- How to Add Funds to a Bitcoin Wallet

- Our Top Picks

- Best Wallet For

- Best for Security

- Ledger Nano X

- Secure storage for any cryptocurrency

- Best for Mobile

- Easy to use iOS & Android wallet

- Best for Desktop

- Electrum

- Simple yet powerful desktop wallet

- I have a wallet, do I have to buy a whole bitcoin?

- QUICK TIP

- The best place to buy your first bitcoin is on an exchange

- Reputation

- Speed

- WARNING

- Ledger Nano X

- Ledger Nano S

- TREZOR T

- TREZOR One

- How to withdraw to your wallet

- 1. Select ‘Send’

- 2. Get a Receiving Address

- 3. Verify and Copy Receiving Address

- 4. Give Exchange Your Receiving Address

- How long will it take till my bitcoin arrives?

- About the Author: Jordan Tuwiner

- Your gateway to Bitcoin & beyond

- Buy quickly and easily

- Free your money and invest with confidence

- Best Safe Bitcoin + Crypto Wallet Apps & Hardware

- Chapters

- Our Top Picks

- Best Wallet For

- Best for Security

- Ledger Nano X

- Secure storage for any cryptocurrency

- Best for Mobile

- ZenGo

- Easy to use iOS & Android wallet

- Best for Desktop

- Electrum

- Simple yet powerful desktop wallet

- Chapter 1

- What is a Bitcoin & Cryptocurrency Wallet?

- Types of Bitcoin Wallets

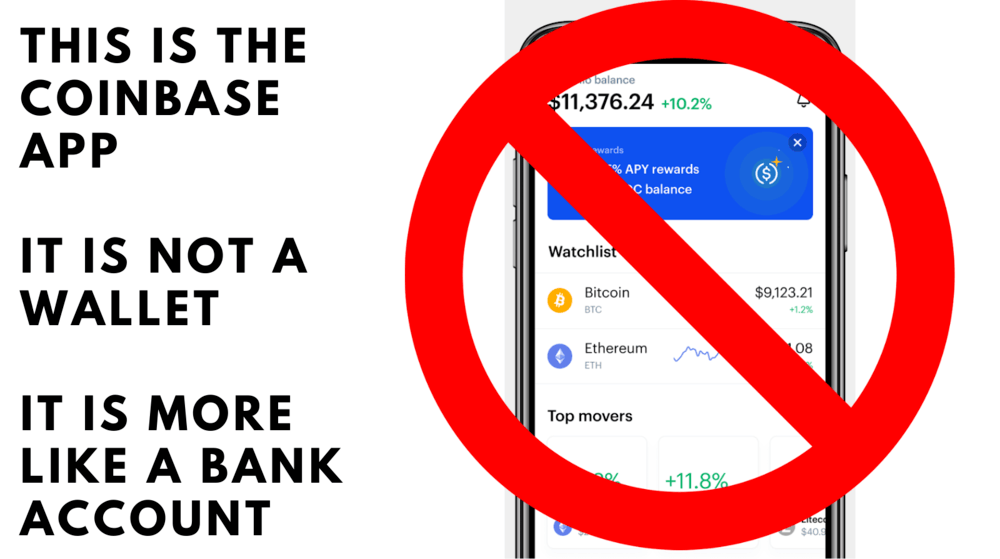

- An Exchange is Not a Wallet

- Chapter 2

- Types of Bitcoin & Crypto Wallets

- Hardware Wallets

- Why are hardware wallets good?

- Why are hardware wallets bad?

- Hot Wallets

- Why are hot wallets good?

- Why are hot wallets bad?

- Which Wallet is Best for You?

- How to Add Funds to a Bitcoin Wallet

- Chapter 3

- Hardware Wallets: Keep Your Coins Safe

- How Hardware Wallets Work

- Why A Hardware Wallet with a Screen is Important

- Bitcoin & Crypto Hardware Wallet Comparison

- Ledger Nano X

- Ledger Nano S

- TREZOR T

- TREZOR One

- Best Bitcoin Hardware Wallet Overviews

- Ledger Nano X

- Ledger Nano S

- TREZOR T

- TREZOR One

- Chapter 4

- Hot Wallets

- Desktop Wallets

- Electrum

- Blockstream Green

- iOS and iPhone Bitcoin Wallets

- BRD

- Edge

- Blockstream Green

- Aqua

- Android Bitcoin Wallets

- BRD

- Edge

- Blockstream Green

- Bitcoin Wallet

- Chapter 5

- Bitcoin Banks: $10 Billion Lost in Hacks

- Chapter 6

- Theft and Scams

- Bonus Chapter 1

- Cryptocurrency Security Advice

- Passwords — Complexity & Re-Use

- Dedicated Email Accounts

- Use a VPN

- Two-Factor Authentication

- Google Fi

- Mobile Crypto Wallets

- Phishing Attacks

- Secure Crypto Storage

- Summary

How to Add Funds to a Bitcoin Wallet

You may have just downloaded your first Bitcoin wallet, but now want to know how to add coins to it.

Doing your first transfer from an exchange to a wallet can be intimidating for first timers.

Not to worry! In this short guide, we will show you how to add coins to your Bitcoin wallet. Once you are finished you’ll be a pro at this very common process.

By the end, you’ll see how easy it is to send and receive Bitcoins from anyone you want!

But first, in case you haven’t got a wallet yet, check out our picks below:

Our Top Picks

Best Wallet For

Best for Security

Ledger Nano X

Secure storage for any cryptocurrency

The Ledger Nano X is the newest crypto hardware wallet, and is very easy to use. It connects to iOS, Android & desktop.

Best for Mobile

Easy to use iOS & Android wallet

BRD is an easy-to-use iOS and Android Bitcoin wallet. It’s available on both iOS and Android.

Best for Desktop

Electrum

Simple yet powerful desktop wallet

Electrum is a Bitcoin-only wallet that has been around since 2011. It’s easy to use, but has advanced features.

On a technical level, your wallet is more like a window onto the Bitcoin network that you control with your own electronic private keys. Whether you use a super secure hardware wallet like the Ledger Nano X, a convenient mobile app like the BRD wallet or an old school favorite Electrum you’ll need to be sure to keep your private keys safe.

I have a wallet, do I have to buy a whole bitcoin?

It’s a common misconception to think that you need to buy one whole bitcoin at a time. These days, that would be quite an expensive endeavor. You can check out the current price of one bitcoin, here.

Instead, the inventor of Bitcoin, Satoshi Nakamoto, made it possible to divide one bitcoin into 100,000,000 pieces.

QUICK TIP

One bitcoin is divisible to 8 decimal places and you can own as little as 0.00000001 bitcoin. In reality, most places where you can buy bitcoin allow you to spend as little as $5 at a time.

In 2010 an early member of the Bitcointalk community, Ribuk, proposed the name ‘satoshi’ for the smallest unit of a bitcoin, and the name stuck. In recent years it’s become common to use the phrase “stacking sats” for buying and holding small amounts of bitcoin in order to periodically accumulate more of the coin.

The best place to buy your first bitcoin is on an exchange

Wallets themselves tend not to give you the option to buy and sell bitcoin for fiat. So, you’re going to have to find a trustworthy and low-cost exchange, and then send the coins from the exchange to your wallet.

