- Top 5 Bitcoin Investors

- Key Takeaways

- Barry Silbert

- Dan Morehead

- Tyler and Cameron Winklevoss

- Michael Novogratz

- Digital Asset Holdings

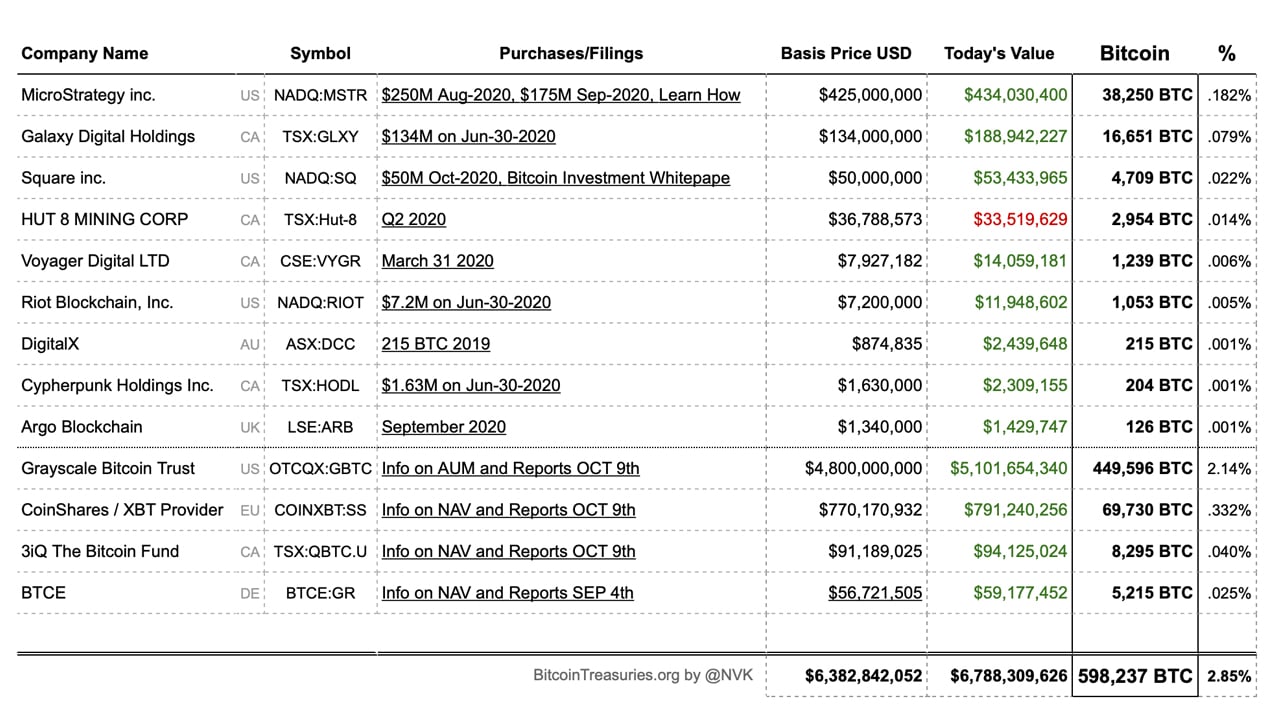

- Here Are the Top Public Companies That Have Adopted Bitcoin as a Reserve Asset

- Grayscale Bitcoin Trust — 2.14%

- Microstrategy Inc. — 0.18%

- Square Inc. — 0.022%

- Coinshares — 0.33%

- Other Listings

- Best Bitcoin IRA Companies

- Diversify your IRA with Bitcoin and other digital assets

- The Best Bitcoin IRA Companies for 2021

- Best Overall : Bitcoin IRA

- Best Investor Experience : Coin IRA

- Best Rates and Fees : iTrustCapital

- Best for Security : BitIRA

- Best for Self-Directed Investments : Equity Trust

- Best Variety of Cryptocurrency Supported : Regal Assets

- Final Verdict

- Compare Providers

- Frequently Asked Questions

- How Do Bitcoin IRAs Work?

- How Should I Choose a Bitcoin IRA Company?

- Are All Bitcoin IRA Companies Safe?

- What Are the Benefits of Bitcoin IRAs?

