- Gitcoin Price ( GTC )

- Gitcoin Links

- Gitcoin Contracts

- GTC Price Live Data

- What Is Gitcoin (GTC)?

- Who Are the Founders of Gitcoin?

- What Makes Gitcoin Unique?

- Related Pages:

- How Many Gitcoin (GTC) Coins Are There in Circulation?

- How Is the Gitcoin Network Secured?

- Where Can You Buy Gitcoin (GTC)?

- Vega Protocol Price ( VEGA )

- Vega Protocol Links

- Vega Protocol Tags

- VEGA Price Live Data

- What Is Vega Protocol (VEGA)?

- Technology Highlights

- How Many VEGA Tokens Are in Circulation?

- yearn.finance Price ( YFI )

- yearn.finance Links

- yearn.finance Contracts

- yearn.finance Tags

- YFI Price Live Data

- What Is Yearn.Finance (YFI)?

- Who Are the Founders of Yearn.Finance?

- What Makes Yearn.Finance Unique?

- How Is the Yearn.Finance Network Secured?

- Where Can You Buy Yearn.Finance (YFI)?

- THORChain Price ( RUNE )

- THORChain Links

- THORChain Contracts

- THORChain Audits

- THORChain Tags

- RUNE Price Live Data

- What Is THORChain (RUNE)?

- Who Are the Founders of THORChain?

- What Makes THORChain Unique?

- Related Pages:

- How Many THORChain (RUNE) Coins Are There in Circulation?

- How Is the THORChain Network Secured?

- Where Can You Buy THORChain (RUNE)?

Gitcoin Price ( GTC )

0.0003585 BTC 29.67 %

0.005502 ETH 29.67 %

Gitcoin Links

Links

Explorers

Community

Gitcoin Contracts

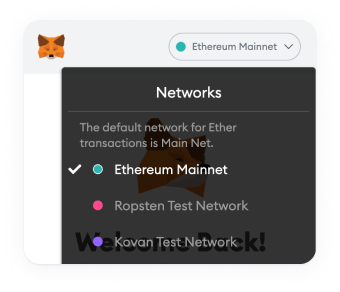

Please change the wallet network

Change the wallet network in the MetaMask Application to add this contract.

Please wait, we are loading chart data

GTC Price Live Data

The live Gitcoin price today is $13.22 USD with a 24-hour trading volume of $304,311,895 USD. Gitcoin is up 29.67% in the last 24 hours. The current CoinMarketCap ranking is #248, with a live market cap of $187,660,680 USD. It has a circulating supply of 14,198,202 GTC coins and the max. supply is not available.

If you would like to know where to buy Gitcoin , the top exchanges for trading in Gitcoin are currently Binance, Coinbase Exchange, LBank, MXC.COM, and Uniswap (V2). You can find others listed on our crypto exchanges page.

What Is Gitcoin (GTC)?

Gitcoin describes itself as a community of builders, creators and protocols that have come together in order to develop the future of the open internet. Gitcoin creates a community that supports new infrastructure for Web3 — includingn tools, technologies and networks — to foster development in the open-source sphere.

GTC is Gitcoin’s governance token, launched in late May 2021. The token is needed for the creation and funding of the DAO that will govern Gitcoin.

Who Are the Founders of Gitcoin?

Gitcoin was founded by Keving Owocki and Scott moore. Owocki is CEO, Moore is technical growth lead and is director of research.

What Makes Gitcoin Unique?

Gitcoin is unique in that it is a platform that supports community building, specifically for open source projects. As of June 2021, over $20 million has been funded for open source projects through Gitcoin, there are over 160,000 active developers monthly and a little over 1,600 projects created.

Gitcoin aims to create a future vision called “Quadratic Lands” — a digital ecosystem with digital democracy and a strong emphasis on community building.

Related Pages:

Learn more about EFFORCE.

Learn more about DAOs.

Check out the CoinMarketCap blog.

How Many Gitcoin (GTC) Coins Are There in Circulation?