- Exchange based in Canada

- Very high buy and sell limits

- Supports Interac & wire

This ad promotes virtual cryptocurrency investing within the EU (by eToro Europe Ltd. and eToro UK Ltd.) & USA (by eToro USA LLC); which is highly volatile, unregulated in most EU countries, no EU protections & not supervised by the EU regulatory framework. Investments are subject to market risk, including the loss of principal.

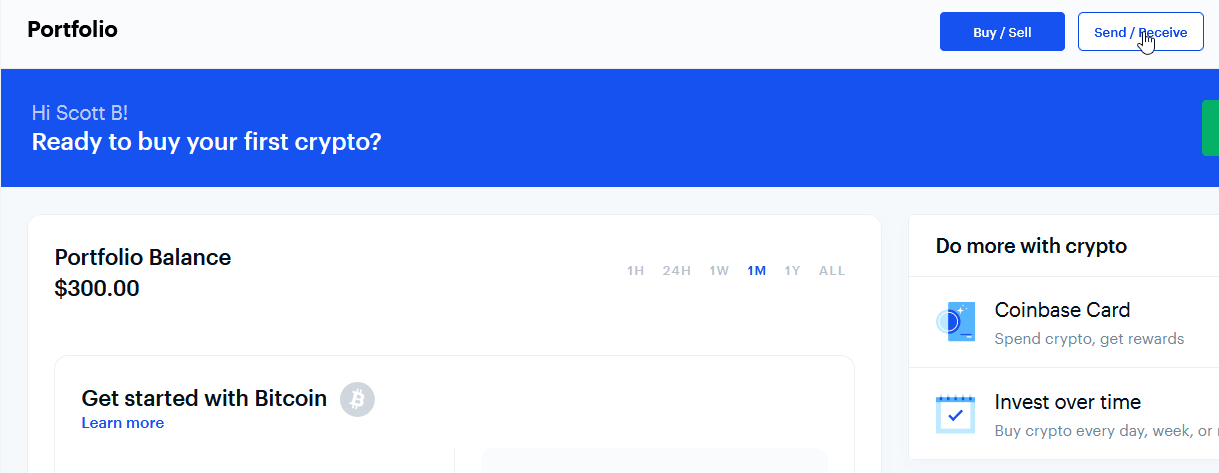

An ideal fiat cryptocurrency exchange for people just getting started is Coinbase. For the following reasons:

- It has the most simple and easy to use user interface

- It’s quick to get verified so you can buy bitcoin almost instantly

- There are great mobile apps for Android and iPhone

- Coinbase is a regulated and FDIC insured exchange

Three important factors for choosing which exchange is the right choice for you are reputation, fees and speed:

Reputation

It’s sad to say, but a lot of exchanges in the past turned out to be scams. That means the longer an exchange has been around, building up a positive reputation, the less likely it is to be a bad actor in the space.

You can also check if the exchange is regulated in your part of the world. We reviewed the top exchanges we would recommend, here.

Another important factor in choosing the right exchange to fund your bitcoin wallet is to compare how much they will charge for converting your fiat to bitcoin.

On average the fees for credit card purchases are around 4%. If you send your money via bank transfer you usually save on fees and can expect to pay somewhere between 1 and 1.5%.

Speed

Finally it’s important to look at how quickly will you be able to buy and then receive your coins. It’s interesting to note that a lot of the problems connected with how quickly you can fund your Bitcoin wallet, are actually due to the slowness of the legacy financial systems, and not cryptocurrency itself.

However, it’s a good idea to look at waiting times and withdrawal limits for the purchasing method of your choice as it’s never a good feeling to be caught out by these kind of factors when you want to buy some Bitcoin in a hurry.

Credit card purchases are usually quicker than bank transfers, but they come at a higher cost.

WARNING

Do NOT get comfortable leaving your cryptocurrency on an exchange. Ideally you should send your money to an exchange, purchase your crypto, and then withdraw the coins immediately to a secure hardware wallet like the Ledger Nano X.

Ledger Nano X

- SCREEN:

- RELEASED: 2019

- PRICE: $145

Ledger Nano S

- SCREEN:

- RELEASED: 2016

- PRICE: $72

TREZOR T

- SCREEN:

- RELEASED: 2018

- PRICE: $189

TREZOR One

- SCREEN:

- RELEASED: 2013

- PRICE: $79

How to withdraw to your wallet

The first few times you withdraw to a bitcoin wallet it can feel a bit nerve wracking. You do need to be careful and ensure that you follow the steps carefully. Wallets that have modern user interfaces and easy to follow step by step processes will help reduce the chance of you making a mistake.

The most important thing is to make sure that the wallet address you send your bitcoin to, the long string of numbers and letters, is correct. If you send your bitcoin to a different address by accident there is no way of getting your money back. So be careful.

As an example, if you are withdrawing from your Coinbase account to your Ledger Nano X you would follow these steps:

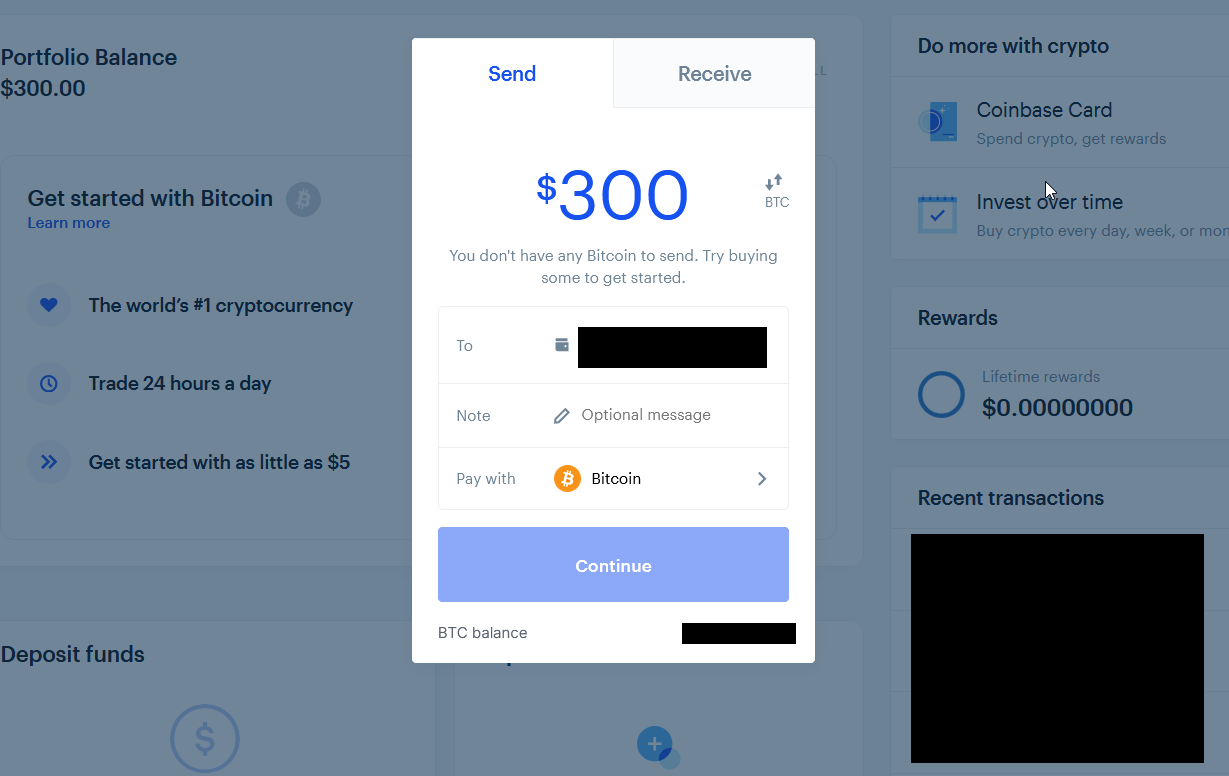

1. Select ‘Send’

Select “Send’ and choose the coin you want to withdraw from your exchange account. You can send as little or as much as your BTC as you wish, but be aware that each withdrawal will have a fee. Once you are comfortable sending and receiving bitcoin it is worth learning a little more about transaction fees and how you can minimize the costs.

