- Beginner´s guide to mining Bitcoins: How to mine Bitcoin step by step

- 1. Get a Bitcoin mining rig

- Customized VPS hosting

- How are other cryptocurrencies mined?

- 2. Get a Bitcoin wallet

- 3. Join a mining pool

- 4. Get a mining programme for your computer

- 5. Start mining

- How to Mine Bitcoin: Beginner’s Guide (2021)

- Getting started with Bitcoin mining is relatively simple. Staying in profit, on the other hand, can be more of a challenge.

- In brief

- What you need to mine Bitcoin

- Types of mining hardware

- How profitable is Bitcoin mining?

- How to choose mining software

- What are Bitcoin mining pools?

- What is cloud mining?

- Bitcoin Mining in 2021

- Disclaimer

Beginner´s guide to mining Bitcoins: How to mine Bitcoin step by step

Are you interested in mining Bitcoins but don´t know much about cryptocurrencies? Then you may welcome our detailed manual for beginners that will tell you how to mine Bitcoin step by step. If you want to learn more about the principles behind mining and how Bitcoin mining works, read our article Bitcoin mining in theory: what is the principle of mining?

1. Get a Bitcoin mining rig

If you want to start mining in the first place, you have to own a mining rig. Although in the beginning of the Bitcoin history, miners used ordinary domestic computers, and later graphic cards, today you will not acquire any Bitcoin with these machines (or more precisely you may gain something, but it will be a really small amount in a very long period of time).

Nowadays, Bitcoins are mined by special hardware designated just for mining Bitcoins or other currencies based on the same algorithm. It is called ASIC (Application-Specific Integrated Circuit chips), uses less energy and mines Bitcoins much faster. This device is expensive and its manufacturing is time-consuming, however, its speed is astonishing. The most powerful machines manage to solve as many as 14 terahashes per second (which means it does 1012 attempts to solve a block per second) and its development goes ahead constantly.

Customized VPS hosting

Choose one of our virtualization platforms and set the parameters of your VPS server according to your ideas.

How to choose an ASIC mining rig?

If you are thinking about starting mining, you should concentrate on the following parameters during your selection: performance (hash rate), consumption of electric power, and price. Hash rate indicates how many attempts to solve a block can the machine make per second.

We recommend you go through various miners’ reviews and then choose the one which seems most advantageous to you. Don´t choose solely according to price, focus on the overall proportion of price, performance, and consumption. To put it in simple terms, the most efficient miner is the best one. You can inspire yourself on the webpage Asic Miner Value where detailed information about new miners is displayed.

Keep in mind that it could be very difficult to get these devices these days because the demand is extremely high. It also influences the price of these devices which varies between hundreds or even thousands of dollars.

Before you buy an ASIC miner, try to calculate the profitability of the chosen device in an online calculator (f.e. Nice Hash or Coinwarz, for multiple currencies try What to mine). Apart from parameters of your mining rig, the calculation also includes the price of electricity, fees from mining pool or the level of mining difficulty. You will find out whether mining can be profitable or how much money you have to invest in the beginning.

During your decision making, take into consideration the increasing difficulty of the mining as well as declining profit over time. What does it mean in practice? If the difficulty increases by about 10% after 14 days, the profit declines by about the same 10%. Find more information about mining difficulty in our article Bitcoin mining in theory: what is the principle of mining?

Where should you put your machine? Into a professional data center

Bitcoin mining demands not only a lot of electric power but also a special place for a machine as mining rigs are noisy and emit a lot of heat. The service miner housing provides a solution to this problem – you can place your machine into a professional data center and get rid of all these concerns. You will profit from a lower price of energy, cooled area, constant monitoring and you won´t be bothered by any noise.

How are other cryptocurrencies mined?

Nowadays, there are thousands of cryptocurrencies which differ by the used algorithm. A specialized mining rig can work only with a particular algorithm. If you buy an ASIC hardware to mine bitcoins you will also be able to mine other cryptocurrencies with the same algorithm (e.g.. Bitshare, Bitcoin Cash or ByteCoin), but not cryptocurrencies based on a different algorithm. However, machines are constantly developing and some companies are starting to offer ASIC devices capable of solving multiple different algorithms (e.g. Baikal Miner).

Moreover, it is still possible to mine cryptocurrencies by graphics cards, if there is no specialized hardware to deal with a particular algorithm. There are many advantages to mining by graphics cards – you can mine multiple cryptocurrencies and the machine produces much less noise and heat. Nevertheless, you have to take care of it and change cards regularly.