- How We Chose the Best Bitcoin IRA Companies

Top 5 Bitcoin Investors

Bitcoin is the largest blockchain-based digital asset, with a market capitalization of $173.5 billion as of June 2020. It is considered to be the most successful cryptocurrency ever. The following are among the leading early investors in bitcoin and blockchain assets, compiled from media reports.

Key Takeaways

- Cameron and Tyler Winklevoss are believed to be the first bitcoin billionaires, reportedly holding about 100,000 coins.

- Dan Morehead launched the first cryptocurrency fund in the U.S. when bitcoin was trading for $65 each.

- Michael Novogratz is the famously bullish bitcoin investor who predicted a $40,000 price a month before it began a year-long collapse.

- Barry Silbert is the founder of Digital Currency Group, which has made more than 125 blockchain-related investments.

Barry Silbert

Barry Silbert is the founder and chief executive officer of Digital Currency Group. The company aims to accelerate development of the global financial system by building and supporting bitcoin and blockchain companies. Digital Currency Group has invested in more than 125 blockchain-related companies. In 2016, it acquired news provider CoinDesk, which runs industry conferences.

Other portfolio companies include Genesis, a provider of liquidity for buyers and sellers of cryptocurrency in the over-the-counter market. Digital Currency Group also owns Grayscale Investments, which manages the Bitcoin Investment Trust (GBTC), an investment vehicle that holds bitcoin and gives investors exposure to the asset’s price movements.

Dan Morehead

Dan Morehead is the founder, CEO and co-chief investment officer of Pantera Capital. The company is the first investment firm to focus on bitcoin, and is one of the largest institutional holders of cryptocurrency. Pantera launched the first cryptocurrency fund in the U.S. when bitcoin traded for $65 each.

Pantera has made 38 portfolio investments. Notable investments include European exchange Bitstamp; Brave, an open-source web browser and advertising ecosystem; Shapeshift, a decentralized exchange for trading coins; and Polychain Capital, a venture fund that is raising $200 million. In December 2017, at the height of the cryptocurrency boom, it was reported that Pantera Capital’s bitcoin fund had earned a 24,000% return for investors.

Tyler and Cameron Winklevoss

Cameron and Tyler Winklevoss are investors in a number of cryptocurrencies and blockchain-related businesses, most notably the Gemini exchange. They are believed to be the first to reach billionaire status by investing in bitcoin, reportedly holding about 100,000 coins worth $950 million as of June 2020. (See more: Winklevoss Twins Are Bitcoin’s First Billionaires.)

The Winklevoss twins launched the Gemini exchange in 2015. The company allows investors to buy, sell and store digital assets. Gemini launched bitcoin futures on the Chicago Board Options Exchange (CBOE) in December 2017. In July 2018, the Securities and Exchange Commission (SEC) denied their application to establish a bitcoin ETF. In addition to bitcoin, the brothers are heavily invested in ethereum, although they have not revealed their exact holdings. (See more: How The Winklevoss Twins Store Their Crypto Fortune.)

Michael Novogratz

Michael Novogratz, a former hedge fund manager at Fortress Investment Group and partner at Goldman Sachs, is a frequent commentator on bitcoin price action. He is the founder, CEO and chair of Galaxy Digital Holdings, an investment fund that trades, manages and advises on blockchain-related assets.

In September 2017, in the midst of what was then a bull market for cryptocurrency, Novogratz estimated that about 20% of his net worth was comprised of digital assets. He said he had made $250 million investing in bitcoin and ethereum and bought a private jet with the proceeds.

In 2018, Novogratz founded Galaxy, contributing $302 million in digital and other assets. Other investors contributed C$302 million. In the March 2020 quarter, Galaxy reported $365.2 million in assets, down from $402.8 million held at the end of 2019. Galaxy held 13,338 bitcoin valued at $122.5 million.

