- Bitcoin Leverage Trading

- Leverage enables you to get a much larger exposure to the market you’re trading than the amount you deposited to open the trade.

- How does leverage work?

- Benefits of using leverage

- Margin and Leverage

- Boost your trades with leverage at 100X on crypto, 500X on Forex

- Amplify potential returns

- What is margin trading?

- How does leverage work?

- Advantages of using leverage

- Disadvantages of using leverage

- New from Bitvo

- Should you be trading Bitcoin with leverage?

- Leverage rules are a byproduct of history

- BTC borrows from legacy finance

- Margin isn’t leverage

- Margin is fluid

- You can have cash and margin accounts

- How leverage on BTC works

- Liquidation isn’t fun

- Check the fine print

- Leverage varies by exchange for various reasons

- Do you really need all 100x?

- Questions? We’re here 24/7.

- Chat with us

- Email Us

- Call Us

Bitcoin Leverage Trading

Leverage enables you to get a much larger exposure to the market you’re trading than the amount you deposited to open the trade.

How does leverage work?

Leverage is a key feature of a PrimeXBT trading platform, and can be a powerful tool for a trader. You can use it to take advantage of comparatively small price movements, ‘gear’ your portfolio for greater position size, and to make your capital grow faster.

Leverage works by using a deposit, known as margin, to provide you with increased exposure. Essentially, you’re putting down a fraction of the full value of your trade – and PrimeXBT is providing you the rest. Our products allow traders to gain exposure to major cryptocurrencies, such as Bitcoin and Ethereum and others, without tying up lots of capital.

PrimeXBT is an advanced, award-winning margin trading platform offering a wide variety of Bitcoin-based CFDs with added leverage and both long and short positions on stock indices, commodities, forex, and cryptocurrencies.

Our products allow traders to access a vast array of trading instruments and build a diverse trading portfolio, without tying up lots of capital.

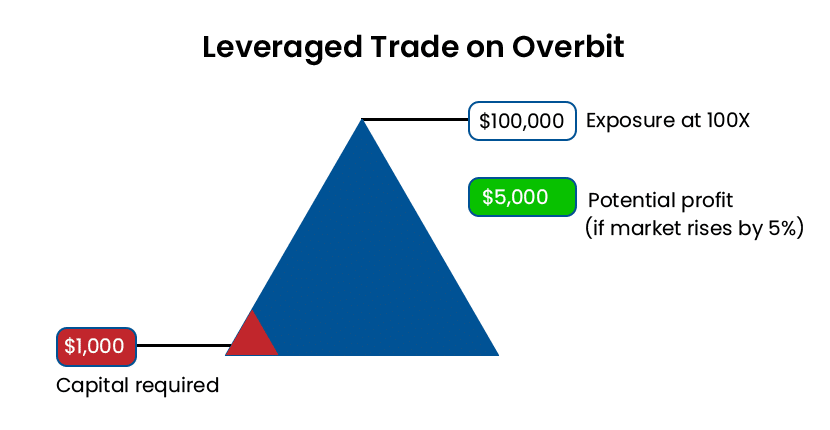

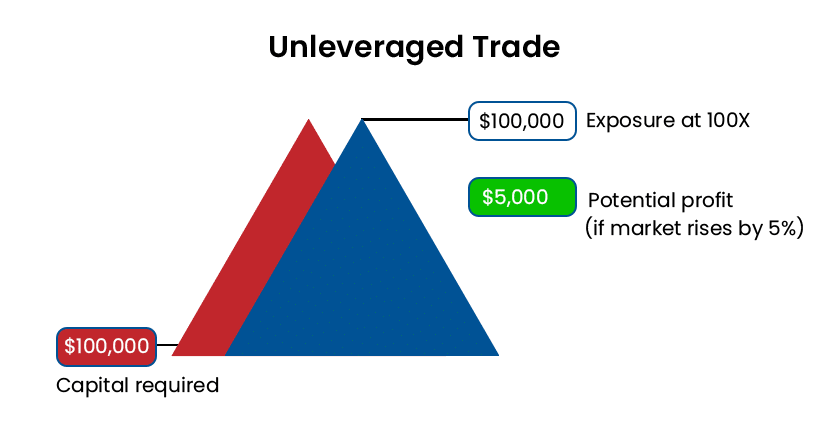

For example, you want to buy 10 Bitcoins at a price of $10,000.

