Bitcoin’s drop from $64K comparable to Black Thursday, but Coinbase outflows hint at accumulation

Elon Musk and coronavirus have something in common: they have both panicked investors — at least once — into dumping their Bitcoin (BTC) holdings.

The similarities notched up higher in the previous six days as Musk doubled down on his chaos-inducing perspective toward Bitcoin. The billionaire entrepreneur engaged in Twitter spat with top cryptocurrency advocates over the weekend, including podcaster Peter McCormick, as he projected his favorite token, Dogecoin, as superior to Bitcoin.

Obnoxious threads like this make me want to go all in on Doge

— Elon Musk (@elonmusk) May 16, 2021

At one point in time, Musk almost admitted that he would have Tesla unload the $1.5 billion investment that it had made in Bitcoin in February. Meanwhile, the bids for the flagship cryptocurrency kept on declining with each of Musk’s tweets. First, they went to $50,000, then sub-$45,000, eventually to bottom-out near $42,000.

Musk later clarified that Tesla has not dumped its bitcoin holdings.

To clarify speculation, Tesla has not sold any Bitcoin

— Elon Musk (@elonmusk) May 17, 2021

But his clarification did little in offsetting Bitcoin’s downside bias. The cryptocurrency eventually extended its bearish correction to more than 35% when measured from its all-time high of nearly $65,000.

That also marked one of the quickest and deepest top-to-bottom retracement moves in the cryptocurrency’s recent history, with on-chain indicators showing that its impact on the market bias was as bad as the one caused by the Black Thursday crash in March 2020 in the wake of the coronavirus pandemic.