In November 2017, Novogratz famously predicted that Bitcoin could reach $40,000 by the end of 2018 —it peaked at $19,650 the following month and subsequently crashed to the $3,000 range over the following year. In February 2020, Novogratz said he expected Bitcoin could set a new all-time high in 2020. (See also: Bitcoin’s Price History)

Digital Asset Holdings

Digital Asset Holdings is a financial technology company and developer of programming languages for the finance industry. Its main product is the Digital Asset Modeling Language (DAML), which is designed for modelling smart contracts. In December 2019, the company raised $35 million in a Series C funding rounding, bringing its total fundraising to $150 million. Digital Asset Holdings is led by co-founder and CEO Yuval Rooz. Former CEO Blythe Masters stepped down in December 2018, though she remains as a board member, strategic advisor and shareholder.

Investing in cryptocurrencies and other Initial Coin Offerings (“ICOs”) is highly risky and speculative, and this article is not a recommendation by Investopedia or the writer to invest in cryptocurrencies or other ICOs. Since each individual’s situation is unique, a qualified professional should always be consulted before making any financial decisions. Investopedia makes no representations or warranties as to the accuracy or timeliness of the information contained herein. As of the date this article was written, the author owns 0.001 bitcoin.

Источник

Here Are the Top Public Companies That Have Adopted Bitcoin as a Reserve Asset

When Microstrategy Inc. bought $425 million bitcoin in the last two months, the decision became an important stamp of institutional approval of the top crypto’s credentials as a mature, safe-haven asset. The American technology firm had just made bitcoin its primary reserve asset to hedge against fiat inflation. Now, it appears major global companies are following Microstrategy’s bitcoin strategy.

The website bitcointreasuries.org is curating bitcoin treasures held in reserve by publicly traded companies from across the world. At the time of writing, 13 companies with a combined total 598,237 BTC, or 2.85% of the total supply of 21 million BTC, are listed on the page. Here is a closer look at some of the entities.

Grayscale Bitcoin Trust — 2.14%

Grayscale Investments is, perhaps, an unsurprising pacesetter in this regard. Through its Bitcoin Trust Fund (GBTC), which owns and tracks the price of bitcoin, the New York-based firm now holds 449,596 BTC, valued at $5.1 billion currently, and representing 2.14% of the digital asset’s total circulating supply. Listed on the OTCQX market, the Trust has snapped up 70% of all newly minted bitcoin in 2020, almost doubling its portfolio in the process.

It is noteworthy that Gbtc holds this BTC on behalf of accredited corporate investors, who typically value privacy and bitcoin’s store of value credentials while calculatively reluctant to gain direct exposure to the asset. Grayscale’s bitcoin trust “became the first publicly quoted securities solely invested in, and deriving value from, the price of bitcoin” when it launched in 2013. The company operates ten crypto investment products focused on institutional investors. Funds cover ethereum (ETH), bitcoin cash (BCH), zcash, XRP, and more.

Microstrategy Inc. — 0.18%

Grayscale may be a pioneer, but it is Microstrategy that’s grabbed all the headlines in recent weeks. The Nasdaq-listed company, which develops mobile software as well as provide cloud-based services, bought $425 million worth of bitcoin in August and September, making BTC Microstrategy’s main reserve asset.

The multi-billion-dollar U.S. firm now holds a total 38,250 BTC, in a move that signals increasing corporate adoption. At current exchange rates, the portfolio is worth more than $433 million – a gain of $8 million, coming as it does against a backdrop of increased stimulus spending that has sent global fiat currencies into a tailspin. Microstrategy CEO Michael Saylor is particularly upbeat.

“This investment reflects our belief that bitcoin, as the world’s most widely adopted cryptocurrency, is a dependable store of value and an attractive investment asset with more long-term appreciation potential than holding cash,” he says.

Square Inc. — 0.022%

Corporate adoption may not be considered a trend just yet, but news that Jack Dorsey’s Square Inc. moved one percent of its total assets into bitcoin suggests something may be building up. On Oct. 8, the New York Stock Exchange-listed mobile payments firm announced it spent $50 million buying 4,709 bitcoin. According to Amrita Ahuja, chief financial officer of Square, “bitcoin has the potential to be a more ubiquitous currency in the future”.

On this account, the company intends that “as it (bitcoin) grows in adoption, we intend to learn and participate in a disciplined way. For a company that is building products based on a more inclusive future, this investment is a step on that journey.” Bitcoin reacted positively to Square’s news, soaring 8% in the last 72 hours to more than $11,300 from $10,500. With a market capitalization of over $83 billion, Square provides software and hardware payment solutions. In 2019, the company reported revenue of $4.7 billion. It has offices in the U.S., Canada, Australia, Japan, and the United Kingdom.

