- Bitcoin Realized HODL Ratio

- Introducing Realized HODL (RHODL) Ratio

- Some caveats

- Where are we now and live data chart

- Philip Swift (@PositiveCrypto)

- What The Puell Multiple, The MVRV Z-Score and Realized Cap HODL Waves Indicate for Bitcoin’s Peak

- @ MarkHelfmanMark

- The Puell Multiple

- The MVRV Z-Score

- Realized Cap HODL Waves

- But April 2013 wasn’t a peak!

- Behavior as data

- Respect the Metrics

- Bitcoin realized cap hodl waves

- Subscribe to Look Into Bitcoin

Bitcoin Realized HODL Ratio

Philip Swift (@PositiveCrypto)

Dec 15, 2020 · 6 min read

A New On-Chain Indicator For Accurate Identification of Bitcoin Global Cycle Highs.

This new indicator builds on previous ideas developed in the blockchain analysis space. If you’re not familiar with them, I highly recommend taking the time to review them as they are excellent and, in my opinion, were pivotal pieces in moving forward the thinking around blockchain analysis:

To keep this article brief, I will assume that the reader is broadly familiar with those tools. Three important terms from those articles to remember:

- Market Value: Also known as market capitalization, to calculate it you would multiply current BTCUSD trading price by the number of bitcoins mined thus far. Very much like Market Cap in traditional markets where one multiplies the share price by number of shares for a given company.

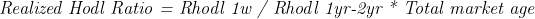

- Realized Value: Instead of counting all of the mined coins at equal current price, the UTXOs are aggregated and assigned a price based on the BTCUSD market price at the time when said UTXOs last moved from one wallet to another wallet. It can be thought of as the cost basis for coins currently held.