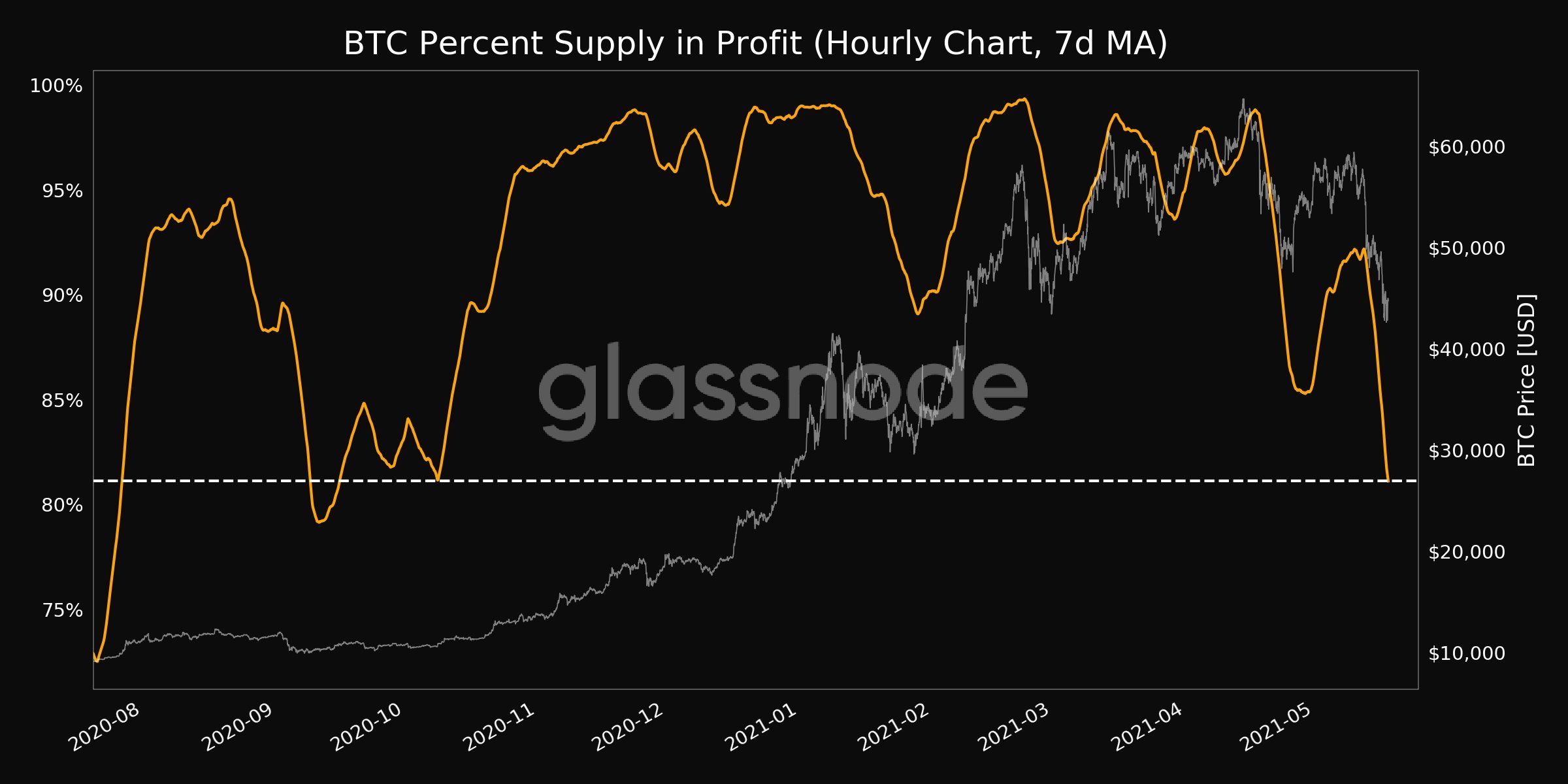

Meanwhile, Blockchain analytics platform Glassnode reported a decline in the profits of Bitcoin’s circulating supply via its proprietary metric.

The «BTC Percent Supply in Profit (7d MA)» showed readings near 81.122 as of London morning on Tuesday, its lowest level since October 2020. The readings were also weak during the March 2020 crash, wherein Bitcoin declined by more than 50%.

