- How to buy bitcoin wallet

- Table of Contents

- Key points to consider

- Not your keys, not your bitcoin!

- Why do I need to verify my identity to purchase bitcoin?

- What are the fees for buying bitcoin?

- Ways to buy bitcoin

- Buying bitcoin with the Bitcoin.com Wallet

- Buying bitcoin from the Bitcoin.com website

- Buying bitcoin from a centralized cryptocurrency exchange

- Buying bitcoin using a peer-to-peer trading platform

- How to Buy a Cryptocurrency Hardware Wallet With Bitcoin Cash

- Buy a Hardware Wallet on the Bitcoin.com Store

- Best Bitcoin Wallets

- Coinbase wins as a simple way to buy, sell, and hold cryptocurrencies

- Best Bitcoin Wallets of 2021

- Best Overall : Coinbase

- Best for Hardware Wallet for Security : Trezor

- Best Hardware Wallet for Durability : Ledger

- Best for Beginners : SoFi

- Best for Free Buying and Selling : Robinhood

- Best for Mobile : Mycelium

- Best for Desktop : Exodus

- Final Verdict

- Compare the Best Bitcoin Wallets

- Frequently Asked Questions

- How Do I Use a Bitcoin Wallet?

- How Much Money Do I Need To Invest in Bitcoin?

- Pros and Cons of Digital Bitcoin Storage

- How Should I Choose a Bitcoin Wallet?

- Methodology

How to buy bitcoin wallet

Get your first bitcoin in minutes!

1. Download the Bitcoin.com Wallet app.

2. Setup your payment method (credit/debit, Apple Pay, etc.).

3. Follow the instructions to buy.

Table of Contents

- Key points to consider

- Not your keys, not your bitcoin!

- Why do I need to verify my identity to purchase bitcoin?

- What are the fees for buying bitcoin?

- Ways to buy bitcoin

- Buying bitcoin with the Bitcoin.com Wallet

- Buying bitcoin from the Bitcoin.com website

- Buying bitcoin from a centralized cryptocurrency exchange

- Buying bitcoin using a peer-to-peer trading platform

Key points to consider

The three key points to consider when buying bitcoin are:

- Payment method

- Platform/venue used

- Where your bitcoin goes

Payment methods range from credit card to bank transfer, payment app (PayPal, Apple Pay, Google Pay, Samsung Pay, etc.), face-to-face with cash, and even barter. Each payment method carries tradeoffs in terms of convenience, privacy, and associated fees.

Platforms/venues for buying bitcoin include digital wallet providers, centralized spot exchanges, OTC desks (private ‘Over-The-Counter’ exchange services used primarily by high-net-worth individuals), peer-to-peer marketplaces, and even payment apps like PayPal.

Of course, it’s also possible to buy bitcoin face-to-face. For example, you could give cash to your friend in exchange for receiving an agreed amount of bitcoin.

As for where your bitcoin goes after you buy it, the options are:

- Into a Bitcoin wallet you control (ie. a ‘non-custodial’ wallet like the Bitcoin.com Wallet)

- Into a Bitcoin wallet someone else controls (eg. a centralized cryptocurrency exchange or a payment app like PayPal).

Not your keys, not your bitcoin!

When you hold bitcoin in a wallet you control (known as a ‘non-custodial’ wallet), you never have to ask for permission to use it. This means you can receive your bitcoin without waiting for a third party like a centralized exchange to approve the transaction. It also means you can send your bitcoin wherever you want, whenever you want.

By contrast, many custodial Bitcoin wallets impose severe restrictions on what you can do with your bitcoin. For example, you may be asked to register an address before sending bitcoin to it, and you may be required to wait several days before being allowed to make a withdrawal. In some cases (PayPal for example), withdrawals of any kind are simply not permitted. It’s also not uncommon to have your account frozen altogether. If you’ve been deemed a security or fraud risk, for example, you may be locked out of your account with no recourse to action.

The best non-custodial Bitcoin wallets also enable you to customize the ‘network fee’ each time you send. This means you can save money on transaction fees when you’re not in a rush, or pay more to send faster when you are.

