- How do you bitcoin miner

- What is Bitcoin Mining?

- What is the Blockchain?

- What is Proof of Work?

- What is Bitcoin Mining Difficulty?

- The Computationally-Difficult Problem

- The Bitcoin Network Difficulty Metric

- The Block Reward

- Bitcoin Mining Guide — Getting started with Bitcoin mining

- How Bitcoin Mining Works

- Step 1 — Get The Best Bitcoin Mining Hardware

- How To Start Bitcoin Mining

- Best Bitcoin Cloud Mining Services

- Bitcoin Mining Hardware Comparison

- What is Bitcoin Mining and How Does it Work?

- Chapters

- Chapter 1

- What is Bitcoin Mining?

- Chapter 2

- How Does Bitcoin Mining Work?

- What is Bitcoin Mining Actually Doing?

- Mining Is Used to Issue new Bitcoins

- Quick Tip

- Miners Confirm Transactions

- Why Does Bitcoin Need Miners?

- Chapter 3

- How to Mine Bitcoins

- Step #1: Get Bitcoin Wallet

- Ledger Nano X

- Ledger Nano S

- TREZOR T

- TREZOR One

- Step #2: Find a Bitcoin Exchange

- Step #3: Get Bitcoin Mining Hardware

- Step #4: Select a Mining Pool

- Quick Tip

- Step #5: Get Bitcoin Mining Software

- Step #6: Is Bitcoin Mining Legal in your Country? Make Sure!

- Step #7: Is Bitcoin Mining Profitable for You?

- How to Mine Bitcoins on Android or iOS

- Chapter 4

- What is Bitcoin Mining Hardware

- GPU Mining

- ASIC Miner

- Chapter 5

- What Are Bitcoin Mining Pools?

- Chapter 6

- Inside the Bitcoin Mining Industry

- What does a mining farm look like?

- How much do crypto mining farms make?

- How much electricity do mining farms use?

- Where are mining farms located?

- Bonus Chapter 1

- Important Bitcoin Mining Terms

- Miner

- Block Reward

- Mining Pool

- Block Reward Halving

- Hashing Power (or Hash Rate)

- Difficulty

- Difficulty Adjustment

- Kilowatt Hour

- Bonus Chapter 2

- Is Bitcoin Mining a Waste of Electricity?

- Isn’t Mining a Waste of Electricity?

- Mining Difficulty

- Block Reward Halving

- Honest Miner Majority Secures the Network

- Mining Centralization

- How Does Bitcoin Mining Work?

- 1) Spending

- 2) Announcement

- 3) Propagation

- 4) Processing by Miners

- 5) Blockchain Confirmation

- The Longest Valid Chain

How do you bitcoin miner

Bitcoin mining is the process of adding transaction records to Bitcoin’s public ledger of past transactions or blockchain. This ledger of past transactions is called the block chain as it is a chain of blocks. The block chain serves to confirm transactions to the rest of the network as having taken place.

Bitcoin nodes use the block chain to distinguish legitimate Bitcoin transactions from attempts to re-spend coins that have already been spent elsewhere.

What is Bitcoin Mining?

What is the Blockchain?

Bitcoin mining is intentionally designed to be resource-intensive and difficult so that the number of blocks found each day by miners remains steady. Individual blocks must contain a proof of work to be considered valid. This proof of work is verified by other Bitcoin nodes each time they receive a block. Bitcoin uses the hashcash proof-of-work function.

The primary purpose of mining is to allow Bitcoin nodes to reach a secure, tamper-resistant consensus. Mining is also the mechanism used to introduce Bitcoins into the system: Miners are paid any transaction fees as well as a «subsidy» of newly created coins.

This both serves the purpose of disseminating new coins in a decentralized manner as well as motivating people to provide security for the system.

Bitcoin mining is so called because it resembles the mining of other commodities: it requires exertion and it slowly makes new currency available at a rate that resembles the rate at which commodities like gold are mined from the ground.

What is Proof of Work?

A proof of work is a piece of data which was difficult (costly, time-consuming) to produce so as to satisfy certain requirements. It must be trivial to check whether data satisfies said requirements.

Producing a proof of work can be a random process with low probability, so that a lot of trial and error is required on average before a valid proof of work is generated. Bitcoin uses the Hashcash proof of work.

What is Bitcoin Mining Difficulty?

The Computationally-Difficult Problem

Bitcoin mining a block is difficult because the SHA-256 hash of a block’s header must be lower than or equal to the target in order for the block to be accepted by the network.

This problem can be simplified for explanation purposes: The hash of a block must start with a certain number of zeros. The probability of calculating a hash that starts with many zeros is very low, therefore many attempts must be made. In order to generate a new hash each round, a nonce is incremented. See Proof of work for more information.

The Bitcoin Network Difficulty Metric

The Bitcoin mining network difficulty is the measure of how difficult it is to find a new block compared to the easiest it can ever be. It is recalculated every 2016 blocks to a value such that the previous 2016 blocks would have been generated in exactly two weeks had everyone been mining at this difficulty. This will yield, on average, one block every ten minutes.

