- Bitcoin what is asics

- Bitcoin ASIC development pace

- Bitcoin ASIC specifications

- Comparing Bitcoin ASICs

- Number of cores

- What Is ASIC Mining?

- Table of Contents

- ASIC Mining Companies

- ASIC Mining Explained

- Is Bitcoin Mining Profitable?

- Advantages of ASIC Mining

- Top Cryptocurrencies for ASIC Miners

- Bitcoin (BTC)

- Litecoin (LTC)

- Ethereum (ETH)

- How to Mine Bitcoin With an ASIC

- Things to Consider Before Venturing into ASIC Mining

- Choosing an ASIC Mining Rig

- Choosing the Best Bitcoin Mining Pool

- Choosing the Right Mining Software

- Closing Thoughts

Bitcoin what is asics

An application-specific integrated circuit (abbreviated as ASIC) is an integrated circuit (IC) customized for a particular use, rather than intended for general-purpose use. In Bitcoin mining hardware, ASICs were the next step of development after CPUs, GPUs and FPGAs. Capable of easily outperforming the aforementioned platforms for Bitcoin mining in both speed and efficiency, all Bitcoin mining hardware that is practical in use will make use of one or more Bitcoin (SHA256d) ASICs.

Note that Bitcoin ASIC chips generally can only be used for Bitcoin mining. While there are rare exceptions — for example chips that mine both Bitcoin and scrypt — this is often because the chip package effectively has two ASICs: one for Bitcoin and one for scrypt.

The ASIC chip of choice determines, in large part, the cost and efficiency of a given miner, as ASIC development and manufacture are very expensive processes, and the ASIC chips themselves are often the components that require the most power on a Bitcoin miner.

While there are many Bitcoin mining hardware manufacturers, some of these should be seen as systems integrators — using the ASIC chips manufactured by other parties, and combining them with other electronic components on a board to form the Bitcoin mining hardware.

Bitcoin ASIC development pace

The pace at which Bitcoin ASICs have been developed, for a previously non-existent market, has seen some academic interest. One paper titled «Bitcoin and The Age of Bespoke Silicon» notes:

The Bitcoin and Cryptocurrency Technologies online course by Princeton University notes:

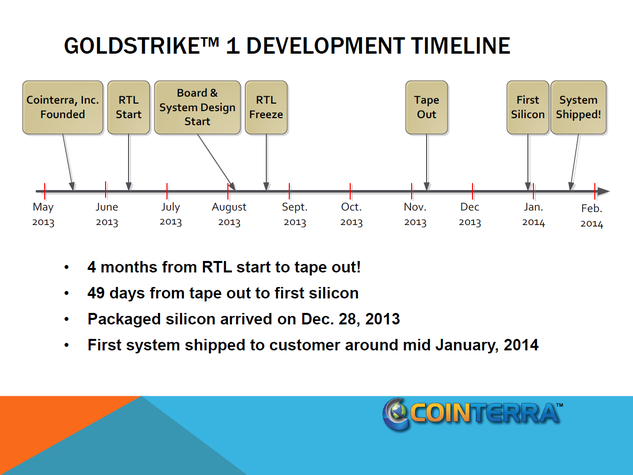

A timeline overview for CoinTerra’s Goldstrike 1 chip also shows this as 8 months between founding the company and shipping a product.

Bitcoin ASIC specifications

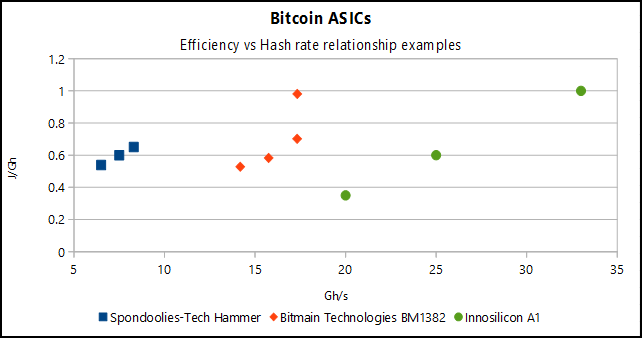

A Bitcoin ASIC’s specification could be seen as having a certain hash rate (e.g. Gh/s) at a certain efficiency (e.g. J/Gh). While cost is another factor, this is often a relatively fixed factor as the minimum cost of a chip will be determined by the fabrication process, while the maximum cost will be determined by market forces, which are outside of post-fabrication technological control.