Coinshares — 0.33%

Coinshares Ltd is a U.K.- based investment fund that is primarily focused on direct and indirect exposure to bitcoin and other cryptocurrencies. The company manages over $1 billion in digital assets, with bitcoin making up nearly 80% of this. Coinshares currently holds – on behalf of investors – a total 69,730 BTC, valued at $790 million, according to bitcointreasuries.org.

Through its subsidiary XBT Provider, Coinshares offers two globally traded exchange-traded notes (ETNs) in bitcoin and ethereum, Bitcoin Tracker One and BTC Tracker Euro, and ethereum, Ether Tracker One and ETH Tracker Euro, respectively. Its ETNs are listed on the Nasdaq Nordic in Stockholm, Sweden and retail investors can buy the instruments. However, the product suffered a blow when the U.K. financial regulator banned the sale of ETNs to retail clients in the country recently.

Other Listings

Several other publicly traded companies are listed on the bitcoin treasuries website. They include bitcoin miners Hut 8 Mining, which trades on the Toronto Stock Exchange (TSX), and Argo Blockchain of the London Stock Exchange. Both companies hold bitcoin as a reserve asset. At the end of June, Hut 8 held 2,954 BTC while Argo Blockchain had 126 BTC by the end of September. Another mining entity, Riot Blockchain, Inc had 1,053 bitcoin in its reserves in June.

Mike Novogratz’s Galaxy Digital Holdings, a TSX-listed firm that “seeks to institutionalize the digital asset and blockchain space,” holds 16,651 BTC, worth about $188 million at prevailing market prices. The company provides asset management, investing, advisory and trading services as well as making principal investments. Voyager Digital Ltd, Cypherpunk Holdings, and DigitalX also make the list of those public companies holding bitcoin as a hedge against fiat inflation.

What do you think about the bitcoin held by public firms in reserve? Let us know in the comments section below.

Источник

Best Bitcoin IRA Companies

Diversify your IRA with Bitcoin and other digital assets

We publish unbiased product reviews; our opinions are our own and are not influenced by payment we receive from our advertising partners. Learn more about how we review products and read our advertiser disclosure for how we make money.

Traditional individual retirement accounts (IRAs) are a great way to provide future financial security. However, as world events continue to increase the volatility of global markets, some investors are looking to diversify their IRAs with alternative assets, including Bitcoin and other cryptocurrencies.

Since Bitcoin is a digital rather than tangible asset, cryptocurrency IRAs require specialized management, greater protection of sensitive data, and deep expertise in cryptocurrency trading. We researched nearly a dozen Bitcoin IRAs based on expertise, security, experience, fees, and more. Here are our top picks.

The Best Bitcoin IRA Companies for 2021

- Best Overall:Bitcoin IRA

- Best Investor Experience:Coin IRA

- Best Rates and Fees:iTrustCapital

- Best for Security:BitIRA

- Best for Self-Directed Investments:Equity Trust

- Best Variety of Cryptocurrency Supported:Regal Assets

Best Overall : Bitcoin IRA

» data-caption=»» data-expand=»300″ data-tracking-container=»true»/>

Bitcoin IRA is a full-service Bitcoin IRA provider offering 24/7 trading, secure cold storage for digital assets, and $100 million of insurance protection, making it our choice as the best overall.

Easy setup and trading

Secure offline digital asset storage

Digital assets insured up to $100 million

High setup and maintenance fees

Established in 2016, Bitcoin IRA is the first and largest cryptocurrency IRA company that lets individuals invest in cryptocurrency with their retirement accounts. The platform’s easy account setup and management, 24/7 real-time trading, and military-grade security features are why we chose it as the best Bitcoin IRA company overall.

Bitcoin IRA makes it easy to create an IRA account and digital wallet in just a few minutes using its app or web dashboard. Once funds are transferred to an account, users can begin trading within three to five days and can buy, sell, and trade online any time of day or night.

Bitcoin IRA supports trading nine types of cryptocurrency, including Bitcoin, Ethereum, Ripple, and Litecoin. Although the minimum to open a standard account is $3,000, the company also offers a Saver IRA that requires an initial deposit of $100 with a recurring investment of $100 per month through a linked bank account.

