility may mean short-term losses, but it also provides higher returns than the traditional stock market. People who bought 1 BTC for $5k in spring and sold it now for $18k have made $13k – that’s a profit very, very few investment opportunities can give you.

Another thing worth mentioning is that the crypto market in general and Bitcoin in particular have shown great resilience amid chaos in the markets in spring 2020 – another good sign.

All that said, please remember one of the main rules of investment – DYOR, do your own research. Check out other cryptocurrencies and other forms of investment and make an informed decision. At the end of the day, you are the only one who can answer the question “should I invest in Bitcoin or not?”.

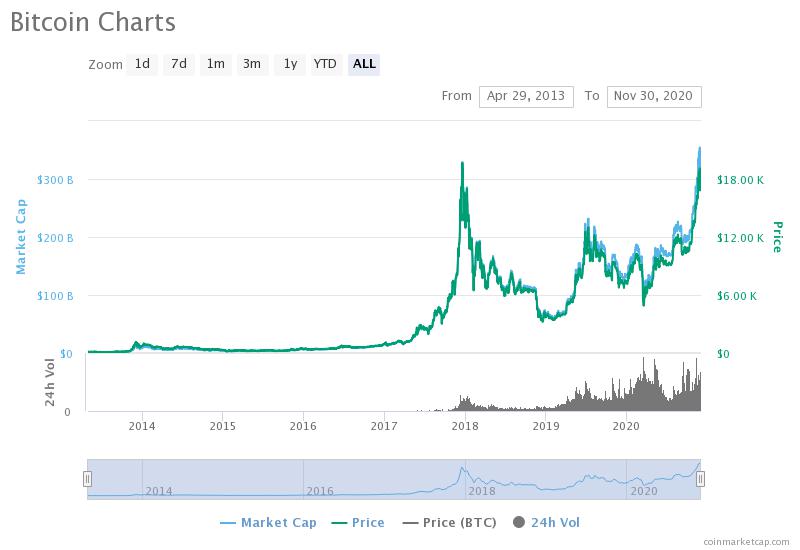

Bitcoin’s Price

As has been mentioned previously in this article, Bitcoin has had a few ups and downs in the recent years, but prior to its surge in October, it mostly stayed below the $10k price level. It hit its ATH (all-time high) of approximately $19665 in December 2017 and hasn’t been able to re-peak since. Recently BTC elevated above $19k but then dipped back below $17k. Many experts are predicting that Bitcoin will recover and is going to not only reach a new ATH, but also surge past $30k, or, according to the JP Morgan forecast, even hit $140k. However, it is also possible that the coin’s price will continue to decline.

How to Invest in Bitcoins and Where to Buy It

Opinions are divided on this topic. Expert traders usually develop their own strategies, but it will be rather hard for novices to follow them. For example, a lot of experienced investors buy up new coins that they predict will have a lot of hype in the future – and, as we’ve mentioned previously, popularity plays a major role in determining a cryptocurrency’s price. However, novices lack the necessary experience to determine which coins will be on top in a few months or a few years. Therefore, established cryptocurrencies with stable growth rates are a much safer, yet still very profitable, bet, and there’s no better crypto to start your investment journey with than Bitcoin.

With Bitcoin being an established currency comes the drawback of there not being an obvious entry point. Although it has its dips, novices looking for immediate or at least quick profit may not be able to recognize them or determine whether the coin will plummet or surge in the near future. As a result, our first advice would be to hodl – do not chase immediate profit, keep an eye out for price surges, and store your coins in a safe place.

Here are a few basic rules that you should follow when you’re just starting out:

This is the most basic rule when it comes to buying any asset. Buy when the price declines and sell when you think it has risen enough for you to make a profit.

As a beginner, you might not be able to tell whether the price is sufficiently low or high enough to sell. Follow crypto bloggers, join chats, or read the forums – you don’t even have to fully immerse yourself in the crypto community to get some tips, just check up on it from time to time.

- Listen to different opinions

Try to follow a wide variety of people and do not make any conclusions based on the opinion of just one expert – they can always be wrong.

Although this is an article about investing in Bitcoin, we have to remind you that one of the most important investment strategies is to diversify your portfolio.

Although it’s good to be aware that the more advanced strategies do exist, do not try to learn them all or use them if you’re just starting out – it’s likely that they will do you more harm than good.

Where You Can Buy Bitcoin

P2P Exchanges

Peer-to-peer exchanges offer users secure transactions and the highest level of anonymity available on the market but lack the liquidity exchanges can provide. In addition to that, they are usually not as beginner-friendly.