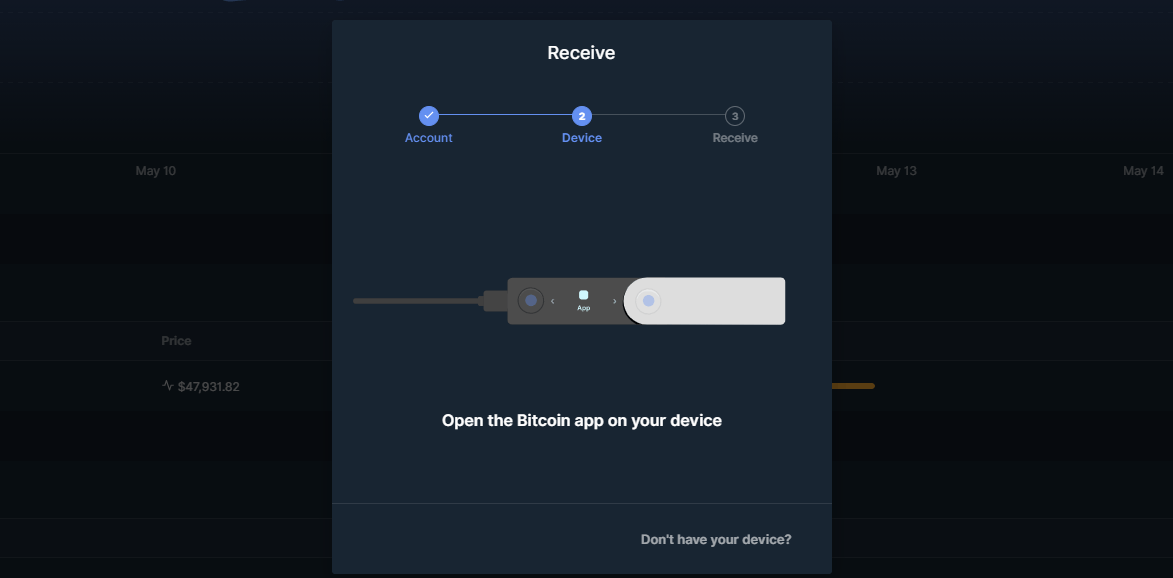

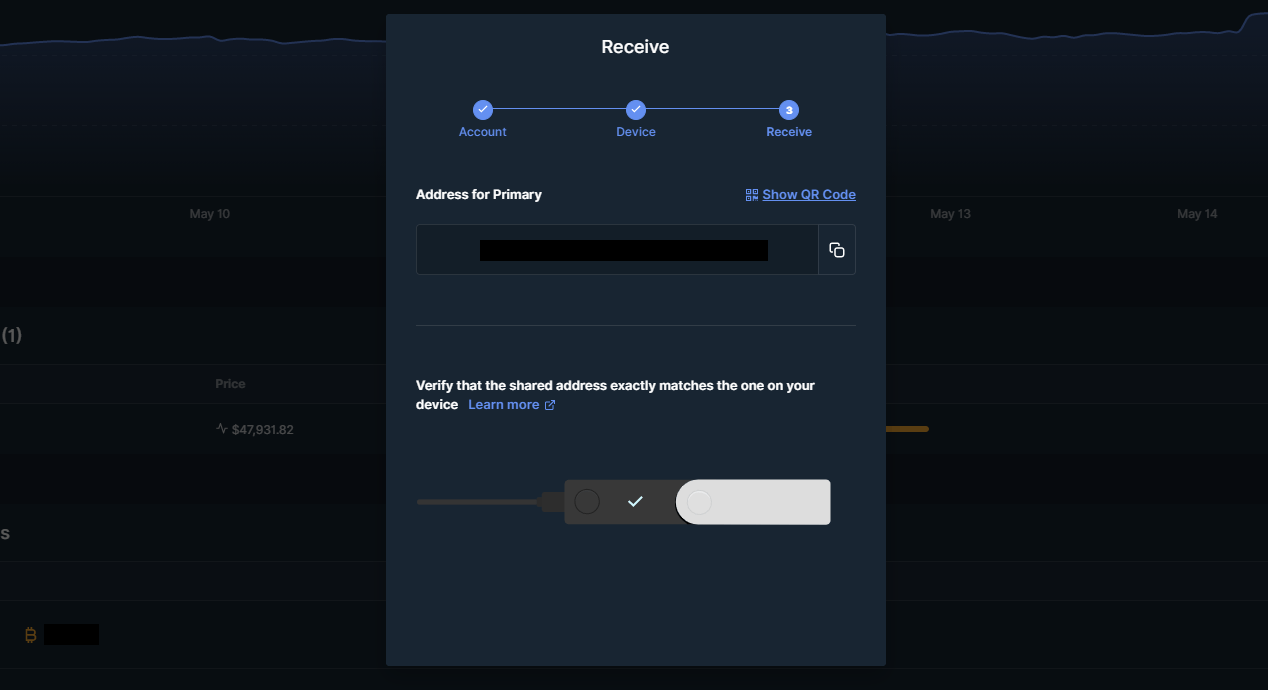

2. Get a Receiving Address

Log in to your Ledger Live account and follow the instructions to copy your wallet address so that you can input it in Coinbase as the receiving address. First you must connect and unlock your Ledger, then open the Bitcoin app on your device.

3. Verify and Copy Receiving Address

Next, check the Bitcoin address that is showing on your device. It should be your Bitcoin wallet address, and nobody else’s.

Then, use the app to copy the address from Ledger Live, or scan the QR code that shows in Ledger live.

4. Give Exchange Your Receiving Address

From your Coinbase or other exchange account, double check the address by sight to ensure you are sending the bitcoin to your wallet address.

How long will it take till my bitcoin arrives?

That depends. If you get into the next block, you Bitcoin will arrive in your wallet within about 10 minutes.This is the time it takes to get one confirmation on the Blockchain.

Typically you should wait 3-6 confirmations before you can be sure your bitcoin has arrived safely.

1 confirmation can be enough if you are sending less than $1000. Each confirmation is a block in the Bitcoin blockchain with your transaction recorded accurately.

These blocks are created about every ten minute by the Bitcoin miners. The miners verify the blocks and get rewarded with Bitcoin for their work.