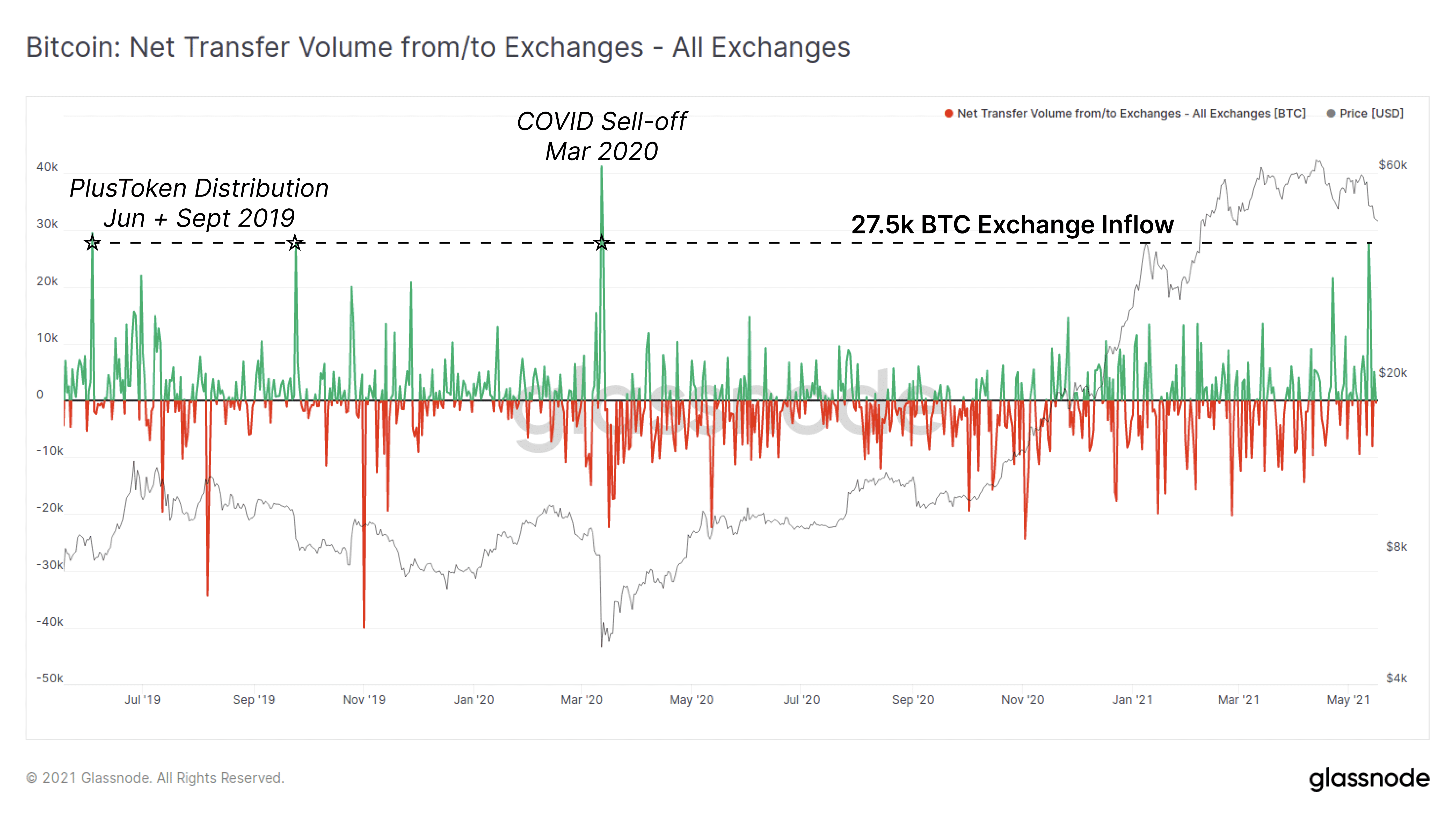

More on-chain indicators point out similar readings between the current, Musk-led bitcoin price crash and the one that appeared amid the coronavirus panic in March 2020.

For instance, the Bitcoin transfer volume tracker at Glassnode showed a spike in BTC inflow across all the exchanges. Its scale was comparable to the inflows seen during the March 2020 sell-off and the distribution by the PlusToken Ponzi scheme in 2019.

A higher BTC inflow indicates a higher probability of traders selling those tokens for other assets, including fiat and altcoins. Conversely, a higher outflow shows traders’ willingness to hold BTC for longer periods.