Perhaps most importantly, non-custodial wallets are more secure. As long as you maintain key management best practices, you’ll never have to worry about getting hacked, nor will you be exposed to counter-party risks like a centralized exchange getting hacked or going bankrupt.

If you don’t have a bitcoin wallet yet, check the Bitcoin.com Wallet — easy-to-use, non-custodial Bitcoin wallet trusted by millions.

Why do I need to verify my identity to purchase bitcoin?

When you buy bitcoin with a government-issued currency through an exchange service, you’re interacting with a regulated business. Such businesses must comply with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations pertaining to the transfer of money. These regulations require the collection and storage of customer information, including identity documents and sometimes proof of address.

What are the fees for buying bitcoin?

Fees for buying bitcoin depend on the payment method and platform/venue used. For example, if you’re buying directly from a friend and settling in cash, you’ll only need to consider the ‘network fee’ for sending the bitcoin from your friend’s digital wallet to yours.

If you’re paying with a credit card or bank transfer, you’ll of course need to factor in the fees for using those payment methods.

Beyond that, exchange services charge additional fees for facilitating trades. These fees cover the exchanges’ operating costs plus a small margin. In general, you’ll pay lower overall fees for larger purchases, so it often makes sense to avoid making many small buys.

Ways to buy bitcoin

Having gone through the basics of buying bitcoin, let’s look in more detail at the methods and processes.

- Buying bitcoin with the Bitcoin.com Wallet

- Buying bitcoin from the Bitcoin.com website

- Buying bitcoin from a centralized cryptocurrency exchange

- Buying bitcoin using a peer-to-peer trading platform

- Buying bitcoin cash using our peer-to-peer trading platform

Buying bitcoin with the Bitcoin.com Wallet

Crypto wallets allow you to buy bitcoin conveniently from within the wallet app, and the Bitcoin.com Wallet is no exception. Importantly, the Bitcoin.com Wallet is fully non-custodial. This means you’re always in complete control of your bitcoin. Here’s the process for buying bitcoin using our app:

- Open the Bitcoin.com Wallet app on your device.

- Select Bitcoin (BTC) and tap the «Buy» button. Note: you can also buy other digital assets.

- Follow the on-screen instructions to choose your preferred wallet for depositing. The Bitcoin.com Wallet actually consists of separate wallets for each digital asset we support (eg. BTC, BCH, etc.). Additionally, you can make as many individual wallets as you want, a feature that can help you to organize your funds. For example, you can make one Bitcoin wallet called My BTC Savings and another Bitcoin wallet called Everyday BTC Spending.

- If it’s your first purchase, verify your identity. After your first purchase, which includes identification verification, future purchases are completed in seconds!

- Once complete, your purchase will proceed.

Of course, you can also use your Bitcoin.com Wallet to receive, hold, and use the bitcoin you’ve already purchased via a different method. Other methods for buying bitcoin include:

Buying bitcoin from the Bitcoin.com website

You can buy bitcoin from the Bitcoin.com website using your credit/debit card or other payment method (Apple Pay, Google Pay, etc.). When you buy bitcoin from our website, you’ll need to decide where to receive it. This means you’ll need to input a Bitcoin ‘address’ when prompted.

For example, a Bitcoin address looks something like this:

Here’s the process for buying from our website:

- Visit our Buy Bitcoin page.

- Select Bitcoin (BTC). Note: you can also purchase a range of other digital assets.

- Choose whether you want to pay in USD or another local currency, and enter the currency amount (eg. $100).

- Click the BUY button.

Enter your wallet address. Here’s where you’ll decide where the bitcoin you’re buying goes. For example, you can send bitcoin straight to your Bitcoin.com Wallet. To do so, you just need to know your Bitcoin address. To get the right address:

- Open the app

- Tap the receive icon

- Select Bitcoin (BTC) and choose the Bitcoin wallet you want to receive it to (eg. My BTC Wallet)

- Tap the copy button to save the address to your clipboard. You’ll need to paste that address into the Bitcoin.com Buy website. If you’re accessing the website from your desktop or laptop, you can, for example, email the address to yourself then paste it in the wallet address field on our site.

