- Dissecting Bitcoin’s Unrealised On–Chain Profit/Loss

- Introducing a New Set of Metrics to Help Time Bitcoin Market Cycles

- 1. The number of current UTXOs that are in profit/loss

- 2. The current supply of Bitcoin that is in profit/loss

- 3. The unrealised profit/loss of the current Bitcoin supply

- Number of UTXOs in Profit/Loss

- Circulating Supply in Profit/Loss

- Unrealised Profit/Loss

- Summary

- Metrics Overview

- Bitcoin net unrealized profit loss nupl

- Subscribe to Look Into Bitcoin

- Glassnode: «безумно бычьи» метрики биткоина указывают на цели выше $200 000

Dissecting Bitcoin’s Unrealised On–Chain Profit/Loss

Introducing a New Set of Metrics to Help Time Bitcoin Market Cycles

Understanding the state of the Bitcoin blockchain with respect to the price at which BTC is being valued by the market is indispensable for any investor in this new asset.

In fact, Bitcoin on–chain data has been used in conjunction with off–chain market data in order to create metrics and indicators that help investors gain fundamental insights into the current state of the market, understand investor sentiment, or model the value of Bitcoin.

Popular examples are MVRV and SOPR.

These metrics have in common that they make use of Bitcoin’s underlying UTXO structure by comparing the value of Bitcoin at two different points in time: The current price and the price at the time a UTXO (bitcoin) was created (last moved), i.e. the realised price.

Here, we make use of the same underlying concept in order to answer a fundamental question:

If all bitcoins were sold today, how much would investors stand to gain or lose?

Or to put it differently: How much of Bitcoin’s circulating supply is at any given point in time in profit or loss — and to what extent?

The ability to access this information is important to investors with regard to Bitcoin’s primary narrative: to act as a digital, permissionless, censorship-resistant Store of Value (SoV).

To answer these questions, we take three different approaches and define new sets of metrics — each adding an additional level of detail:

1. The number of current UTXOs that are in profit/loss

A UTXO is in profit (loss) if the current price is higher (lower) than the price at the time the UTXO was created.

2. The current supply of Bitcoin that is in profit/loss

A bitcoin is in profit (loss) if the current price is higher (lower) than the price at the time the bitcoin last moved.

3. The unrealised profit/loss of the current Bitcoin supply

The profit (loss) of a bitcoin is calculated by taking the difference between the current price and the price at the time the bitcoin last moved.