As more miners join, the rate of block creation will go up. As the rate of block generation goes up, the difficulty rises to compensate which will push the rate of block creation back down. Any blocks released by malicious miners that do not meet the required difficulty target will simply be rejected by everyone on the network and thus will be worthless.

The Block Reward

When a block is discovered, the discoverer may award themselves a certain number of bitcoins, which is agreed-upon by everyone in the network. Currently this bounty is 25 bitcoins; this value will halve every 210,000 blocks. See Controlled Currency Supply.

Additionally, the miner is awarded the fees paid by users sending transactions. The fee is an incentive for the miner to include the transaction in their block. In the future, as the number of new bitcoins miners are allowed to create in each block dwindles, the fees will make up a much more important percentage of mining income.

Bitcoin Mining™® © 2011-2021 Hesiod Services LLC | Terms | Privacy

Источник

Bitcoin Mining Guide — Getting started with Bitcoin mining

Bitcoin mining is difficult to do profitably but if you try then this Bitcoin miner is probably a good shot.

How Bitcoin Mining Works

Before you start mining Bitcoin, it’s useful to understand what Bitcoin mining really means. Bitcoin mining is legal and is accomplished by running SHA256 double round hash verification processes in order to validate Bitcoin transactions and provide the requisite security for the public ledger of the Bitcoin network. The speed at which you mine Bitcoins is measured in hashes per second.

The Bitcoin network compensates Bitcoin miners for their effort by releasing bitcoin to those who contribute the needed computational power. This comes in the form of both newly issued bitcoins and from the transaction fees included in the transactions validated when mining bitcoins. The more computing power you contribute then the greater your share of the reward.

Sometimes you may want to mine a more volatile altcoin like MWC which is superior for scalability, privacy, anonymity and fungibility by utilizing MimbleWimble in the base layer.

With mainnet launching in November 2019 it has risen from $0.22 to over $8.00 in its first two months.

Step 1 — Get The Best Bitcoin Mining Hardware

Purchasing Bitcoins — In some cases, you may need to purchase mining hardware with bitcoins. Today, you can purchase most hardware on Amazon. You also may want to check the bitcoin charts.

How To Start Bitcoin Mining

To begin mining bitcoins, you’ll need to acquire bitcoin mining hardware. In the early days of bitcoin, it was possible to mine with your computer CPU or high speed video processor card. Today that’s no longer possible. Custom Bitcoin ASIC chips offer performance up to 100x the capability of older systems have come to dominate the Bitcoin mining industry.

Bitcoin mining with anything less will consume more in electricity than you are likely to earn. It’s essential to mine bitcoins with the best bitcoin mining hardware built specifically for that purpose. Several companies such as Avalon offer excellent systems built specifically for bitcoin mining.

Best Bitcoin Cloud Mining Services

Another option is to purchase in Bitcoin cloud mining contracts. This greatly simplifies the process but increases risk because you do not control the actual physical hardware.

Being listed in this section is NOT an endorsement of these services. There have been a tremendous amount of Bitcoin cloud mining scams.

Hashflare Review: Hashflare offers SHA-256 mining contracts and more profitable SHA-256 coins can be mined while automatic payouts are still in BTC. Customers must purchase at least 10 GH/s.

Genesis Mining Review: Genesis Mining is the largest Bitcoin and scrypt cloud mining provider. Genesis Mining offers three Bitcoin cloud mining plans that are reasonably priced. Zcash mining contracts are also available.

Hashing 24 Review: Hashing24 has been involved with Bitcoin mining since 2012. They have facilities in Iceland and Georgia. They use modern ASIC chips from BitFury deliver the maximum performance and efficiency possible.

Minex Review: Minex is an innovative aggregator of blockchain projects presented in an economic simulation game format. Users purchase Cloudpacks which can then be used to build an index from pre-picked sets of cloud mining farms, lotteries, casinos, real-world markets and much more.

Minergate Review: Offers both pool and merged mining and cloud mining services for Bitcoin.

Hashnest Review: Hashnest is operated by Bitmain, the producer of the Antminer line of Bitcoin miners. HashNest currently has over 600 Antminer S7s for rent. You can view the most up-to-date pricing and availability on Hashnest’s website. At the time of writing one Antminer S7’s hash rate can be rented for $1,200.

Bitcoin Cloud Mining Review: Currently all Bitcoin Cloud Mining contracts are sold out.

NiceHash Review: NiceHash is unique in that it uses an orderbook to match mining contract buyers and sellers. Check its website for up-to-date prices.

Eobot Review: Start cloud mining Bitcoin with as little as $10. Eobot claims customers can break even in 14 months.

MineOnCloud Review: MineOnCloud currently has about 35 TH/s of mining equipment for rent in the cloud. Some miners available for rent include AntMiner S4s and S5s.

Bitcoin Mining Hardware Comparison

Currently, based on (1) price per hash and (2) electrical efficiency the best Bitcoin miner options are:

Источник

What is Bitcoin Mining and How Does it Work?

Bitcoin mining seems crazy!

Computers mining for virtual coins? Is Bitcoin mining just free money?

Well, it’s much, much more than that!

If you want the full explanation on Bitcoin mining, keep reading.