Once the transaction has confirmed a few times, you can relax and be certain that you have added the funds correctly.

About the Author: Jordan Tuwiner

Jordan Tuwiner is the founder of BuyBitcoinWorldwide.com. His work has been featured in The Guardian, International Business Times, Forbes, VentureBeat, CoinDesk and many other top Bitcoin media outlets. His articles are read by millions of people each year looking for the best way to buy Bitcoin and crypto in their country.

He has also written extensively about the history, technology, and business of the crypto world. Jordan is also the creator of some of the internet’s most famous Bitcoin pages, including The Quotable Satoshi and Bitcoin Obituaries.

To learn more about Jordan, see his full bio.

We Help The World Buy Bitcoin

Disclaimer: Buy Bitcoin Worldwide is not offering, promoting, or encouraging the purchase, sale, or trade of any security or commodity. Buy Bitcoin Worldwide is for educational purposes only. Every visitor to Buy Bitcoin Worldwide should consult a professional financial advisor before engaging in such practices. Buy Bitcoin Worldwide, nor any of its owners, employees or agents, are licensed broker-dealers, investment advisers, or hold any relevant distinction or title with respect to investing. Buy Bitcoin Worldwide does not promote, facilitate or engage in futures, options contracts or any other form of derivatives trading.

Buy Bitcoin Worldwide does not offer legal advice. Any such advice should be sought independently of visiting Buy Bitcoin Worldwide. Only a legal professional can offer legal advice and Buy Bitcoin Worldwide offers no such advice with respect to the contents of its website.

Buy Bitcoin Worldwide receives compensation with respect to its referrals for out-bound crypto exchanges and crypto wallet websites.

Wallabit Media LLC and/or its owner/writers own Bitcoin.

Источник

Your gateway to Bitcoin & beyond

The tools and information you need to buy, sell, trade, invest, and spend cryptocurrencies

Buy quickly and easily

Use your credit card, payment app, or bank account to buy Bitcoin, Bitcoin Cash, Ethereum, and other select cryptocurrencies

Buy as little as $30 worth to get started!

Free your money and invest with confidence

The full-service Bitcoin Wallet trusted by millions

Track the market

Make better investment decisions with real-time data at your fingertips

Stay informed

Get around the clock updates, analysis, and insights on the news that matters most

Learn the essentials

Get up to speed on Bitcoin, Bitcoin Cash, and Ethereum with articles, guides, and step-by-step tutorials

What is Bitcoin?

Bitcoin is based on the ideas laid out in a 2008 whitepaper titled Bitcoin: A Peer-to-Peer Electronic Cash System

How do I create a Bitcoin wallet?

Creating a Bitcoin wallet is as easy as installing software on your mobile device or computer

How do I receive bitcoin?

To receive bitcoin, simply provide the sender with your address. You just need to make sure you’re providing the right one.

What is Bitcoin?

Bitcoin is based on the ideas laid out in a 2008 whitepaper titled Bitcoin: A Peer-to-Peer Electronic Cash System

How do I create a Bitcoin wallet?

Creating a Bitcoin wallet is as easy as installing software on your mobile device or computer

How do I receive bitcoin?

To receive bitcoin, simply provide the sender with your address. You just need to make sure you’re providing the right one.

Bitcoin.com in your inbox

A weekly rundown of the news that matter, plus educational resources and updates on products & services that support economic freedom

Источник

Best Safe Bitcoin + Crypto Wallet Apps & Hardware

This guide will help you to find the best Bitcoin wallet or cryptocurrency wallet for YOU!

There’s no «one size fits all» wallet. Wallets come on different platforms with different features.

If you want the best possible wallet, keep reading.

Chapters

Our Top Picks

Best Wallet For

Best for Security

Ledger Nano X

Secure storage for any cryptocurrency

The Ledger Nano X is the newest crypto hardware wallet, and is very easy to use. It connects to iOS, Android & desktop computers.

Best for Mobile

ZenGo

Easy to use iOS & Android wallet

ZenGo is an easy-to-use iOS and Android Bitcoin & crypto wallet. Start within 20 seconds.

Best for Desktop

Electrum

Simple yet powerful desktop wallet

Electrum is a Bitcoin-only wallet that has been around since 2011. It’s easy to use, but has advanced features.

Chapter 1

What is a Bitcoin & Cryptocurrency Wallet?

A Bitcoin/cryptocurrency wallet is the first step to using Bitcoin or crypto.

A “wallet” is basically the equivalent of a bank account. It allows you to receive bitcoins and other coins, store them, and then send them to others.

You can think of a wallet as your personal interface to the Bitcoin network, similar to how your online bank account is an interface to the regular monetary system.

Wallets contain private keys; secret codes that allow you to spend your coins.

In reality, it’s not coins that need to be stored and secured, but the private keys that give you access to them.

A crypto or Bitcoin wallet is simply an app, website, or device that manages private keys for you.

This guide will show you how to create a wallet and pick the best one.

Types of Bitcoin Wallets

There are a few different types of Bitcoin wallets used today, and each of them come with their own tradeoffs between security and convenience:

We’ll cover this in full detail in chapter two (up next), but put simply there are wallets for holding your everyday spending money (hot wallets) and there are wallets for your long term savings (cold wallets). There are even several types of both hot and cold wallets.

An Exchange is Not a Wallet

Again, we will cover this is more detail in Chapter five below, but its worth stating here as well that your Bitcoin «bank» or exchange accounts that do hold Bitcoin are NOT wallets.

If that is confusing, don’t worry — it will all make sense by the time we are done here.

This is not to say that bitcoin banks are inherently bad.

It is simply important to remember that whoever controls the private keys controls the bitcoin attached to those keys. A misunderstanding of this point has led to hundreds of millions of US dollars being lost in the past, so it’s important to understand this key difference in how Bitcoin private keys can be stored.

For now, just know that private keys are what you need to protect if you want to keep your bitcoin safe from hackers, user error, and other possible issues.

Chapter 2

Types of Bitcoin & Crypto Wallets

Now let’s discuss the types of wallets and why you might want to use one kind over another.

By the end of this chapter, you should have a good idea of which wallet is right for you.

Hardware Wallets

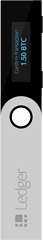

A hardware wallet is a physical electronic device, built for the sole purpose of securing crypto coins.

The core innovation is that the hardware wallet must be connected to your computer, phone, or tablet before coins may be spent.

The two most popular and best Bitcoin and cryptocurrency hardware wallets are:

Hardware wallets are a good choice if you’re serious about security and convenient, reliable Bitcoin & crypto storage.

Hardware wallets keep private keys separate from vulnerable, internet-connected devices.

Your all-important private keys are maintained in a secure offline environment on the hardware wallet, fully protected even should the device be plugged into a malware-infected computer.

As bitcoins and cryptocurrencies are digital, cyber-criminals could, potentially, target your computer’s “software wallet” and steal them by accessing your private key.

Generating and storing private keys offline using a hardware wallet ensures that hackers have no way to reach your coins.

Hackers would have to steal the hardware wallet itself, but even then, it can be protected with a PIN code.

Don’t worry about your hardware wallet getting stolen, lost or damaged either; so long as you create a secret backup code, you can always retrieve your coins.