The total supply of GTC is 100,000,000 tokens. 15% is set aside for a retroactive airdrop, 50% is in the Gitcoin DAO and 35% is for existing stakeholders. The retroactive airdrop is for past users of Gitcoin, the DAO allocation is for governance purposes and the existing stakeholders include anyone who has contributed to building Gitcoin in the past or the future (with a vesting schedule of at least two years for Gitcoin team members).

For more information about GTC’s distribution, see here.

How Is the Gitcoin Network Secured?

GTC has no economic value, according to the token’s introductory blog post. Token is a fork of the COMP/UNI governance system, with a built-in delegation prompt in the retroactive claim process.

Where Can You Buy Gitcoin (GTC)?

Please write a couple of sentences to name some of the main exchanges where this asset is listed. Please also work in a link to our fiat on ramp url using generic anchor text such as “read more here” or “explained here” etc.

Here are some other articles that you may be interested in:

Источник

Vega Protocol Price ( VEGA )

Why is there no Market Cap?

Vega Protocol Links

Links

Community

Vega Protocol Tags

Consensus Algorithm

Property

Please wait, we are loading chart data

VEGA Price Live Data

The live Vega Protocol price today is $46.50 USD with a 24-hour trading volume of $1,075,526 USD. Vega Protocol is down 5.29% in the last 24 hours. The current CoinMarketCap ranking is #2779, with a live market cap of not available. The circulating supply is not available and a max. supply of 64,999,723 VEGA coins.

If you would like to know where to buy Vega Protocol , the top exchange for trading in Vega Protocol is currently BitZ. You can find others listed on our crypto exchanges page.

What Is Vega Protocol (VEGA)?

Vega Protocol provides the derivatives scaling layer for Web3. It is a custom-built proof-of-stake blockchain, which makes it possible to trade derivatives on a decentralised network with comparable experience to using a centralised exchange.

VEGA is the network governance and staking token. It is used for:

- Voting on the creation of new markets on the network

- Running validator nodes on the network via staking VEGA tokens

- Earning fees from traders through staking and delegation

- Governing important network parameters which ensure markets are secure and fair

Technology Highlights

Vega Protocol implements a number of novel technology innovations, which enable high-performance trading of derivatives in a decentralised environment.

- Atomic margin calculations enable traders to maximise their capital-efficiency without compromising the safety of markets

- Pseudonymous trading identities ensure the network is accessible to anybody in the world without restriction

- The power to create new markets is put into the hands of the users of the network, through the permissionless market creation and governance protocol

- Strong liquidity incentives ensure that markets are attractive to both traders and liquidity providers at all times

How Many VEGA Tokens Are in Circulation?

VEGA has a fixed supply of 64,999,723 tokens, and the estimated circulating supply is as follows:

- Initial circulating supply of 2 million tokens

- Six months later, about 7.5 million tokens

- After one year, it’ll be about 19 million tokens

- In two years it will be approximately 60 million tokens

Here are some other articles that you may be interested in:

Источник

yearn.finance Price ( YFI )

yearn.finance Links

Links

Explorers

Community

yearn.finance Contracts

Please change the wallet network

Change the wallet network in the MetaMask Application to add this contract.

yearn.finance Tags

Property

Please wait, we are loading chart data

YFI Price Live Data

The live yearn.finance price today is $36,532.21 USD with a 24-hour trading volume of $234,698,551 USD. yearn.finance is down 3.85% in the last 24 hours. The current CoinMarketCap ranking is #64, with a live market cap of $1,338,373,534 USD. It has a circulating supply of 36,635 YFI coins and a max. supply of 36,666 YFI coins.

If you would like to know where to buy yearn.finance , the top exchanges for trading in yearn.finance are currently Binance, Huobi Global, ZG.com, OKEx, and CoinTiger. You can find others listed on our crypto exchanges page.

What Is Yearn.Finance (YFI)?

Yearn.finance is an aggregator service for decentralized finance (DeFi) investors, using automation to allow them to maximize profits from yield farming.

Its goal is to simplify the ever-expanding DeFi space for investors who are not technically minded or who wish to interact in a less committal manner than serious traders.