Chapters

Chapter 1

What is Bitcoin Mining?

Bitcoin mining is the backbone of the Bitcoin network.

Miners provide security and confirm Bitcoin transactions.

Without Bitcoin miners, the network would be attacked and dysfunctional.

Bitcoin mining is done by specialized computers.

The role of miners is to secure the network and to process every Bitcoin transaction.

Miners achieve this by solving a computational problem which allows them to chain together blocks of transactions (hence Bitcoin’s famous “blockchain”).

For this service, miners are rewarded with newly-created Bitcoins and transaction fees.

Chapter 2

How Does Bitcoin Mining Work?

What is Bitcoin mining actually doing?

Miners are securing the network and confirming Bitcoin transactions.

Miners are paid rewards for their service every 10 minutes in the form of new bitcoins.

What is Bitcoin Mining Actually Doing?

What is the point of Bitcoin mining? This is something we’re asked everyday!

There are many aspects and functions of Bitcoin mining and we’ll go over them here. They are:

- Issuance of new bitcoins

- Confirming transactions

- Security

Mining Is Used to Issue new Bitcoins

Traditional currencies—like the dollar or euro—are issued by central banks. The central bank can issue new units of money ay anytime based on what they think will improve the economy.

Bitcoin is different.

With Bitcoin, miners are rewarded new bitcoins every 10 minutes.

The issuance rate is set in the code, so miners cannot cheat the system or create bitcoins out of thin air. They have to use their computing power to generate the new bitcoins.

Quick Tip

Mining is not the fastest way to get bitcoins.

Buying bitcoin is the fastest way.

Miners Confirm Transactions

Miners include transactions sent on the Bitcoin network in their blocks.

A transaction can only be considered secure and complete once it is included in a block.

Because only a when a transaction has been included in a block is it officially embedded into Bitcoin’s blockchain.

More confirmations are better for larger payments. Here is a visual so you have a better idea:

Why Does Bitcoin Need Miners?

In short, miners secure the Bitcoin network.

They do this by making it difficult to attack, alter or stop.

The more miners that mine, the more secure the network.

The only way to reverse Bitcoin transactions is to have more than 51% of the network hash power. Distributed hash power spread among many different miners keeps Bitcoin secure and safe.

Chapter 3

How to Mine Bitcoins

Actually want to try mining bitcoins?

Well, you can do it. However, it’s not profitable for most people as mining is a highly specialized industry.

Most Bitcoin mining is done in large warehouses where there is cheap electricity.

Most people should NOT mine bitcoins today.

Most Bitcoin mining is specialized and the warehouses look something like this:

That’s who you’re up against! It’s simply too expensive and you are unlikely to turn a profit.

For hobby mining, we’ll show you some steps you can take to get started mining bitcoins right now.

Step #1: Get Bitcoin Wallet

When earning bitcoins from mining, they go directly into a Bitcoin wallet.

You can’t mine without a wallet.

Ledger Nano X

- SCREEN:

- RELEASED: 2019

- PRICE: $145

Ledger Nano S

- SCREEN:

- RELEASED: 2016

- PRICE: $72

TREZOR T

- SCREEN:

- RELEASED: 2018

- PRICE: $189

TREZOR One

- SCREEN:

- RELEASED: 2013

- PRICE: $79

If you aren’t sure which one to buy, our best bitcoin wallets guide will help you select a wallet.

Step #2: Find a Bitcoin Exchange

When earning bitcoins from mining, you may need to sell the coins to pay for power costs. You may also need to buy coins on exchanges.

- Exchange based in Canada

- Very high buy and sell limits

- Supports Interac & wire

This ad promotes virtual cryptocurrency investing within the EU (by eToro Europe Ltd. and eToro UK Ltd.) & USA (by eToro USA LLC); which is highly volatile, unregulated in most EU countries, no EU protections & not supervised by the EU regulatory framework. Investments are subject to market risk, including the loss of principal.

Step #3: Get Bitcoin Mining Hardware

You won’t be able to mine without an ASIC miner.

ASIC miners are specialized computers that were built for the sole purpose of mining bitcoins.

Don’t even try mining bitcoins on your home desktop or laptop computer! You will earn less than one penny per year and will waste money on electricity.

Step #4: Select a Mining Pool

Once you get your mining hardware, you need to select a mining pool.

Without a mining pool, you would only receive a mining payout if you found a block on your own. This is called solo mining.

We don’t recommend this because your hardware’s hash rate is very unlikely to be anywhere near enough to find a block solo mining.

How do mining pools help?

By joining a mining pool you share your hash rate with the pool. Once the pool finds a block you get a payout based on the percent of hash rate contributed to the pool.

If you contributed 1% of the pools hashrate, you’d get .125 bitcoins out of the current 12.5 bitcoin block reward.

Quick Tip

Mining is actually NOT the fastest way to get bitcoins.

Buying bitcoin is the fastest way. Our exchange finder makes it easy to find an exchange. Try it here.

Step #5: Get Bitcoin Mining Software

Bitcoin mining software is how you actually hook your mining hardware into your desired mining pool.

You need to use the software to point your hash rate at the pool.

Also in the software you tell the pool which Bitcoin address payouts should be sent to.