Institutional versus retail sentiment

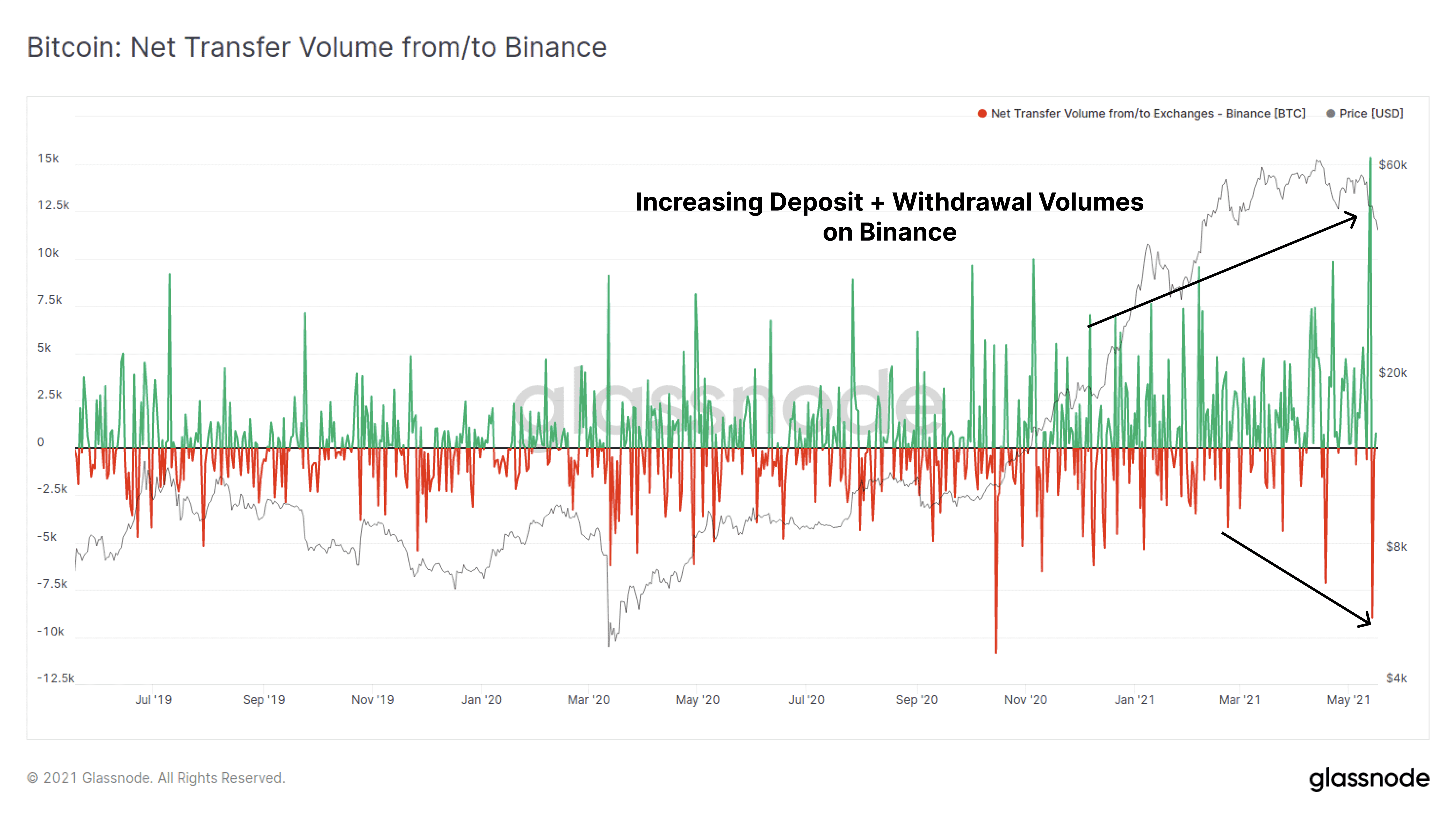

Glassnode’s Bitcoin transfer volume data meanwhile provided two stark investment perspectives between retail and institutions. In its weekly newsletter, the analytics platform broke down its observation based on the inflow/outflow data collected from two of the world’s largest cryptocurrency exchanges: Binance and Coinbase.

Binance is a non-US entity that attracts mostly retail traders and investors around the world. Meanwhile, Coinbase’s standing is higher among US-based institutional investors. Glassnode noted that Binance was the biggest receiver of the Bitcoin inflows during the Musk-led market crash.

«This provides further indication that the recent inflows are likely to be driven by both new market entrants (panic sellers) and potentially due to capital rotation into other crypto-assets,» wrote Glassnode in a weekly note.

Ki-Young Ju, the chief executive of CryptoQuant — a South Korea-based blockchain analytics platform, also noted that most BTC inflows went to Binance, adding that it is not necessarily a bearish signal.

«I’m going to wait until the inflow signal cools off,» he added, nonetheless.