Bitcoin IRA also takes security seriously. The platform offers 256-bit encrypted SSL trading, stores digital assets offline in separate cold storage accounts, and insures its digital assets up to $100 million.

Bitcoin IRA does not list fees on its site, but third-party sources indicate that the company charges a one-time fee of 10% to 15% of the initial investment, a $240 annual custodial account fee, a $75 asset conversion fee, a 5% buy fee, and a 1% sell platform fee.

Best Investor Experience : Coin IRA

» data-caption=»» data-expand=»300″ data-tracking-container=»true»/>

Best Bitcoin IRA Companies

Coin IRA walks individuals through the process of setting up and managing a Cryptocurrency IRA and offers low fees and multiple storage options, placing it in first place for the best investor experience.

Cryptocurrency consultants available

Multiple secure wallet options

$20,000 minimum to open a cryptocurrency IRA account

No fees listed on website

An offshoot of gold and silver IRA provider Goldco, Coin IRA was founded in 2017 to turn the company’s expertise in alternative asset IRA investing toward cryptocurrency. Its dedicated cryptocurrency advisors, low fees, and choice of security options make it our choice for the best investor experience.

Coin IRA helps individuals get started with its free, downloadable «Ultimate Guide to Cryptocurrency Investing» that educates readers on the investment benefits of Cryptocurrency IRAs, how to convert existing retirement accounts to invest in cryptocurrencies, and more. From there, the company offers specialized cryptocurrency retirement experts who can walk customers through the process of setting up an account.

Coin IRA supports investment and trading in Bitcoin, Ethereum, Litecoin, and more. It also gives its clients the option to choose their level of asset security. Assets can be stored securely offline, moved into a hard wallet that they control, or transferred directly to their preferred cryptocurrency wallet.

Coin IRA’s minimum investment is $20,000 to open a Cryptocurrency IRA, or $3,500 if funds are transferred from a non-IRA account. Although the company doesn’t publish fees on its website, they have confirmed the annual costs include a $50 setup fee, a $195 annual maintenance fee, and .05% monthly for cryptocurrency storage.

Best Rates and Fees : iTrustCapital

» data-caption=»» data-expand=»300″ data-tracking-container=»true»/>

iTrustCapital makes it easy for both novice and expert investors to start a Bitcoin IRA with expert consultants and transparent pricing, making it our choice for the best rates and fees in Bitcoin IRAs.

Low account and trading fees

$1,000 minimum investment

No financial advisors on staff

Founded in 2018, iTrustCapital lets individuals buy and trade cryptocurrencies and physical gold in real time through their retirement accounts. The company has the lowest service and trade fees we’ve come across, placing it in the top spot for best rates and fees.

iTrustCapital offers some of the most affordable trading and investing fees. While it’s not uncommon to pay up to 15% per transaction to trade cryptocurrencies, iTrustCapital charges just 1% per transaction. Clients also pay a reasonable $29.95 monthly service fee and are charged no initial purchase fees, broker fees, or scaling based on the size of their assets.

iTrustCapital allows clients to trade in Bitcoin, Ethereum, Litecoin, Bitcoin Cash, Ripple, Stellar, Polkadot, Chainlink, Cardano, and EOS any time of day or night using its 24-hour transaction service. There is only a $1,000 minimum to start an account and a $30 trade minimum. iTrustCapital also lets its clients diversify their IRA portfolios with gold while enjoying the same fees.

iTrustCapital secures its digital assets with an institutional-grade virtual wallet employing multiple authentication protocols used by banks and the military. The company does secure its access with a $50 million insurance policy from Munich Re, a leading provider of insurance-related risk solutions with over 140 years of experience.

Best for Security : BitIRA

» data-caption=»» data-expand=»300″ data-tracking-container=»true»/>

BitIRA offers Bitcoin IRAs with dollar-for-dollar insurance coverage for digital assets and true offline cold storage of private keys, placing it in the top position as the best for security.

Digital assets kept in guarded offline storage

Full insurance coverage for digital assets

Multi-encryption encoding for transactions

Must open accounts with a digital currency specialist

Though only established in 2017, BitIRA has made a name for itself by offering the highest levels of security for both cryptocurrency transactions and storage, backed by unlimited insurance coverage, making it our choice as the best for security.