Changelly

Changelly, with its intuitive user-friendly interface, low fees, and competitive rates, is a great platform for crypto newbies. Changelly offers great rates for Bitcoin, and lets you exchange it for over 160 cryptocurrencies. The company has recently expanded their ecosystem to include a fiat-to-crypto marketplace where you can purchase crypto with your native currency, and a beginner-friendly full-featured trading platform Changelly PRO. They work with the best fiat gateways and provide users with an easy, quick, and personalized way to buy BTC with your credit or debit card, bank transfer, or Apple Pay.

Binance

Binance is one of the most popular cryptocurrency exchanges, and it also lets users buy Bitcoin with their credit cards, bank transfer, or with over 150 different cryptocurrencies. Being the biggest cryptocurrency exchange, it has the highest liquidity and thus the best rates, but it’s not very beginner friendly due to its not as easy to use and navigate interface. Just like the other exchanges on our list, they have high standards of security and fair fees. Their ecosystem also includes a trading platform.

How to Secure Bitcoins

Whether you want to speculate on Bitcoin’s price or believe that it is the future and are prepared to hodl it till the end of time, you will need a secure way to store the coins you purchased. There are two types of crypto wallets: hot and cold. The former are connected to the Internet, making it easier to carry out basic transactions. On the other hand, cold, or as they are also called hardware, wallets are not connected to the Internet and thus are a lot more secure. However, that doesn’t mean hot wallets are not safe at all: they are still a good way to store your coins. Hot wallets are used for storing smaller sums of crypto or if the owner wants easy access to their funds, while hardware wallets are usually used by people who want to hodl their cryptocurrency.

Exodus

This is one of the best hot crypto wallets for beginners. It has a simple, user-friendly interface that is perfect for newbies who are just figuring things out. If you ever have any questions, do not hesitate to contact their great support team. Exodus offers both mobile and desktop versions. It supports over 100 cryptocurrencies (including Bitcoin, of course) and allows users to easily swap them within the interface. Exodus can be downloaded for free. It is also compatible with TREZOR hardware wallets.

TREZOR

This is one of the best hardware wallets on the market. TREZOR Model T’s touch screen and an intuitive web interface make it perfect for beginners. This wallet can be connected to both your smartphone or your computer as it comes with a USB Type-C cable. It is extremely secure, supports over 1400 cryptocurrencies, and lets users exchange crypto within its web interface via built-in exchanges. It’s one downside is its hefty price tag – Trezor Model T is $170.

Ledger Nano X

This is one of the most popular hardware crypto wallets, and for a good reason. It is easy to use yet provides top-notch security. This wallet supports around 1500 cryptocurrencies, and just like the others on this list lets users exchange them within its interface. The Ledger Live app allows wallet owners to easily manage their portfolio on their computer or mobile phone. Overall, this is a good beginner-friendly hardware wallet that will cost you $119.

When Is the Right Time to Buy?

The short answer would be to buy low, when the price dips and is likely to rise again. Follow the general advice that is applicable to all assets: buy in anticipation of the events or news that are likely to drive the prices up.

Источник

Understanding the Various Ways to Invest in Bitcoin

Ezra Bailey / Getty Images

Bitcoin was designed with the intent of becoming an international currency to replace government-issued (fiat) currencies. Since Bitcoin’s inception in 2009, it has turned into a highly volatile investing asset that can be used for transactions where merchants accept it.

Could you and should you invest in Bitcoin? You can, and it depends on your appetite for risk. Learn the various types of ways you can invest in Bitcoin, strategies you can use and the dangers involved in this cryptocurrency.

Investment Types

Over the past decade, multiple ways to invest in Bitcoin have popped up, including Bitcoin trusts and ETFs comprised of Bitcoin-related companies.

Buying Standalone Bitcoin

The first way you can invest in Bitcoin is by purchasing a coin or a fraction of a coin via trading apps such as Coinbase. In most cases, you’ll need to provide personal information to set up an account, then deposit money you’ll use to purchase bitcoins.

Some platforms may require a minimum deposit amount to purchase bitcoins.

Then, as with any stock or ETF, you have access to Bitcoin’s price performance and the option to buy or sell. When you buy, your purchase is kept safe in an encrypted wallet only you have access to.

Greyscale’s Bitcoin Investment Trust (GBTC)

Investors looking to invest in Bitcoin through the capital markets can access an investment through Greyscale’s Bitcoin Investment Trust (GBTC). Using Greyscale provides certain advantages that make an investment in bitcoin a more digestible option. For one, shares of GBTC are eligible to be held in certain IRA, Roth IRA, and other brokerage and investor accounts—allowing easy access for all levels of investors in a wide variety of accounts.