When reading the specifications for ASICs on this page is that they should be interpreted as being indicative, rather than authoritative. Many of the figures will have come from the manufacturers, who will present their technology in the best light — be that high hash rates that in practice may not be very efficient and require additional cooling, or very high efficiency at a cost of hash rate and risking being slow in the race against difficulty adjustments.

Complicating the matter further is that Bitcoin ASICs can often be made to cater to both ends of the spectrum by varying the clock frequency and/or the power provided to the chip (often via a regulated voltage supply). As such, chips can not be directly compared.

Comparing Bitcoin ASICs

Two proposals have been made in the past for attempts at comparing ASICs — Gh/mm² and η-factor.

Gh/mm² is a simple measure of the number of Gigahashes per second of the chip, divided by its die area (area of the the actual silicon). This measure however does not take into account the node size which affects how many logical cells can fit in a given area.

As a result, η-factor was suggested at the BitcoinTalk Forums which attempts to take the node size into account, by multiplying the Gh/mm² value by the half the node size, three times.

Although the merit of these approaches can be debated, ultimately these figures are not as important as the ones that detail what is required to make an ASIC work. If an ASIC requires highly stable power supply, then the power supply circuitry on a board may be more expensive than for another ASIC. If the ASIC has a complex communications protocol, additional relatively expensive components may be required. If an ASIC’s die is large, fewer (rectangular slices) can be obtained from a (circular) wafer, defects affect its design dispropotionately, and cooling solutions are generally more complex compared to smaller die chips which in turn have other overhead. Chips with a BGA design are less simple to integrate than a QFN, requiring more expensive (inspection and testing) equipment.

Nevertheless, for historic purposes they are included in listings here where sufficient information is available.

Number of cores

One other oft-mentioned number statistic for an ASIC chip is the number of cores or hashing engines that are on the chip. While this number is directly related to performance, it is not necessarily a comparitive relation.

Bitmain Technologies’ BM1382 calculates 63 hashes per clock cycle (Hz), while their more efficient BM1384 calculates 55 hashes per clock cycle. Similarly, while these hashes per clock cycle are spot-on for the claims regarding the number of cores, BitFury’s BF756C55 is claimed to have 756 cores, but yields around 11.6 hashes per clock cycle. This is because the reference to cores sometimes mean different things, and certain designs result in less straightforward calculation [1]

Nevertheless, when a designer makes claims regarding hash rates at certain clock frequencies, one can determine if A. there is a straightforward calculation and B. if the designer is being imprecise (rounding values) or even intentionally dishonest, as the ratio between clock cycles and hash rate should remain the same.

Источник

What Is ASIC Mining?

Mining cryptocurrency may seem like an easy way to make a quick crypto — here, we explain the intricacies of ASIC mining.

Table of Contents

In Bitcoin’s very early days at the beginning of the 2010s, any cypherpunk with a half-decent computer CPU had ample processing power to mine and earn thousands of BTC as block rewards in no time. However, as more users got into the game, BTC mining difficulty increased and a mining arms race kicked off in earnest. The math was simple, whoever garnered the most hash power would get the Bitcoin.В

This eventually led to the creation of powerful mining rigs requiring more robust mining devices known as application specific integrated circuits (ASICs).В

For the original class of Bitcoin miners, ASIC machines quickly became a curse word as it gave companies and individuals with deeper pockets an insurmountable advantage when it came to mining BTC. As time progressed, it soon became clear that there was no way for even the best gaming rig to compete with a dedicated ASIC device that’s geared for one purpose and one purpose only — mining as much crypto as possible.В

ASIC Mining Companies

ASIC devices came to prominence through a Chinese company called Bitmain. Notably, Bitmain dominates ASIC Bitcoin mining activities through its AntMiner product range.В