If you don’t have a Bitcoin wallet or address learn how to get one here.

There is mining software available for Mac, Windows, and Linux.

Step #6: Is Bitcoin Mining Legal in your Country? Make Sure!

This won’t be much of an issue in MOST countries.

Consult local counsel for further assistance in determining whether Bitcoin mining is legal and the tax implications of doing the activity.

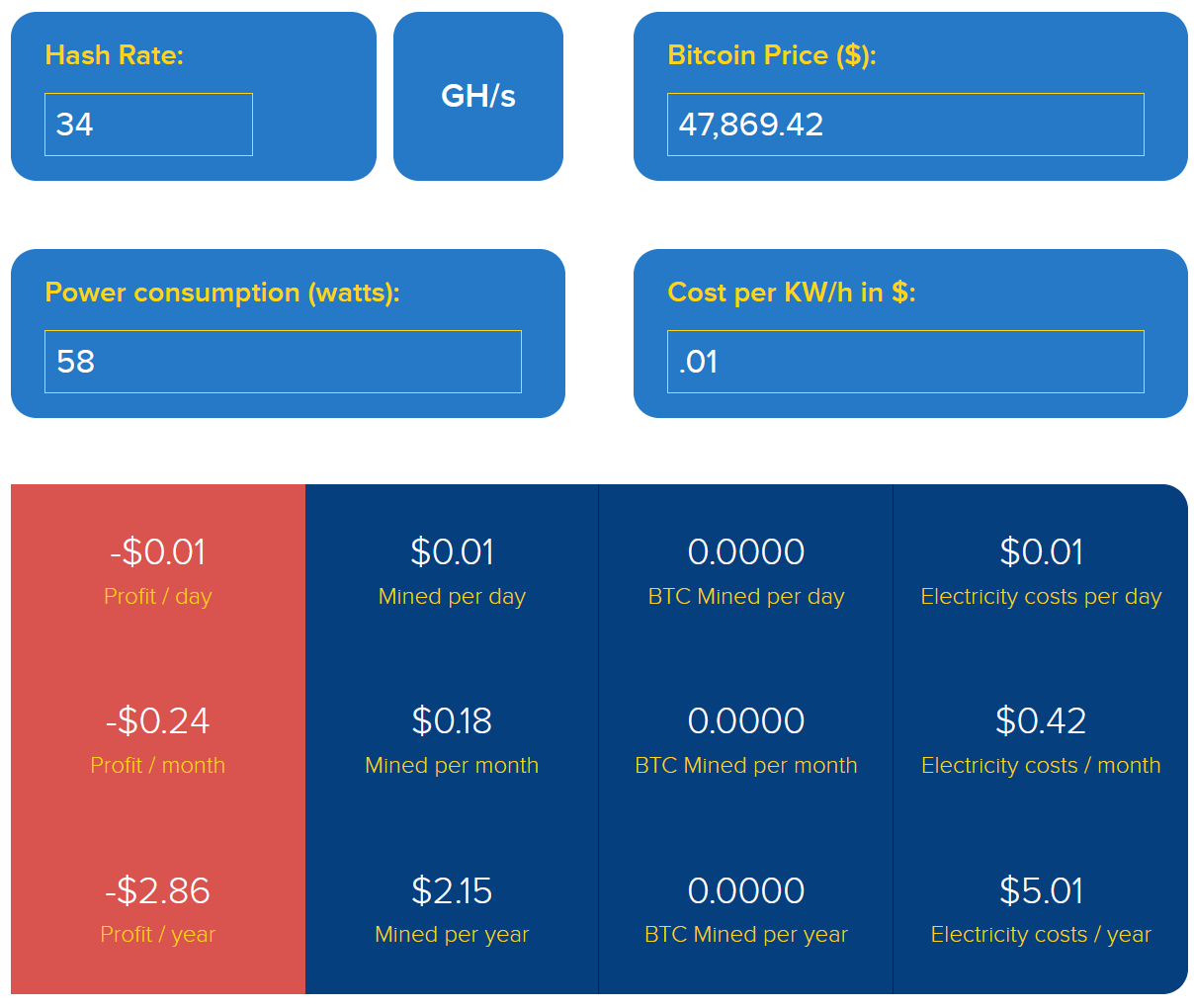

Step #7: Is Bitcoin Mining Profitable for You?

Do you understand what you need to do to start?

You should run some calculations and see if Bitcoin mining will actually be profitable for you.

You can use a Bitcoin mining calculator to get a rough idea.

I say rough idea because many factors related to your mining profitability are constantly changing.

A doubling in the Bitcoin price could increase your profits by two.

But:

It could also make mining that much more competitive that your profits remain the same.

How to Mine Bitcoins on Android or iOS

Here’s what’s funny:

You actually CAN mine bitcoins on any Android device.

Using mining software for Android you can mine bitcoins or any other coin.

What’s not so fun?

You’ll likely make less than one penny PER YEAR!

Android phones simply are not powerful enough to match the mining hardware used by serious operations.

So, it might be cool to setup a miner on your Android phone to see how it works. But don’t expect to make any money.

Do expect to waste a lot of your phone’s battery!