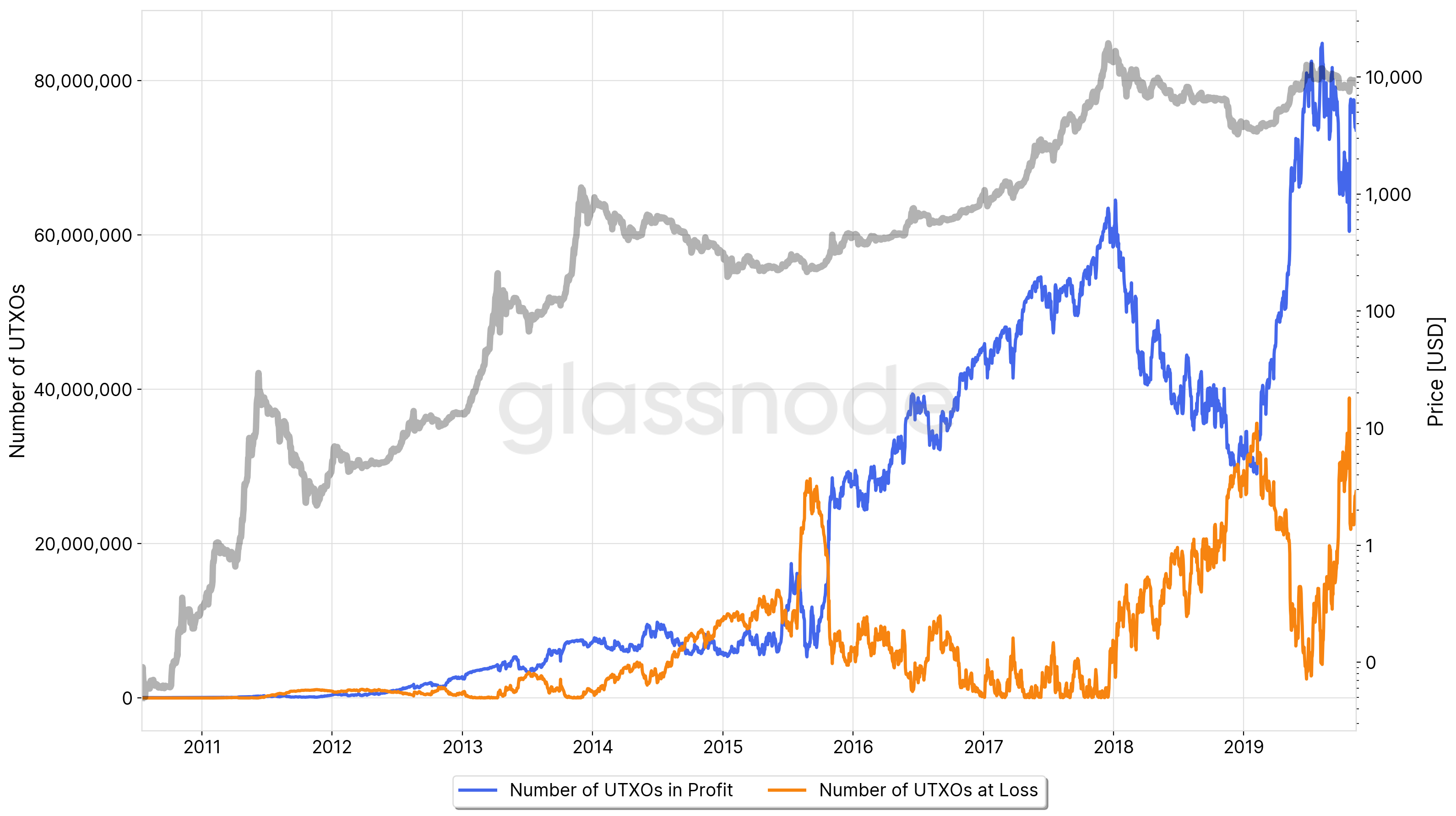

Number of UTXOs in Profit/Loss

The number of UTXOs in profit/loss is computed in a straight-forward manner: We simply count all existing UTXOs whose price at creation time was lower or higher than the current price, respectively.

Figure 1 below shows the absolute amount of UTXOs in profit/loss at any given point in time.

In order to account for the increasing number of UTXOs over time, we normalise these time series by the size of the UTXO set and obtain the relative number of UTXOs in profit/loss, i.e. the percentage.