Launched in February 2020, the service, formerly known as iEarn, has seen huge growth in recent months as new products debuted and developers released in-house token YFI.

Who Are the Founders of Yearn.Finance?

Yearn.finance is the brainchild of Andre Cronje. After leaving the iEarn project in February 2020, Cronje returned to oversee a rebirth, with new tools emerging and YFI going live in July.

Since then, its fortunes have turned around, with assets under total value locked coming in at just over $1 billion as of the end of September 2020.

Cronje has a long career in cryptocurrency and has become synonymous with DeFi in particular. He also has positions at smart contract ecosystem Fantom and CryptoBriefing, a resource dedicated to initial coin offerings (ICOs) and crypto media.

What Makes Yearn.Finance Unique?

Yearn.finance set out to simplify DeFi investment and activities such as yield farming for the broader investor sector.

The platform makes use of various bespoke tools to act as an aggregator for DeFi protocols such as Curve, Compound and Aave, bringing those who stake cryptocurrency the highest possible yield.

New features continue to be rolled out, these aiming, among other things, to help preserve the long-term value of the platform.

Yearn.finance makes a profit by charging withdrawal fees, currently 0.5% at the end of September 2020, as well as 5% gas subsidization fees. Due to its governance model, these can technically be changed by consensus at any time.

The target market for yearn.finance is investors who do not have the time to study the increasingly complex DeFi phenomenon from scratch, or who wish to optimize their returns.

Related Pages:

Find out more about Harvest Finance (FARM) here.

Crypto newbie? Discover everything you need to know with Alexandria, CoinMarketCap’s dedicated education resource.

Check out CMC’s blog for more on YFI.

How Many Yearn.Finance (YFI) Coins Are There in Circulation?

Yearn.finance in-house token YFI has a fixed supply of 30,000 coins. There was no premine upon launch in July 2020, and developers did not receive any starting funds: the total supply at launch was 0 YFI.

Since then, the majority of the capped supply has entered circulation, and the success of the token is reflected in its all-time high price of $41,000, which it hit in mid-September 2020. YFI was also the first cryptocurrency to become worth more than Bitcoin (BTC) per unit.

Users of yearn.finance earn YFI through providing liquidity, while token holdings dictate governance privileges.

How Is the Yearn.Finance Network Secured?

Yearn.finance users can face a high risk of losing money thanks to market conditions changing rapidly and opportunistic entities attempting to profit from less-experienced participants.

Cronje himself has sought to maintain transparency about the platform’s provenance, noting that even after code audits, yearn.finance could not be guaranteed to be 100% safe — DeFi involves inherent risk.

Where Can You Buy Yearn.Finance (YFI)?

YFI is a freely-tradable token, with pairs for cryptocurrencies, stablecoins and fiat currencies all widely available.

Major exchanges trading YFI include Binance, OKEx and Huobi Global, as well as automated market maker (AMM) Uniswap.

New to crypto and want to know how to buy Bitcoin (BTC) or any other token? Find out the details here.

Источник

THORChain Price ( RUNE )

0.0002064 BTC 12.86 %

0.003168 ETH 12.86 %

THORChain Links

Links

Explorers

Community

THORChain Contracts

Please change the wallet network

Change the wallet network in the MetaMask Application to add this contract.

THORChain Audits

THORChain Tags

Property

Please wait, we are loading chart data

RUNE Price Live Data

The live THORChain price today is $7.62 USD with a 24-hour trading volume of $83,583,815 USD. THORChain is down 12.86% in the last 24 hours. The current CoinMarketCap ranking is #57, with a live market cap of $1,626,432,669 USD. It has a circulating supply of 213,536,800 RUNE coins and a max. supply of 500,000,000 RUNE coins.

If you would like to know where to buy THORChain , the top exchanges for trading in THORChain are currently Binance, FTX, HitBTC, Gate.io, and MXC.COM. You can find others listed on our crypto exchanges page.

What Is THORChain (RUNE)?

THORCHain is a decentralized liquidity protocol that allows users to easily exchange cryptocurrency assets across a range of networks without losing full custody of their assets in the process.