Chapter 4

What is Bitcoin Mining Hardware

Bitcoin mining hardware (ASICs) are high specialized computers used to mine bitcoins.

The ASIC industry has become complex and competitive.

Mining hardware is now only located where there is cheap electricity.

When Satoshi released Bitcoin, he intended it to be mined on computer CPUs.

Enterprising coders soon discovered they could get more hashing power from graphic cards and wrote mining software to allow this.

GPU Mining

GPU mining is when you mine for Bitcoins (or any cryptocurrency) using a graphics card.

If you were to open your desktop computer right now, you’d likely see a piece of hardware that looks like the one below:

GPU mining was one of the earliest forms of mining, but is no longer profitable due to the introduction of ASIC miners.

GPUs were surpassed in turn by ASICs.

ASIC Miner

ASIC stands for «Application Specific Integrated Circuit». In plain english, that just means it is a chip designed to do one very specific kind of calculation. In the case of a Bitcoin ASIC miner, the chip in the miner is designed to solve problems using the SHA256 hashing algorithm.

Here is what an ASIC looks like:

You can learn more about ASIC Miners on our mining hardware page.

Nowadays all serious Bitcoin mining is performed on ASICs, usually in thermally-regulated data-centers with access to low-cost electricity.

Economies of scale have thus led to the concentration of mining power into fewer hands than originally intended.

Chapter 5

What Are Bitcoin Mining Pools?

Mining pools allow small miners to receive more frequent mining payouts.

By joining with other miners in a group, a pool allows miners to find blocks more frequently.

But, there are some problems with mining pools as we’ll discuss.

As with GPU and ASIC mining, Satoshi apparently failed to anticipate the emergence of mining pools.

Pools are groups of cooperating miners who agree to share block rewards in proportion to their contributed mining power.

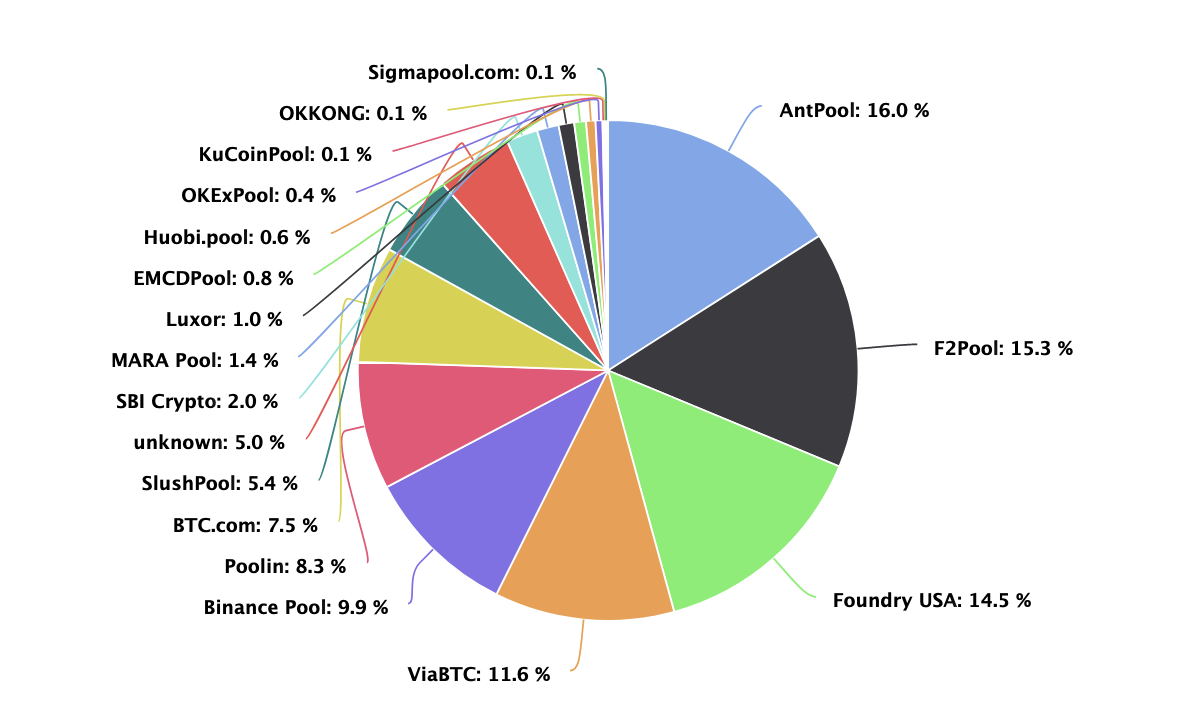

The pie chart below displays the current distribution of total mining power by pools:

While pools are desirable to the average miner as they smooth out rewards and make them more predictable, they unfortunately concentrate power to the mining pool’s owner.

Chapter 6

Inside the Bitcoin Mining Industry

The mining industry has come a long way since the early days of graphics card mining.

Today there are very professional industrial mining operations. Let’s take a look at how they work.

What does a mining farm look like?

Let’s take a look inside a real Bitcoin mining farm in Washington state.

Mining farms look very similar to a data center. They contain rows of hardware with powerful fans to keep the miners from over heating.