Buying bitcoin from a centralized cryptocurrency exchange

With this method, the bitcoin you purchase will at first be held by the cryptocurrency exchange on your behalf. If you’d like to take full control of your bitcoin, you’ll need to withdraw it from the exchange to a non-custodial wallet like the Bitcoin.com Wallet. When you withdraw bitcoin from an exchange, you’ll be subject to the exchange’s withdrawal policy and fees. In some cases, you may not be able to withdraw for days or weeks, and the withdrawal fee could be much higher than a Bitcoin transaction fee would normally be.

Here’s the typical flow for buying bitcoin from an exchange.

- Visit a cryptocurrency exchange website like Bitcoin.com Exchange. Here’s a curated list of other top crypto exchanges.

- Create an account and verify your identity as required.

- Follow the website’s instructions to buy your bitcoin (BTC) or other digital asset.

- Your bitcoin will appear in your exchange account.

- If you’d like to take full control of your bitcoin, send it from the exchange to your non-custodial wallet (like the Bitcoin.com Wallet).

Buying bitcoin using a peer-to-peer trading platform

A variety of platforms facilitate the trading of bitcoin and other digital assets by offering 1) a venue for buyers and sellers to post their buy and sell orders, and 2) an escrow and dispute resolution service.

Since these platforms principally help people find each other, in many jurisdictions they aren’t technically classified as exchanges or ‘money transmitters,’ so in some cases they don’t require you to reveal your identity in order to use them. For privacy-conscious buyers, therefore, P2P platforms can be an effective method for obtaining bitcoin despite being generally less convenient, and often more costly overall (it can be hard to get the «correct» market rate using this method due to lack of liquidity). Note however, that as a seller, using a peer-to-peer platform to engage in the commercial sale of bitcoin (beyond, say, a few small transactions here and there) may find you on the wrong side of the law in your country.

Most peer-to-peer Bitcoin exchanges integrate a reputation system, meaning they track and display the trading history of their users. If you’re looking to buy using a P2P exchange, you’ll want to choose sellers who have a good reputation, meaning they’ve completed several trades and never had a complaint.

The process for buying bitcoin using a peer-to-peer exchange is typically as follows:

- Browse through listings by payment type (eg. bank transfer, PayPal, etc.), amount, location of seller, reputation, and so on.

- Initiate a trade. Doing so locks up the bitcoin in an escrow account.

- Send the agreed payment amount via the agreed payment method. Note, this could potentially even mean meeting the seller in person and handing over cash directly.

- The seller then confirms receipt of the payment via the website or app .This triggers the bitcoin to be released from escrow to your Bitcoin wallet.

- In some cases, the purchased bitcoin will be released from escrow directly to the Bitcoin wallet of your choosing. In other cases, it will first be sent to your peer-to-peer platform account wallet (which is typically a custodial web wallet). In that case, you’d then want to withdraw it to a Bitcoin wallet you control. Note that this final step often incurs a fee, which typically constitutes the peer-to-peer platform’s business model.

Начните покупать на сумму от 30 долларов!

Выберите из Bitcoin, Bitcoin Cash, Ethereum и других криптовалют

Источник

How to Buy a Cryptocurrency Hardware Wallet With Bitcoin Cash

Storing digital funds in a secure hardware wallet (HW) is a vital part of safeguarding your cryptocurrency holdings against hackers and other cyber threats. Here’s how to buy one of these devices for yourself using bitcoin cash.