The Antminer S9, released in May 2016, was the leader in mining during Bitcoin’s 2017 bull run and helped Bitmain’s value reach billions of dollars. Unfortunately, Bitmain has seen a power struggle in recent years between co-founders Jihan Wu, the Bitcoin Cash advocate, and Micree Zhan, which has adversely impacted the company. In January 2021, Wu announced that he would be leaving the company as CEO and chairman after reaching an amicable settlement with Zhan. After failing in its quest for an IPO in 2018 in Hong Kong, Bitmain is rumored to be gearing up for another attempt in 2021.В

Other mining startups like Canaan, Bitfury and KnCMiner also thrive. And in 2018, Halong Mining made a stab at the monopoly of AntMiner through its Dragonmint T1 ASIC-based blockchain mining device.This leveled the playing field just a little bit.

ASIC Mining Explained

ASIC mining is essentially the process of mining cryptocurrencies like Bitcoin using ASIC rigs. An ASIC miner is a piece of equipment that is purposely-built solely for mining. Unlike other types of mining devices, ASICs can only be used to mine cryptos and nothing else.

Mining is an activity that is required by a proof-of-work (PoW) blockchain to carry out its operations. It involves making complex calculations to solve a mathematical puzzle, which miners compete in order to earn a block reward.

Bitcoin’s anonymous creator, Satoshi Nakamoto, envisioned a scenario of increased Bitcoin mining difficulty when more mining devices plug into the network. With the growing number of powerful mining devices, miners are incentivized to invest in ASIC hardware to give them the highest chance of successfully mining a block.

Note that each ASIC device is designed to mine a particular coin (or rather, a particular algorithm). For example, a Bitcoin ASIC miner can only mine BTC, while a Litecoin ASIC miner only interfaces with the LTC blockchain. This is because each digital currency has its own cryptographic hash algorithm, which ASIC devices are intended to match. Bitcoin, for instance, uses the SHA-256, while Litecoin uses Scrypt.

Is Bitcoin Mining Profitable?

Yes, Bitcoin mining is profitable, but it’s a little more nuanced. In the early days, things were simple. Standard CPUs handled BTC mining, and the rewards were 50 BTC for every successfully mined block. Today, the cost of running a BTC miner is higher while the rewards (amount of BTC) are lower, with current block rewards only 6.25 BTC following the 2020 Bitcoin halving. Furthermore, mining Bitcoin with CPUs has not been profitable for a long time.В

However, while the block rewards were higher back then, the prices were also substantially lower compared to today. This makes ASIC mining not only a worthwhile endeavor, but also a reasonably profitable venture.

The tricky bit is that you have to consider so many metrics before diving into the space, the most pertinent of which are electricity cost and the AntMiner price.В

The Antminer price is determined by, among other things, its model and hash rate, which is a measure of its computing power. The higher the better, but also the more expensive.

Later in this article, we’ll look at how to calculate an ASIC’s mining profitability by factoring in the hash rate, Antminer price and electricity cost.

Advantages of ASIC Mining

ASIC mining may be more costly than all other mining schemes in terms of hardware, but it has some key benefits. For example:

- Easy to set up — Thanks to their specialized nature of mining a single coin, they have plug and mine capabilities.

- High mining efficiency – ASICs have high computation powers and efficiency compared to GPUs and CPUs.

- Relatively high profits – With an ASIC’s power, you are almost assured of getting a bulls’ eye and earning rewards faster than with any other type of hardware.

- Low energy consumption – Thanks to mining innovations in recent years, these devices have been designed to consume less energy relative to their computing power, compared to other mining models.

Top Cryptocurrencies for ASIC Miners

Bitcoin (BTC)

Top on the list is the leading cryptocurrency, Bitcoin. Its phenomenal price increase per coin over the past few years boosts its profitability. Despite the reward to miners being cut in half every four years, the price has consistently increased after a certain period of time with each halving, making it even more profitable, and as a PoW-powered platform, all mining rewards go to miners.

To mint as many BTCs as possible, use the latest or the most powerful ASICs in the industry. Some of the best ASIC Bitcoin miners include the AntMiner S9, which has a hash rate of 13.5 tera hashes per second (TH/s), or the Innosilicon Terminator 2-Turbo with a 24 TH/s hash rate.

