- Bitcoin Halving Reward and Price History Analysis: Part III

- Bitcoin (BTC) Halving History With Charts & Dates

- What is a Bitcoin Halving?

- Unlock your financial freedom

- When was the last Bitcoin Halving?

- Bitcoin Halving Chart with Dates

- 1) Pre-Halving Era

- 2) 1st Halving Era

- 3) 2nd Halving Era

- Bitcoin stock to flow model

- Bitcoin Halving 2020

- Bitcoin Halving: Price Effects and Historical Relevance

- Issuance Schedule

- Halving’s Historical Effect on Price

- First Halving

- Second Halving

- Third Halving

- Future Incentive Mechanisms

- Conclusion

Bitcoin Halving Reward and Price History Analysis: Part III

Bitcoin Halving Reward and Price History Analysis: Bitcoin Price Target $309,269 by Aug 2021

Interpretation:

1) The orange vertical lines are 1 year before the bitcoin halving. The next 1 year before the halving is May 2019. The bitcoin market usually starts a bull market 1 year before the halving.

2) The blue vertical lines are the bitcoin halving dates. The next halving date is May 2020. The previous halving dates were Nov 2012 and July 2016.

3) The green vertical lines are a time projection of when we should return to all time new highs based on the last bitcoin halving cycle.

4) The red vertical line prior to 2019 represent all time highs for a given halving cycle.

5) The red vertical line after 2019 is a price projection of the next new high based on the 2020 halving cycle. The high of the 2020 cycle should come on August of 2021.

6) The red horizontal line is a price prediction of the next new high of the 2020 halving cycle. The bitcoin price high prediction on Aug 2021 is $309,269

7) The white trend lines trace the projected price movement produced by the halving cycle.

9) The purple box lines trace the bitcoin bear market cycle from the high to the low and back to the old high.

10) The purple curved lines represent conservative price trajectories during the bull runs.

11) The yellow horizontal lines provide the estimates of the times between important halving cycle events. Bars represents months and D represents days.

Special Update Notes From Previous Analyses

*) I switched the blue and green vertical lines from earlier halving analyses.

**) The November 2013 vertical lines looks orange because the the yellow vertical line and red vertical line came at the same time: one year after the halving was the price high of that halving cycle.

Источник

Bitcoin (BTC) Halving History With Charts & Dates

Blog Home › Uncategorised › Bitcoin (BTC) Halving History With Charts & Dates

The next Bitcoin halving will soon be upon us, and many people expect it to have a positive effect on the Bitcoin price. The third such event in Bitcoin’s history, it’s projected to occur in mid-May of this year.

If you’re unsure how halvings work or why they’re significant, you may also be wondering why they’re relevant to price. In this article, we’ll explain what a Bitcoin halving is, and will look at its historical price impact.

What is a Bitcoin Halving?

For every block a miner adds to the blockchain, he or she is rewarded with a certain amount of newly-created Bitcoin. Yet there is also a finite number of Bitcoins that can ever be created. In order to extend the life of Bitcoin and ensure that it remains a deflationary asset, Satoshi Nakamoto wrote into Bitcoin’s code that the supply of new BTC awarded to miners is halved every 210,000 blocks, or roughly every 4 years. For this reason, Bitcoin halvings serve as major milestones in Bitcoin’s timeline, dividing it into distinct periods.

Unlock your financial freedom

But why does this affect the price? Just as multiplying the available supply of fiat currency has dramatic knock-on effects for a country’s economy, most notably rampant inflation, halving the supply of bitcoin is a major economic change with wide-reaching consequences. Increasing supply has the effect of making fiat money less scarce, thus reducing its value—that’s why prices rise rapidly when inflation is high. Decreasing bitcoin supply increases scarcity, which historically has led to a higher value.

When was the last Bitcoin Halving?

The last Bitcoin Halving took place on July 9th, 2016 which caused the block reward to fall from 25 new Bitcoin created to 12.5 new Bitcoin created. As to be expected, there were large fluctuations in the Bitcoin in the months surrounding this event.