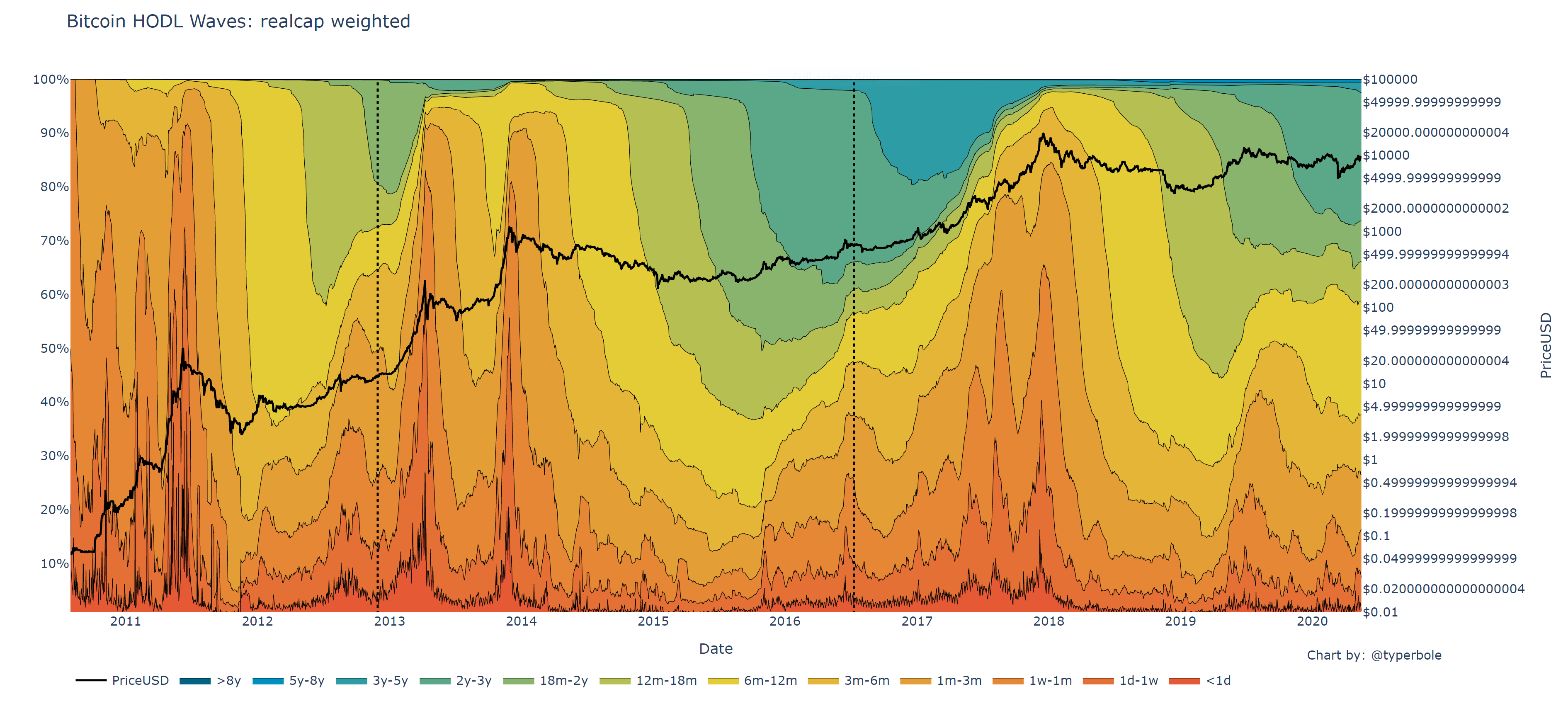

- HODL Waves: Groups UTXO’s by age since they were last moved. When these different groups by age are charted, they look like waves. Hence the term HODL waves.

Recently @typ e rbole created a version of HODL waves where the UTXO’s in each age band were weighted by their Realized Value price. The result looks like this:

Introducing Realized HODL (RHODL) Ratio

This new indicator aims to identify extremes in market psychology over time to accurately identify Bitcoin global cycle highs and lows.

It achieves this by analysing Realized Value HODL waves that are made up of coins that have last moved recently on a short time frame (the past week) versus Realized Value HODL waves made up of coins that last moved much further in the past and on a longer time frame (1–2 years ago).

It then also calibrates for the principle that due to Lindy Effect it becomes easier for HODL’ers to HODL over time, and also to account for lost coins. It does this by multiplying the Realized HODL Ratio result by number of days since the data set started. I start my data set in August 2010 around the time an exchange-listed price for Bitcoin began to operate.

Therefore the formula for Realized HODL Ratio is:

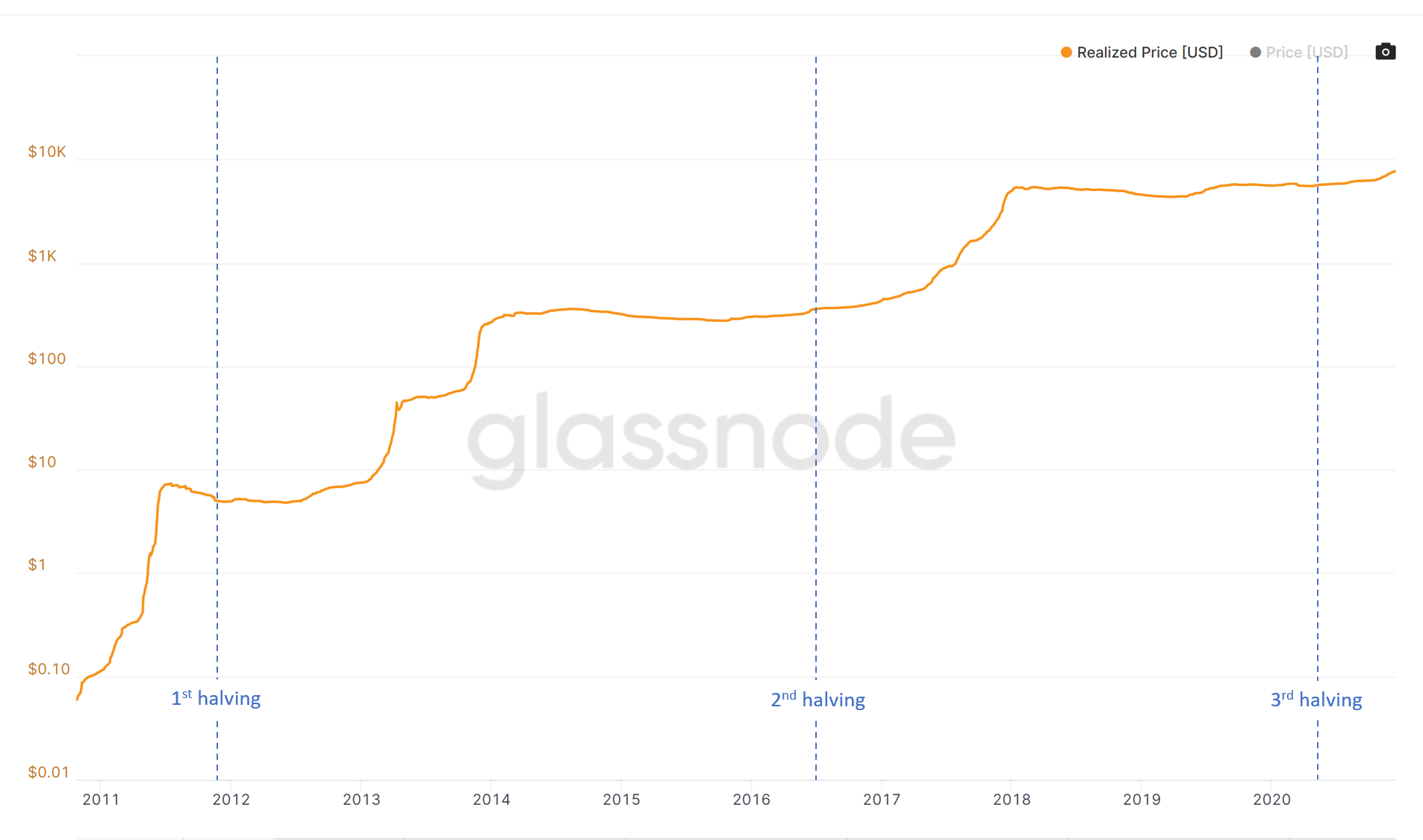

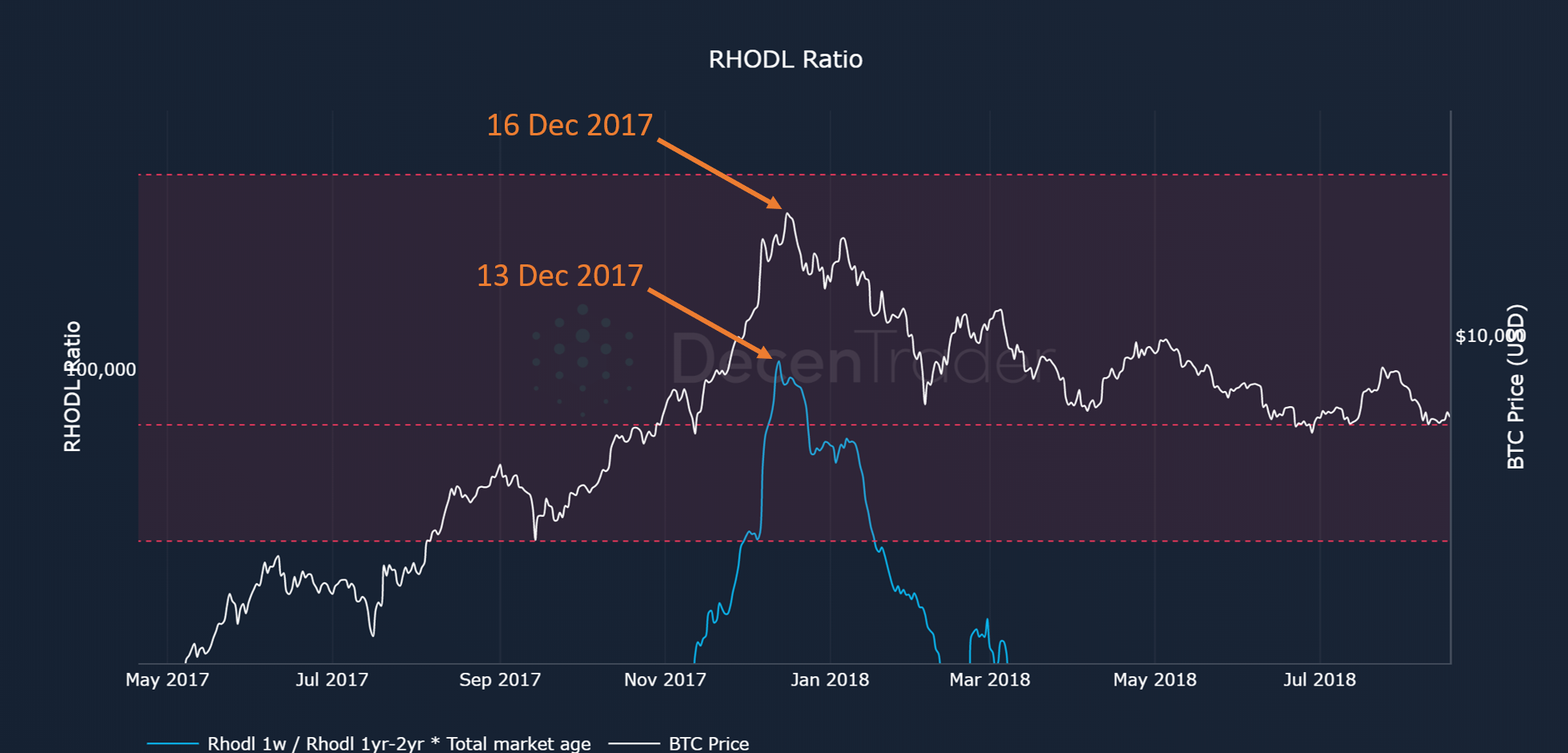

The resulting indicator highlights when shorter-term Realized HODL waves are worth considerably more or less versus longer-term Realized HODL waves. Which in turn highlights the major cycle tops of Bitcoin’s price cycles with great accuracy and consistency…within 1 week of the market topping for each cycle:

Realized HODL Ratio is arguably effective because it captures the speculative boom/bust market psychology of Bitcoin as it moves through its adoption phase market cycles. These cycles are in part driven by the halving schedule and the continued adoption of Bitcoin over time. This can be visualized when overlaying the Bitcoin halving events with Realized Value, where we see on macro timescales to date, how Realized Value sets a base level over a 1–2yr period prior to the halving before then accelerating as market fervour commences.

The RHODL Ratio is noteworthy because it provides some different and interesting results versus other on-chain indicators:

A notable issue with on-chain indicators to date that attempt to pick global cycle tops and bottoms is that they provide what could be argued as a false sell signal in 2013.

In April 2013, $BTC price reached $230 before retracing and then accelerating back up to the actual macrocycle top of $1,130 seven months later, in November 2013. Theoretically, an investor relying on these tools would have sold the $230 area and waited for a buy signal (indicator entering the equivalent of the green zone on the chart below) before re-entering. In this instance, there was no buy signal across those indicators and the investor would have missed the subsequent run-up to $1,130.

While an investor should never rely on such tools in isolation, it is not particularly satisfactory that on-chain tools highlight April 2013 as a global cycle top. As can be seen below, this issue does not occur with Realized HODL Ratio:

2. Accurate at calling tops:

While the pink band can be used to scale out of $BTC investments, Realized HODL Ratio correctly identifies market cycle tops to within 1 week of the market topping out.