Investors are provided with a product that tracks the value of one-tenth of a bitcoin. As an example, if the value of Bitcoin is $1,000, each share of GBTC should have a net asset value of $100. This value is not without costs, as GBTC maintains a 2% fee that affects the underlying value.

In reality, investors are paying for security, ease of use, and liquidity (conversion to cash). By arranging strong offline storage mechanisms, GBTC allows investors who are less technical to access the bitcoin market safely.

GBTC trades on the capital markets as well, which allows it to trade at a premium or discount of its net asset value (NAV).

Amplify Transformational Data Sharing ETF (BLOK)

BLOK is an actively managed fund that has holdings in 15 different industries and is traded on the New York Stock Exchange Arca. The company invests in other companies that are involved with and developing blockchain technologies. BLOK’s net expense ratio is 0.70%.

Bitwise 10 Private Index Fund

The Bitwise 10 Private Index Fund is based on the Bitwise 10 Large Cap Crypto Index, a basket of large capacity coins in which the company tries to provide security and the ease of use of a traditional ETF.

The Bitwise 10 Private requires a $25,000 minimum investment and has a fee ratio of 2.5%. Similar to GBTC, the assets are held in cold storage (offline), providing necessary security for its investors.

Investment Strategies

Buy and ‘Hodl’ Bitcoin

Hodl (an intentional misspelling of hold) is the term used in the bitcoin investment community for holding bitcoin—it has also turned into a backronym (where an acronym is made from an existing word)—it means «hold on for dear life.» An investor that is holding their Bitcoin is “hodling,” or is a “hodler.”

Many people invest in Bitcoin simply by purchasing and holding the cryptocurrency. These are the people who believe in Bitcoin’s long-term prosperity, and they see any volatility in the short term as little more than a blip on a long journey toward high value.

Long Positions on Bitcoin

Some investors want a more immediate return by purchasing Bitcoin and selling it at the end of a price rally. There are several ways to do this, including relying on the cryptocurrency’s volatility for a high rate of return, should the market move in your favor. Several bitcoin trading sites also now exist that provide leveraged trading, in which the trading site effectively lends you money to hopefully increase your return.

Short Positions on Bitcoin

Some investors might bet on Bitcoin’s value decreasing, especially during a Bitcoin bubble (a rapid rise in prices followed by a rapid decrease in prices). Investors sell their bitcoins at a certain price, then try to buy them back again at a lower price.

For example, if you bought a bitcoin worth $100, you would sell it for $100, and then wait for that bitcoin to decrease in value. Assuming the buyer of that bitcoin wanted to sell, you could buy it back at the lower price. You make a profit on the difference between your selling price and your lower purchase price.

It can be difficult to find a platform for short selling, but the Chicago Mercantile Exchange is currently offering options for Bitcoin futures.

There is always the danger that the market will move against you, causing you to lose the money that you put up. Any trader should understand the concepts of leverage and margin calls before considering a shorting strategy.

Understanding Risk if You Invest in Bitcoin

Bitcoin Is a Volatile Asset

Those fluctuations can be dramatic. In April 2013, the world gasped when Bitcoin’s value jumped from around $40 to $140 in one month. That increase, however, paled in comparison to the Bitcoin surge of 2017. In January, Bitcoin was hovering between $900 and $1,000. In the first week of September, it pushed past $4,700, only to drop down near $3,600 two weeks later. By mid-December, it raced to an all-time high of $19,891.99, then plummeted to around $6,330 less than two months later.

Exchanges May Have Glitches and Hacks

Exchanges can be tricky because many of them have proven to be highly unreliable—especially in the early days of Bitcoin. One of the first and largest Bitcoin exchanges, Japan-based Mt. Gox, collapsed after being hacked—losing 850,000 bitcoins and hundreds of millions of dollars. In April 2016, a glitch in an exchange led to Bitcoin’s price to momentarily drop to $0.60 on Coinbase.

The Bottom Line

Bitcoin’s drawbacks aren’t prohibitive. However, it is extremely important that you know what you’re doing, and that you don’t invest more than you can afford to lose. It is considered a very high-risk investment, meaning that it should represent a relatively small part of your investment portfolio.

If you are interested in investing in Bitcoin, you have multiple options. Buying bitcoins through an exchange subjects you to volatility, but opting for a trust or an ETF investing in crypto-tech companies could minimize the risk you’d face buying coins.

Источник

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/GettyImages-556565241-618e0aef60064f559a5e87b2425d4770.jpg)