Bitcoin Halving Chart with Dates

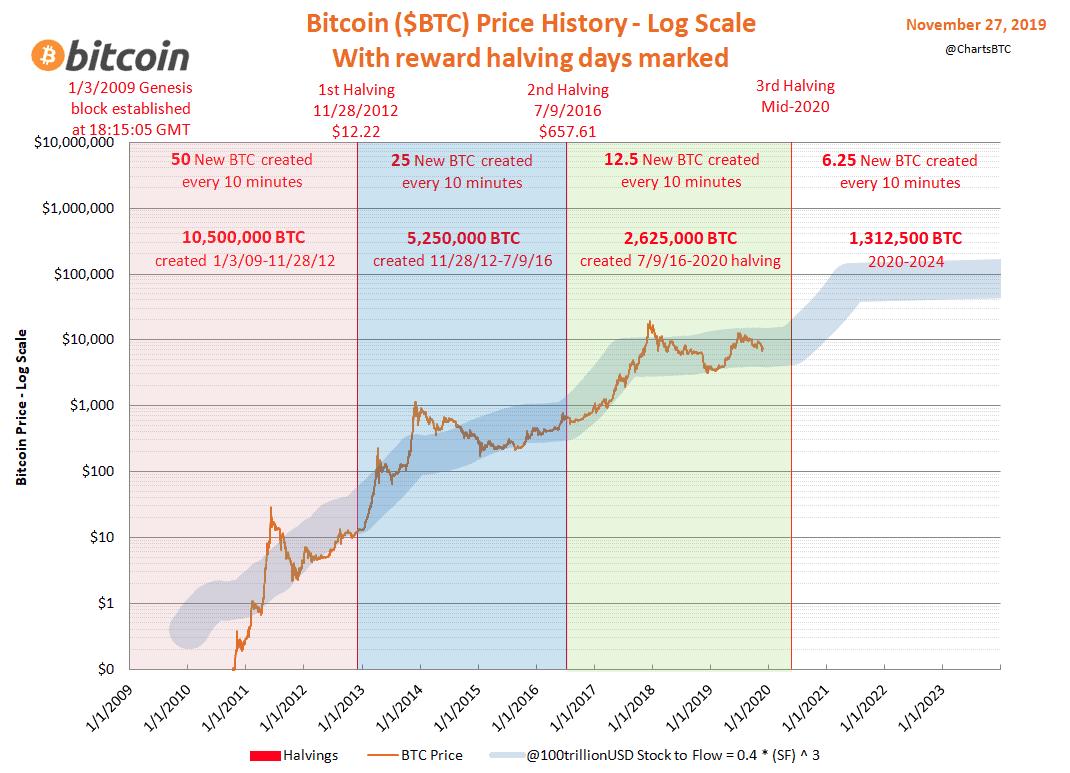

One of the best ways to gauge what effect the new halving will have on price is to look at a price chart with all previous halvings demarcated:

Courtesy of @ChartsBTC on Twitter, this logarithmic chart shows Bitcoin’s price against halvings.

Let’s examine this chart in depth, as it helps to clarify the price effect of previous halvings. We’ll examine each of Bitcoin’s 4 “ages” in turn, starting from the reddish block on the left.

1) Pre-Halving Era

Time Span: January 9 th 2009 to November 28 th , 2012.

Block Span: 0 to 210,000.

Block Reward: 50 BTC per block mined.

The leftmost block represents Bitcoin’s earliest period, during which time it was largely unknown to the general public. Satoshi set the initial block reward at 50 BTC. Thus, for every block a miner added to the chain, they both earned and created 50 BTC. The result of this high reward was rapid early issuance, with 50% of Bitcoin’s entire total supply (of 21 million BTC) issued during this initial period.

Satoshi personally acquired a large chunk, as he was practically the only miner throughout much of 2009. Outside of technical curiosity, there was little incentive to participate in early mining, as BTC had yet to establish any real value. Only in late 2010, with the emergence of early exchanges, was a price point above $1 established. This demonstration of value soon attracted more miners, ramping up difficulty and driving competition for ever-faster mining hardware and cheaper power.

As awareness of this new technology’s potential began to spread, a credible market value was gradually established, and early adopters realized that Bitcoin had the potential to achieve tremendous growth in the future.

Bitcoin’s abundant early supply was thus soaked up by those with foresight. This led to Bitcoin’s first price spike above $10, as sellers noticed the demand and began demanding a higher price for their coins. A crash followed but recovery was rapid, as the market realized that the halving in late 2012 would offer price support. The pattern of a rising price leading to a halving was established at the end of this era.

2) 1st Halving Era

Time Span: November 28 th , 2012 to July 9 th , 2016.