3. Minimal indicator downward drift over time:

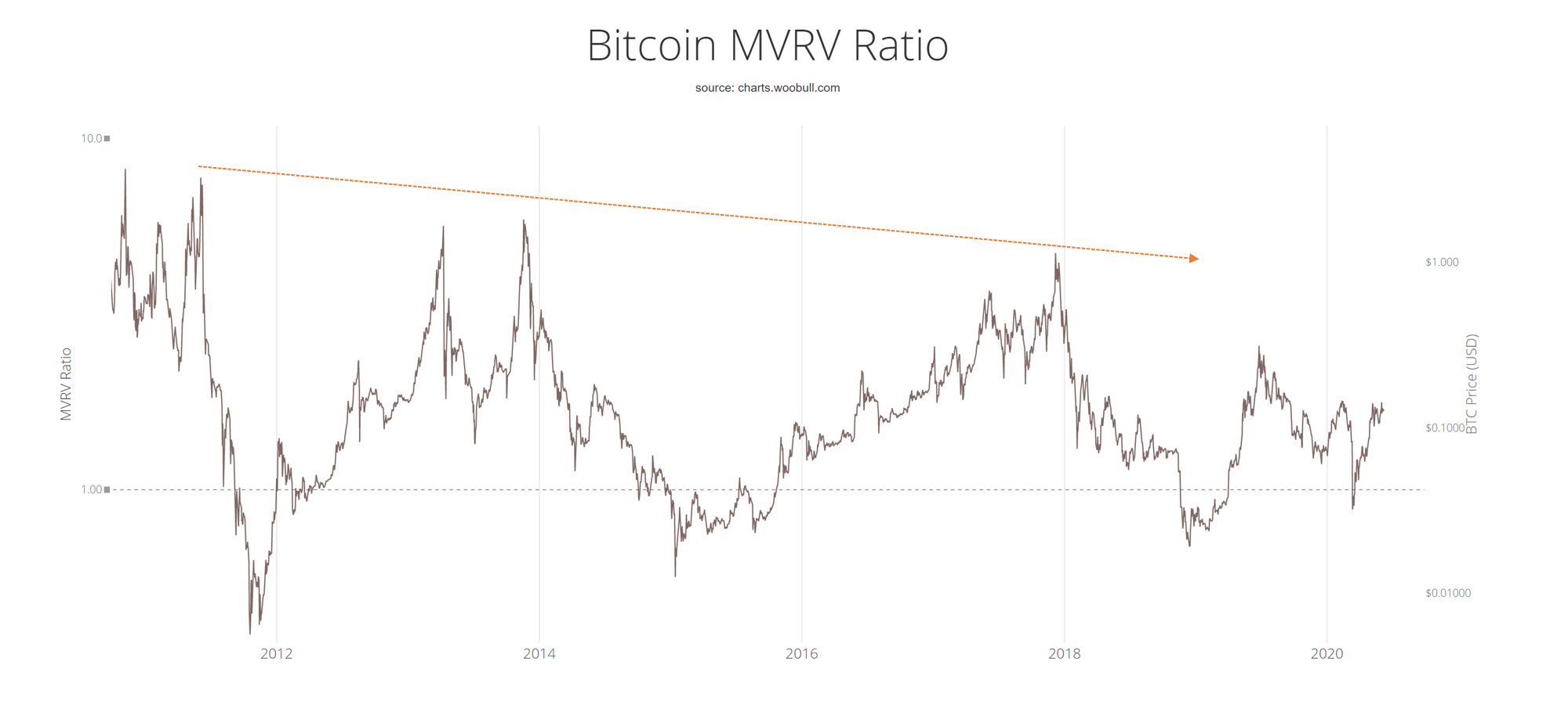

MVRV and some other on-chain indicators appear to be drifting downwards over time which will add difficulty to timing future cycle tops. As David Puell explains:

Going forward, as market cap decreases in volatility, we believe that the upper threshold of MVRV might not prove as reliable — as market cap overextends less and less above realized cap as time progresses.

While not totally exempt from this issue, Realized HODL Ratio appears to have far less downward drift over time allowing for greater confidence in identifying forthcoming market cycle tops.

Some caveats

- Market Cycles: Realized HODL Ratio uses it’s 1–2yr HODL period as a base time period to compare short term activity against. Therefore it relies on Bitcoin continuing to grow in a broadly consistent manner over time. While this is likely for the next 3-5 years due to halving effects and adoption rates, nothing is guaranteed.

- Market Structure: It is likely that market cap volatility will decrease over time, which will impact Realized HODL Ratio’s ability to signal tops. As with other indicators, it may struggle to signal a market top should we see prolonged drops in volatility and rounded tops in Bitcoin’s price structure in the future.

Where are we now and live data chart

Currently, RHODL Ratio is indicating that we are in the early stages of a bull market having moved out of the green accumulation band. Current RHODL ratio levels are comparable with early bull market stages of 2013 and 2016.

This suggests that there remains plenty of upside this coming bull run before we enter the overbought red zone.

You can click here (night mode) or here (day mode) to access a live interactive data chart of RHODL Ratio.

Thanks and reference

Thank you to Glassnode for supplying the underlying data sets for this analysis and the RHODL live charts.

Thank you also to Rafael Schultze-Kraft, David Puell, Filbfilb and Willy Woo for reviewing and providing feedback on initial drafts.

Philip Swift (@PositiveCrypto)

Crypto Trader and Investor. Market Cycles + Blockchain Analysis + Market Psychology. Follow me on Twitter for my analysis @positivecrypto

Источник

What The Puell Multiple, The MVRV Z-Score and Realized Cap HODL Waves Indicate for Bitcoin’s Peak

@ MarkHelfmanMark

Editor, Crypto is Easy newsletter. #1 writer, Medium. Bitcoin author, analyst, commentator.

Bitcoin’s price is down almost 30% from its all-time high of $65,000.

Some fear the top is in. The bull market’s over. Bitcoin peaked in April.

Is that possible?

Thanks to the transparency of bitcoin’s blockchain, we have data to answer that question.

When you look at spending behaviors, money entering and leaving exchanges, gains and losses among bitcoin wallets, and other information about what people do with bitcoin, you can spot certain patterns that emerge when bitcoin nears its market cycle tops but never any other time.

Three metrics — Puell Multiple, MVRV Z-score, and Realized Cap HODL Waves — can help you decide whether an upswing marks the peak of the market or just the ebbs and flows of a very volatile asset.