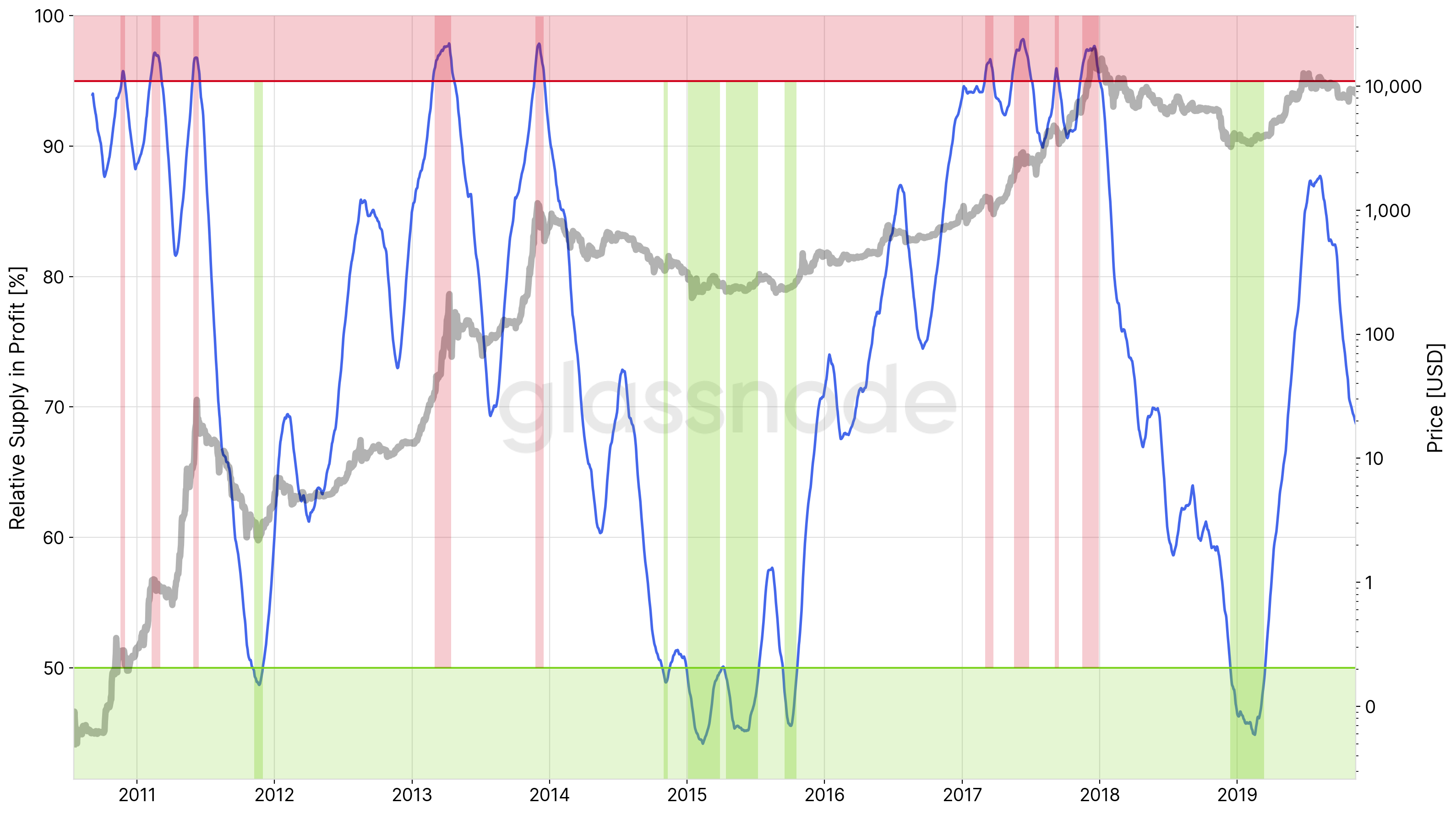

Figure 2 below represents the 50d MA of the relative UTXO counts in profit. Note that when this metric approaches 100%, it has historically been a good indicator for global market tops.

The bull run of 2017, however, shows a distinct behaviour with a sustained period of profitable UTXOs above 95% – a clear indication of the remarkable nature of the bull run that year. Throughout those months, the metric can be used to help identify short-term cycles and as a clear indicator to stay highly alerted throughout the mania of such periods.

Note that the relative number of UTXOs in profit approaches 100% every time a previous ATH price is broken – this is self-evident as it becomes nearly impossible to be in losses once a new ATH is surpassed. Therefore, we applied the simple 50d MA, which we have found to fit historic data optimally and which creates a signal that serves to indicate global/local Bitcoin cycle tops as shown above.

Live implementations of UTXOs in Profit/Loss metrics are available in Glassnode Studio:

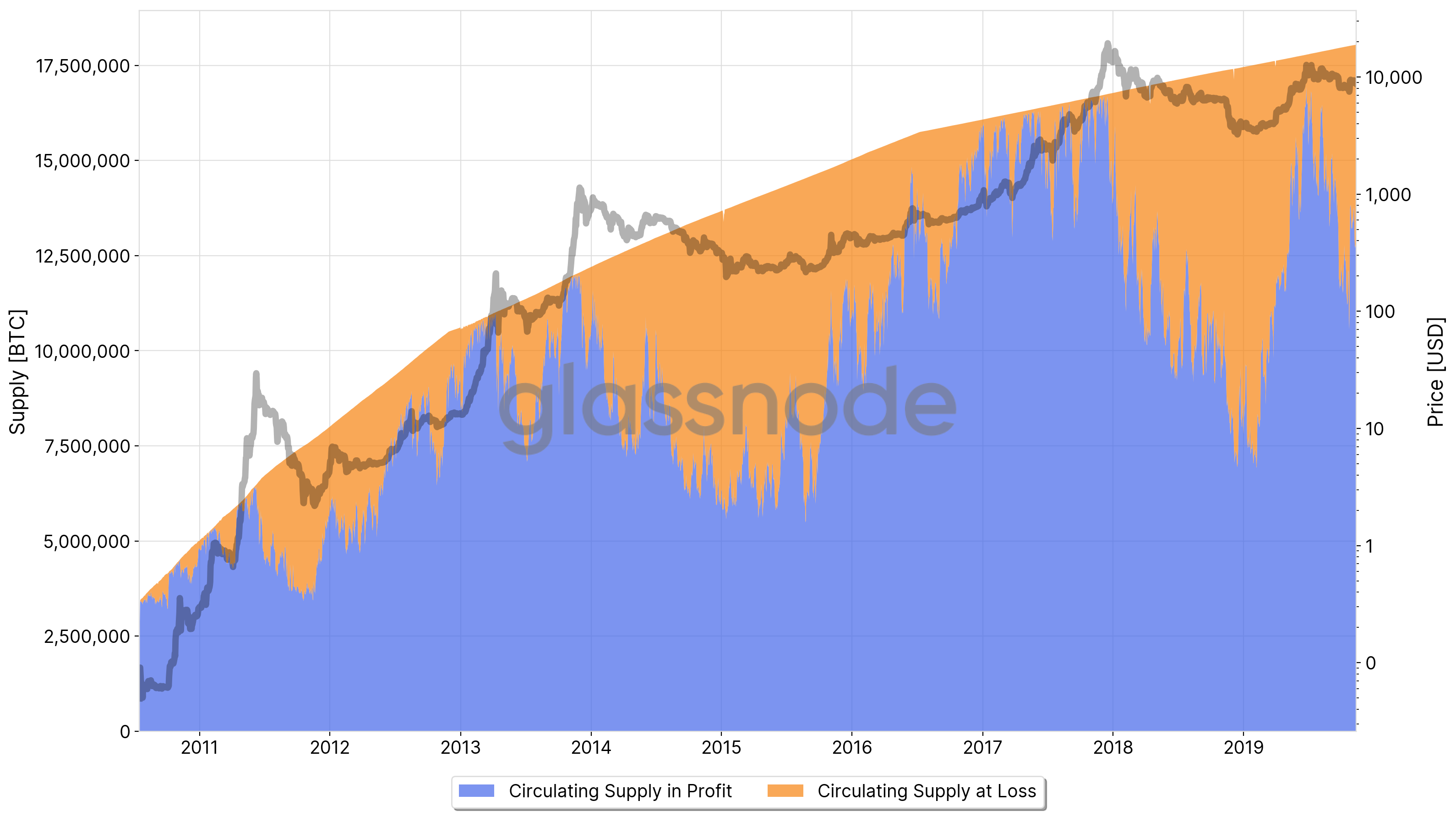

Circulating Supply in Profit/Loss

A similar but even more informative metric is the number of circulating bitcoins that are in profit or loss. Instead of counting UTXOs, we now consider their bitcoin value (i.e. individual bitcoins) and sum up those whose price at the time they last moved was lower or higher than the current price, respectively.

The stacked graph below shows the supply of bitcoins in profit/loss at any given point in time.

