- Bull Market Comparison

- Indicator Information

- Follow Us

- Say Hello

- Data from

- Privacy Overview

- How Bitcoin’s 2020 High Compares To Past Bull Market “Tops”

- Crypto Bull Market Tops Match Current Price Action Despite Bearish Sentiment Shift

- Route 128: The Road To Successfully Buying The Dip In Bitcoin?

- Tony Spilotro

- Bitcoin – Comparing Previous Market Cycles With The Bull Run of 2021

- @ liquidarycomLiquidary.com

- Bitcoin’s first real market cycle 2011

- 2011-2013 – Bitcoin gained attention

- 2017 Bitcoin bull run vs. Bitcoin today

- 2017 Bitcoin bull run vs. Bitcoin today

- Stock to Flow model

- Conclusion

Bull Market Comparison

Indicator Information

This chart compares the current bull market to the ones in the past. In this chart, a bull market starts when the price has recovered 100% from the previous all-time high.

The starting price of each bull market is adjusted to the last bull market starting price.

- Start of 2013 bull market: 2013-02-28

- Start of 2017 bull market: 2017-02-23

- Start of 2020 bull market: 2020-11-17

Follow Us

Say Hello

Data from

Privacy Overview

Necessary cookies are absolutely essential for the website to function properly. These cookies ensure basic functionalities and security features of the website, anonymously.

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category «Analytics». |

| cookielawinfo-checbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category «Functional». |

| cookielawinfo-checbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category «Other. |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category «Necessary». |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category «Performance». |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

Functional cookies help to perform certain functionalities like sharing the content of the website on social media platforms, collect feedbacks, and other third-party features.

Performance cookies are used to understand and analyze the key performance indexes of the website which helps in delivering a better user experience for the visitors.

Analytical cookies are used to understand how visitors interact with the website. These cookies help provide information on metrics the number of visitors, bounce rate, traffic source, etc.

Advertisement cookies are used to provide visitors with relevant ads and marketing campaigns. These cookies track visitors across websites and collect information to provide customized ads.

Other uncategorized cookies are those that are being analyzed and have not been classified into a category as yet.

Источник

How Bitcoin’s 2020 High Compares To Past Bull Market “Tops”

Buffalo skull in Temple of Thailand

Bitcoin price suffered a powerful correction from the 2020 high of $12,400, taking the crypto asset back below $10,000 briefly. After a short-lived dead-cat bounce to $11,200, Bitcoin price is back once again at $10,500 and trying to hold.

Although the correction has been steep, the selloff closely resembles the last bull market’s most violent tops. And while sentiment has swiftly shifted bearish, if history repeats, buying even the scariest dips will be incredibly rewarding.

Crypto Bull Market Tops Match Current Price Action Despite Bearish Sentiment Shift

In a bull market, dips are for buying and can lead to enormous ROI. But at this stage of where Bitcoin is in its market cycle, combined with an economic environment full of uncertainty, it isn’t clear if the cryptocurrency is fully bullish, or remains in the grasps of a Bear

Until a new all-time high is set, the market has more to thaw from the long crypto winter.

Breaking above $10,000 is one major step in the right direction for bulls, and holding seven straight retests on daily timeframes above it is the second. All that’s left is confirming the uptrend is intact by setting another new 2020 high.

But a recent severe selloff from the current high has turned sentiment bearish quickly, prompting investors to fear more downside ahead.

However, one keen-eyed crypto analyst has shared some compelling charts that suggest that the latest top, is just like past bull market tops, and the crypto asset is ready to fly higher.

In the above comparison, the most recent top in Bitcoin price action closely resembles the structure that took Bitcoin out from its Bear

The below chart shows the same current top juxtaposed next to yet another bull market “top” in Bitcoin price action. After a fall, none of these “tops” ever proved to be actual peaks, and the crypto asset kept on climbing.

Route 128: The Road To Successfully Buying The Dip In Bitcoin?

It’s also important to note, that within this crypto analyst’s charts, may also be another sign to look out for that the latest “top” more closely matches that of a bull market peak.

Within each smaller photo above, Bitcoin is holding strong at the 128-day moving average. Zooming out to view the bigger picture shows just how important this unusual support line has acted during previous bullish impulses.

This moving average supported the cryptocurrency’s bullish continuation at each major pullback – pullbacks that closely resemble the one we just had.