Think of a hardware wallet like your own underground steel vault. If you own a significant amount of bitcoin or crypto, you should strongly consider getting one!

Why are hardware wallets good?

- Easiest way to securely store bitcoins and other coins

- Easy to backup and secure

- Less margin for error; setup is easy even for less technical users

- Multiple hardware wallets can be used together for extra security

Why are hardware wallets bad?

- They’re not free!

- They can be challenging for new users to understand

Hot Wallets

Hot wallets are wallets that run on internet connected devices like a computer, mobile phone, or tablet.

Private keys are secret codes. Because hot wallets generate your private keys on an internet connected device, these private keys can’t be considered 100% secure.

Think of a hot wallet like your wallet today: you use it to store some cash, but not your life savings. Hot wallets are great if you make frequent payments, but not a good choice for the secure storage of bitcoins.

Why are hot wallets good?

- Easiest way to store small amounts of bitcoin and crypto

- Convenient; spending and receiving payments is easy and fast

- Some hot wallets allow access to funds across multiple devices

Why are hot wallets bad?

- Not safe for the secure storage of large amounts of bitcoins and crypto

- You might forget about the application being installed on your phone

Which Wallet is Best for You?

Investing or saving? Then a hardware wallet will keep your coins safe.

Otherwise, a software wallet will send and receive bitcoins & crypto just fine. Best of all, software wallets are free.

Each wallet has pros and cons, and different wallets are built to solve different problems.

Some wallets may be geared towards security, while some wallets may be more focused on ease-of-use.

Your specific needs should determine the wallet you use, as there is no “best bitcoin wallet”.

How to Add Funds to a Bitcoin Wallet

Most wallets don’t give you the ability to buy and sell bitcoin. So, if you want funds in your wallet you’ll need to purchase on an exchange and send the coins to your wallet.

We’ve listed some popular exchanges below:

- Exchange based in Canada

- Very high buy and sell limits

- Supports Interac & wire

This ad promotes virtual cryptocurrency investing within the EU (by eToro Europe Ltd. and eToro UK Ltd.) & USA (by eToro USA LLC); which is highly volatile, unregulated in most EU countries, no EU protections & not supervised by the EU regulatory framework. Investments are subject to market risk, including the loss of principal.

Below, we’ve listed wallets you can buy or download. We suggest using the wallets listed or doing research before buying or downloading any wallet.

Each day, new Bitcoin scam wallets are added to the Google Play Store and Apple app store that are designed to steal peoples’ bitcoins.

We only list wallets that have published and open-sourced their code.

Chapter 3

Hardware Wallets: Keep Your Coins Safe

Hardware wallets aren’t free.

But the price can be worth it if you own a significant amount of coins.

A hardware wallet will protect a few hundred in bitcoin/crypto just as effectively as a few million.

How Hardware Wallets Work

Hardware wallets are secure, offline devices. They store your private keys offline so they can’t be hacked.

This means you can even use one on a malware infected computer.

Why A Hardware Wallet with a Screen is Important

In the table below, you’ll notice we show which hardware wallets have screens.

Screens provide extra security by verifying and displaying important wallet details. Since the hardware wallet is nearly impossible to hack, its screen is more trustworthy than data displayed on your computer.

Bitcoin & Crypto Hardware Wallet Comparison

Check the table below for a quick comparison. Note:

Ledger Nano X

- SCREEN:

- RELEASED: 2019

- PRICE: $145

Ledger Nano S

- SCREEN:

- RELEASED: 2016

- PRICE: $72

TREZOR T

- SCREEN:

- RELEASED: 2018

- PRICE: $189

TREZOR One

- SCREEN:

- RELEASED: 2013

- PRICE: $79

Best Bitcoin Hardware Wallet Overviews

Ledger Nano X

Ledger Nano X

The Ledger Nano X is Ledger’s newest hardware wallet. The main benefit is that it has bluetooth, making it the first hardware wallet that connects with iOS devices. It’s more secure than using just an app on your phone, because all transactions are signed with the Nano X.

Buy Learn More About Ledger Nano X

Ledger Nano S

Ledger Nano S

The Ledger Nano S is the cheapest of the three hardware wallets with a screen; it costs about $59. Ledger, one of the most well-known Bitcoin security companies, released the device in August 2016.

Buy Learn More About Ledger Nano S

TREZOR T

TREZOR T

The TREZOR Model-T is a second generation Bitcoin/crypto hardware wallet manufactured by SatoshiLabs. The TREZOR line debuted in 2014 with the TREZOR One and has remained one of the most popular cryptocurrency cold storage solutions to date.

Buy Learn More About TREZOR T

TREZOR One

TREZOR One

TREZOR launched in August 2014 as the first Bitcoin hardware wallet, offering secure bitcoin storage plus the ability to spend with the convenience of a hot wallet. TREZOR is a small, thumb-sized device.

Buy Learn More About TREZOR One

Chapter 4

Hot Wallets

Just a quick refresher:

Hot wallets are Bitcoin wallets that run on internet connected devices like a computer, mobile phone, or tablet.

As hot wallets generate private keys on an internet connected device, these private keys can’t be considered 100% secure.

Think of a hot wallet like your wallet today: you use it to store some cash, but not your life savings. Hot wallets are great if you make frequent payments, but not a good choice for the secure storage of bitcoins.

Desktop Wallets

Desktop wallets are downloaded and installed on your computer. If privacy is your main concern, the Bitcoin core wallet is a good option since it does not rely on third parties for data.

Electrum

Electrum

Electrum is a light weight Bitcoin wallet for Mac, Linux, and Windows. Electrum was created in November 2011. The main features of Electrum are: support for hardware wallets (such as TREZOR, Ledger Nano and KeepKey), and secure Bitcoin storage using an offline computer. Electrum is a good option for both beginners and advanced users.