To open such trade with a traditional exchange, you would be required to pay 10 x $10,000 for a position of $100,000 (ignoring any commission or other charges). If the Bitcoin price goes up by 5%, your 10 Bitcoins are now worth $10,500 each.

If you choose to sell, then you’d have made a $5,000 profit from your original $100,000 investment.

Here you’d only have to pay 1% of your $100,000 position, or $1,000 to open such trade. If the Bitcoin price rises by 5%, you would still make the same profit of $5,000, but at a considerably reduced cost.

That means that profits can be hugely multiplied.

Benefits of using leverage

- Magnified profits. You only have to put down a fraction of the value of your trade to receive the same profit as in a conventional trade with any other exchange.

- Gearing opportunities. Using leverage can free up capital that can be committed to other investments. The ability to increase the amount available for investment is known as gearing.

- Gaining from the market fall. Using leveraged products to speculate on market movements enables you to benefit from markets that are falling, as well as those that are rising.

- Products and Tools

- PrimeXBT Platform

- Turbo Platform

- Covesting Module

- All Trading Assets

- Long/Short Trading

- Copy Trading

- Cryptocurrency Trading

- Bitcoin Leverage

- Litecoin Leverage

- Ripple Leverage

- Ethereum Leverage

- EOS Leverage

- BTC/USD Chart

- ETH/USD Chart

- LTC/USD Chart

- XRP/USD Chart

- Forex Trading

- EUR/USD Chart

- GBP/USD Chart

- USD/CAD Chart

- USD/JPY Chart

- AUD/USD Chart

- ETH/BTC Chart

- LTC/BTC Chart

- XRP/BTC Chart

- Indices Trading

- NASDAQ Trading

- Hang Seng Trading

- Japan NIKKEI Index

- FTSE 100 Index

- ASX 200 Index

- DAX 30 Index

- SP500 Index

- NASDAQ Chart

- SP500 Chart

- Commodities Trading

- Natural Gas Trading

- Crude Oil Trading

- Gold Trading

- Brent Chart

- Crude Oil Chart

- Natural Gas Chart

- About

- About Us

- Security

- Fees and Conditions

- Press and Media

- Help Center

- Legal Terms

- Privacy Policy

- Cookie Policy

- Risk Disclosure

- Blog

- Platform announcements

- Technical analysis

- Price prediction

- Market research

- Interesting

- Education

PrimeXBT products are complex instruments and come with a high risk of losing money rapidly due to leverage. These products are not suitable for all investors. You should consider whether you understand how these products work and whether you can afford to take the high risk of losing your money. Seek independent advice if necessary.

This website products and services are provided by PrimeXBT Trading Services LLC

PrimeXBT Trading Services LLC is incorporated in St. Vincent and the Grenadines as an operating subsidiary within the PrimeXBT group of companies. PrimeXBT Trading Services LLC is not required to hold any financial services license or authorization in St. Vincent and the Grenadines to offer its products and services.

PRIMEXBT DOES NOT ACCEPT ANY USERS OR RESIDENTS FROM UNITED STATES OF AMERICA, JAPAN, SAINT VINCENT AND THE GRENADINES, CANADA, ALGERIA, ECUADOR, IRAN, SYRIA, NORTH KOREA OR SUDAN, UNITED STATES MINOR OUTLYING ISLANDS, AMERICAN SAMOA, RUSSIAN FEDERATION AND THE COUNTRIES OR TERRITORIES WHERE ITS ACTIVITY SHALL BE ESPECIALLY LICENSED, ACCREDITED OR REGULATED BY OTHER WAYS. YOU SHALL CHECK YOUR APPLICABLE LAW AND BE FULLY RESPONSIBLE FOR ANY NEGATIVE IMPACT ARISEN FROM YOUR RESIDENCE COUNTRY REGULATIONS. IF YOU ARE TRAVELLING TO ANY OF THESE COUNTRIES, YOU ACKNOWLEDGE THAT OUR SERVICES MAY BE UNAVAILABLE AND/OR BLOCKED IN SUCH COUNTRIES.