Mining farms are typically very industrial looking — they aren’t flashy or sleek. Usually, its just a warehouse with great temperature control.

Bitcoin mining farms exclusively use ASIC miners to mine various coins. Many of these farms are minting several Bitcoins per day.

How much do crypto mining farms make?

How much a mining farm makes depends on many factors:

- The price it pays for electricity

- How old its mining hardware is

- The scale of its operation

- The price of Bitcoin when the miner sells it

- The level of difficulty when the Bitcoin is mined

By far, the biggest factor affecting how much money a mining farm makes is how much it pays for electricity. Nearly all mining farms are using the same hardware.

Since the reward for finding a block is fixed, and the difficulty is adjusted based on total processing power working on finding blocks at any given time, then electricity is the only cost that is variable. If you can find cheaper power than other miners, you can afford to either increase the size of your mining operation, or spend less on your mining for the same output.

How much electricity do mining farms use?

As previously mentioned, mining farms use a lot of electricity. How much they consume depends on how big their operation is. However the latest Bitmain ASIC miner consumes about 1350 watts.

In total, it is estimated that all mining farms will use about 75 Terawatt hours of electricity in the year 2020. That is roughly the equivalent to 15 times the yearly energy consumption of denmark.

Where are mining farms located?

Mining farms are located all over the world. We don’t know where every mining farm in the world is, but we have some educated guesses.

Most of the mining has been and still is located in China. In fact, as of 2020, it is believed that as much as 65% of Bitcoin mining occurs in China.

Why is so much Mining happening in China? Samson Mow of Blockstream and former CTO of BTCC mining pool explains.

The main advantages of mining in China are faster setup times and lower initial CapEx which, along with closer proximity to where ASICs are assembled, have driven industry growth there

Bonus Chapter 1

Important Bitcoin Mining Terms

In this bonus chapter, we will learn about some of the most common terms associated with bitcoin mining.

If you are thinking about mining at any level, understanding what these terms means will be crucial for you to get started.

Miner

Anyone who mines Bitcoins (or any other cryptocurrency).

Block Reward

The block reward is a fixed amount of Bitcoins that get rewarded to the miner or mining pool that finds a given block.

Mining Pool

A collection of individual miners who ‘pool’ their efforts or hashing power together and share the block reward. Miners create pools because it increases their chances of earning a block reward.