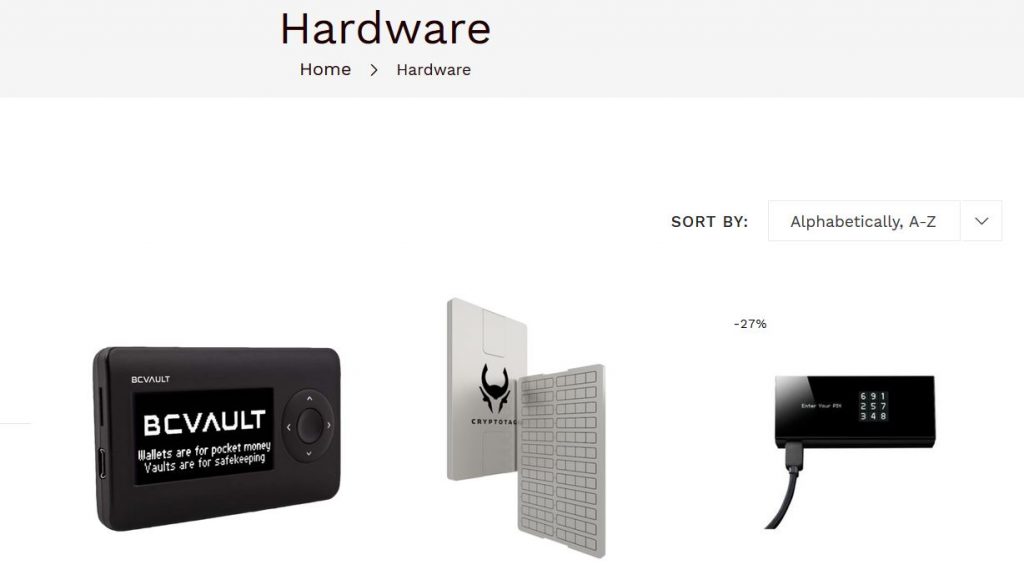

Buy a Hardware Wallet on the Bitcoin.com Store

The Bitcoin.com Store’s hardware section offers a variety of deals on physical digital asset storage devices such as the popular Ledger Nano S and Keepkey. Right now you can get one Ledger Nano S or a Keepkey for just $57.50, a pair from the same manufacturer for just $108 and a pack of five Ledger Nano S or five Keepkey hardware wallets for just $255.

The selection also includes a Cryptotag starter kit for $199 and the BC Vault One for $155. Designed and manufactured in the Netherlands, Cryptotag stores your recovery seed using a titanium plate meant to protect it from physical dangers such as a house fire or a flood. The BC Vault One features an integrated gyro sensor, random key generation and encrypted backups, with support for BCH and over 2,000 other cryptocurrencies.

If you also need to secure some of your cryptocurrency holdings held by a third party such as on an exchange, you can use a physical security key. These hardware devices are a major upgrade for two-factor authentication methods and some hardware wallets support this feature too so you don’t need to buy two different devices.

If you are looking for more gadgets to buy with your bitcoin cash, check out the Bitcoin.com Store’s gift cards section. It offers hundreds of premium branded cards to retailers and online services, including sectors such as electronics and digital gaming.

What’s your favorite cryptocurrency hardware wallet? Share your thoughts in the comments section below.

Источник

Best Bitcoin Wallets

Coinbase wins as a simple way to buy, sell, and hold cryptocurrencies

While the concept of Bitcoin may be new to some, this well-known cryptocurrency has been around for more than a decade. Bitcoin (BTC) is one of many digital currencies that have become fairly common investment holdings among tech-savvy households.

Proponents of cryptocurrencies argue that digital currencies are easier and safer, and come with better privacy, than traditional currencies. Because of its limited supply, Bitcoin has shown up on some people’s radar as an investment opportunity as well. Even the widely used PayPal mobile app is offering an option to buy, sell, and hold cryptocurrencies in its wallet. However, it should be noted that cryptocurrencies are still risky investments.

In short, Bitcoin wallets store a collection of bitcoin private keys. Typically, the wallet is password- or otherwise protected from unauthorized access. A Bitcoin wallet is controlled solely by its owner, not distributed and shared like blockchain technology.

Best Bitcoin Wallets of 2021

- Best Overall:Coinbase

- Best for Hardware Wallet for Security:Trezor

- Best Hardware Wallet for Durability:Ledger

- Best for Beginners:SoFi

- Best for Free Buying and Selling:Robinhood

- Best for Mobile:Mycelium

- Best for Desktop:Exodus

All of the providers included in this article can help investors gain exposure to bitcoin and other cryptocurrencies. However, not all of the providers listed below meet the strict definition of a bitcoin wallet, as many do not permit users to deposit or withdraw cryptocurrency from their account. Some of these providers may also subject investors to increased risk of loss from hacking. To better understand the risks involved, be sure to read the full provider sections below.

Best Overall : Coinbase

» data-caption=»» data-expand=»300″ data-tracking-container=»true»/>

- Fees: Flat fee between $0.99 to $2.99, plus funding fee of up to $3.99%.