PRIOR TO TRADING WITH MARGIN YOU SHOULD CAREFULLY CONSIDER THE TERMS AND CONDITIONS OF THIS WEB-SITE, TO THE EXTENT NECESSARY, CONSULT AN APPROPRIATE LAWYER, ACCOUNTANT, OR TAX PROFESSIONAL. IF ANY OF THE FOLLOWING TERMS ARE UNACCEPTABLE TO YOU, YOU SHOULD NOT USE THE WEB-SITE, AND TO THE EXTENT PERMITTED BY LAW, YOU AGREE NOT TO HOLD ANY OF THE COMPANY AND ITS RESPECTIVE PAST, PRESENT AND FUTURE EMPLOYEES, OFFICERS, DIRECTORS, CONTRACTORS, CONSULTANTS, EQUITY HOLDERS, SUPPLIERS, VENDORS, SERVICE PROVIDERS, PARENT COMPANIES, SUBSIDIARIES, AFFILIATES, AGENTS, REPRESENTATIVES, PREDECESSORS, SUCCESSORS AND ASSIGNS LIABLE FOR ANY LOSSES OR ANY SPECIAL, INCIDENTAL, OR CONSEQUENTIAL DAMAGES ARISING FROM, OR IN ANY WAY CONNECTED, TO THE TRADING WITH MARGIN, INCLUDING LOSSES ASSOCIATED WITH THE TRADING WITH MARGIN.

PLEASE NOTE THAT COMPANY IS IN THE PROCESS OF UNDERTAKING A LEGAL AND REGULATORY ANALYSIS OF BITCOIN TRADING WITH MARGIN. FOLLOWING THE CONCLUSION OF THIS ANALYSIS, COMPANY MAY DECIDE TO AMEND THE INTENDED FUNCTIONALITY IN ORDER TO ENSURE COMPLIANCE WITH ANY LEGAL OR REGULATORY REQUIREMENTS TO WHICH COMPANY IS SUBJECT. WE SHALL PUBLISH A NOTICE ON OUR WEBSITE OF ANY CHANGES THAT WE DECIDE TO MAKE MODIFICATIONS TO THE FUNCTIONALITY AND IT IS YOUR RESPONSIBILITY TO REGULARLY CHECK OUR WEBSITE FOR ANY SUCH NOTICES. ON THE CONCLUSION OF THIS ANALYSIS, WE WILL DECIDE WHETHER OR NOT TO CHANGE THE FUNCTIONALITY OF THE WEB-SITE.

The company does accept only participants:

- he/she/it is of an age of majority (at least 18 years of age), meets all other eligibility criteria and residency requirements, and is fully able and legally competent to use the Website, enter into agreement with the PrimeXBT and in doing so will not violate any other agreement to which he/she/it is a party;

- he/she/it has necessary and relevant experience and knowledge to deal with margin trading, cryptocurrencies and Blockchain-based systems, as well as full understanding of their framework, and is aware of all the merits, risks and any restrictions associated with margin trading, cryptocurrencies and Blockchain-based systems, as well as knows how to manage them, and is solely responsible for any evaluations based on such knowledge;

- Is not a foreign or domestic PEP.

