- How To Earn Interest on Bitcoin – Bitcoin Saving accounts

- 5 Best websites to Earn Bitcoin interest: Bitcoin Saving accounts

- 1. BlockFi

- 2. Celsius

- 3. Binance Saving account

- 4. Compound finance

- 5. Nexo

- Conclusion: Best ways to earn interest in bitcoin

- How to Earn Interest on Bitcoin

- BlockFi

- Celsius Network

- 11 Best Bitcoin Lending Sites to Earn Interest [Upd. Jun’21]

- @ dmitry.leijkoDmitry Leiko

- What Are Crypto and Bitcoin Loans?

- Interest in BTC Loans

- Risks of BTC Loans

- Bitcoin Lending Sites

- How to Lend Bitcoin

- Difference Between Traditional Banking and P2P Lending

- 12 Best Bitcoin Lending Platforms in 2021

- 1. BlockFi – Best Lending Platform 👍

How To Earn Interest on Bitcoin – Bitcoin Saving accounts

- Do you want to earn interest on Bitcoin holding?

- Do you want to earn interest on other cryptos that you hold?

If your answer is yes to any of these questions, then you have come to the right place. In this resource, you will find some of the best and trustable financial products that let you earn interest on Bitcoin or Altcoin’s interest by just holding them. These financial products use the various mechanism to lend these cryptos to other institutes, margin trading exchanges and other ways to generate a return and thus share the earnings with you.

I have done my best to find all the trustable resources that could be used. Most of them offer interest in Bitcoin and a few are part of Defi (Decentralized finance) which lets you earn interest in popular cryptocurrencies.

Disclaimer: Even though all these methods work, you should know that lending itself is a risky segment. A few of them have a locking period and based on your risk management, you should pick one.

I have also shared a few websites that let you earn interest on Stable coins holding, which is something worth knowing and using in the time of the bear market or when the crypto market is going down.

| Bitcoin Saving Accounts | Interest rate for BTC (APY) | Interest Up to (APY) | Withdrawal | Supported coins |

| Cryptocom | 4% | 8% | Instant | BTC, ETH, BNB, BAT, USDT, USDC |

| BlockFi ( Recommended , available globally 🌍) | 6.2% | 6.2% | Up to 2 days | BTC, ETH, GUD |

| Celsius | 3.75% | 3.75% (BTC), 8% (Stable coins) | Instant | BTC, ETH, XRP, Stable Coins & more |

| Binance (Great for trading as well) | Variable | 1.5-3% | Instant | BNB, BTC, USDT, ETH, ADA, BCH and many more. |

| Nexo | BTC not available ATM | 8% | Instant | All StableCoins |

| Compound finance | BTC not available ATM | WBTC (0.17%), DAI (2-5%) | Instant | WBTC, ETH, DAI, USDC, REP, ZRX |

5 Best websites to Earn Bitcoin interest: Bitcoin Saving accounts

1. BlockFi

For earning interest in Bitcoin, BlockFi should be your first choice as Bitcoin Lending Platform. They offer interest up to 6.2% Annually on Cryptos. BlockFi supports following Cryptocurrencies:

Highlights of BlockFi:

- Interest earned is paid out at the beginning of the month.

- Interest earned is compounded monthly.

- You can also trade on the platform. For example: Sell your Bitcoin for USDC when price is high and buy back when the price is low. You will be earning interest in both cases.

The amount of interest you will earn on crypto lending on BlockFi varies based on the amount you wish to lend. The below chart gives a glimpse of Annual Percentage Yield (APY)* you will be earning:

Note: The APY is calculated based on monthly compounding.

The locking period for Blockfi is one month and the withdrawal requires a manual interview and can take up to 7 days. Do keep a note of fees for withdrawal on BlockFi interest account (BIA).

2. Celsius

Celsius is a platform that offers Interest On Bitcoin and other major cryptocurrencies. The interests are paid out weekly, and if you take an interest in the platform token (CEL), your earned interest rate will be higher. At the time of writing, these are the coins supported by Celsius for earning interest:

- Bitcoin – 4.60%

- Ethereum – 3.90%

- Litecoin – 4.50%

- Ripple – 2.50%

- OmiseGo – 4.25%

- Bitcoin cash – 3.75%

Highlights of Celsius network:

- No minimum deposit

- Fee-free withdrawal

- No lock-up period

3. Binance Saving account

Binance is the world’s best cryptocurrency exchange and is loved by millions of traders globally. Binance offers a feature called “Binance Savings”, where you can lend your Bitcoin and earn interest on it. The interest rate is flexible, and at the time of writing, they are offering 1.6% Estimated Annual Yield.