- Cloud Storage: Yes

- Cold Storage: No

Coinbase is primarily a cryptocurrency exchange and not a personal wallet. While users have the ability to deposit or withdraw bitcoin from their accounts, users do not have access to the private keys of cryptocurrency held on the exchange. As a result, users may face an increased risk of loss due to hacking, and assets held on the exchange are not insured by SIPC. But, Coinbase does allow users to hold cryptocurrency traded on its platform.

Easy to get started with

Best-known cryptocurrency exchange

Strong security track record

High transaction fees

Past incidents of downtime

Coinbase is one of the easiest ways to buy, sell, and hold cryptocurrencies. With Coinbase, you can connect a U.S. bank account and easily transfer dollars in or out of your Coinbase investing and trading account. You can also use a standalone Coinbase Wallet for mobile.

This digital exchange and online cryptocurrency wallet provider is great for people new to Bitcoin. It makes buying and selling very similar to buying and selling stock through your brokerage account. Coinbase trading accounts offer 62 different tradable cryptocurrencies, including U.S. dollars and the Coinbase USD Coin, which is pegged to the dollar. Some coins can even earn interest.

Another great feature is Coinbase Earn, which gives you free cryptocurrencies in exchange for watching videos and taking quizzes. Coinbase Pro is an active trading platform with its own high-end interface, application programming interface (API) support, and fee structure.

If you use Coinbase, watch out for high fees and costs. There are flat transaction fees, plus a spread Coinbase charges when converting between currencies. Those can add up quickly. Also, while they are definitely not a common occurrence, Coinbase has experienced outages in the past that left users unable to buy or sell.

Best for Hardware Wallet for Security : Trezor

» data-caption=»» data-expand=»300″ data-tracking-container=»true»/>

- Fees: N/A

- Cloud Storage: No

- Cold Storage: Yes

Ultra-secure offline storage

Supports more than 1,000 currencies

Easy-to-use touchscreen on Model T

Complex setup for less tech-savvy users

The Trezor One is a secure device that includes multi-factor authentication and supports more than 1,000 digital coins. The more expensive Model T supports more coins, offers a better screen and interface, and a few other useful features.

The Trezor hardware wallet is a device that can store your digital coins offline. It plugs into your computer or smartphone. The device has a small screen you can use to manage your secure connection. Currently, you can buy the introductory-level Trezor One for $60 or the higher-end Model T for $181.

Just make sure you never lose your Trezor or your recovery information (a password, PIN, and recovery seed), otherwise, your bitcoins could be gone for good.

Best Hardware Wallet for Durability : Ledger

- Fees: N/A

- Cloud Storage: No

- Cold Storage : Cold

Extremely secure offline storage

Supports many currencies

Highest-end mobile version includes Bluetooth

Complex setup for less tech-savvy users

Extra steps may be required to buy and load currency into external hardware wallet

The Ledger Nano X and Ledger Nano S are hardware wallets that keep your bitcoins safe in an offline device. About the size of a USB flash drive, Ledger devices connect to your phone or computer to store and access your digital holdings. The device is surrounded by a stainless steel cover, which makes it very durable.

With included Ledger Live software, you can check your balance, and send and receive currencies. Ledger supports over 1,800 digital coins and tokens, so you are far from limited to Bitcoin. Ledger Live even supports coin staking, in which you can earn rewards based on your balance.

The basic Ledger Nano S and Bluetooth-enabled Ledger Nano X cost $59 or $119, respectively. Nano S supports up to 27 currencies and has capacity for up to six applications at a time, while Nano X holds up to 100 applications at a time. Apps may be needed for certain currencies and other purposes, which means you may not be able to use all supported currencies at the same time with one device. Both use highly secure chips similar to the ones used in a chip-based credit card or passport.

Best for Beginners : SoFi

» data-caption=»» data-expand=»300″ data-tracking-container=»true»/>

- Fees: Up to 1.25% of transaction

- Cloud Storage: Yes

- Cold Storage : No

SoFi is a brokerage platform. While the company does not meet the strict definition of a bitcoin wallet or cryptocurrency exchange, it does help users who want to invest gain exposure to cryptocurrencies. However, SoFi users are not able to deposit or withdraw cryptocurrency from their account, and do not have the same security as some other bitcoin wallets.