- he/she/it will not be using the Website for any illegal activity, including but not limited to money laundering and the financing of terrorism;

Keep in mind that trading with margin may be subject to taxation. You are solely responsible for withholding, collecting, reporting, paying, settling and/or remitting any and all taxes to the appropriate tax authorities in such jurisdiction(s) in which You may be liable to pay tax. PrimeXBT shall not be responsible for withholding, collecting, reporting, paying, settling and/or remitting any taxes (including, but not limited to, any income, capital gains, sales, value added or similar tax) which may arise from Your participation in the trading with margin.

Content, research, tools, and coin symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular asset or to engage in any particular investment strategy. The projections or other information regarding the likelihood of various investment outcomes are hypothetical in nature, are not guaranteed for accuracy or completeness, do not reflect actual investment results, do not take into consideration commissions, margin interest and other costs, and are not guarantees of future results. All investments involve risk, losses may exceed the principal invested. You alone are responsible for evaluating the merits and risks associated with the use of our systems, services or products.

Источник

Margin and Leverage

Boost your trades with leverage at 100X on crypto, 500X on Forex

Amplify potential returns

Trading cryptocurrency is typically seamless and straightforward unless you’re searching for much more complex options. Enter Margin Trading, which can help you to boost your profits from market swings, allowing you to execute more complex, active trading strategies. With the power of Overbit’s new and improved trading platform, you can use leverage to go long or short on a multitude of cryptocurrencies and Forex markets. You can go up to 100X leverage on cryptocurrency and 500X leverage on Forex. When you compare this to a regular spot trade, you will realize that you have 100 times the earning potential.

What is margin trading?

Margin trading is also known as leveraged trading or contracts for difference (CFD) or swap trading. Margin trading is historically widely used in trading the forex markets to magnify profits from small price movements in currency pairs. The leverage ratio that is allowed in the forex market is one of the highest that investors can use.

Margin trading allows traders to open trade positions larger than their available capital. In favourable circumstances, this translates to higher profits than what the trader would have gained without using leverage.

How does leverage work?

Leverage is the ratio between the amount a trader can trade versus the amount the trader has to place to open the trading position. Leverage can sometimes be expressed as a ratio, for example 100 to 1, or as a multiple amount, for example 100X.

Let’s say the Bitcoin price is $10,000. A trader has $1000 in Bitcoin (0.1 BTC) in their account and wants to open a BUY position using 100X leverage. To put it simply, the trader can multiply 0.1 BTC by 100. This gives them the opportunity to open a BUY position worth 10 Bitcoin or $100,000. The size of the trade is also known as the notional value.

If the price of Bitcoin increases to $10,500, the trader can close their position and take a $5000 profit, plus their original deposit. Therefore, the trader has increased their money by 5X. On the other hand, if the Bitcoin price goes down by $500 to $9,500 – the trader stands to lose the entire $1000 amount put towards this position.

If the trader opened this position without leverage, they would need to deposit the entire $100,000 or 10BTC to get the same amount of market exposure.

Please note: 100X leverage has been used to simplify the maths required for this illustration. This should not be taken as investment advice and you should only trade with high leverage at your own risk and with money you can afford to lose. Please read our risk disclosure statement for more information.

Advantages of using leverage

Magnified profits – As shown in the illustration above, you only need to put down a fraction of the notional value of the trade – yet you gain the benefit as if you had put down the entire amount.

Gain exposure to other opportunities – by freeing up your capital, you can allocate it to other trades, strategies or investment ideas.

Go long or go short – margin trading allows you to speculate on the market whether it is going up or down. If the price of a market is falling, you can open a position by selling the asset. This is known as shorting the market.

Disadvantages of using leverage

Magnified losses – In the same way that a magnified profit can be achieved, if the market moves against you, your losses are magnified too. Therefore, you could lose your entire initial capital on one trade. On Overbit, you will not lose more than your deposit. You should exercise risk management when performing your trades to minimise your losses.

Liquidation – If the market has moved against you and your price is current price is close to the liquidation price, then you will be required to deposit more funds or close the position otherwise you risk getting liquidated where you could potentially lose your entire deposit.