To use this feature:

- Head over to Binance

- Click on Finance > Savings

Here you will be able to lend your Bitcoin and start earning interest. You also have an option to auto-subscribe, which will automatically lend your Bitcoin balance at the end of the day. This is idle for traders who are taking a break of a few days, and still want their idle Bitcoin to earn extra income for them.

4. Compound finance

Compound finance is at the forefront of decentralized finance where you can lend few of the major cryptocurrencies and interest on them. When you lend cryptocurrencies using Compound, you adding funds to the liquidity pool. You are not directly dealing with borrowers; rather they are borrowing from the market. Interest rates are determined algorithmically (real-time) based on supply and demand.

At the time of writing, you can lend the following cryptocurrencies on Compound finance:

- ETH

- DAI

- BAT

- USDC

- 0x (Zrx)

- Augur

- WBTC (This is for lending Bitcoin, and I will cover in-depth in the upcoming guide)

Here is the recent interest rate (Supply APR) for all supported cryptocurrencies:

With time, you can expect Compound finance to add more cryptocurrencies.

The most common way to access the Compound protocol is by using Metamask. However, for users who are paranoid about security, you should use Defi saver that let you access compound protocol using a hardware wallet such as Ledger Nano X, Ledger Nano S, Trezor, and Fortmatic.

There are two stable coins supported by Compound finance right now:

Highlights of Compound.finance:

- The compound protocol lives on Ethereum blockchain

- There is no locking period. You can withdraw your funds anytime

- Interest rate is not locked and changes based on supply and demand.

- Interest is paid after every ETH block confirmation (every

5. Nexo

I discovered Nexo a few months back and already shared about this with CoinSutra users on Telegram and on Twitter. If you are an existing member, you may be aware of Nexo already. This is another high-quality platform that let you earn Interest on Stable coins. You will be earning up to 8% interest, and interest is paid out daily, which automatically start earning high yield Interest.

Supported coins: USD, EUR, GBP, USDT, TUSD, USDC, PAX, DAI

Highlights of Nexo:

- Supports all major stable coins.

- Instant deposit and withdrawal

- No locking period

- 100% asset-backed guarantee

- Custodial insurance of $100 million by BitGo and Lloyd’s of London

- Business audited by Deloitte

- Instant withdrawal from wallet with Zero withdrawal fees

The newest addition is Zero withdrawal fees for any of the cryptocurrencies from the Nexo wallet. They have a web app and mobile wallet, which makes it easy to use the Nexo platform.

Conclusion: Best ways to earn interest in bitcoin

As the cryptocurrency and decentralized financial market are increasing, I’m hopeful to see more trustable networks and platforms in the coming days. For now, these are some of the best options for you to earn interest in cryptocurrency and Bitcoin. Depending on how you are using cryptocurrencies, you can pick to earn interest in Bitcoin or in Stable coin.

Here is a summary of the above-listed platforms:

It would be nice to know which platform are you using to earn interest in Cryptocurrencies and Bitcoin? After trying any of these above-listed platforms, do come back to share your review and opinion.

Do join CoinSutra on Telegram and on YouTube to get instant updates.

Harsh Agrawal is the Crypto exchanges and bots experts for CoinSutra. He founded CoinSutra in 2016, and one of the industry’s most regarded professional blogger in fintech space.

An award-winning blogger with a track record of 10+ years. He has a background in both finance and technology and holds professional qualifications in Information technology.

An international speaker and author who loves blockchain and crypto world.

After discovering about decentralized finance and with his background of Information technology, he made his mission to help others learn and get started with it via CoinSutra.

Join us via email and social channels to get the latest updates straight to your inbox.

Источник

How to Earn Interest on Bitcoin

When I was young I remember looking at my bank book and seeing nice interest payments for cash I had in the bank. Fast forward to today and banks are giving essentially nothing for interest — your money just sits there collecting dust. In an ideal world you could put it into the stock market but there are always funds that you can’t put at risk.

That got me thinking about new and creative ways to earn interest on USD. One idea that came to mind was converting USD to USDC (US Dollar Coin) and using a service to earn interest on it — some even promised 8%, much more than any bank offers. That also got me to thinking about earning interest on other cryptocurrencies that I’ve owned for years but have no desire to sell.