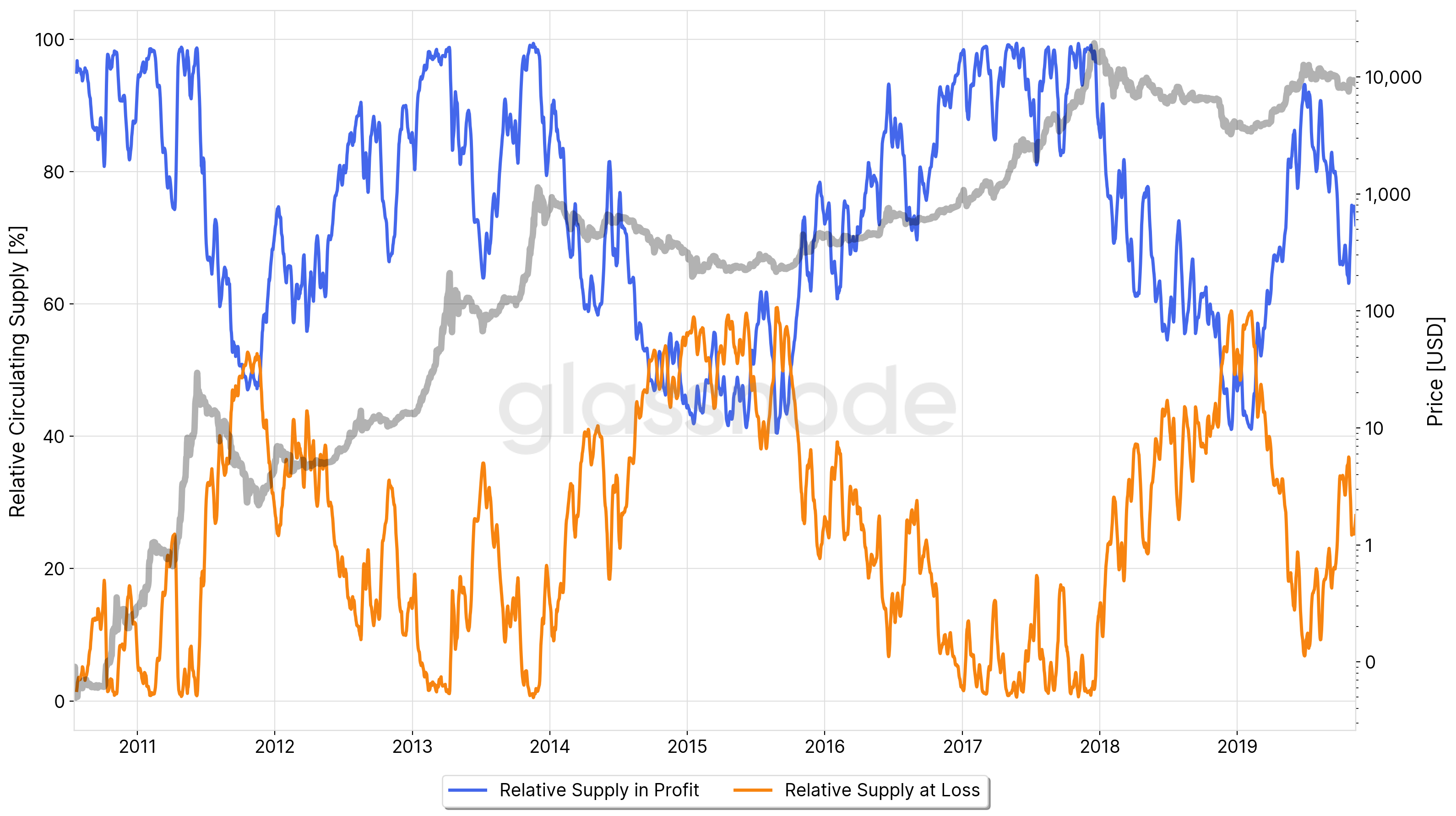

Similarly, we adjust this data by dividing by the circulating supply and obtain the relative Bitcoin supply (i.e. percentage) that is in profit/loss.

The resulting graph is a metric we have found to be exceptionally useful to help understand Bitcoin market cycles.

Let’s take close look at the Percent of Supply in Profit, again applying the 50d MA.

The Percent of Supply in Profit metric represents an oscillator that allows us to better understand the current state of the Bitcoin market:

- In a similar fashion to the relative UTXO count chart above, using a simple threshold at 95% helps to identify market tops.

- By looking at periods in which the relative supply in profit falls below 50% , this indicator is useful to help identify market bottoms and convenient entry points.

Live implementations of Supply in Profit/Loss metrics are available in Glassnode Studio:

Unrealised Profit/Loss

Finally, we take a step further and look at the Unrealised Profit/Loss of Bitcoin.

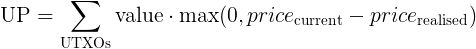

In comparison to simply summing up the circulating supply that is in profit or loss, Unrealised Profit/Loss takes into account the actual USD value by which a bitcoin is in gains/losses. In other words, we weight each circulating bitcoin by the difference between the current price and its realised price and sum up all bitcoins in profit and loss, respectively.

Mathematically speaking Unrealised Profit (UP) and Unrealised Loss(UL) are defined as

The following graph shows Bitcoin’s raw Unrealised Profit/Loss.

While the UP line very much resembles the shape of the Bitcoin price, the amount of unrealised loss (UL) shows a distinctive pattern with clear-cut downward spikes at periods in which the losses are virtually non-existent. These moments naturally correspond to those in which the relative number of bitcoins/UTXOs in profit approaches 100% ( see Figures 2+5).