Litecoin (LTC)

For those looking to mine something different — like perhaps a blockchain with a lower mining difficulty than BTC — then LTC is a good bet. Although it’s a PoW protocol, it differs from Bitcoin in terms of hashing algorithms, since LTC uses Scrypt. As such, it needs unique ASIC Litecoin miners.

Miners that handle the Scrypt-based cryptocurrencies include the AntMiner L3++ with a hash rate of 596 mega hashes per second (MG/s) or the Innosilicon A4+ with 620 MG/s. In addition, the Innosilicon A6 LTCMaster, with a speed of up to 1.2 Giga hashes per second (GH/s) is a worthwhile investment, although it may come at a higher cost.

Ethereum (ETH)

You may probably think it’s not worth it to mine ETH, since the network is shifting to a proof-of-stake (PoS) system. To some extent, you may be right. However, Ethereum still supports PoW and is likely to do so for a certain period of time since Ethereum 2.0, its PoS upgrade, is a multi-year undertaking.В

Besides, ASIC Ethereum miners are not as costly as Bitcoin’s. Therefore, you have a chance to make easy money from mining the less competitive second-largest cryptocurrency. After all, its decreasing hash rate is ideal for new miners using ASIC devices.

Ethereum utilizes the Ethash hash algorithm. Therefore, the best ETH miners currently are the AntMiner E3, which operates at 190 MH/s, and the InnoSilicon A10 ETHMaster, with a power of up to 485 MH/s. The InnoSilicon A10 Pro’s 700 MH/s puts it among the most efficient ASIC ETH miners in the market.В

How to Mine Bitcoin With an ASIC

Although ASICs have plug-and-mine capabilities, it’s a bit more complicated than simply purchasing hardware and plugging it in. Since it is a business, things like planning for profitably must come into play. Luckily, you can use a Bitcoin mining profitability calculator to estimate the ROI margin before you even step out to shop for those ASICs.В В

A calculator considers crucial metrics such as your mining rig’s hash rate, the current BTC price, the rig’s power consumption and electricity costs. It’ll then show you the profitability per day, month, and year.

CryptoCompare offers a reliable mining profitability calculator. First, you need to follow the steps below to know your hash rate, power consumption, cost per KWh, pool fee, etc. Then click here and input your variables (see step 4).

With Bitmain’s AntMiner devices widely used in the market, it’s good to shop around for a good ASIC Bitcoin miner with the same or even higher computational power. However, if pre-used devices are the only ones within your range, ensure that they’re working correctly before swiping that credit card.

Here are the steps to mine Bitcoin with an ASIC device:

- Choose an ASIC mining rig.

- Choose your mining software.

- Join a reputable mining pool.

- Use a mining profitability calculator to ensure that you’ll profit.

- Create a new Bitcoin wallet for your Bitcoin rewards or use what you already have. This can either be a software or hardware wallet.

And you’re done! The same steps can be applied in mining Litecoin, Ethereum and other digital currencies.В

The next section will elaborate this further.

Things to Consider Before Venturing into ASIC Mining

Before venturing into ASIC mining, it’s best to deeply consider critical things like the mining rig, pool and software.

Choosing an ASIC Mining Rig

Choosing the best rig boils down to your preferred device and your budget. For those looking to buy new machines, going for the latest models is the best choice. However, there are also pre-owned models on online marketplaces such as Amazon and eBay.

The right equipment depends on one’s needs. Some will want to utilize spare space in their garage, while others may be looking to build mini ASIC mining farms.

Whichever the option, there are essential things to consider. For example:

- Hardware – A rig comprises several ASIC devices connected to work as a single unit. Things to look out for in hardware are computational speed and electrical power consumption. Efficiency is also a critical aspect when choosing the hardware. Less efficiency means more electricity costs relative to output, and vice versa.

Motherboard – This is the backbone of the rig because it holds the hardware together. The choice of a motherboard depends on the hardware you want to run on it.