With THORChain, users can simply swap one asset for another in a permissionless setting, without needing to rely on order books to source liquidity. Instead, market prices are maintained through the ratio of assets in a pool (see automated market maker).

The native utility token of the THORChain platform is RUNE. This is used as the base currency in the THORChain ecosystem and is also used for platform governance and security as part of THORChain’s Sybil resistance mechanisms — since THORChain nodes must commit a minimum of 1 million RUNE to participate in its rotating consensus process.

THORChain was funded through an initial DEX offering (IDO) which launched through the Binance DEX in July 2019. Its mainnet originally launched in January 2021, but a multi-chain upgrade is currently scheduled for 2021.

Who Are the Founders of THORChain?

According to an official representative of THORChain, the platform has no CEO, no founder and no directors. Instead, the further development of the platform is organized through Gitlab.

On top of this, those currently working on the project are largely anonymous. Again, an official representative of THORChain states that this is to «protect the project and ensure that it can decentralize.»

A tweet by the project sheds some light on the theory behind maintaining a project with an anonymous team, as quoted below:

“-> Developers work for the Nodes, by shipping code that makes the system more valuable.

-> Nodes work for the Stakers, by securing assets and being online.

-> Stakers bring capital, placed on-market for the Swappers.

-> Swappers pay fees, bringing economic activity.”

What Makes THORChain Unique?

THORChain uses a unique system to help mitigate the issue of “impermanent losses” — or the often temporary losses that a liquidity provider can experience when contributing to liquidity pools. It achieves this by using a slip-based fee to help ensure liquidity stays where it is needed.

On top of this, THORChain combines a range of novel technologies, including on-way state pegs, a state machine, the Bifröst Signer Module and a TSS protocol to seamlessly facilitate cross-chain token swaps. This is all kept behind the scenes, making the platform accessible to even inexperienced traders.

The platform isn’t profit-oriented. All fees generated by the protocol go directly to the users, and there are no provisions for the team. Instead, the team is incentivized by simply holding RUNE — just like everyone else.

The RUNE token is currently available on multiple blockchains, including Binance Chain (as a BEP-2 token) and Ethereum (as an ERC-20 token).

Related Pages:

Check out Uniswap (UNI) — the governance token for the popular Uniswap AMM.

Check out 1inch (1INCH) — the native token for the 1inch DEX aggregator.

Have you seen the CoinMarketCap blog yet?

How Many THORChain (RUNE) Coins Are There in Circulation?

As of February 2021, there are 158.4 million RUNE in circulation out of a total supply of 500 million.

As we touched on earlier, THORChain initially launched following an IEO on the Binance DEX. As part of the IEO, 20 million RUNE were sold. Prior to this, a total of 130 million RUNE were sold in earlier funding rounds.

According to the official Binance DEX proposal, 10% of the total supply (50 million tokens) was allocated to the team, and locked until the launch of the mainnet — unlocking at 20% per month thereafter.

THORChain currently has an emission curve starting at 30% APR. This is scheduled to target around 2% APR after ten years.

How Is the THORChain Network Secured?

THORChain is built using the Cosmos SDK and is powered by the Tendermint consensus mechanism. This keeps the network safe from attacks through a novel BFT proof-of-stake (PoS) system that sees a large number of validators work together to propose and finalize blocks of transactions.

Beyond this, THORChain’s smart contracts have been audited by several third-party security firms, including one by Certik — which found no vulnerabilities.

Where Can You Buy THORChain (RUNE)?

RUNE is a popular cryptocurrency that is available to purchase and trade on a large number of both centralized and decentralized exchange platforms. The most prominent of these are Binance (centralized) and SushiSwap (decentralized).

As of February 2021, the vast majority of RUNE trading pairs are crypto/crypto pairs. However, RUNE can be bought with Korean won (KRW) on ProBit Exchange and US dollars (USD) on FTX. For more on buying cryptocurrencies with fiat, see our popular guide.

Here are some other articles that you may be interested in:

Источник