Funding fees – Depending on the direction of your trade could pay or receive funding fees every 8 hours. You can see this in the contract details of the market you are trading. The fee represents an interest payment that is paid to or received from the counter-party of the position you are trading.

Источник

New from Bitvo

Home / Education / Articles / Should you be trading Bitcoin with leverage?

Should you be trading Bitcoin with leverage?

So you heard you could trade Bitcoin with 100x leverage, did you?

You looked around to see how, if you put in this much, and you leverage that much, you could make a killing.

But the text on the page you aren’t looking at has all the details of what could happen if things don’t go your way — words like margin call, liquidation and losses.

Let’s take a look at what trading crypto with leverage is, what you should know before you take the plunge.

Leverage rules are a byproduct of history

Trading with leverage isn’t new. It’s been around for a long time across many different markets. Modern regulations around trading with leverage date back to a significant financial debacle, the crash of 1929.

During the crash, heavily leveraged clients, speculators and brokers, got caught offside as stocks fell. As collateral declined in value, margin deposits were wiped out, and losses exploded. Selling increased the call on these loans, which drove more selling and more pressure on borrowers.

The result of 1929 and the aftermath were comprehensive securities laws in the United States and the establishment of a national regulator. In Canada, the Bank Act of 1934 provided the nation with a central bank while regulation remained a primarily a provincial affair. Today Canadian regulation around trading with leverage across financial products falls under IIROC.

BTC borrows from legacy finance

Leverage is used widely across the entire legacy financial sector. It is used strategically in fund management and various trading strategies. Without leverage, our modern financial markets would not exist.

You can learn about leverage looking at financial markets where cryptocurrency, (ahem), borrowed a number of the concepts. And of course, one cannot look at using leverage to trade Bitcoin without noticing a hint of irony.

After all, Satoshi’s groundbreaking release was a reaction to failing financial markets in 2008, which were heavily influenced in part by excessive leverage.

If you are thinking about trading crypto with leverage, it would be wise to take a closer look at the fine print. In the fine print are the details your eyes glossed over when you saw how much you could make with “one hunned X.”

Margin isn’t leverage

Reading about these leveraged BTC trades, there is the word margin, and there is the word leverage. These are two different things that both apply to the same transaction.

Margin refers to the deposit of cash or some form of crypto, you are required to put into your account. Margin is essentially a security deposit for a transaction in some asset. The margin and the subsequent loan relative to the asset you are buying defines the amount of leverage you are using.

Or put the other way, the amount of leverage you can use in a given transaction tells you how much margin is required and what your loan amount will be.

The cryptocurrency exchange you trade with will tell you whether you can deposit BTC, some other form of crypto, or fiat as margin. Sometimes you can use both.

Margin is fluid

Now, the important thing to remember about this deposit, sometimes called initial margin, is that it isn’t static. Margin is based on a formula, and all of the changes and reasons for those changes in your margin amount are outlined clearly in the fine print on each exchange’s website.

So if the price of the asset you are trading on margin falls (or rises if you are short), you will be required to deposit additional funds. The additional funds are called maintenance, and the call you receive to deposit them is a margin call.

If you don’t post additional funds when you receive a margin call, you will be “liquidated.” While the term sounds a lot like a hangover, it refers to being sold out if you are long, or bought back in, if you are short.

You can have cash and margin accounts

Your crypto margin deposit is placed in a margin account, which is distinct from a “cash” account.

If you trade stocks, you can have a cash account and a margin account for trades and investments on the long side. To trade on the short side, there is only a margin account. In futures, margin is required for every trade, and for options, margin applies to writing or selling naked contracts but not for buying them. This applies to BTC options and futures as well.

We’ll come back to margin in a second.

Now leverage is simply how much more of an asset you control versus how much you have on deposit. Leverage is the ability to control more of an asset with less of your own money.

How leverage on BTC works

If you want to own 1 BTC at $30,000, you can either buy one for $30,000 in your cash account, or you can buy that Bitcoin in your margin account with 10x leverage and a margin deposit of $3,000. A loan of $27,000 supplies the balance of the transaction in your margin account.