2. Get a Bitcoin wallet

The next important step is to set up a Bitcoin wallet. That’s where you will receive your Bitcoins and will be able to manipulate with them. Bitcoin wallets allow you to manage your Bitcoin addresses (Bitcoins themselves are technically stored in the Blockchain).

Each Bitcoin address has a form of a public key and matching private key. The public key comprises of a unique combination of characters and it looks for example like this: 18ukxpD1eqnVjux13ehEz8r4d8py1dSdzw. It works basically like a bank account number so if you want to receive Bitcoins from somebody, you have to tell him your public key. Every bitcoin address is public and you can trace back every transaction that passed through it. In contrast, the private key is secret and it serves to send off transactions. If you lose your private key, you lose your Bitcoins placed on this particular address forever.

In general, there are multiple types of wallets from simple online wallets, software ones to the most secure hardware and paper wallets. Each wallet has its advantages and disadvantages. Some of them can keep multiple currencies at the same time.

Which wallet is the best for beginners?

The best option for starting miners is a software wallet. It is secure but still easy to manage and suitable for frequent manipulation with mined currency. You easily download a wallet to your computer, where your coins will be stored and nobody can get to them.

There are two kinds of software wallets: full ones which download the whole Blockchain or light-weight ones which store only relevant transactions. The first option requires a lot of space and memory in your computer but is definitely safer. On the contrary, the light-weight variant is connected with Blockchain managed by a third party and you can´t fully control it.

If you have decided to choose a full version of the wallet, you can download f.e. the original Bitcoin Core. Take into account that its full synchronization takes a couple of hours because the Blockchain currently is the size of tens of GBs. Set your own password to the wallet in the programme and don´t forget to save a copy of your wallet on another device, otherwise, your Bitcoins will be lost forever in case of any failure of your computer. If you prefer a wallet which can manage multiple currencies, you can try Exodus.

3. Join a mining pool

Even with the best ASIC miner, it is almost impossible to gain Bitcoin today. A single machine can´t compete with many large mining farms all around the world and mining Bitcoins on your own isn´t always profitable. But don´t worry, there is one solution to this situation — cooperation between miners in so-called mining pools.

Miners provide their computing power to a group and when Bitcoins are mined, the gain is divided among members according to a given power. The income is lower but regular. However, members of a pool have to pay a fee to an operator of the pool, the price of fees is usually around 0 and 2% of the received reward.

You can choose from many pools, this graph from 2017 illustrates the representation of the biggest pools. For better orientation, you can use the comparison of mining pools on Bitcoin Wiki. It is recommended for beginners to try Slush Pool, the very first pool in existence and is considered one of the most credible ones. Here’s an interesting fact – a Czech programmer Marek Palatinus is responsible for the birth of Slush Pool.

As soon as you choose a mining pool, register yourself on its website and set your account. Afterward, you will receive a worker ID for your miner.

4. Get a mining programme for your computer

Now you have your hardware, a Bitcoin wallet and chosen a mining pool, so it´s time to get a mining client to run on your computer. It connects you to the Blockchain and Bitcoin network. Mining software delivers work to miners, collects complete results of their work and adds all information back to the Blockchain. In addition to that, Bitcoin mining software monitors miner´s activities and shows basic statistics like temperature, cooling, hash rate, and average mining speed.

In general, there are many free programmes used to mine Bitcoins, the best programmes can run on almost all operational systems and each of them has its advantages and disadvantages. Some mining pools also have their own software.

Beginners will appreciate Nice Hash Miner. It is very easy to use, mines multiple cryptocurrencies and automatically chooses an algorithm which is the most profitable in a particular moment. Download the programme and choose a device you would like to mine with.

5. Start mining

And now you can start mining and earning Bitcoins! Connect your miner to a power outlet, link it with computer and install mining software. Fill in your information about your wallet and mining pool into the mining software, choose a device, and let the mining begin!

Some advice to send you off: if you want to mine profitably, keep track of the news from the crypto world. The development goes ahead very fast and it changes on a day to day basis.

Источник

How to Mine Bitcoin: Beginner’s Guide (2021)

Getting started with Bitcoin mining is relatively simple. Staying in profit, on the other hand, can be more of a challenge.

In brief

- Bitcoin mining helps to keep the Bitcoin network secure against attacks.