Power supply – Miners need power. How big or small the power supply is relies on the number of powered devices. It also depends on whether you’ll be overclocking your miners, since doing so consumes more power.

Central Processing Unit (CPU) – The CPU coordinates different aspects of the rig, including the ASICs. Therefore, a sound processor is key to ensuring the rig’s smooth running.

Choosing the Best Bitcoin Mining Pool

While it’s possible to be a solo Bitcoin miner, it may require considerable investments in mining devices to find a new block on the BTC-powered blockchain. The next option is to join a mining pool where miners join the power of their rigs, direct it on Bitcoin and share the rewards for any successfully mined block.

Unfortunately, quack pools are also conducting mischievous businesses. To avoid falling prey, consider the following mining pool variables:

- Reputation – Some pools don’t pay miners, while others charge exorbitant rates. The trustworthiness can be seen by analyzing other miners’ comments on different social platforms like Reddit and Twitter. However, be cautious of artificially sounding positive praises. Some players in the crypto industry are known to employ sock puppets, i.e. false online identities used to pad review scores.

Size – A pool’s size is a testament to its reliability, trustworthiness, and influence. Therefore, a bigger pool is oftentimes a better choice since it has a higher hash rate; hence, it has a higher likelihood of uncovering a new block. Consequently, participants of large pools get frequent and consistent rewards.

Payment rules – How often does the pool release funds to miners? Is there a minimum payout? These factors are vital before settling on a Bitcoin mining pool. If the minimum payouts are high, a small miner may need to wait longer before getting their rewards.

Payment rules dictate pool fees and payout methods. Payout methods include DGM (double geometric method), ESMPPS (Equalized Shared Maximum Pay Per Share) and CPPSRB (Capped Pay Per Share including Recent Backpay).

Choosing the Right Mining Software

A mining software is a computer program specially designed to connect the mining hardware and pool. Choosing the wrong BTC mining software will render you unable to connect to a pool or the Bitcoin network itself.В

The best software depends on the target operating system; it will also rely on your expertise. Popular Bitcoin mining software include the MultiMiner (best for beginners), CGMiner (for advanced users) and BitMiner (for a quick setup).

The software can either be free or paid. Some paid versions are subscription-based, while others charge according to your rig’s hash power.

Closing Thoughts

Our quest to find the perfect answer to «what is ASIC mining» has taken us through choosing a mining rig, pool and software, among other details.В

From the above discussion, it’s evident that despite the fact that ASIC Bitcoin mining is very profitable, there are factors to consider before diving in, since it is also competitive. For example, joining a pool is better than solo mining if you lack the financial muscle to build a massive rig set or a mini ASIC farm.

For the best ASIC Bitcoin mining hardware, it’s about your wallet size. If your credit card balance allows, going for high performing devices such as the Dragonmint T1 or the Bitmain Antminer S19 Pro will give higher profits.В

Do, however, keep in mind that with technology, things change very fast. As Moore’s Law predicts, the ASIC miner you buy today at great cost might be an expensive paperweight long before you earn back your return on investment, as newer, more powerful models are released each year.В

Also, the price of Bitcoin is also very important, and if the price drops low enough, you’ll be mining at a further loss. The 2018 crypto winter brought mining companies like Bitmain to its knees due to low Bitcoin prices, and another similar winter could potentially happen again.В

Therefore, make sure to do proper research and exhaust all your options before diving in. Happy mining!В

This article contains links to third-party websites or other content for information purposes only (“Third-Party Sites”). The Third-Party Sites are not under the control of CoinMarketCap, and CoinMarketCap is not responsible for the content of any Third-Party Site, including without limitation any link contained in a Third-Party Site, or any changes or updates to a Third-Party Site. CoinMarketCap is providing these links to you only as a convenience, and the inclusion of any link does not imply endorsement, approval or recommendation by CoinMarketCap of the site or any association with its operators. This article is intended to be used and must be used for informational purposes only. It is important to do your own research and analysis before making any material decisions related to any of the products or services described. This article is not intended as, and shall not be construed as, financial advice. The views and opinions expressed in this article are the author’s [company’s] own and do not necessarily reflect those of CoinMarketCap.

Источник

.png)