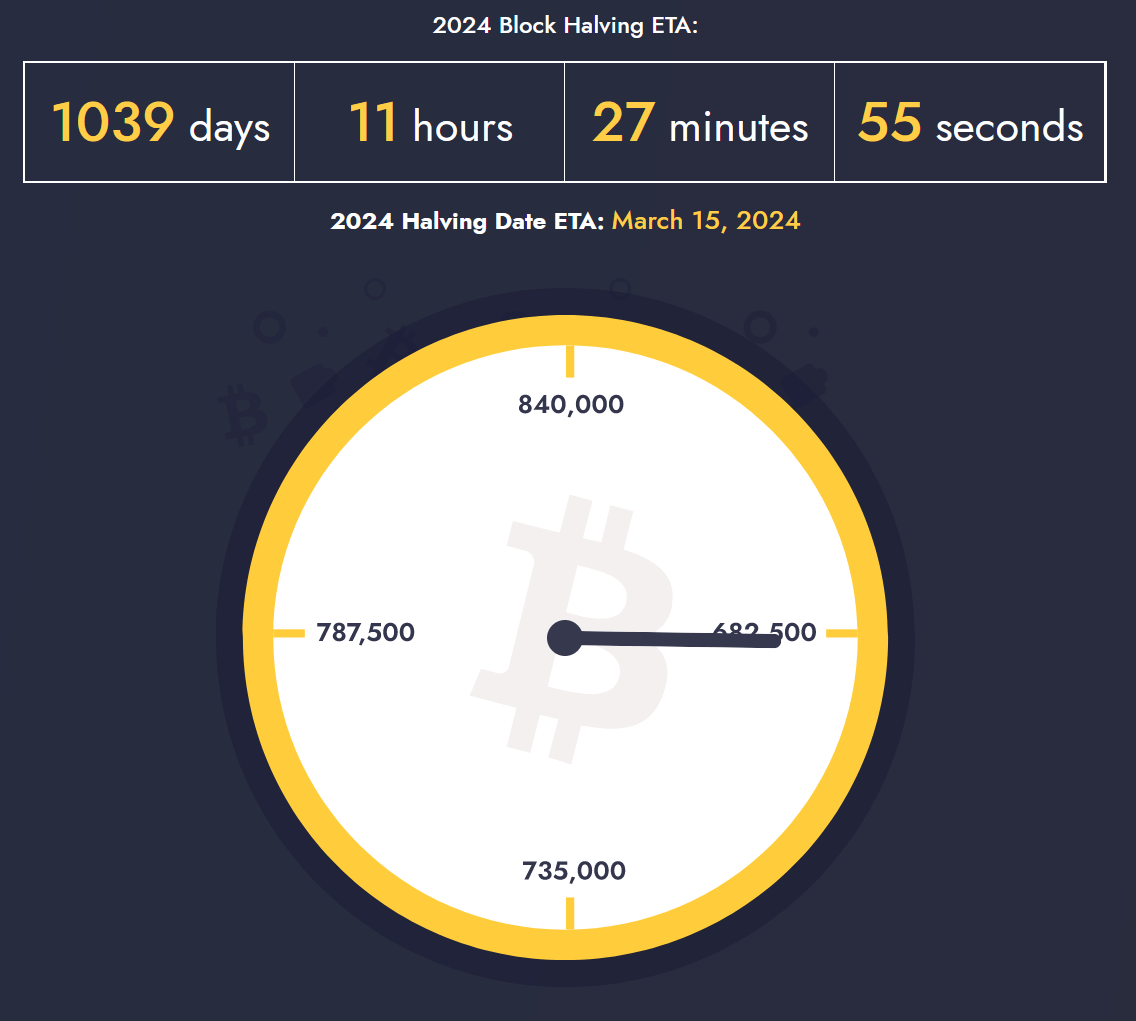

Block Reward Halving

Approximately every 4 years, the block reward gets cut in half. The first block reward ever mined was in 2008 and it it was for 50 Bitcoins. That block reward lasted for four years, where in 2012, the first reward halving occurred and it dropped to 25 Bitcoins.

In 2016, a second halving occurred where the reward was reduced to 12.5 Bitcoins. And as of the time of this writing, we are on the cusp of the third halving (ETA May 11th), where the reward will be cut down to 6.25 Bitcoins. You can find the most up to date estimation of exactly when the next halving will occur on our bitcoin block reward halving clock.

Hashing Power (or Hash Rate)

How many calculations (hashes) a miner can perform per second.

Or it can refer to the total amount of hashing done on a chain by all miners put together — also known as «Net Hash».

You can learn more about Hash Rate by reading our article about it.

Difficulty

Measured in Trillions, mining difficulty refers to how hard it is to find a block. The current level of difficulty on the Bitcoin blockchain is the primary reason why it is not profitable to mine for most people.

Difficulty Adjustment

Bitcoin was designed to produce block reliably every 10 minutes. Because total hashing power (or Net Hash) is constantly changing, the difficulty of finding a block needs to adjust proportional to the amount of total hashing power on the network.

In very simple terms, if you have four miners on the network, all with equal hashing power, and two stop mining, blocks would happen ever 20 minutes instead of every ten. Therefore, the difficulty of finding blocks also needs to cut in half, so that blocks can continue to be found every 10 minutes.

Difficulty adjustments happen every 2,016 blocks. This should mean that if a new block is added every 10 minutes, then a difficulty adjustment would occur every two weeks. The 10 minute block rule is just a goal though. Some blocks are added after more than 10 minutes. Some are added after less. Its a law of averages and a lot if left up to chance. That doesn’t mean that for the most part, blocks are added reliably every 10 minutes.

Kilowatt Hour

A measurement of energy consumption per hour. Most ASIC miners will tell you how much energy they consume using this metric.

Bonus Chapter 2

Is Bitcoin Mining a Waste of Electricity?

The media constantly says Bitcoin mining is a waste of electricity.

But, there are some problems with their theories as we’ll discuss.

Isn’t Mining a Waste of Electricity?

Certain orthodox economists have criticized mining as wasteful.

It must be kept in mind however that this electricity is expended on useful work:

Enabling a monetary network worth billions (and potentially trillions) of dollars!

Compared to the carbon emissions from just the cars of PayPal’s employees as they commute to work, Bitcoin’s environmental impact is negligible.

As Bitcoin could easily replace PayPal, credit card companies, banks and the bureaucrats who regulate them all, it begs the question:

Isn’t traditional finance a waste?

Not just of electricity, but of money, time and human resources!

Mining Difficulty

If only 21 million Bitcoins will ever be created, why has the issuance of Bitcoin not accelerated with the rising power of mining hardware?

Issuance is regulated by Difficulty, an algorithm which adjusts the difficulty of the Proof of Work problem in accordance with how quickly blocks are solved within a certain time frame (roughly every 2 weeks or 2016 blocks).

Difficulty rises and falls with deployed hashing power to keep the average time between blocks at around 10 minutes.

For most of Bitcoin’s history, the average block time has been about 9.7 minutes. Because the price is always rising, mining power does come onto the network at a fast speed which creates faster blocks. However, for most of 2019 the block time has been around 10 minutes. This is because Bitcoin’s price has remained steady for most of 2019.

Block Reward Halving

Satoshi designed Bitcoin such that the block reward, which miners automatically receive for solving a block, is halved every 210,000 blocks (or roughly 4 years).

As Bitcoin’s price has risen substantially (and is expected to keep rising over time), mining remains a profitable endeavor despite the falling block reward… at least for those miners on the bleeding edge of mining hardware with access to low-cost electricity.

Honest Miner Majority Secures the Network

To successfully attack the Bitcoin network by creating blocks with a falsified transaction record, a dishonest miner would require the majority of mining power so as to maintain the longest chain.

This is known as a 51% attack and it allows an attacker to spend the same coins multiple times and to blockade the transactions of other users at will.