Block Span: 210,000 to 420,000.

Block Reward: 25 BTC per block mined.

As 50% of BTC supply was issued during the earliest era, it’s logical that 75% of supply had been issued by the end of this phase. The economic model of supply and demand has it that if supply decreases while demand holds steady or increases, prices must rise. This was proven nicely during Bitcoin’s 2 nd era, as the price rose dramatically.

As predicted, decreased supply (and expanding public awareness) led to a higher Bitcoin price during this era. Price peaked explosively above $1,000 in late 2013 before crashing as the leading exchange at the time, Mt. Gox, failed catastrophically. This led to an extended period of decline and stabilization. Significantly, price held above the previous era’s peak, maintaining a bullish chart from a long term perspective.

It’s likely that the prospect of the 2016 halving motivated to resume its upward trend.

3) 2nd Halving Era

Time Span: July 9 th , 2016 to mid-May 2020 (estimated).

Block Span: 420,000 to 630,000.

Block Reward: 12.5 BTC per block mined.

We arrive now at our current era. By around May of this year, a little over 89% of all Bitcoin will be issued.

One difference to notice from previous eras is that the usual pattern of a steady price rise about a year out from the halving has yet to occur. A possible reason for this is the fallout from the massive PlusToken ponzi scam in China. The fraudsters accumulated a massive $2 billion worth of Bitcoin which, according to blockchain analysis experts, is still being sold off. This major selling volume is reportedly suppressing the price of Bitcoin.

Nevertheless, many people predict that barring any major shake-ups in the current crypto ecosystem, once the next halving occurs, Bitcoin’s price will have to rise due to diminished supply.

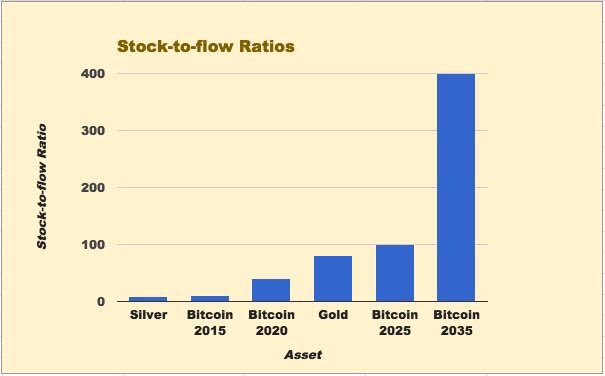

Bitcoin stock to flow model

In addition to supply and demand considerations, there’s another popular economic model that has relevance to any discussion of the halving. The Stock-to-Flow Model has recently gained popularity as a means of projecting Bitcoin’s price. This model tracks the ratio between existing supply (stock) and the rate of new issuance (flow). This is essentially another way to measure scarcity.

From Jim Brysland ; a comparison of Bitcoin’s Stock to Flow ratio against monetary metals.

The model shows that sometime before 2025, Bitcoin will overtake gold in terms of scarcity value, thus potentially becoming a better store of value than the yellow metal. The increasing ratio is directly related to the reduction of “flow” through the halving mechanism.

Bitcoin Halving 2020

It’s impossible to predict how much Bitcoin’s price will rise during the next halving age, or even that it will rise at all! However, previous ages have seen major peak-to-peak increases:

- From the pre-halving to 1 st halving era, we saw a 37 times increase ($31.50 to $1178).

- From the 2 nd to 3 rd halving eras, we saw a 16 times increase ($1178 to $19800).

While this is far from enough data for any meaningful projections, if the above pattern continues we might see a 7 fold price increase during the upcoming 4 th halving era, which would take price into the $138,600 range. This is pure speculation however and certainly should not be construed as investment advice.

Источник

Bitcoin Halving: Price Effects and Historical Relevance

Over the past 18 months, the crypto community has faced a significant bear market. Major digital assets such as Bitcoin and Ethereum have endured 70–80% declines while the rest of the “altcoin” market has looked much worse. Luckily, 2019 has shown to be a more promising year for digital assets as Bitcoin and Ethereum have increased by +55.45% and +48.69% over the past three months, respectively. As the outlook becomes more positive, the community is looking ahead towards one major event coming in the next year — the Bitcoin halving.