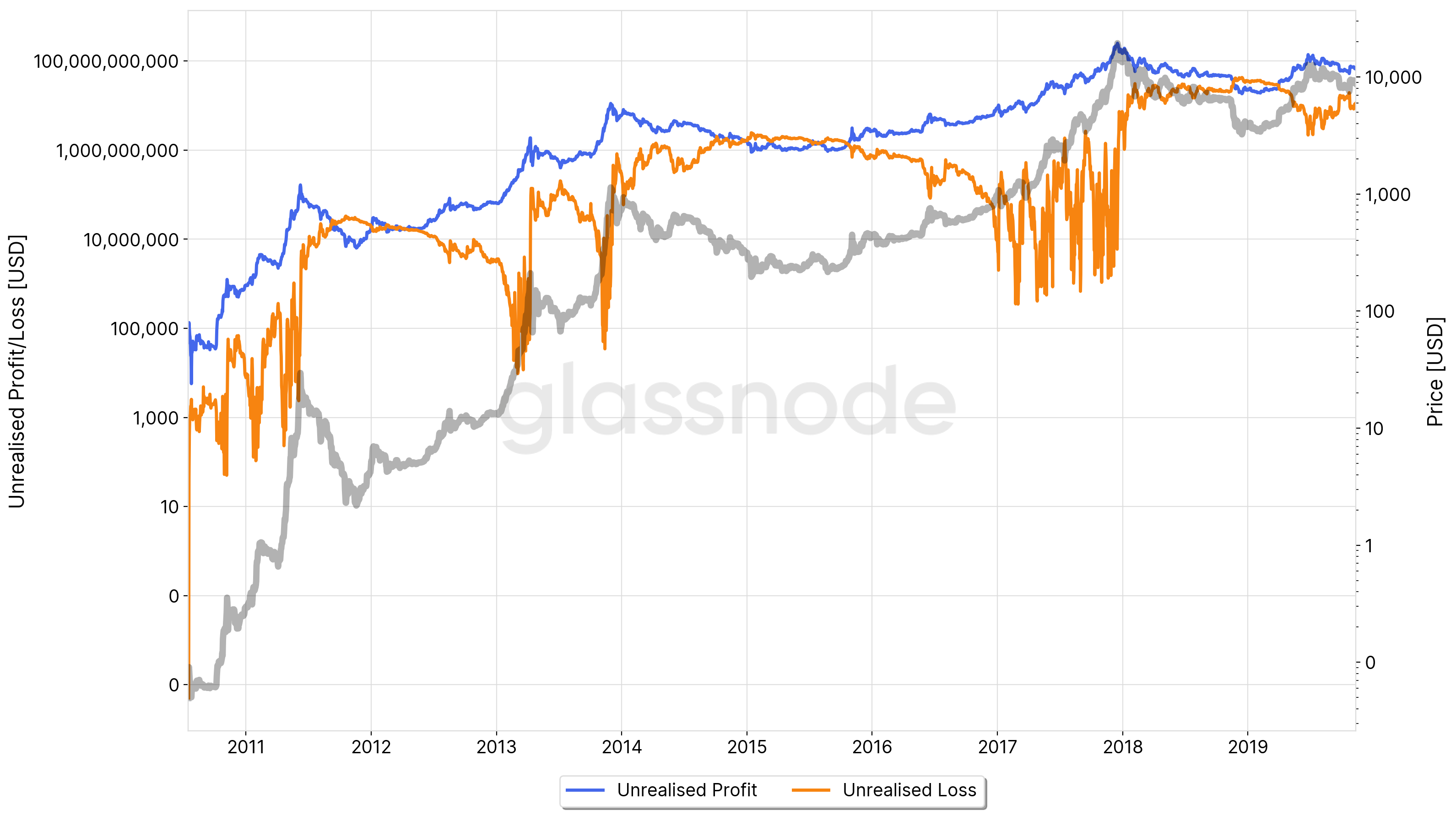

In order to obtain a conclusive and more informative metric, we normalise the data by the market cap, giving us the Relative Unrealised Profit (RUP) and the Relative Unrealised Loss (RUL). The resulting signals clearly reveal distinct patterns at different states of the market cycles.

In particular we see how the RUP spikes ( RUP > 0.75 ) indicate potential tops and selling points. Conversely, periods in which the RUL exceeds the RUP ( RUP ) have been historically indicative of market bottoms and good buying opportunities.