I’ve spent the last few months using three different services for earning interest on cryptocurrencies: Nexo, BlockFi, and Celsius Network. Over that time, I’ve enjoyed earning thousands of dollars in interest. Let’s explore the strengths of each services!

Nexo is the world’s largest and most trusted lending institution in the decentralized finance space and has already processed more than $3 billion for 800,000+ clients in 200+ countries.

What I Like:

- Daily payouts — 6pm is my favorite time of the day!

- Deposit, withdraw, and view holdings with the elegant mobile app or website

- Pays interest on other large cap cryptocurrencies like Ether ($ETH) and Litecoin ($LTC)

- Pays interest on lessor used cryptocurrencies like Stellar ($XLM), Chainlink ($LINK), and more

- $100 million insurance on all custodial assets

- Website and mobile app are both very easy to use

What Could Be Improved:

- The 8% interest rate paid out for stablecoins is less than the 8.6% rate provided by BlockFi and 10.5% at Celsius Network

BlockFi

BlockFi is a US-based firm that provides the wealth management products crypto investors need, all powered by blockchain technology.

What I Like:

- BlockFi’s rates for Bitcoin, Litecoin, and Ethereum are excellent

- BlockFi is based in the United States

- Provides a website and mobile app

What Could Be Improved

- Public-facing website looks drab to the point where I question how much I should trust the service

- Interest is paid out at the beginning of each month, so a month goes by with no immediate gratification

- Many popular altcoins aren’t supported

Celsius Network

Celsius Network, founded by VoIP creator Alex Mashinsky, offers interest and crypto loans with zero fees; «free, free, free»!

What I Like:

- Supports multiple altcoins like Ripple, Stellar, and Basic Attention Token

- Mobile app is well designed and easy to use

- Interest is paid weekly

What Could Be Improved

- Celsius Network doesn’t have an investor control panel where I can do things like deposit, withdraw, etc — everything needs to be done via a mobile app

After a few months of using each of these services, I can honestly say that they were all easy to use and rewarding:

- Nexo’s mobile app and website are really well done, they accept the most cryptocurrencies, and their daily payouts instill confidence that I’m actually earning something.

- BlockFi feels more mature but their website really needs work — it made me hesitant to deposit funds.

- Celsius accepts more cryptocurrencies than BlockFi but not being able to manage funds one a desktop computer website fills me with dread

Regardless of the service you choose, earning interest on your cryptocurrencies is an opportunity no HOLDER should ignore. If you aren’t making interest on your crypto, someone else is!

Note: This blog post uses referral links — each of them provides free bitcoin to both you and I if you join.

Источник

11 Best Bitcoin Lending Sites to Earn Interest [Upd. Jun’21]

@ dmitry.leijkoDmitry Leiko

Entrepreneur, product owner, SEO specialist, cryptocurrency enthusiast. All you need to know;) [email protected]

Cryptocurrency is turning out to be one of man’s most revolutionary developments. There are hundreds of them available today, chief of which is Bitcoin. More and more people are purchasing Bitcoin today.

However, purchasing Bitcoin alone is not enough to earn significant interest. Your Bitcoin just sits there. Many people know this and start trading to earn profits from their bags of Bitcoin. People also delve into other means of making profits, like lending Bitcoin for interest. This field is one that is fast gaining traction in the world of cryptocurrency.

Bitcoin lending involves one party lending BTC to another party at an agreed interest rate. The party that lends is called the lender, creditor, or investor. The party that borrows is the borrower. While that sounds simple enough, you still need to know how to go about it.

Finding someone to lend your Bitcoin to isn’t exactly a walk in the park. You may have to look for days or even weeks before getting connected to someone to do business with. And even after you find someone to lend to, you still have to construct a safe and secure deal. This is where crypto lending sites come into play.

Crypto lending sites handle all the technicalities and intricacies of crypto loans. This greatly reduces the risk of getting scammed and offering an easy way to earn. There are several crypto lending sites today, making it challenging for users to choose a suitable one to use. This article will address this, outlining 12 of the best Bitcoin lending sites you can use in 2021.

We have created this list using several different factors and our experience from years of lending and borrowing Bitcoin. You will learn about these companies and their pros and cons, which will guide you in making the right decision for yourself.