Bitcoin price is currently sitting right smack on the 128-day moving average, so we’ll soon find out if Bitcoin is indeed in a bull market, or if the crypto winter is about to get a lot colder.

Tony Spilotro

I’m Tony Spilotro. Behind the pseudonym, I’m a global remote work leader with a decade of award-winning content experience and excellence. Here, I explore my newfound passions pertaining to privacy, finance, economics, politics, cryptography, property rights, and other libertarian-esque views. I am a Bitcoin evangelist, maximalist, and educator whenever I can be, helping to spread its message of freedom from government control, monetary policy mismanagement, and passing the buck — literally – to future generations. My journey from a curious retail crypto investor to a serious Bitcoin advocate, trader, and technical analyst is an unusual one, but life-changing nonetheless and has become less about money and more about a long-overdue revolution. While a firm believer in the laws governing math and science, I am profoundly fascinated by the impact of astrology and astronomy including moon and solar cycles and planetary alignment and their ability to influence and potentially predict markets. It hasn’t yet clicked for me as to how to put anything to use, but I consider it my current rabbit hole I can’t yet dig out of. My perspective of growing up alongside the internet, the dot com era, the Great Recession, and roots in video games collecting coins and rare items caused Bitcoin to immediately make sense to me. Through all of these lenses, I seek to produce content that is educational and entertaining, and I thank you sincerely for taking the time to read what I have to say. Please follow me on Twitter and feel free to drop me a line if you would like to work together.

Источник

Bitcoin – Comparing Previous Market Cycles With The Bull Run of 2021

@ liquidarycomLiquidary.com

Cryptocurrency Ranking Platform.

Bitcoin is booming. Just recently Elon Musk announced via a SEC filing that he put 10% of Tesla’s balance sheet into Bitcoin. However, every time there is a big drop people are scared that the end is near and that Bitcoin goes again down 80-90% like it did in 2018.. or 2014… or 2013. You see where I am getting there – Bitcoin often does that. Hence, we have market cycles and this article will look over previous market cycles in Bitcoin and where Bitcoin stands today.

Bitcoin’s first market “cycle” (why quotations? Because back then there was not really a market – more like OTC trades and small exchanges) in 2010 brought Bitcoin up over 5000% — going form a cent per Bitcoin to half a

dollar. Right after that we saw a 70% drop.

In the next paragraphs we are going through the previous large cycles, remember though that each cycle includes many 30%/40% dips – historically this was a normal thing in bull markets.

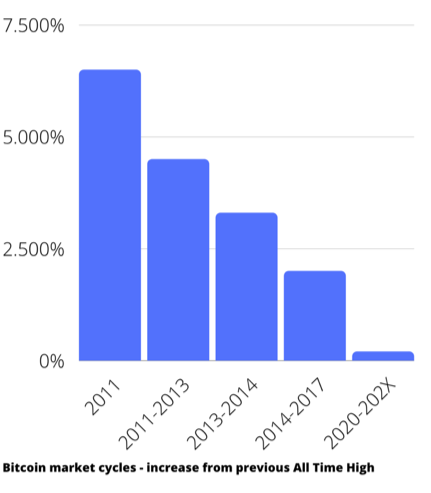

Bitcoin’s first real market cycle 2011

In 2011, Bitcoin started out from a low of 0.17$ and reached a high of 30$ in summer 2011. From the previous All-Time-High it increased by 6500%. Back then the narrative was clear – can Bitcoin break a Dollar?

Of course, it can we would say today but back then things weren’t that certain. The market was driven by a lot of enthusiasts, there was hardly any liquidity compared to today and media coverage was almost only negative if it existed at all.

2011-2013 – Bitcoin gained attention

Bitcoin for the first time was really on the screen of a group of media outlets and some investors. We saw an increase form 30$ to over 1,000$. In that cycle there even was a crash from 250$ to 50$ (which arguably is a cycle itself), however straight after that drop another rally started up to the 1,000$ mark.