To achieve it, an attacker needs to own mining hardware than all other honest miners.

This imposes a high monetary cost on any such attack.

At this stage of Bitcoin’s development, it’s likely that only major corporations or states would be able to meet this expense… although it’s unclear what net benefit, if any, such actors would gain from degrading or destroying Bitcoin.

Mining Centralization

Pools and specialized hardware has unfortunately led to a centralization trend in Bitcoin mining.

Bitcoin developer Greg Maxwell has stated that, to Bitcoin’s likely detriment, a handful of entities control the vast majority of hashing power.

It is also widely-known that at least 50% of mining hardware is located within China.

However, it’s may be argued that it’s contrary to the long-term economic interests of any miner to attempt such an attack.

The resultant fall in Bitcoin’s credibility would dramatically reduce its exchange rate, undermining the value of the miner’s hardware investment and their held coins.

As the community could then decide to reject the dishonest chain and revert to the last honest block, a 51% attack probably offers a poor risk-reward ratio to miners.

Bitcoin mining is certainly not perfect but possible improvements are always being suggested and considered.

How Does Bitcoin Mining Work?

This simplified illustration is helpful to explanation:

1) Spending

Let’s say the Green user wants to buy some goods from the Red user. Green sends 1 bitcoin to Red.

2) Announcement

Green’s wallet announces a 1 bitcoin payment to Red’s wallet. This information, known as transaction (and sometimes abbreviated as “ tx”) is broadcast to as many Full Nodes as connect with Green’s wallet – typically 8. A full node is a special, transaction-relaying wallet which maintains a current copy of the entire blockchain.

3) Propagation

Full Nodes then check Green’s spend against other pending transactions. If there are no conflicts (e.g. Green didn’t try to cheat by sending the exact same coins to Red and a third user), full nodes broadcast the transaction across the Bitcoin network. At this point, the transaction has not yet entered the Blockchain. Red would be taking a big risk by sending any goods to Green before the transaction is confirmed. So how do transactions get confirmed? This is where Miners enter the picture.

4) Processing by Miners

Miners, like full nodes, maintain a complete copy of the blockchain and monitor the network for newly-announced transactions. Green’s transaction may in fact reach a miner directly, without being relayed through a full node. In either case, a miner then performs work in an attempt to fit all new, valid transactions into the current block.

Miners race each other to complete the work, which is to “package” the current block so that it’s acceptable to the rest of the network. Acceptable blocks include a solution to a Proof of Work computational problem, known as ahash . The more computing power a miner controls, the higher their hashrate and the greater their odds of solving the current block.

But why do miners invest in expensive computing hardware and race each other to solve blocks? Because, as a reward for verifying and recording everyone’s transactions, miners receive a substantial Bitcoin reward for every solved block!

And what is a hash? Well, try entering all the characters in the above paragraph, from “But” to “block!” into this hashing utility. If you pasted correctly – as a string hash with no spaces after the exclamation mark – the SHA-256 algorithm used in Bitcoin should produce:

If the characters are altered even slightly, the result won’t match. So, a hash is a way to verify any amount of data is accurate. To solve a block, miners modify non-transaction data in the current block such that their hash result begins with a certain number (according to the current Difficulty, covered below) of zeroes. If you manually modify the string until you get a 0… result, you’ll soon see why this is considered “Proof of Work!”

5) Blockchain Confirmation

The first miner to solve the block containing Green’s payment to Red announces the newly-solved block to the network. If other full nodes agree the block is valid, the new block is added to the blockchain and the entire process begins afresh. Once recorded in the blockchain, Green’s payment goes from pending to confirmed status.

Red may now consider sending the goods to Green. However, the more new blocks are layered atop the one containing Green’s payment, the harder to reverse that transaction becomes. For significant sums of money, it’s recommended to wait for at least 6 confirmations. Given new blocks are produced on average every ten minutes; the wait shouldn’t take much longer than an hour.

The Longest Valid Chain

You may have heard that Bitcoin transactions are irreversible, so why is it advised to await several confirmations? The answer is somewhat complex and requires a solid understanding of the above mining process:

Let’s imagine two miners, A in China and B in Iceland, who solve the current block at roughly the same time. A’s block (A1) propagates through the internet from Beijing, reaching nodes in the East. B’s block (B1) is first to reach nodes in the West. There are now two competing versions of the blockchain!

Which blockchain prevails? Quite simply, the longest valid chain becomes the official version of events. So, let’s say the next miner to solve a block adds it to B’s chain, creating B2. If B2 propagates across the entire network before A2 is found, then B’s chain is the clear winner. A loses his mining reward and fees, which only exist on the invalidated A -chain.

Going back to the example of Green’s payment to Red, let’s say this transaction was included by A but rejected by B, who demands a higher fee than was included by Green. If B’s chain wins then Green’s transaction won’t appear in the B chain – it will be as if the funds never left Green’s wallet.

Although such blockchain splits are rare, they’re a credible risk. The more confirmations have passed, the safer a transaction is considered. This is why what is known as ‘0-conf’ or «0 confirmations» on the Bitcoin Cash blockchain is so dangerous.

Источник