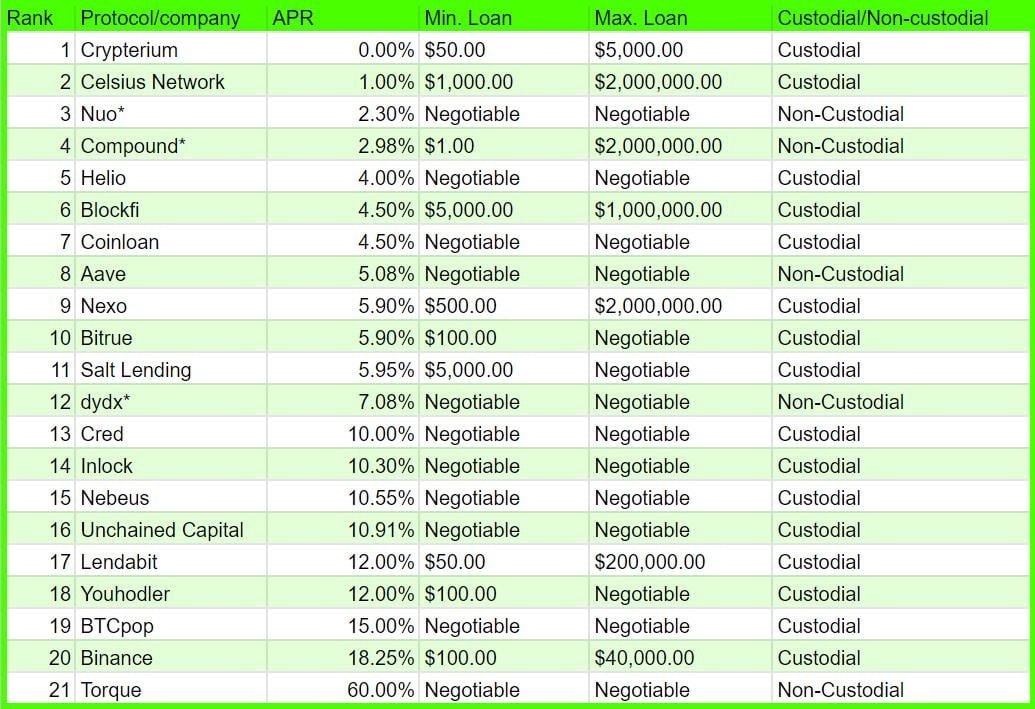

If you are too lazy to read a lot of text and you want to immediately see the rating, especially for you. I created this list by carefully analyzing these platforms and also based on my experience with them. (up to $250 crypto bonus)

Best crypto loan platforms for lending and borrowing:

Disclaimer. All links to the companies above contain a referral code. By clicking on the link, the author of the article will receive a reward, in addition, you will also receive a welcome bonus. Enjoy!

What Are Crypto and Bitcoin Loans?

Crypto and Bitcoin loans are just like regular bank loans. They usually involve at least two parties. One party is borrowing while the other is lending. The borrower takes the loan with the agreement to pay back at an agreed-upon rate. There may or may not be collateral. The currency in a crypto loan is cryptocurrency. If the cryptocurrency being loaned is BTC, the loan is called a bitcoin loan.

Borrowers in a crypto loan receive a credit line, which may be in fiat or stable coin. Borrowers have to pay back with interest at the time agreed with the lender. The lenders in a Bitcoin loan deposit an amount of Bitcoin they are willing to loan out. When the loan matures, the lender collects back their Bitcoin with the agreed interest.

Interest in BTC Loans

There are two types of interest in BTC loans – simple and compound interest. The key difference between the two is compound interest is added periodically to the deposit. The frequency of adding this interest varies from platform to platform. It may be daily, weekly, monthly, or even quarterly. Compound interest will see lenders earn better returns on their initial deposits.

Lending platforms with compound interest usually have an APY value. APY stands for Annual Percentage Yield. This figure is the rate of return a lender will earn in a year if the interest is compounded.

You can calculate APY using this formula.

We don’t want to bore you with APY calculations but know that platforms with high APY values will offer more return to lenders.

Risks of BTC Loans

Cryptocurrencies, including BTC, are usually very volatile. This volatility is usually more prominent when the BTC has to be converted to fiat currency. Let’s consider it practically.

Imagine someone borrows BTC at an exchange rate of 1BTC to $30,000 and the exchange rate is 1BTC to $40,000 at the time of loan repayment. A borrower that converted BTC to fiat currency when borrowing will have to pay more to settle their debt. Although this volatility also means borrowers may gain if the exchange rate drops.