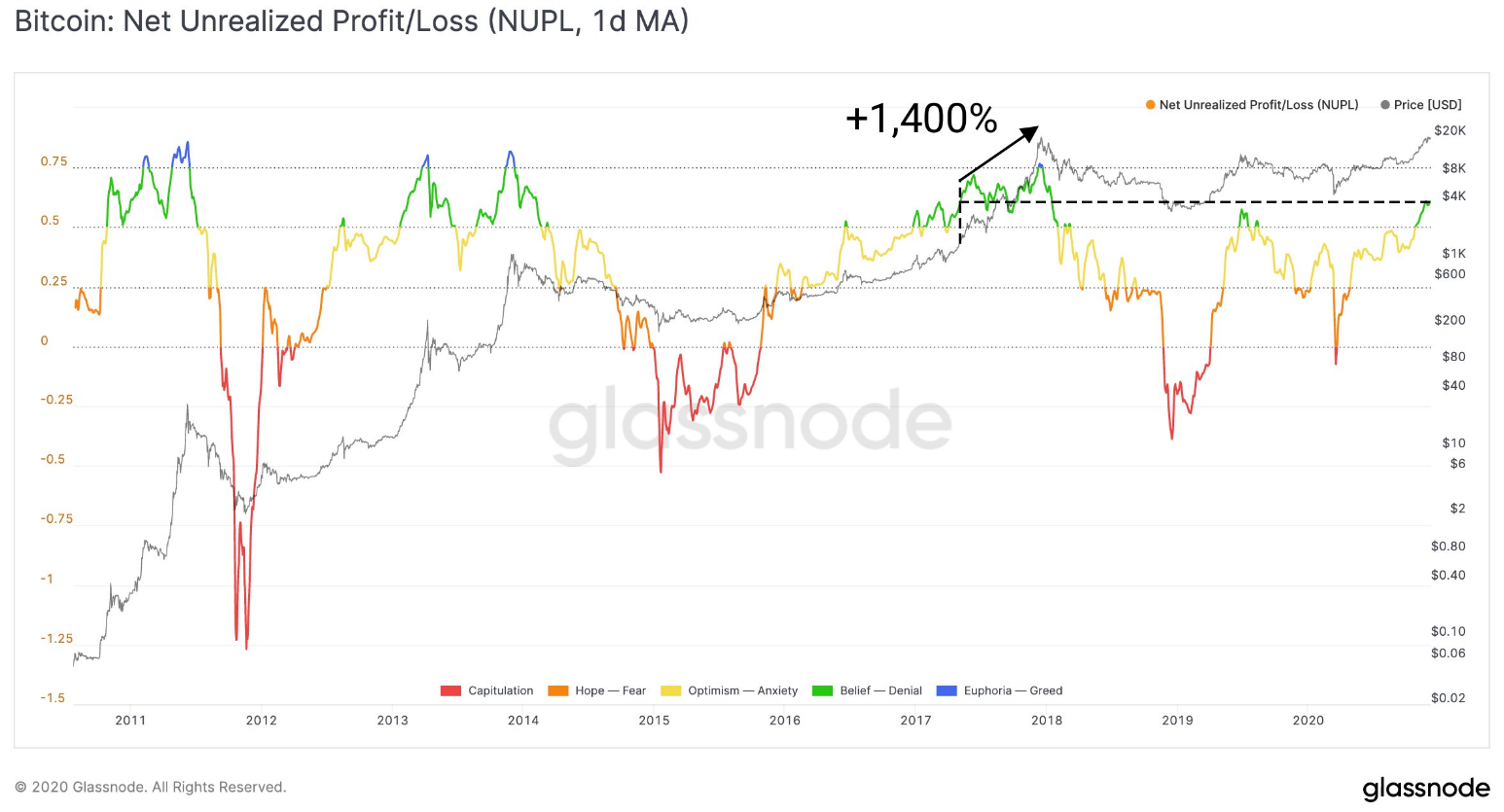

By taking the delta of both curves, we finally calculate the Net Unrealised Profit/Loss (NUPL).

Deconstructing this signal into different bands gives insight into market sentiment derived from on–chain data. The thresholds below are set at 0.0 , 0.25 , 0.5 , and 0.75 . Even though arbitrary, historically they show accurate patterns that can be attributed to distinct sentiments throughout the macro cycles of Bitcoin.

By mapping these bands to the price of Bitcoin we see how the NUPL represents different periods of the Bitcoin market cycles. Understanding the current NUPL value can help investors navigate through different stages of the market and identify periods of profit taking as well as efficient entry points.

UPDATE: Net Unrealised Profit/Loss has been previously derived by Adamant Capital in a different manner: They calculate it by subtracting realised cap from market cap, and dividing the result by the market cap, i.e. (Market Cap — Realised Cap) / Market Cap . This is mathematically in fact equivalent to the derivation introduced here: Unrealised Profit * Market Cap — Unrealised Loss * Market Cap .

Live implementations of Unrealised Profit/Loss metrics are available in Glassnode Studio:

Summary

We explored and presented a set of on–chain metrics that incorporate the relationship between the current price and the realised price of Bitcoin. In particular we defined metrics related to

1) the Number of UTXOs in Profit/Loss,

2) the Bitcoin Supply in Profit/Loss, and

3) the Unrealised Profit/Loss.

These metrics help in understanding the current profit and loss of stakeholders in the Bitcoin network using on–chain data — information that is crucial to evaluate the state of Bitcoin as a Store of Value (SoV).

Moreover, these metrics are indicative of the Bitcoin market cycles and shed light on investor sentiment at different stages, most notably using Net Unrealised Profit/Loss.

With the present work, we have equipped Bitcoin investors with a new set of tools providing a better understanding of Bitcoin’s market cycles and its economics. The introduced metrics are can be used to assist investment strategies that go beyond simple HODLing, and help to avoid buying towards the top and selling near the bottom of Bitcoin’s cycles.

Metrics Overview

All analyses in this article were done using data from Glassnode Studio . For API access to this data visit the Glassnode API page .

- Sign up for the Glassnode Insights Newsletter

- Follow us and reach out on Twitter

- For on–chain metrics and activity graphs, visit Glassnode Studio

- For automated updates about on–chain activity on exchanges, visit our Glassnode Alerts Twitter

Disclaimer: This report does not provide any investment advice. All data is provided for information purposes only. No investment decision shall be based on the information provided here and you are solely responsible for your own investment decisions.

Источник

Bitcoin net unrealized profit loss nupl

This indicator is derived from Market Value and Realized Value, which can be defined as:

Market Value: The current price of Bitcoin multiplied by the number of coins in circulation. This is like market cap in traditional markets i.e. share price multiplied by number of shares.