If BTC goes up $3,000 to $33,000, your profit in your cash account is 10%, less any fees.

The margin account, on the other hand, has a profit of 100% minus interest on the loan and any fees after the loan is repaid.

Now I know you were looking at that 100% number and thinking to yourself, that’s enough to buy a tire for a Lambo. And that may be true.

But leverage has a nasty little secret. Remember when I mentioned liquidation?

Liquidation isn’t fun

Here’s the thing, leverage works both ways.

If Bitcoin goes the other way, from $30,000 to $27,000, your cash account is down 10%. But if you are trading on margin with 10:1, your margin deposit is now gone. A decline means your account gets a margin call and a request for additional funds or you will be sold out (or bought in if you are short).

Not only that, when you get sold out, any losses above your $3,000 deposit will be added to your account as a debit. So not only do you lose 100% of your deposit, depending on the volatility, you might lose a lot more.

If you’ve ever watched a margin liquidation in the equity markets before, you don’t want the margin manager handling your Bitcoin liquidation trade in crypto. They blow those positions out without mercy.

Now imagine the impact of a trade liquidation on your account using 100x leverage, on an unregulated exchange, in a volatile Bitcoin market with a downside bias. And you thought the flu was bad!

Check the fine print

If you plan to use leverage to trade Bitcoin, you should be aware of a few essential details.

First, you want to look at the security record and procedures of the exchange. After all, they will be taking custody of either your fiat, BTC or some other asset. You also want to understand how much margin is required and how the maintenance process works.

For example, some exchanges might require margin specifically deposited to your margin account. Some exchanges may allow you to use balances in your other accounts (if you have them) at that exchange as the maintenance without having to transfer funds.

Margin and maintenance calculations have clearly articulated formulas on every exchange’s website, so there should be no surprises.

Leverage varies by exchange for various reasons

You may want to consider what types of assets are required for deposit and if you have the option, whether fiat is better than using BTC in this instance.

Make sure you understand the loan values and their time period. Crypto margin account loans are often charged hourly.

When it comes to the amount of leverage available, this varies with each exchange, type of product, and whether or not the exchange adheres to regulation.

So crypto futures will typically allow for higher leverage than non-futures crypto exchanges. Exchanges that are subject to regulation will also typically have lower leverage rates than exchanges that remain unregulated.

There may be some leverage restrictions based on the size of your account, experience and transaction frequency.

Do you really need all 100x?

The key point to remember is that even when leverage is offered or available, it doesn’t have to be used. And just because you can use up to 100x, doesn’t mean that you should.

Leverage is a fundamental part of certain types of financial assets. It is a crucial feature of commodity futures and currency trading. It has a role in part of options trading. Margin account loans for equities are a valuable source of revenue for brokerage firms. They also generate fees for lending out qualified equities for short sales in margin accounts.

Using leverage for trading Bitcoin is neither good nor bad, but rather a tool that can provide different advantages and disadvantages

Remember to stay on top of your risk management and use some trading rules when you trade in markets where leverage is present, whether you use it or not.

If you do use it, read all the print on the page, not just the marketing schtick about how much you can make.

Because it’s nice to dream about the new car with your profits using 100x leverage. Just make sure you don’t have to sell the old car if that leveraged trade you’re imagining, leaves a smouldering hole in your account.

You can buy, sell, and trade Bitcoin in Canada, on Bitvo’s fast, secure, and easy to use cryptocurrency exchange platform.

Bitvo’s clients also get exclusive access to the Bitvo Cash Card. All you have to do is register below.

Ready to get started? Begin trading today.

Questions? We’re here 24/7.

Get in touch with our support team.

Chat with us

Start an online chat to get instant answers to your questions.

Email Us

Send us an email, and we’ll get back to you right away.

Call Us

Our support team is standing by to take your call.

Источник