- With the right combination of equipment, electricity costs, and a few other considerations, Bitcoin mining can be profitable.

- Bitcoin mining profitability has increased as a result of the 2020-21 bull run—but there are shortages of mining hardware.

Bitcoin mining is the process of participating in Bitcoin’s proof-of-work (POW) consensus mechanism to discover new blocks and help with transaction validation. The combined efforts of all the Bitcoin miners is responsible for the integrity of the blockchain , and ensures that transactions remain essentially irreversible.

Each time a new block is discovered, the miner receives a reward, known as the Bitcoin block reward. Following the 2020 halving, this is currently set at 6.25 BTC per block, but most miners generally receive much less due to working together as part of a mining pool.

Rather than buying or trading Bitcoin, many individuals choose to simply mine their own, since it often costs less to mine Bitcoin than it does to buy it on the open market. As a result, mining and selling Bitcoin can be a profitable business endeavor, under the right conditions .

Here’s how to get involved.

What you need to mine Bitcoin

If you’re looking to get involved in Bitcoin mining, then you’re going to need to get to grips with a few things first.

First and foremost, you will need a Bitcoin wallet . The exact type of wallet you use doesn’t really matter, so long as it’s secure. This will be used to receive your mining proceeds, which, depending on your mining setup, could be substantial. Hardware wallets are widely considered to be the gold standard in security, but they’re more cumbersome to use. Many miners instead use software wallets like Electrum , due to their convenience.

Next up, you’re going to need your mining hardware. We’ll cover this in greater depth in the next section, but this is the machine you will use to actually participate in the Bitcoin mining process. In general, the more powerful your machine (in terms of hash rate), the greater your rewards—but there are other considerations too (more on this later).

Lastly, there’s the mining software. This is software that you run on your computer which tells your mining hardware how to perform, such as which mining algorithm it should work on, when it should operate, and which Bitcoin address mining rewards should be sent to. This can affect your mining yields, so it’s wise to choose carefully.

Types of mining hardware

When Bitcoin mining first began in 2009, the difficulty was so low that low-power devices could participate in the mining process using their CPU resources. At the time, even individual miners using their regular computer could discover blocks—earning 50 BTC apiece by doing so.

However, as the popularity of Bitcoin mining grew, miners began looking for ways to get an edge on the competition—and thus GPU mining was born. In 2010, people began hooking up large arrays of graphics processing units (GPUs) to mine Bitcoin—which, according to mining consultancy firm Navier, yields a six-times efficiency improvement over CPU mining.

But the era of GPU mining was short-lived. In 2011, it was found that a specialized type of hardware known as field programmable gate arrays (FPGAs) could be designed to mine Bitcoin with even greater efficiency. This type of hardware ran the Bitcoin mining roost until 2013, when it was usurped by application-specific integrated circuit (ASIC) miners—which still dominate to this day.

Nowadays, unless you plan to mine Bitcoin from a supercomputer with tens of thousands of CPU or GPU cores, you are unlikely to be competitive as a Bitcoin miner—and almost invariably won’t turn a profit. You will almost certainly need an ASIC miner, unless your acquisition and electricity costs are negligible.

As of writing, Bitmain’s AntMiner S19 Pro, S19, and T19 are arguably the most efficient Bitcoin miners available—but getting hold of stock is challenging.

How profitable is Bitcoin mining?

Though Bitcoin mining profitability has improved in recent months—largely due to Bitcoin’s rapidly increasing market value, the amount of money you can earn can vary considerably based on several parameters.

The most important of these is your hardware . More powerful hardware can crunch the calculations required to discover Bitcoin blocks much faster—thereby earning you more rewards. But it’s also generally more expensive.

The next most important consideration is your electricity costs . Cheap, reliable electricity can help to maximize your mining yield, since electricity costs will be your primary expense. Moreover, you will need to factor in your maintenance costs, such as cooling, modifications, installation costs etc., and if you use a pool, consider how the pool fee will affect your yield.

How to choose mining software

Before you get your Bitcoin mining hardware up and running, you are going to need to choose the mining software for your computer. This is used to control which mining algorithm you want to work with, which pool you will use, and acts as the hub for controlling your miner.

Though these all offer the same basic utility, they can vary considerably in both their efficiency and the additional features they offer. Moreover, choosing the right mining software can impact the efficiency of your Bitcoin mining operation, so it’s often a good idea to try out a few before committing long-term.