2017 Bitcoin bull run vs. Bitcoin today

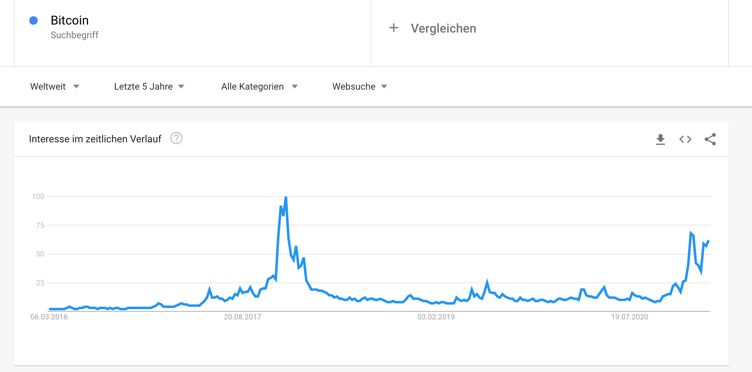

In 2017 the Bitcoin market increased from about 1,000$ to almost 20,000$ — 2000%. In that cycle there was a lot of public interest in Bitcoin and especially altcoins and ICOs. Below there is a chart of the Google search trends from back then vs. today.

Here we are seeing that as of today, even though Bitcoin trades at 2-3X the 2017 ATH, there is still not so much public awareness. This could be a good indicator that the current cycle isn’t over yet, since the current buyers seem to be more institutional (or better corporate -Tesla, Microstrategy,

etc) buyers than retail investors.

Another indicator is the fact that we haven’t really seen a “craze” like last year – there were “vaporware” ICOs popping up everywhere with some

random stock pictures, no product and often not even a legal entity raising

millions and leaving investors behind with no money.

Another interesting point to look at are dips in the bull market – In 2017 we had two 35% and one 25% dip in the cycle. In the current cycle we got one 30% correction at 42,000$ and one at 58,000$ down to 43,000$.

2017 Bitcoin bull run vs. Bitcoin today

Here we are seeing that as of today, even though Bitcoin trades at 2-3X the 2017 ATH, there is still not so much public awareness. This could be a good indicator that the current cycle isn’t over yet, since the current buyers seem to be more institutional (or better corporate — Tesla, Microstrategy, etc) buyers than retail investors.

Another indicator is the fact that we haven’t really seen a “craze”

like last year – there were “vaporware” ICOs popping up everywhere with some random stock pictures, no product and often not even a legal entity raising millions and leaving investors behind with no money.

Another interesting point to look at are dips in the bull market – In 2017 we had two 35% and one 25% dip in the cycle. In the current cycle we got one 30% correction at 42,000$ and one at 58,000$ down to 43,000$.

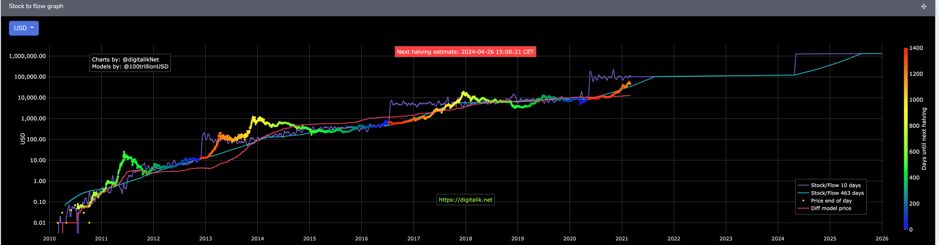

Stock to Flow model

PlanB created a model called the Stock to Flow model that models the Bitcoin price with an indicator known from commodity (especially gold) markets.

As history proves the model so far seems to be working – the chart below shows the model.

This would indicate a price of Bitcoin of about 100,000$ or higher at the end of the cycle. What’s interesting to see in the chart that the Bitcoin price shot above the s2f 463 line (light blue line) at the end of each cycle, however from cycle to cycle this “pump” above that line becomes smaller. If this trend continues we would see Bitcoin topping out at about that line.

Conclusion

All in all, no one knows where prices of any asset are going, however above we talked about some models and examples on how to look at the Bitcoin prices and its market cycles. There is always the potential risk of some black swan event like a global financial crisis (e.g. given the decoupling of the stock market and the actual economy and the resulting bubble) or some other event that would cause people to sell their Bitcoin.

What’s important to take away is that each cycle ended up with a “crash”. Each crash has always ended above the previous All-Time-High creating a long-term uptrend for Bitcoin. Both crashes and bubbles get both smaller with the market growing and maturing.

Источник