Easy to get started

Manage investments and crypto with one account

Many additional free finance tools and features for customers

Limited currencies available

SoFi is a financial company that offers investing, student and personal loans, a credit card, and other financial products. Within SoFi Invest, you can buy, sell, and hold bitcoins and other cryptocurrencies. There is a $10 minimum to open an account. When buying crypto, SoFi charges up to 1.25% of the transaction as a markup.

SoFi supports just four currencies. That’s not as impressive as some of the digital wallet providers and dedicated crypto exchanges that offer hundreds or more. With SoFi, you can buy Bitcoin, Ethereum, Litecoin and Bitcoin Cash.

SoFi offers a great user experience and works well for crypto beginners. It’s good for buying and selling, but not for transfers to or from other wallets. Advanced users may find the platform and trading system at SoFi limiting, but it’s a good choice for someone completely new to Bitcoin.

Best for Free Buying and Selling : Robinhood

» data-caption=»» data-expand=»300″ data-tracking-container=»true»/>

- Fees: N/A

- Cloud Storage: Yes

- Cold Storage : No

Robinhood is a securities brokerage platform and does not meet the strict definition of a bitcoin wallet or cryptocurrency exchange. Users who wish to gain exposure to cryptocurrency can do so through Robinhood, but are unable to deposit or withdraw bitcoin from their account. Users may also face increased risk of loss from hacking.

No transaction cost

Quick to get started

History of downtime

Limited currencies available

Robinhood started as a free stock trading platform and has expanded to include Bitcoin and other cryptocurrencies. Robinhood has both a wallet-like offering (so users can store currency) as well as an exchange like Coinbase (to buy/sell currency), so everything is in one place. However, you can’t withdraw or transfer coins to and from Robinhood using another wallet.

Robinhood is a mobile-first platform but has a desktop version, available on the web, too. And what really sets Robinhood apart is that it’s completely free to use. There are no commissions when buying or selling Bitcoin. Robinhood customers can currently buy, sell, and hold Bitcoin, as well as six other cryptocurrencies.

Robinhood has experienced some outages in the past, so it may not be quite as reliable as some other wallet providers.

Best for Mobile : Mycelium

» data-caption=»» data-expand=»300″ data-tracking-container=»true»/>

- Fees: $0.25 -$7

- Cloud Storage: No

- Cold Storage : Yes

Download and get started for free

Very high security, including offline (cold) storage

Make payments, transfers, and exchange cryptocurrencies

It may be overwhelming for people brand new to cryptocurrencies

Mycelium is a popular crypto wallet for Android and iOS devices. The website says that this wallet is made for people who are not as familiar with Bitcoin, but it may be a bit intimidating for people completely new to cryptocurrencies. It works well for experienced crypto enthusiasts who want features like QR-code-based payments, offline storage, and control over your own private keys. Mycelium offers secure online accounts that work with hardware wallets, the Glidera exchange API that integrates buying and selling features, and other integrations.

Mycelium does anything you may need in crypto, including sending and receiving Bitcoin, Ethereum, and other coins with your smartphone. It’s free to install and get started, though you may run into fees from the exchanges you use with your wallet.

Best for Desktop : Exodus

» data-caption=»» data-expand=»300″ data-tracking-container=»true»/>

- Fees: N/A

- Cloud Storage: No

- Cold Storage : No

Desktop-first app that supports over 100 assets

Integrates with Trezor

High-quality user interface

No two-factor authentication

Exodus is a software wallet that lives on your laptop or desktop computer. There’s a mobile app version available as well. This digital wallet includes an attractive user interface that puts many investor-focused tools in your hands.

The desktop-first wallet, which also integrates with Trezor wallets, turns your digital currencies like Bitcoin and many others, into a portfolio with graphs and charts. You can exchange and store coins right on your desktop or in the app. It supports more than 100 different digital assets, too.