When selecting your mining software, these are some of the basic considerations you will want to make:

- 🖥️ Operating system support: Check that the software works with your operating system—e.g. Windows, macOS, Raspberry Pi OS, Linux, etc.

- 🧮 Algorithm support: Bitcoin uses the SHA256 mining algorithm, the software will need to support this to successfully mine Bitcoin.

- 🧰 Hardware support: Some programs support CPU, GPU, FPGA, and ASIC mining, whereas others will only support specific hardware.

- 🏋️♂️ Efficiency: Low resource miners are generally more efficient, but they are often more difficult to use.

- 💱 Additional functionality: Automatic coin switching, remote access, mining scheduling are among some of the most popular additional features.

Oftentimes, Bitcoin mining software can be downloaded and used free of charge. However, you will often find that these software programs offer additional features for a fee (or donation), while those that are the simplest to use and setup come at a cost.

Find out more about the best Bitcoin mining software available in 2021.

What are Bitcoin mining pools?

A Bitcoin mining pool is a coordinated group of Bitcoin miners that work together to improve their odds of successfully mining BTC. The combined efforts of a large number of Bitcoin miners ensures that they are able to discover more blocks than when working alone and hence generate a more stable income. While it is possible to mine Bitcoin solo, doing so is unlikely to ever yield any rewards—unless you are packaging some serious hardware. Instead, with Bitcoin mining pools, everybody aligns their mining power to the same purpose for the common good of the pool.

When mining Bitcoin as part of a pool, you will share in the rewards generated by that mining pool in proportion to your fraction of the hash rate controlled by the pool. As such, if you contribute 1% of the hash rate, you will get 1% of the rewards—regardless of which miner in the pool actually discovers the blocks.

Choosing which pool works best for you will mostly come down to personal preference. But in general, the larger the pool the more consistent your income will be. On top of this, you may want to consider pools based on their task assignment mechanism, minimum payout threshold, fee schedule, and transparency, among other parameters.

“A good pool must have a good reputation, technology and know-how. Additionally, it is important you consider pools that are attempting to help the ecosystem grow. A pool that wants the best for Bitcoin is a pool you should always go for,” Alejandro De La Torre, VP at Poolin , told Decrypt .

What is cloud mining?

Although most Bitcoin miners tend to set up their own hardware and work together with a mining pool, it’s not the only way to get involved.

Cloud mining is rapidly gaining popularity as a simpler alternative. Cloud mining providers are online platforms that allow you to rent computing power used for cryptocurrency mining. This allows you to get started with Bitcoin mining with essentially zero barriers to entry. You simply create an account, choose a mining plan, make your payment, and earn your Bitcoin—completely eliminating the efforts and costs involved in purchasing your own hardware and setting it up.

These platforms either pool mining power from their users, or have their own massive mining operations—leveraging the economies of scale to offer mining power to users at near cost rates. But though these platforms are cheaper to start with, there is no guarantee that they are profitable, and they often require lengthy contracts to get the best rates.

When choosing a cloud mining provider, it’s important to read into the specifics of your contract and use one of the numerous Bitcoin mining profitability calculators to estimate if your plan will be profitable over its lifetime.

Bitcoin Mining in 2021

Starting in July 2020, Bitcoin mining profitability began surging in line with Bitcoin’s increasing value. Since then, the estimated yield per hash rate has multiplied fivefold, climbing from $0.065/TH/s in July 2020 to $0.32/TH/s in Feb 2021—its highest value since July 2019.

As a result, many long-term Bitcoin miners are making five times more profit than they were six months ago.