BitIRA uses multi-encryption encoding for transactions to keep them secure while they’re most vulnerable online. Once completed, transactions are moved to physical keys kept offline inside grade-5 nuclear bunkers protected by armed guards and computer security specialists 24/7.

BitIRA is so confident in its security measures that it covers all digital assets dollar-for-dollar, insuring all client digital currencies at full value. The company also offers a $1 million consumer protection insurance policy to protect against internal cases of fraud or theft as well as a $1 million cybersecurity policy.

BitIRA requires a minimum investment amount of $5,000 to start an IRA and requires customers to work with a digital currency specialist to open an account. The company allows clients to invest and trade in six types of cryptocurrency, including Bitcoin, Ethereum, Ripple, and Litecoin.

Although BitIRA doesn’t list fees on its website, third-party sources indicate that customers can expect to pay a setup fee of $50, $195 for annual account maintenance, and 0.05% per month for secure offline storage.

Best for Self-Directed Investments : Equity Trust

» data-caption=»» data-expand=»300″ data-tracking-container=»true»/>

Equity Trust has been managing self-directed IRAs for 38 years with both traditional and alternative investments and no transaction fees, placing it in our top spot as the best for self-directed investments.

38 years’ experience in self-directed IRAs

Supports traditional and alternative investments

No transaction fees

High administration fees

Must open accounts with a representative

As a financial services company established in 1974, Equity Trust branched into self-directed IRAs (SDIRAs) in 1983. The company’s extensive expertise in traditional and alternative investments, no transaction fees, and personal guidance make it our top choice as the best for self-directed investments.

Clients will need to speak to a representative directly in order to start an Equity Trust SDIRA and are required to make an initial investment of $10,000. Once an account is open, clients can trade in up to eight cryptocurrencies, including Bitcoin, Ethereum, and Litecoin, with no fees and a one-day settlement.

Equity Trust also takes security seriously, employing over six security features, including multi-factor authentication, multi-encryption, and secure cold storage. The company also offers end-to-end insurance on its digital assets.

Equity Trust offers its clients access to SDIRA specialists who can help them manage their accounts as well as educational tools to help them understand their investment options. The company does offer a dashboard to its clients for handling transactions, requiring them to issue directions to an account specialist to invest funds from their accounts.

Equity Trust does not list fees on its site, but our research shows the company charges annual administration fees between $205 to $2,150 depending on the size of the account as well as a $50 setup fee, a $20 per month platform fee, and a 0.07% monthly cold storage fee based on the account balance.

Best Variety of Cryptocurrency Supported : Regal Assets

» data-caption=»» data-expand=»300″ data-tracking-container=»true»/>

Regal Assets offers IRAs that allow clients to invest in both hard assets as well as digital assets including all popular cryptocurrencies, placing it in our top spot for the best variety of cryptocurrency supported.

Supports all popular cryptocurrencies

Digital assets insured up to $250 million

$25,000 initial investment required

Must open accounts with a representative

Founded in 2010 as an alternate assets investment firm, Regal Assets added cryptocurrency to its portfolio in 2017. Although its original focus is on precious metals, the company allows trading of popular cryptocurrency investments and is our choice for the best variety of cryptocurrency supported.

Regal Assets makes it easy to create an IRA account with an initial investment of $25,000 or by rolling over funds from a traditional IRA. Once a client fills out an online application, a team member will contact them to set up their account.

As a top-rated crypto IRA company in the U.S., Regal Assets was the first company in the industry to receive a crypto trading license. Although the company’s site only lists 14 supported cryptocurrencies, including Bitcoin, Ethereum, Ripple, and Litecoin, it allows its clients to invest in just about any cryptocurrency they want.

Another unique feature of Regal Assets is its flat fees, which include a $100 annual administration fee and a $150 yearly storage fee, both of which are waived during the first year. The storage fees include multiple offshore storage options for precious metals, which is less than other firms offer.

Final Verdict

As more firms allow their clients to add alternative assets like Bitcoin to their IRAs, understanding which ones offer the best expertise, security, and support can be tricky. In the end, companies with deep expertise in managing both traditional and digital assets are the ones who can future-proof their clients’ retirements.