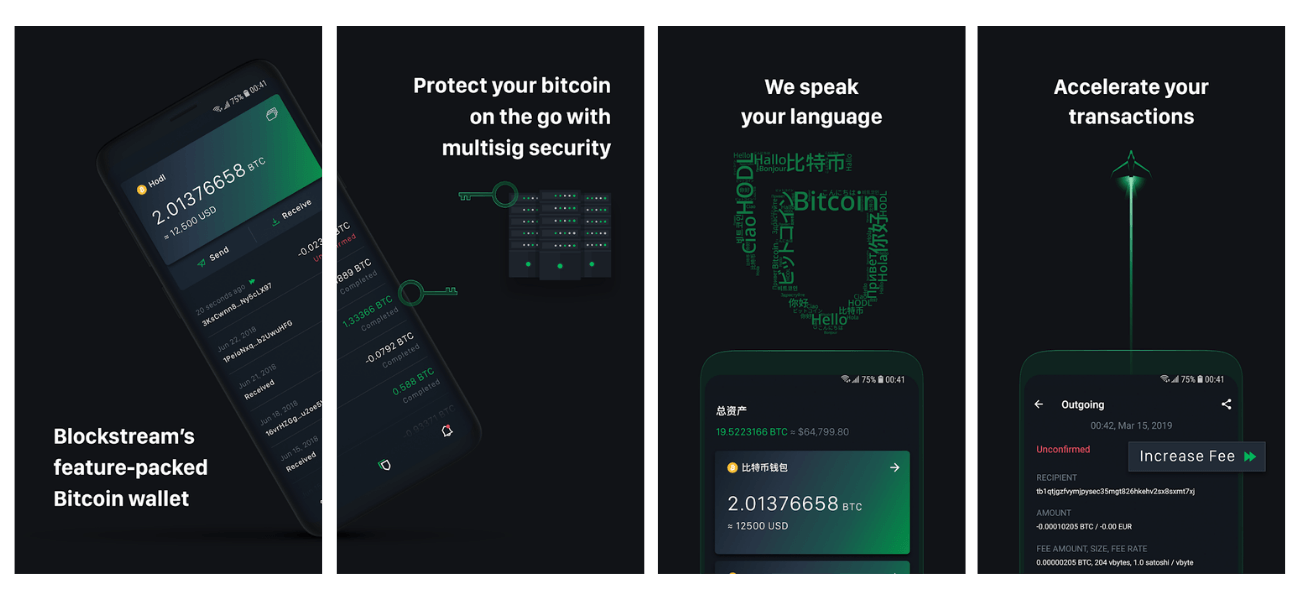

Blockstream Green

Blockstream Green

Blockstream Green is a powerful Bitcoin wallet for iOS, Android, and Desktop. It’s very easy to use and can be setup in a few minutes.

iOS and iPhone Bitcoin Wallets

Apple banned Bitcoin wallets from the App Store in February 2014, but reversed its decision a few months later. Luckily, there are now plenty of options for iOS users.

BRD

BRD

We consider BRD, along with Copay (below), as the best bitcoin wallet for iPhone. It’s open source and gives the user full control over their private keys. It also has a clean interface which makes the sending and receiving of bitcoins a pleasurable and super-simple process.

Edge

Edge

Edge is an easy to use Bitcoin wallet for iPhone and Android. Its familiar login feature makes using the app a breeze for people new to bitcoin. The wallet also creates automatic backups, so you don’t have to worry about the technicalities of performing manual wallet backups.

Blockstream Green

Blockstream Green

Blockstream Green is a powerful Bitcoin wallet for iOS, Android, and Desktop. It’s very easy to use and can be setup in a few minutes.

Aqua

Aqua is a new non-custodial, singlesig wallet made by Blockstream as a way to offer a more newb friendly wallet than Blockstream Green. It’s incredibly simple to use and supports liquid assets as well.

Android Bitcoin Wallets

There is a large selection of Android wallets. Since Bitcoin wallets were originally banned by Apple, developers spent much of their time developing for Android.

BRD

BRD

BRD, the great iPhone Bitcoin wallet, recently released an Android wallet. It offers the user control of private keys, an easy to use interface, and passcode support.

Edge

Edge

Edge is an easy to use Bitcoin wallet for iPhone and Android. Its familiar login feature makes using the app a breeze for people new to bitcoin. The wallet also creates automatic backups, so you don’t have to worry about the technicalities of performing manual wallet backups.

Blockstream Green

Blockstream Green

Blockstream Green is a powerful Bitcoin wallet for iOS, Android, and Desktop. It’s very easy to use and can be setup in a few minutes.

Bitcoin Wallet

Bitcoin Wallet

Bitcoin Wallet, or “Schildbach Wallet”, was the first mobile Bitcoin wallet. Bitcoin Wallet is more secure than most mobile Bitcoin wallets, because it connects directly to the Bitcoin network. Bitcoin Wallet has a simple interface and just the right amount of features, making it a great wallet and a great educational tool for Bitcoin beginners.

Chapter 5

Bitcoin Banks: $10 Billion Lost in Hacks

One last thing to keep in mind when it comes to bitcoin wallets is that there is a difference between a wallet and a bank.

Some Bitcoin users view Coinbase as a Bitcoin wallet, but companies like this operate much more like banks.

The private keys are what users need to protect to safely use the Bitcoin network without getting robbed. When you hand someone else control over your private keys, you are essentially making a deposit at that financial institution – much like a deposit at any bank.

Don’t store coins on exchanges! Bitcoin users have lost over $10 billion worth of bitcoins in exchange hacks and scams. Control your own private keys.

This is not to say that bitcoin banks are inherently bad. Companies like Coinbase have done wonders for bringing more users into the ecosystem. It is simply important to remember that whoever controls the private keys controls the bitcoin attached to those keys.

A misunderstanding of this point has led to billions of US dollars being lost in the past, so it’s important to understand this critical difference in how Bitcoin private keys can be stored.

Understanding how bitcoin wallets work is an important aspect of safely using this new technology. Bitcoin is still in its early years of development and wallets will become much more user-friendly in time.

In the near future, certain devices may eventually come with pre-installed wallets that interact with the blockchain without the user’s knowledge.

For now, it’s vital to keep in mind that the private keys are what you need to protect if you want to keep your bitcoin safe from hackers, user error, and other possible issues.

Chapter 6

Theft and Scams

No matter which wallet you choose, remember:

Our bitcoins are only safe if the private key was generated securely, remains a secret, and—most importantly—is controlled only by YOU!

Let’s learn about what happens when this isn’t the case.

Here are two examples where users got ripped off by leaving bitcoins in the care of a third party:

To avoid theft, scams, and any other loss of funds, follow these three basic principles:

- Generate your private keys in a secure, offline environment. (Except if using trivial amounts, in which cases keys may be created in a hot wallet).

- Create backups of your private keys. This helps to protect against the loss of your bitcoins due to hard drive failure or some other problem or accident. Ideally you should have a duplicate set of backups kept off-site to protect against the possibility of fire, robbery, etc.

- Encrypt wallets to provide additional security. This helps prevent the physical theft of your funds in the event that your device or hardware wallet is stolen.

Securing your bitcoins properly is the most important step for any Bitcoin user.

With Bitcoin you have the privilege — but also the responsibility — to safeguard your own money. There have been countless scams related to Bitcoin that could have been prevented had people not entrusted others with their bitcoins.

It’s a good rule of thumb to never trust anyone else with your money.

Bonus Chapter 1

Cryptocurrency Security Advice

Whether your on an exchange or using a wallet, this section will give you some tips on how to secure your cryptocurrency in ways you may not have seen before.

From changing your mobile network to encrypting your internet connection — these tips are actionable and easy to implement quickly.

The migration of value into the digital realm brings with it new challenges in terms of best security practices. As with any unit of value, there is always someone, somewhere that seeks to extract this value for their own ends, whether it be through coercion, social manipulation or brute force.

This guide is intended to provide a broad overview of the best practices for securing your crypto assets. While most of these steps are not mandatory, following them will greatly increase your financial security and peace of mind in the crypto world.