Historically speaking, the Bitcoin halving has exhibited itself as an extremely positive event for price action. For those of you who are unfamiliar, the Bitcoin halving is when the network’s issuance rate (or inflation rate) is reduced by 50% every four years. Cutting the inflation rate in half not only reduces the amount of new Bitcoin entering circulation every day, but it also increases the mining costs for securing the network. In the past, this has been one of the driving factors behind Bitcoin’s previous bull runs.

Before we dive into the historical effects of the Bitcoin halving, we first want to outline the economic dynamics surrounding its halving. If you’re already familiar with these nuances, feel free to jump to the “ Halving’s Historical Effect on Price” section.

Issuance Schedule

The issuance schedule states that block rewards will continually diminish by 50% every 210,000 blocks, effectively reducing Bitcoin’s issuance to zero as time goes on.

Bitcoin began with a block reward of 50BTC per block. Seeing as the network was (and still is) in its infancy, the time associated with the creation of new blocks has gradually changed as computational power is added and removed from the network. Generally speaking, historical data has shown that a new block is created about once every 10 minutes. Taking this assumption into account, we can assume that the block reward will halve roughly once every 4 years. The math is as follows:

210,000 blocks x 10 mins per block / 60 mins per hour / 24 hours per day / 365 days per year.

Here’s a look at how this has played out in the past:

One of the biggest benefits to Bitcoin is its transparency and algorithmic monetary policy — a characteristic the current financial system lacks. Right now, about 1,800 new Bitcoin enter circulation every day. Following the third halving event in 2020, the daily issuance rate will drop to about 900 BTC per day, resulting in Bitcoin’s annual rate dropping from 3.70% to 1.79%. This is an interesting development as Bitcoin’s issuance will now be below the inflation rate of most developed countries. For comparison, the inflation rate in the United States is 1.9% for the 12 months ending in March 2019. The biggest difference here is that Bitcoin is a non-sovereign, fixed supply asset whereas the US dollar has no supply cap and entirely relies on the US government.

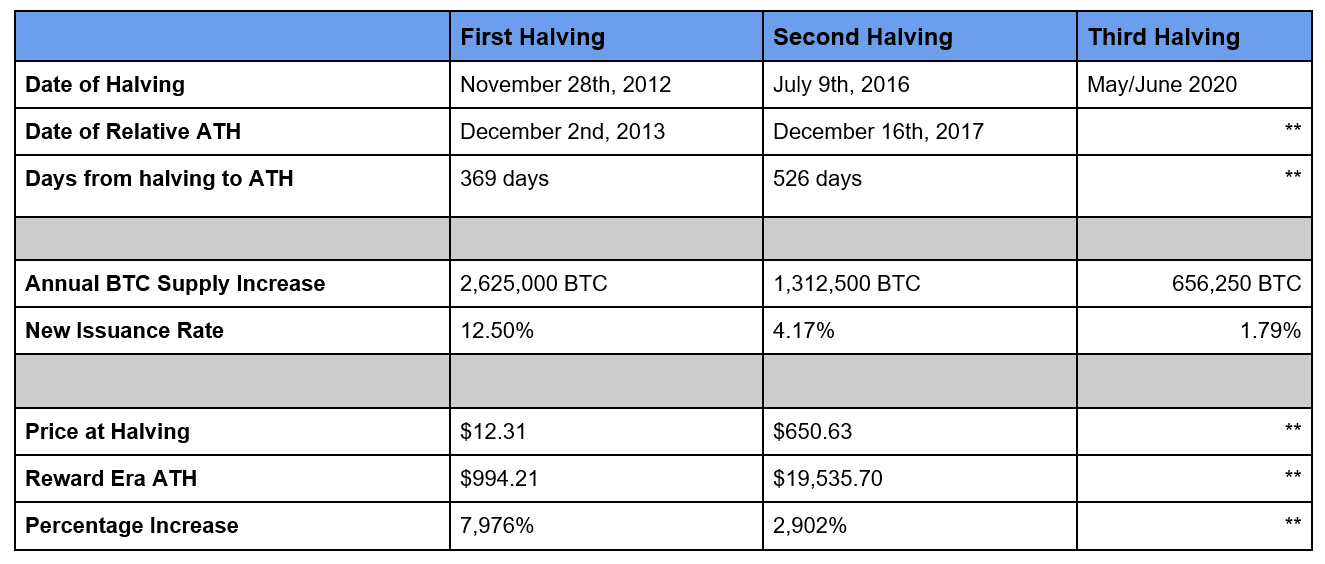

Halving’s Historical Effect on Price

For those of us who have looked into digital assets as an investment vehicle, Bitcoin’s historical price action in response to halving events has been very interesting to say the least. While past performance is not indicative of future results, we wanted to analyze some of the past metrics from previous halvings to get a sense as to what may lie ahead.