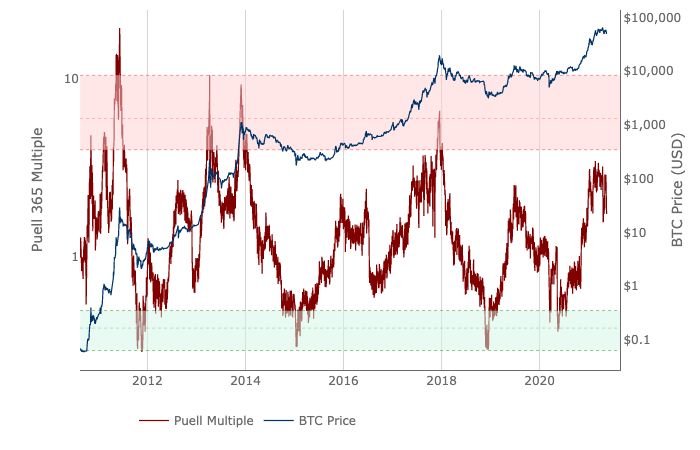

The Puell Multiple

The Puell Multiple compares the price of a newly mined bitcoin with the average market value of all mined bitcoins over a given period of time.

When the Puell Multiple gets high, miners tend to sell en masse.

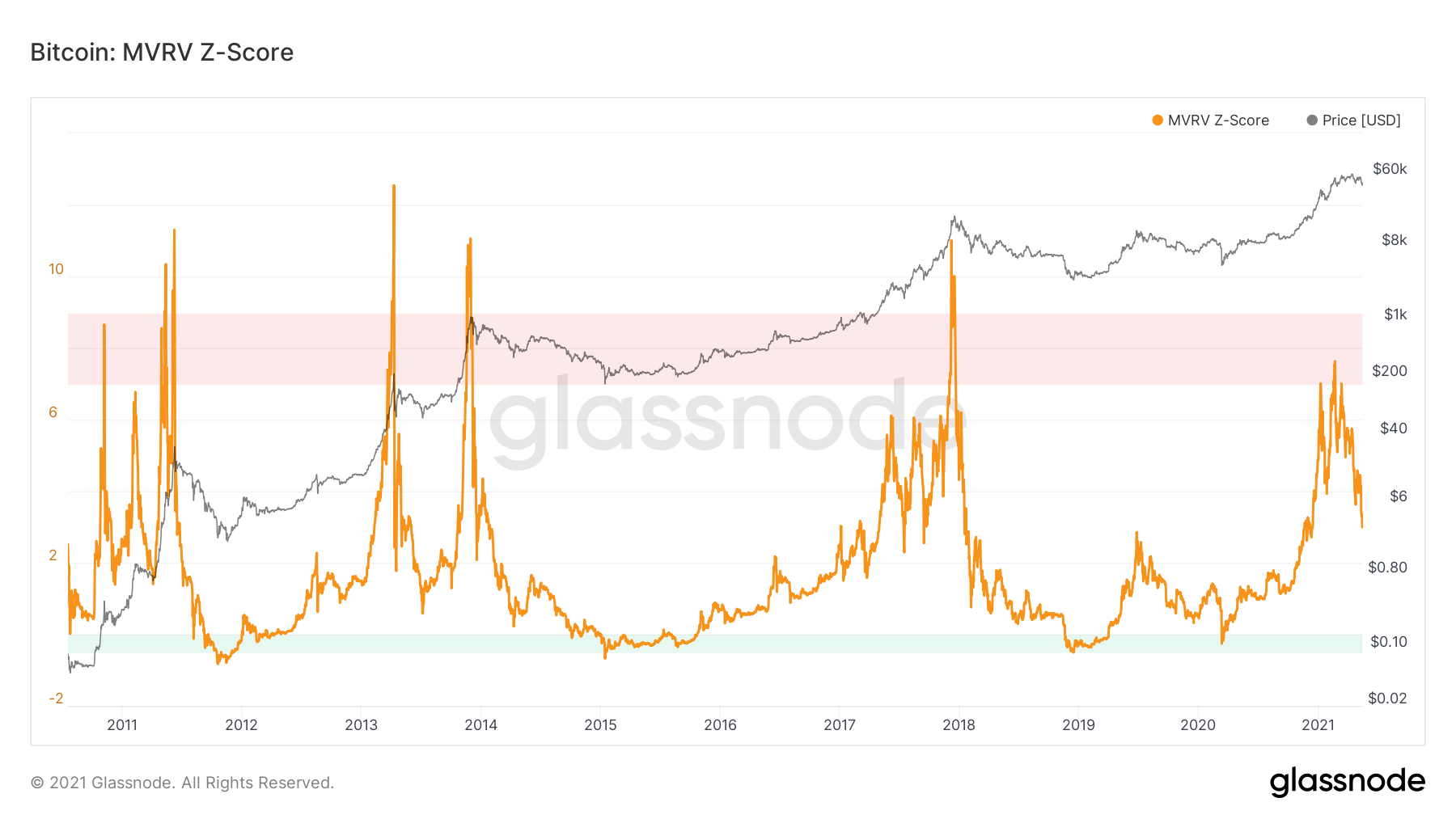

The MVRV Z-Score

MVRV Z-score measures the difference between bitcoin’s present price and the average price people paid for it. When the score gets high, people convert bitcoin into other things.