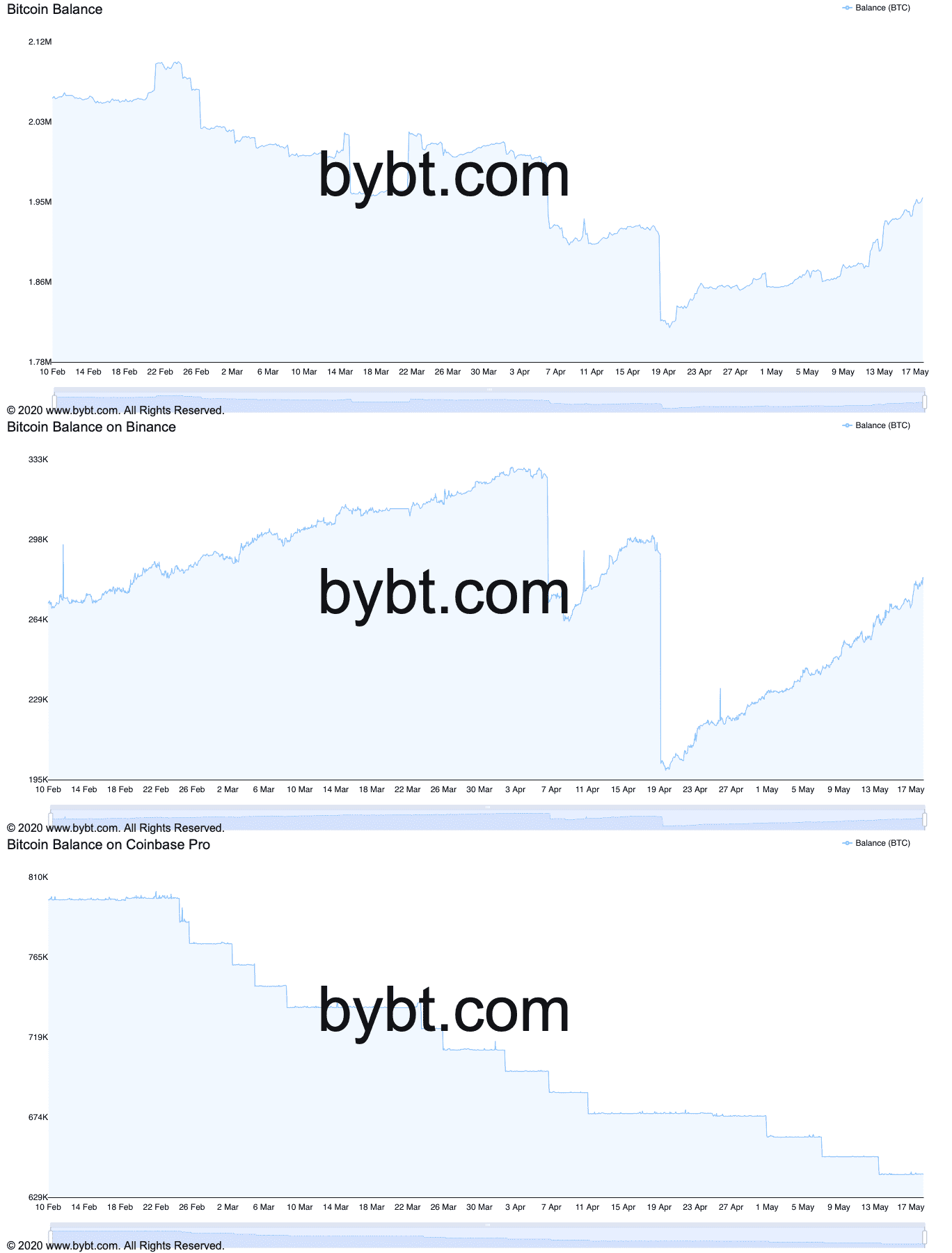

On the other hand, Coinbase logged higher new Bitcoin outflows ever since the cryptocurrency broke above the $20,000-price milestone last year. The trend continued even in the current week, showing that institutional investors were absorbing the retail market’s selling pressure.

Still bullish

In other words, rich investors purchased bitcoin tokens at local lows as average ones sold them under the influence of Musk.

«Don’t listen to what they say,» said early-stage investor Anthony Pompliano in his note to clients on Monday. He added:

«Just watch what they do with their money. Elon Musk and Tesla understand that they are going to be dependent on bitcoin moving forward. It wouldn’t surprise me if they are actually buying more bitcoin now at depressed prices or at least plan to purchase more in the future.»

Pompliano added that Bitcoin remains the best-performing macro asset, an «apex predator» with vastly outperformed stocks, bonds, real estate, and commodities. Twitter CEO Jack Dorsey, whose payment company Square added bitcoin to its balance sheet to beat inflation fears, also noted last Friday that his team would «forever work» to make Bitcoin better.

The comments came in contrast to Elon Musk’s support for Dogecoin. Veteran investor Paul Santos wrote in his Seeking Alpha piece that the Tesla CEO might want to make money out of thin air by exploiting the so-called cryptocurrency euphoria.

Crypto News is the news aggregator about cryptocurrency, ICO, mining and blockchain.

Источник

Bitcoin Net Flow to Exchanges At 3-Month High

Last Updated Jul 28, 2020 @ 12:29

A sudden spike of Bitcoin net flow towards centralized exchanges hints for an upcoming price dump. However, another indicator suggests otherwise.

After Bitcoin’s significant rally to above $10,000, centralized exchanges have seen the largest hourly net flow of BTC in over three months. The question remains if such a vast amount of coins heading towards platforms could unleash a sell-off and, consequently, a price drop.

Record BTC Net Flow Towards Exchanges

According to data from the monitoring company Glassnode, the net transfer volume from and to centralized exchanges has spiked in the past 24 hours.

Bitcoin Net Transfers From/To Exchanges. Source: Glassnode

It’s worth noting that this “from and to” volume contains transfers initiated from one cryptocurrency platform to another, not only transfers from external addresses. However, the company’s CTO Rafael Schultze-Kraft highlighted that it still represents “a positive net flow.”

Interestingly, the most recent volume transfer increase had surpassed another large one from early May, when Bitcoin was attempting to rise above $10,000 again. Shortly after, though, the price began to tumble and reached $8,100 on some exchange.

Another substantial BTC transfer volume towards exchanges came in early June. Just a few days later, Bitcoin went on another downwards move from a high of $10,000 to $9,000.