As the first and largest cryptocurrency IRA company, Bitcoin IRA takes our top spot as the best overall due to its easy account setup, 24/7 real-time trading, and advanced security features.

Coin IRA is our pick for the best investor experience with its free, downloadable «Cryptocurrency IRA Guide,» access to specialized cryptocurrency consultants, and choice of three secure digital asset storage options.

In terms of pricing, iTrustCapital wins for the best rates and fees with a simple 1% transaction fee and low monthly service fee of just $29.05, while BitIRA aced the best for security category with multi-encryption encoding for transactions and offsite storage in nuclear bunkers protected by armed guards.

Equity Trust brought nearly 40 years of experience in SDIRAs, seamlessly blending traditional and digital assets with no transaction fees, making it our choice as the best for self-directed investments.

Finally, we picked Regal Assets for the best variety of cryptocurrency supported since it allows its clients to invest in any popular cryptocurrency they desire as well as precious metals to create diverse and secure portfolios.

Compare Providers

| Company | Why We Chose It | Notable Features |

|---|---|---|

| Bitcoin IRA | Best Overall | Full-service Bitcoin IRA provider offering 24/7 trading |

| Coin IRA | Best Investor Experience | Cryptocurrency consultants and multiple storage options |

| iTrustCapital | Best Rates and Fees | $29.95 monthly service fee and 1% per transaction |

| BitIRA | Best for Security | Guarded offline storage and full insurance coverage |

| Equity Trust | Best for Self-Directed Investments | 38 years’ experience in self-directed IRAs |

| Regal Assets | Best Variety of Cryptocurrency Supported | Supports investing using all popular cryptocurrencies |

Frequently Asked Questions

How Do Bitcoin IRAs Work?

A Bitcoin IRA allows individuals to diversify their IRAs with investments in Bitcoin or other cryptocurrencies. Because the IRS considers Bitcoin property, taxing them like stocks and bonds, account holders need a custodian to manage their IRA.

Bitcoin IRA firms also allow account holders to freely trade cryptocurrency on their platforms and offer either secure online or offsite storage for their clients’ digital assets.

How Should I Choose a Bitcoin IRA Company?

Security and fees are two of the most important criteria for choosing a Bitcoin IRA company. Since cryptocurrency isn’t backed by any fiat currency, investors who have their accounts hacked risk losing everything. As a result, many firms store digital assets in physical vaults to protect accounts from cyberattacks and also insure investments up to a certain dollar value.

Fees are also a big consideration, since many firms charge high trading and administrative fees based on the size of accounts, as well as storage fees, potentially cutting into the profitability of investments. It’s also important to choose a company with dedicated experience in managing IRAs and not just cryptocurrencies.

Are All Bitcoin IRA Companies Safe?

Some would say that the uncertainty of cryptocurrency in general makes Bitcoin IRAs inherently risky. Those willing to accept the risk must find firms with the technology and infrastructure to manage transactions securely and protect their digital assets.

To this end, firms that offer multiple layers of transaction encoding and security features, a variety of cryptocurrency choices for investing, and offline cold storage provide the most security available for their clients.

What Are the Benefits of Bitcoin IRAs?

The main advantage of Bitcoin IRAs is that they add diversification to retirement portfolios to both mitigate risk and maximize potential returns. Investors who diversify their IRAs with precious metals due to their relative market stability are now looking to cryptocurrencies for the same reason. Including digital currencies in some types of retirement accounts can also help investors avoid heavy capital gains taxes.

How We Chose the Best Bitcoin IRA Companies

We looked at nearly a dozen Bitcoin IRAs for this review. Our first consideration was to find companies with both deep experience in managing IRAs as well as alternative assets like cryptocurrencies.

Security was also a major consideration. Since Bitcoin and other cryptocurrency isn’t backed by any bank or hard assets, a cyber hacker could potentially wipe out an entire Bitcoin IRA. For that reason, we made sure to choose companies that provided state-of-the-art security features and high insurance coverage for their digital assets.

Finally, we included companies with low or reasonable fees since managing a Bitcoin IRA can be potentially much more expensive than managing most traditional retirement accounts.

Источник