Maybe they want to cash out their new fortune? Perhaps they fear the market will crash?

For whatever reason, they tend to sell en masse, too — like the miners.

Every bitcoin bull market has ended with the MVRV Z-score at extreme levels.

Realized Cap HODL Waves

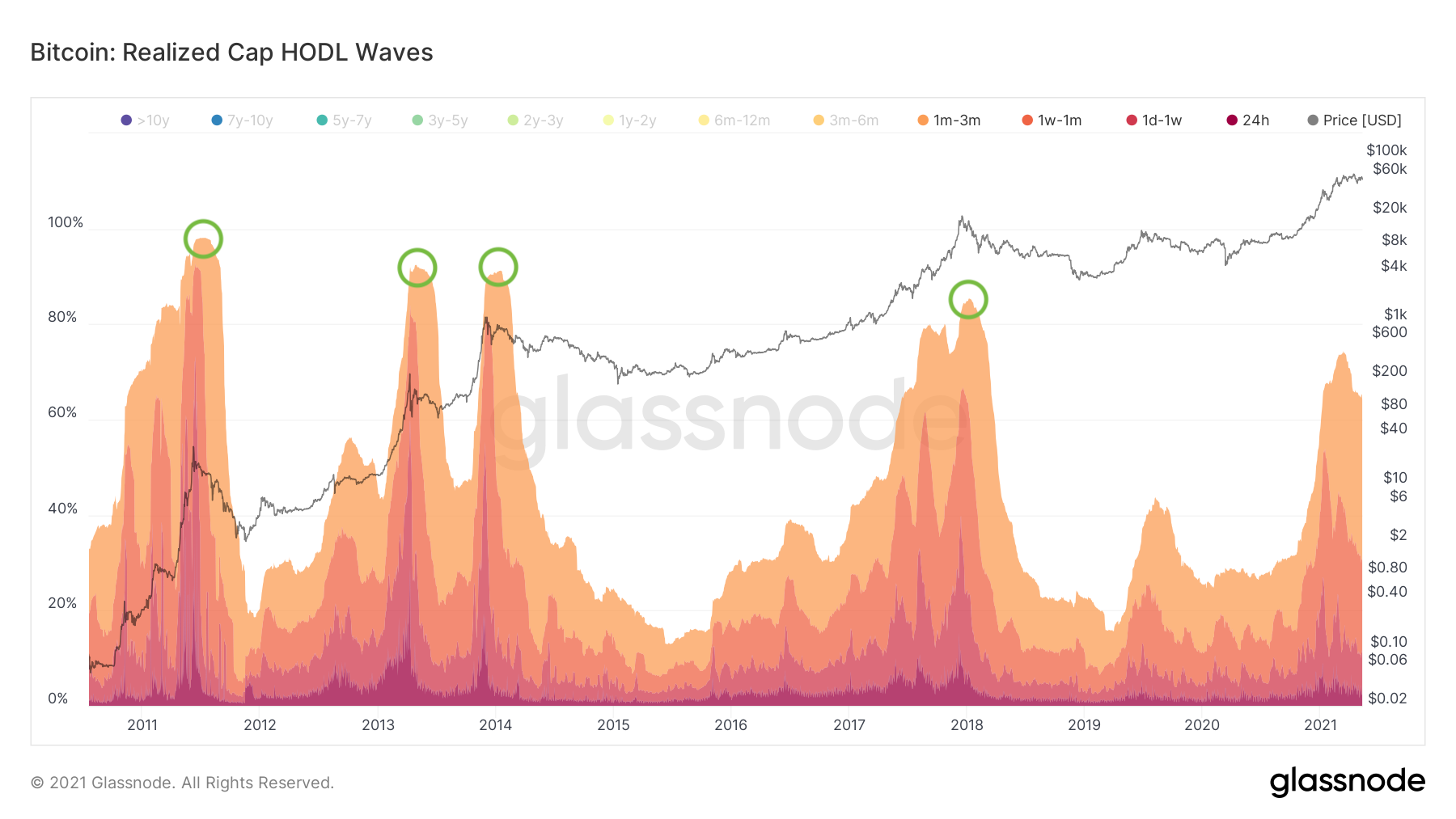

While the Puell Multiple and MVRV Z-score can reliably signal market peaks, realized cap HODL Waves offer clues about how close or far those market peaks might be.