One cannot tell what the exchange rate will be for sure at the time of repayment and may lose a lot of funds. The same principle applies to lenders that convert BTC to fiat currency before lending.

Another risk is the safety of assets and collateral on the platforms. The top platforms are usually very secure, but users may fall into scammers’ hands when using substandard platforms. This risk is even more amplified when both parties are in different regions of the world.

Bitcoin Lending Sites

Finding someone to loan to or borrow from isn’t easy. This is why many lenders and borrowers use lending sites. These sites serve as intermediaries to connect lenders and borrowers. Note that the borrowers can be institutions, miners, or other individuals. Lending sites choose the interest rate of the Bitcoin loan. They also structure the deal and choose the duration of the loan.

There are usually different interest rates for borrowers and lenders. The interest rate for the borrowers is usually kept low enough to encourage people to borrow. Lenders also lend at a fixed rate which may be set by the lending platforms. In peer-to-peer platforms, lenders are free to dictate the terms of the loan.

There are many lending sites today. Different companies have different policies and modes of operation. Borrowers and lenders typically find companies they can trust with their Bitcoin assets. Users also look out for companies that will profit them the most.

How to Lend Bitcoin

The first step to lending Bitcoin is finding a lending site to use, which you can get from this article. After finding a suitable one, you need to open an account with the lending site. Opening an account with the lending platforms is usually free and generally take less than 10 minutes.

You then choose your cryptocurrency, Bitcoin in this case, and deposit the amount you are willing to loan. Most lending platforms will seek to verify the identity of the lender. They usually ask for a driver’s license, passport, National ID, or other government-issued documents.

Most lending sites require some form of identification. But there are still a few companies that do not need you to identify yourself before taking a loan. Aside from being rare, lending and borrowing are usually harder in companies like this. Their rates are also hugely inflated.

After verification of identity, the lending site will show you the terms of the agreement. The typical loan duration is one year, although some lending sites may allow longer or shorter durations. If you are comfortable with the terms put forward, you can confirm the loan.

Everything, from opening an account to lending BTC takes around thirty minutes. Some other cryptocurrencies may take more time to finalize, though.

I recommend watching a video from CoinTelegraph about it

Difference Between Traditional Banking and P2P Lending

Traditional banking is different from peer-to-peer lending. In the former, borrowers request loans from a bank. In peer-to-peer lending, on the other hand, borrowers request loans on online lending platforms.

Investors fund both traditional and banking and peer-to-peer lending. However, investors in traditional banking deposit money in a bank to earn interest. The investors don’t necessarily deposit money to lend to other parties. It’s more of a bank safeguarding their funds.

In peer-to-peer lending, investors lend money directly to other borrowers to earn interest. Therefore, lending in banks is an agreement between the bank and the borrower. But lending in P2P platforms is an agreement between the borrower and the lender. The P2P platform only serves as a medium or intermediary to connect the borrowers and lenders.

Traditional banking is different from peer-to-peer lending. In the former, borrowers request loans from a bank. In peer-to-peer lending, on the other hand, borrowers request loans on online lending platforms.

Investors fund both traditional and banking and peer-to-peer lending. However, investors in traditional banking deposit money in a bank to earn interest. The investors don’t necessarily deposit money to lend to other parties. It’s more of a bank safeguarding their funds.

In peer-to-peer lending, investors lend money directly to other borrowers to earn interest. Therefore, lending in banks is an agreement between the bank and the borrower. But lending in P2P platforms is an agreement between the borrower and the lender. The P2P platform only serves as a medium or intermediary to connect the borrowers and lenders.

12 Best Bitcoin Lending Platforms in 2021

Lending Bitcoins and earning interest from a Bitcoin lending platform is easy but finding the right one to use may be quite challenging. This makes sense, considering the massive number of platforms available today. However, all platforms are not the same. To fully maximize profits and secure your funds, you need to know the best platforms to use.

Choosing one to work with is important. There are many factors to consider. Some of them are the interest rate, loan duration, deposit limit, collateral, user fees, reputation, ease of use, customer service, and user reviews. Considering all of these factors can be a bother for non-professionals and casuals. This is why we have created a list of the best platforms you can use in 2021.

Updated 02/23/21 before we start you can check rates comparison:

1. BlockFi – Best Lending Platform 👍

Up to $250 bonus in crypto using my referral link, enjoy😏

Источник