Realized Value: Rather than taking the current price of Bitcoin, Realized Value takes the price of each Bitcoin when it was last moved i.e. the last time it was sent from one wallet to another wallet. It then adds up all those individual prices and takes an average of them. It then multiplies that average price by the total number of coins in circulation.

By subtracting Realized Value from Market Value we calculate Unrealized Profit/Loss.

Unrealized Profit/Loss estimates the total paper profits/losses in Bitcoin. This is interesting to know but of greater value is identifying how this changes relatively over time.

To do this we can divide Unrealized Profit/Loss by Market Cap. This creates Relative Unrealized Profit/Loss which is very useful to track investor sentiment over time for Bitcoin.

How To View The Chart

The key principle of this tool is in the ratio between market cap and Bitcoin investors taking profit.

When market cap rises much faster than profit taking we see that the market is overheating, one could say due to investor greed (red band). For the strategic investor such times have historically been favourable to take profit.

We can break down different percentages of Bitcoin Relative Unrealized Profit/Loss to determine what stage of the market we are in. This can be advantageous for the long term strategic investor.

Created By

Date Created

Fall Further Down The Rabbit Hole

Here is the original publication by the team at Adamant Capital: A primer on bitcoin investor sentiment and changes in saving behaviour

Any information on this site is not to be considered as financial advice. Please review the Disclaimer section for more information.

Subscribe to Look Into Bitcoin

Sign up today and receive:

- Indicator email alerts for critical levels

- Monthly newsletter

- Private Tradingview indicator scripts

Subscribe

Источник

Glassnode: «безумно бычьи» метрики биткоина указывают на цели выше $200 000

Цена биткоина может вырасти в десять раз от текущих уровней. К такому выводу пришел технический директор Glassnode Рафаэль Шульце-Крафт на основе шести ончейн-метрик.

1/ Where are we in the #Bitcoin market cycle?

A look at some of the most important on-chain market indicators.

TLDR: Insanely bullish, most metrics are far from the top. If things develop anything like 2017, we could see more than 10x $BTC from here.

Эксперт оценил динамику биткоина с момента, когда по каждой из метрик наблюдались аналогичные значения, что и сейчас, до зафиксированных при достижении первой криптовалюты рекорда в 2017 году. Затем этот прирост цены биткоина он умножил на ее нынешний уровень.

Одна из метрик — Net Unrealized Profit/Loss (разница между нереализованными прибылями и убытками на основе последнего перемещения монет) — сейчас составляет лишь 78% от того значения, которое наблюдалось на пике три года назад.

Первая криптовалюта подорожала за этот отрезок времени на 1400%, обновив исторический максимум (АТН). При умножении этой динамики на текущее значение цены аналитик получил ориентир в $286 000.

Метрика Market Cap to Thermocap ratio, оценивающая премию цены первой криптовалюты к затратам майнеров, сейчас отстоит от ATH в 2017 году на 25%. Проделав упомянутые действия выше, Шульце-Крафт получил цель для биткоина в $138 000.

Показатель MVRV Z-Score, указывающий на переоценку или недооценку первой криптовалюты относительно ее «справедливой цены», сегодня эквивалентен 66% ATH в 2017 году. Описанный ранее алгоритм может указывать на задел для роста биткоина до $240 000.

Оценивающие поведение долгосрочных держателей метрики MVRV (средняя прибыль/убыток по всем выпущенным монетам) и SOPR (коэффициент прибыльности потраченного выхода) на 13% ниже рекордных значений 2017 года. По схожей методологии технический директор Glassnode получил «справедливые» значения биткоина в $274 000 и $328 000.

По показателю Reverse risk, оценивающему уровень уверенности долгосрочных держателей первой криптовалюты относительно ее цены, Шульце-Крафт получил запас хода биткоина до $240 000. Метрика отстоит на 11% от ATH в 2017 году.

Эксперт призвал относиться к расчетам критически и не воспринимать его рассуждения как рекомендацию к действиям. Он добавил, что цель его изысканий — показать потенциал роста цифрового золота, базирующийся на предпосылке, что представленные ончейн-метрики далеки от критических значений 2017 года.

8/ Take these numbers with a grain of salt, it’s a single datapoint.

What this aims to show: These #BTC cycle indicators are still far away from their values that indicated a $BTC top in 2017.

If things develop like 2017 and the metrics hold true, I expect over 10x from here.

Напомним, 156 000 опрошенных Cindicator трейдеров уверены, что в 2021 году биткоин будет торговаться в районе $30 000.

По мнению аналитиков Bloomberg, диапазон колебаний цены биткоина в следующем году может составить $10 000-$50 000, а капитализация увеличиться до $1 трлн.

Источник