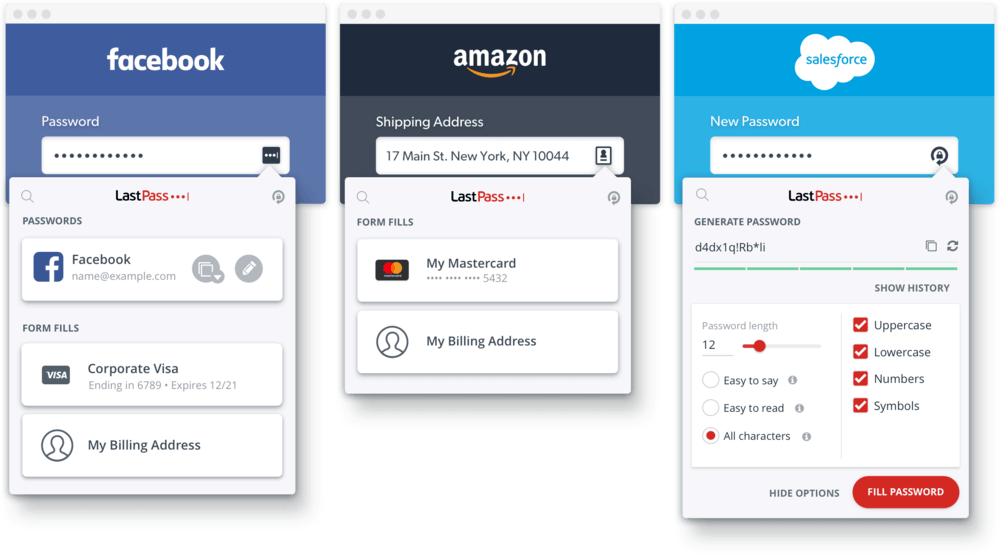

Passwords — Complexity & Re-Use

Starting from the ground up, password complexity and re-use are two major pain points that many average users do not consider adequately. As you can see by this list, average password complexity still leaves a lot to be desired. The less complex your password is, the more susceptible to hack your account is. If you use the same passwords, or even slight variations of the same passwords across multiple accounts, your chances of compromise are greatly increased.

So what can you do? Fortunately the fix for this is relatively easy. Use randomly generated 14 character+ passwords and never re-use the same password. If this seems daunting to you, consider leveraging a password manager such as LastPass or Dashlane that will assist in password generation and storage.

You can find out if any accounts associated with you have ever been compromised here as well as using this tool to test just how strong variations of your passwords may be (*do not use your real password on here, only similarly structured variations).

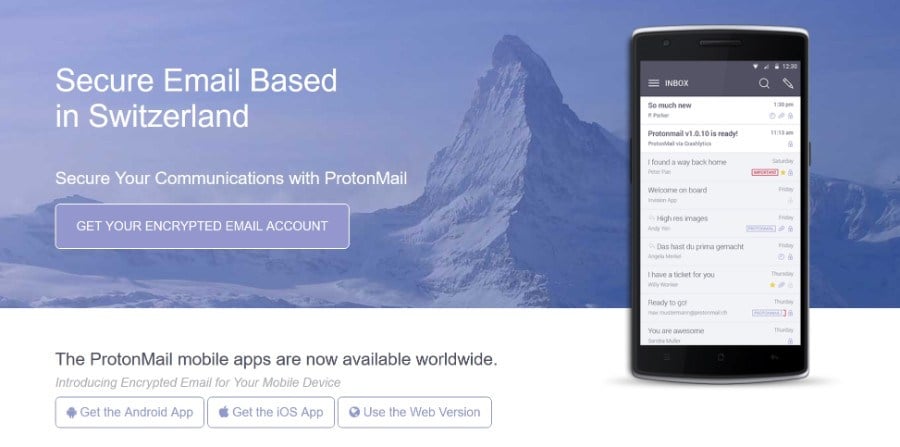

Dedicated Email Accounts

Almost every online service/exchange requires some type of email account association during the activation process. If you are like most people, you will probably use your default email that you’ve had for years, and perhaps add a bit more complex password for the account itself for good measure.

In most cases however, all a hacker needs is access to your emails in order to reset account passwords that may be tied to it. It’s as simple as navigating to the website/exchange and clicking the ‘forgot password’ link to begin the process. So, if you are like most people and have an email address that has been active for years, with a weak login password, your chances of being hacked are much higher.

For the above reasons, do yourself a favor and create a new/dedicated email address for use with your crypto accounts. Services like ProtonMail and Tutanota are free and offer end to end encryption without sacrificing usability (mobile app availability etc.). If you decide to stick with Gmail, consider activating the Advanced Protection Program that Google offers.

Use a VPN

A virtual private network (or VPN) is simply a must for everyone today, but especially cryptocurrency users.

As we surf the internet, there are unfortunately a lot of eyes on us at all times. One very big set of eyes watching us is our internet service provider (or ‘ISP’). They see and hear everything we do on the internet. And they often share that information with third parties. But our ISP and its friends are not the only people watching. Anyone using the same wifi network that we are using can also see what we are up to online.

A VPN solves this problem. When we use a VPN, our computer’s IP address is not connecting to any website directly. Instead we are communicating to another IP address over an encrypted connection. Then that IP address makes website requests on our behalf and send us back that data. This helps keep onlookers onto our connection locked out so that only one party knows what we are doing (the VPN).

It’s therefore important that you choose a VPN service with a great track record.

The reason VPNs are important for cryptocurrency users especially is that we use Bitcoin to keep as much data hidden as possible. However, when we expose our IP address, we might give away that our IP address is connected to someone who owns and uses cryptocurrency, merely because of the websites we visit.

Long story short: everyone should be using a VPN regardless of whether or or not they use Bitcoin. It’s for your own safety.

Two-Factor Authentication

We typically recommend setting up two-factor authentication (2FA) for any and every account that offers it, even if the service is not crypto related. All 2FA does is require a second means of confirmation that you are who you say you are when logging into accounts. Most typically this is in the form of something you know (password) and something you own (SMS code sent to phone).

While SMS is still the most common form of 2FA offered by online services, it is unfortunately the least secure. The following general use 2FA methods are ranked from most secure to least:

- FIDO U2F — This is a physical device that plugs into a USB port and requires a physical button touch to generate a unique 2FA access code. It is preferable because a hacker would need to have the device in their physical possession in order to access your account. Most hacks occur remotely which makes this our top 2FA choice (albeit not a panacea).

Google Fi

Speaking of SIM attacks, there is one way to avoid them.

Services like Google Fi offer an alternative to traditional mobile phone contracts that are not only more flexible but also more secure.

With Google Fi, you can prevent any changes from occurring on your account without providing a second authentication factor. And because there are no SIM cards in a Google Fi plan, there are also no SIM attacks. This makes it impossible for attackers to hijack your text-messages and take over your accounts.

Currently, Google Fi is the only mobile phone service in the US that offers 2FA. So if you intend on taking your security seriously in this area, Google Fi is the only way to do it if you live in the United States.

Another nice perk of Google Fi is that it’s easy to change your phone number whenever you want. This feature alone also increases your security since many of our phone numbers have been leaked before and can be used to access other accounts online. If your leaked phone number is no longer active, you are a little more protected.