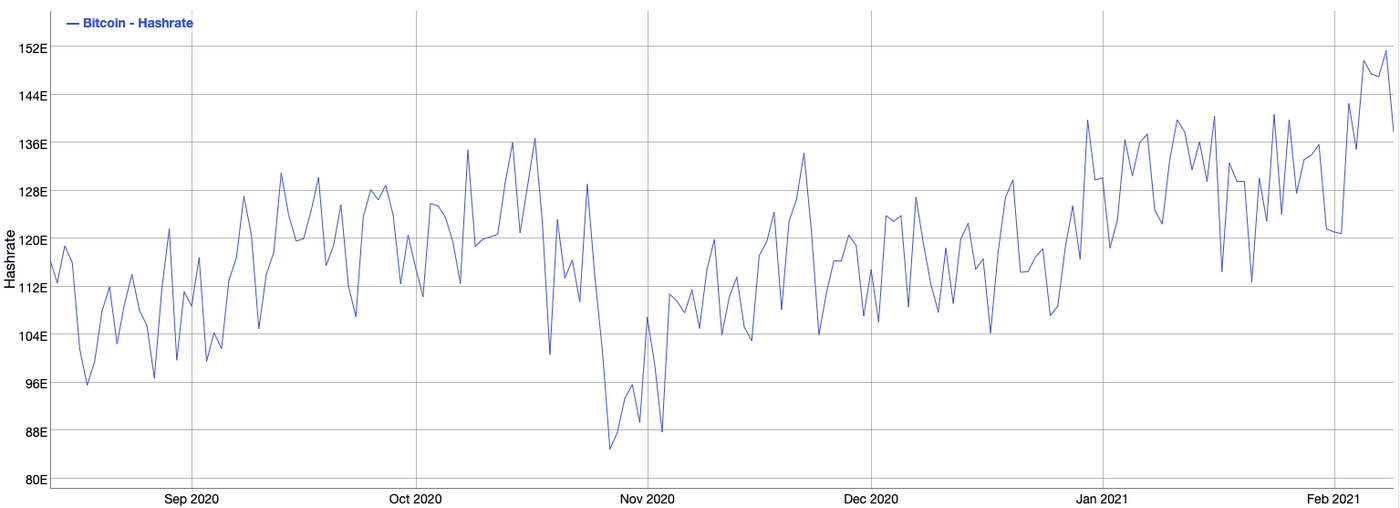

Despite the dramatic increase in profitability, the overall Bitcoin mining network hasn’t grown quite so fast. In fact, over the last six months, the hash rate has only increased from around 116 EH/s to just shy of 160 EH/s—equivalent to around a 38% increase.

This may be partly due to a major shortage of new ASICs, thanks to a confluence of supply constraints, overdemand, and major mining operations buying up supplies right out of the gate. As a result, most major ASIC manufacturers and distributors are sold out until mid-2021—including both Bitmain and Ebang, who are sold out until August and May 2021 respectively.

Assuming the difficulty increases by a further 38% between now and August, those buying now may find they’re earning less than expected—unless Bitcoin’s value continues growing to make up for the difference (as it has in previous months).

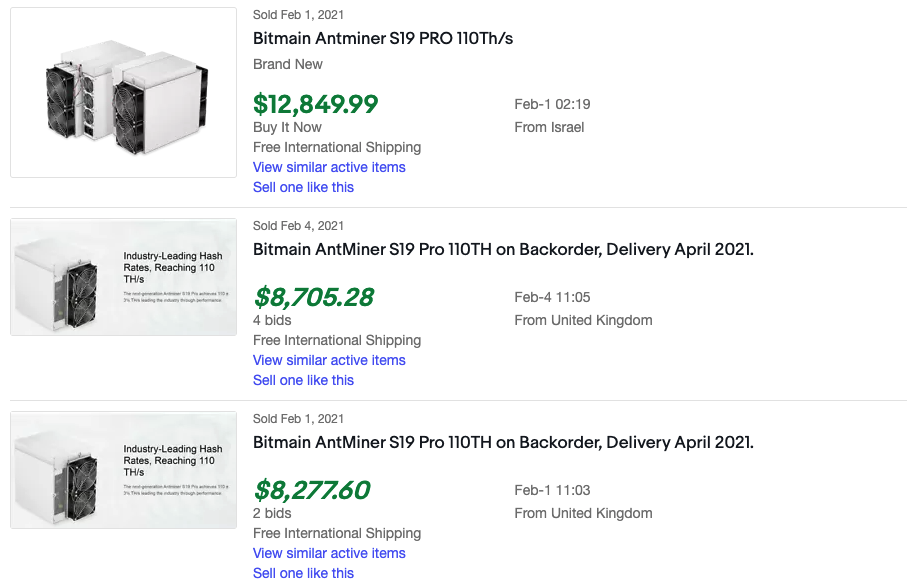

On the other hand, this shortage has led to a revival of the ASIC secondary market, with prices for mining hardware soaring on eBay—and some units selling for more than triple their usual price.

Unfortunately, with Bitcoin recently touching its highest-ever value, institutional adoption rising, and search interest through the roof, it’s unlikely the ASIC situation is likely to ameliorate any time soon.

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.

Источник