First Halving

The first official halving (decreasing the block reward to 25BTC per block) happened on November 28th, 2012. Historical data shows that following a large pump in June of 2011, an upward trend began to form in November 2011, approximately one year prior to the halving.

This “pre-halving” uptrend resulted in a +341.90% price increase in Bitcoin, trading at an average of $12.31 per BTC come the first halving in November 2012.

The 1st halving reduced Bitcoin’s daily issuance rate from

7,200 BTC per day to

3,600 BTC per day. Almost immediately, Bitcoin then went on to make historic gains as it skyrocketed by almost 8,000% over a year-long period, reaching around $1,000 in late November of 2013. (depending on the exchange data).

Unfortunately, it wasn’t all fun and games. In December 2013, Bitcoin began a multi-year bear market (largely thanks to the infamous Mt. Gox hack) as the asset declined over 80% before investors saw a reversal nearly two years later in October 2015.

Second Halving

The second official halving (decreasing the block reward to 12.5BTC per block) happened on July 9th, 2016. It’s important to note that the time between the first and second halving was actually 1316 days, or 3.6 years. With this, data shows that an upward trend began to form in October 2015, approximately 9 months prior to the halving.

The “pre-halving” uptrend resulted in Bitcoin increasing 112.0% over the 9 month period and an average trading price of $650 per BTC at the time of halving in July 2016 (52x from the last halving price). The second halving event dropped Bitcoin’s daily issuance rate from

3,600 BTC to the current

1,800 BTC per day. This ultimately pushed BTC into the most recent bull run of 2017 where the asset saw a +2,800% increase over the following 18 months. The peak finally hit in mid-December of 2017, with a price just shy of $20,000 BTC (depending on exchange data).

Similar to the previous bear market from the bull run in 2013, Bitcoin went on the drop nearly 80% over a 12 month period where we’re presuming it hit a bottom of around $3,200 in December of 2018.

Third Halving

The third official halving (decreasing the block reward to 6.25BTC per block) is scheduled to happen in approximately 57,455 blocks (based on block height 572545 as of April 20th, 2019). Based on the assumption of 10 minutes per block, the anticipated halving date is set to happen in late May to early June of 2020 (approximately 400 days from now).

If historical data is a good indicator of previous success (traditionally it’s not), we at Fitzner Blockchain Consulting would expect BTC to perform positively this year as we approach the halving event in mid-2020. More specifically, we should expect double-digit or perhaps low triple-digit percentage gains by the end of 2019. If our historical analysis is correct, we’re expecting Bitcoin will likely be trading at around half of the current peak price (approximately $10,000/BTC) with a new expected ATH within 12 to 18 months after the halving event in May 2020.

Future Incentive Mechanisms

As block rewards continue to diminish, Bitcoin’s fixed supply should accrue value as the cost of “producing” one BTC increases with each halving — likely one of the driving factors behind Bitcoin’s cycles. As future block rewards continually diminish to zero, future miners will have to rely on other incentives within the system to secure the network.

The last Bitcoin is estimated to be mined around the year 2140 when the block reward drops to less than 1 satoshi. While the likelihood that Bitcoin will still exist in over a hundred years is anything but certain, it’s quite interesting to speculate how incentive mechanisms *would* work following the last block reward.

Right now, miners are paid through a combination of block rewards and transaction fees. Block rewards act as a base incentive for miners to contribute computing power while transaction fees incentivize the order in which miners validate the transaction.

Conclusion

For those of us who are relatively new to digital assets, we hope that this article can provide some confidence that the future of these markets is still quite bright. After looking at different market trends since inception, the similarity between these cycles seems anything but coincidental.

Fitzner Blockchain Consulting is bullish on Bitcoin leading up to the next halving. At this time, we are strong believers in Bitcoin’s “Store of Value” proposition relative to any other crypto asset in the market today. If you or your business are interested in learning more about how to accept, spend or utilize Bitcoin in any way, shape or form, please contact us to schedule a free consultation on how to get started today.

Источник