There is no account setup, so your currency and wallet are just for you. Exodus gives you a private key to access your bitcoins, as well as other useful security tools to keep your assets as safe as possible. Remember, though, that your private key is stored on your computer. Make a backup of the key to ensure it’s safe, just in case your computer is stolen or dies.

Final Verdict

A cryptocurrency wallet is a must-have if you want to store cryptocurrencies safely. Without a secure wallet in place, you’ll leave yourself open to security breaches which could cost you in a big way.

You’ll need to find a wallet that brings together the security you crave with the accessibility you need. Coinbase is a good place to start looking for your ideal cryptocurrency wallet. But don’t rule out the other options without taking a closer look.

Compare the Best Bitcoin Wallets

| Company | Type of Wallet (hot/cold) | Purchase Cost | Incorporated Exchange | Compatible Hardware |

|---|---|---|---|---|

| Coinbase Best Overall | Hot | Free | Yes | N/A |

| Trezor Best for Hardware Wallet for Security | Cold | $60 — $181 | Yes | Trezor Model T, Trezor One White |

| Ledger Best Hardware Wallet for Durability | Cold | $59 — $119 | Yes | Ledger Nano S, Ledger Nano X |

| SoFi Best for Beginners | Hot | Free | Yes | N/A |

| Robinhood Best for Free Buying and Selling | Hot | Free | Yes | N/A |

| Mycelium Best for Mobile | Cold | Free | Yes | Ledger Nano S, Ledger Nano X, Trezor Model T, Trezor One White, KeepKey |

| Exodus Best for Desktop | Hot | Free | Yes | Trezor Model T, Trezor One White |

Frequently Asked Questions

How Do I Use a Bitcoin Wallet?

Bitcoin wallets act as a virtual wallet for your digital currencies. Just as you could put dollars, euros, pounds, and yen in your physical wallet, you can put Bitcoin, Ethereum, Litecoin, and Ripple in your Bitcoin wallet.

Some wallets featured in this list allow you to buy and sell bitcoins with an integrated platform. Others are only made for storage. There are pros and cons to keeping your cryptocurrencies online or in an offline wallet. It’s up to you to decide on the right mix of security and convenience for your needs and comfort.

How Much Money Do I Need To Invest in Bitcoin?

If you’re looking to buy Bitcoin, it’s important to understand the costs and risks involved. There is no universal minimum purchase rule for digital currencies, but some exchanges have minimum order sizes and, when you take fees into account, small purchases may not always be practical.

Examples of places you can buy small amounts of Bitcoin are Coinbase ($2), Robinhood (0.00001 BTC minimum purchase), and SoFi (minimum $10 purchase).

It’s not a good idea to put more money into Bitcoin than you can afford to lose. While many people made millions when Bitcoin skyrocketed to nearly $20,000 in 2017, the price dropped below $3,500 one year later. It then blew past $40,000 in early 2021. All of which demonstrates that Bitcoin is highly volatile.

Pros and Cons of Digital Bitcoin Storage

Pros

- Securely store Bitcoin and other digital currencies

- Ability with some to buy and sell coins to take advantage of market fluctuations

- Flexibility to keep your coins online and accessible, or offline and ultra-secure

Cons

- Some exchanges associated with these wallets charge high fees

- Setting up some wallets can be complex

- Hardware wallets require an initial cost

How Should I Choose a Bitcoin Wallet?

The best bitcoin wallet for your needs depends on your comfort with technology and your goals. Here are some of the best types of wallets for different situations:

- Beginners: Consider starting with an online wallet that charges very low fees for transactions. SoFi, Robinhood, and Coinbase are best for this group. If you have a strong investment background, SoFi, Robinhood, and Exodus are good choices.

- Experienced users: Hardware wallets offer the best security. People very comfortable with computers should have no problem navigating the additional complexities. Trezor and Ledger are suitable for this group.

- Serious enthusiasts: Consider a dedicated cryptocurrency wallet that gives you either added security or enhanced features. Coinbase, Trezor, Ledger, Edge, and Exodus are solid options.

Methodology

Bitcoin wallets are essential for digital currency users. For this list of top choices, we looked at over 15 different Bitcoin wallets. When choosing the best bitcoin wallets, we focused on cost, security, ease-of-use, and features helpful for typical crypto users.

Источник