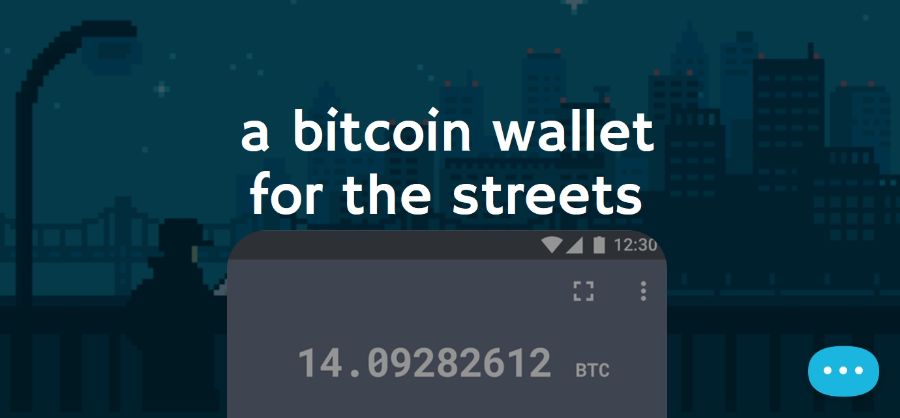

Mobile Crypto Wallets

Mobile app wallets such as Mycelium, BRD, Samourai, Cryptonator, etc. should be treated similarly to how you may treat your physical wallet/purse.

You only carry small amounts of discretionary spending funds in these wallets as they are more susceptible to loss or theft. Again, what is more convenient for you is more convenient for a malicious actor as well. Your phone is also susceptible to malware and should not be considered sufficiently safe for storing large amounts of funds.

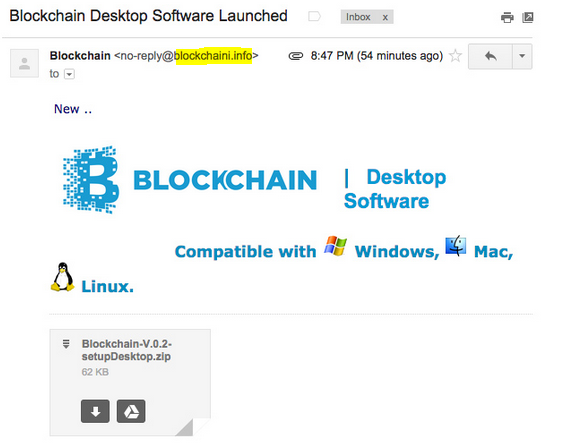

Phishing Attacks

If you have crypto then you are an ideal target for phishing scams. Facebook and Twitter are just two of many avenues that hackers scour for potential victims. It has become common to see fake crypto exchange emails or ICO fundraising confirmations circulating such as the example below.

Phishing email impersonating Blockchain.info. Note send address & logo irregularity.

It is best to NEVER open suspicious attachments or provide credentials through email and to always closely inspect the logo, wording and send address of any emails received that pertain to financial accounts or that request sensitive information.

When in doubt, navigate to the legitimate exchange or web service that the email supposedly originated from and contact their support team to inquire on the validity of what you received before taking further action.

Secure Crypto Storage

If you don’t hold the private keys, you don’t own your money!

This category is how most people have been compromised and lost money in crypto. How? Primarily, by treating an exchange (Coinbase, Binance, Bittrex, Poloniex etc.) as a wallet to store their crypto assets in.

Mt. Gox, Bitfinex, BitGrail and Coincheck are just four out of a handful of crypto exchanges that have been hacked in the past 5 years, with the cumulative amount stolen exceeding $1 billion USD. While some users of these exchanges have been ameliorated to an extent, many are still suffering from the partial or even total loss of crypto funds that they held on these exchanges at the time of the hacks.

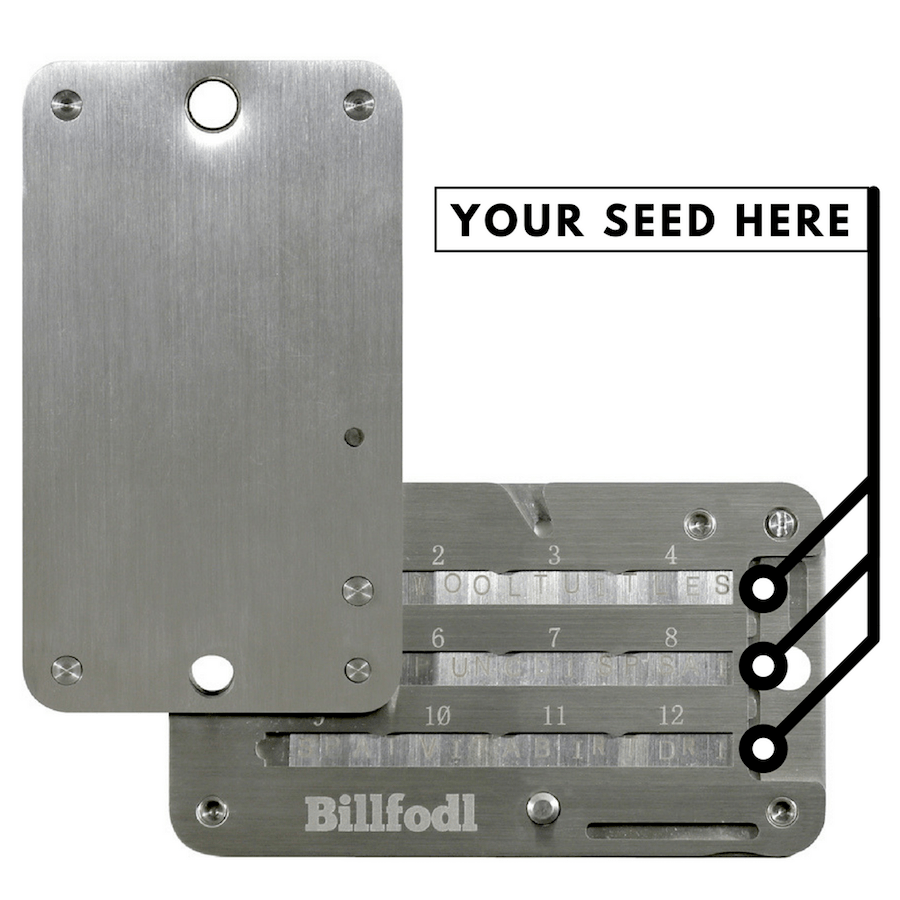

Our advice is to hold crypto on hardware and back it up using a steel wallet.

If you wish to trade on exchanges, only do so with funds that you are potentially willing to forfeit entirely should either the exchange or your individual account become compromised.

A few of our recommended hardware wallet manufacturers are Ledger and Trezor. You can find our more detailed wallet reviews here . As with all hardware/software, please ensure that your device firmware is kept up to date, as patches are pushed out continuously to address security concerns.

The Subject of Secure storage is something we cover in much greater depth in the next Bonus Chapter

Summary

Security on the web is akin to game of whack-a-mole and your level of security will likely scale accordingly with the amount of sensitive data (or crypto assets) that you are protecting.

While there is no such thing as an ‘unhackable’ system, there are valuable steps that you can take to drastically reduce your likelihood of compromise.

Always remember to:

- Use complex and unique passwords

- Create a separate/dedicated email account for crypto services

- Use two-factor authentication

- Store most (if not all) of your funds on hardware wallets

- Be wary of phishing emails

Источник

Ledger Nano X

Ledger Nano X  Ledger Nano S

Ledger Nano S  TREZOR T

TREZOR T  TREZOR One

TREZOR One  Blockstream Green

Blockstream Green  Edge

Edge  Bitcoin Wallet

Bitcoin Wallet