Unlike the traditional HODL waves that capture transactions, realized cap HODL waves factor in the realized price of bitcoins that have not moved within certain time frames.

While the full chart gets messy, I pulled out the waves for short-term HODLers, those who have held bitcoin for three months or less. See below, courtesy of Glassnode.

Historically, bitcoin peaks when at least 80% of its market value falls into these bands. Each previous market cycle peak is circled.

But April 2013 wasn’t a peak!

Yes, many people say that.

According to these three metrics, April 2013 marked the top of a 77-week bull market. For the latter part of that run, bitcoin’s price went up for 12 of 13 months.

What followed? An 83% correction. It took almost seven months for bitcoin’s price to recover.

I can understand why people say April 2013 was not a market cycle peak. That’s a fair point — but it was certainly something you’d want to avoid. With this data, you would’ve side-stepped it.

Behavior as data

The MVRV Z-score and Puell Multiple both measure human behaviors and impute all of the movements of bitcoin from all entities. When they both hit their peaks at the same time, bitcoin hits its peak, too.

At the same time, realized cap HODL Waves confirm the strong hands have moved nearly all of their bitcoin to new entrants, generally people who buy less often, purchase smaller amounts when they do, and sell more quickly when the price drops or when prices go too high, too fast.

As a result, bitcoins flood the market and overwhelm buyers.

That’s happened only four times in bitcoin’s history. Each time, bitcoin’s price dropped at least 67% in the month afterward and as much as 90% to the eventual bottom.

For an asset where big crashes are the norm and every boom seems to go parabolic, this data tells you when to exit or accumulate.

Respect the Metrics

Where can you find these charts?

I advise starting with these websites:

I’m certain you can find other people who publish this data.

I analyze these and other charts in my newsletter, Crypto is Easy, and they form the basis for my plan for bitcoin’s bull market, which I share with subscribers.

What did those three metrics say about the April 16, 2021 all-time high of $65,000?

Definitely not the peak of the bull market.

As we’ve seen for the entirety of bitcoin’s history, it can go up during bear markets and down during bull markets.

While this drop is nothing to worry about, keep these metrics handy for the next time you see extreme movements in bitcoin’s price.

With 1,000% returns seemingly mundane over the course of a full bull market and 80% losses standard for each bear market, even a small advantage can mean the difference between a devastating loss and a massive windfall.

Mark Helfman publishes the Crypto is Easy newsletter. He is also the author of three books and a top bitcoin writer on Medium and Hacker Noon. Learn more about him in his bio.

Источник

Bitcoin realized cap hodl waves

This indicator uses a ratio of Realized Value HODL Waves.

In summary, Realized Value HODL waves are different age bands of UTXO’s (coins) weighted by the Realized Value of coins within each band.

The Realized Value is the price of UTXO’s (coins) when they were last moved from one wallet to another.

RHODL Ratio looks at the ratio between RHODL band of 1 week versus the RHODL band of 1-2yrs.

It also calibrates for increased hodl’ing over time and for lost coins by multiplying the ratio by the age of the market in number of days.

When the 1 week value is significantly higher than the 1-2yr it is a signal that the market is becoming overheated.

How to Use this Indicator

The indicator is able to identify with great accuracy the price high of each of Bitcoin’s previous macro cycles.

It identifies the market top to within a few days accuracy.

RHODL ratio entering into the red band signals that the market is approaching the top of its cycle. This has historically been a good time for investors to take profits in each cycle.

Unlike other on-chain indicators, RHODL ratio does not give a false signal of a cycle high in April 2013. This gives it a unique advantage over other on-chain indicators.

Created by

Date created

Fall Further Down the Rabbit Hole

Any information on this site is not to be considered as financial advice. Please review the Disclaimer section for more information.

Subscribe to Look Into Bitcoin

Sign up today and receive:

- Indicator email alerts for critical levels

- Monthly newsletter

- Private Tradingview indicator scripts

Subscribe

Источник