Naturally, this brings speculations that these events could prompt similar adverse price developments for Bitcoin. After several unsuccessful attempts and weeks of stagnant movements, the primary cryptocurrency finally managed to conquer the $10,000 price level as reported.

Not So Fast

And while the net transfer volume towards exchanges broke a 3-month record, another indicator suggests that the situation could be somewhat different. The so-called Bitcoin days destroyed (BDD) intends to measure more precisely the real BTC transfer volume.

Its idea is to block a potentially fake noise of high transaction volume. For instance, if a person sends a specific number of bitcoins from one address to another multiple times, he can create the perception of particularly high transaction volume. However, the BDD tracks the coins which haven’t been spent for a while.

It works by multiplying the number of bitcoins in each transaction by the number of days since those coins were last spent. In essence, if someone sends 10 BTC, which weren’t spent in 100 days, would have 10 multiplied by 100 to get the Bitcoin days destroyed number. According to some, this represents a more accurate indication of the BTC network activity.

And, further data from Glassnode revealed that “in contrast to the last two times BTC hit $10,000, we haven’t seen an increase in Bitcoin Days Destroyed.”

Bitcoin Days Destroyed Performance. Source: TradingView

SPECIAL OFFER (Sponsored) Binance Futures 50 USDT FREE Voucher: Use this link to register & get 10% off fees and 50 USDT when trading 500 USDT (limited offer).

PrimeXBT Special Offer: Use this link to register & enter POTATO50 code to get 50% free bonus on any deposit up to 1 BTC.

Источник

exchange

Индикаторы и стратегии

Aggregates the Bitcoin volume from multiple exchanges into a single indicator. # Exchanges and Pairs Included are only exchanges supported by TradingView: * Binance * Bitstamp * Bittrex * Coinbase * Gemini * itBit * Bitfinex * Kraken * Poloniex * HitBTC * OKCoin * BitMEX Excluded low volume exchanges (not in CMC Top): * CEX.IO * Coinfloor Excluded low volume.

Release: 2018-03-29 __________________________ WHAT IT DOES Bitcoin is listed on multiple exchanges. Many people have called for a single global index that would quote BTC volume across all exchanges: this script is such a virtual volume aggregate of the 17 largest fiat exchanges on TradingView (listed in the script comments, and in Format > Inputs for you to.

Instead of the Volume this plots the closure price times volume, hence the Value. Useful in study of long term phenomenons.

Shows the candles of a specified EXCHANGE:PAIR in an indicator without overlay. Has the following advantages over the standard comparison in TradingView: — The compared pair is below your main chart. — You can see the price of the compared pair. — You can add multiple compared pairs and all of them will be shown in their own space with their own price.

Here you can easily see the volume on many large crypto exchanges , you can change the coin by entering the ticker id but be aware that not all exchanges list the same coins and some have different ticker names. Known to work: BTCUSD ETHUSD LTCUSD XRPUSD

Simple spread between two tickers. Click format to set inputs for tickers. ex: «COINBASE:BTC:USD»

This indicator shows Bitcoin price deviation from average of price across difference exchanges in percentage. As you can see, price at Bitfinex and Binance (both BTC/Tether pairs) are going up relative to BTC/USD pairs. This means Tether price is going down for some fishy reason(s). In the next update, I will add Tether price.

This is a % premium vs average BTCUSD price. In other words, how much % more are exchanges selling bitcoin at compared to normal BTCUSD price? Blue: Korea Red: Japan Yellow: China Green: USD Exchanges including Bitfinex, Poloniex, Coinbase, and Bitstamp

BTC World Price: Multi-Exchange VWAP __________________________ WHAT IT DOES What you see above are not Bitmex candles, but this indicator’s. Bitcoin is listed on multiple exchanges. Many people have called for a single global index that would quote BTC price and volume across all exchanges: this script is such a virtual aggregate (formerly: Multi-Listed.

This script sums the volume for BTCUSD across several popular exchanges. I share it not so much as an indicator as a tool to use in other indicators (i.e. those that rely on volume, which often do not work very well for crypto due to the low volumes). Similar sums could easily be created for other currency, and with a little thought I could probably add the.

It selects the min/max price for btc/usd from a set of exchanges and shows them on the chart. It is possible to add or remove exchanges by editing the source code

Aggregates the ETH/fiat volume from multiple exchanges into a single indicator. # Exchanges and Pairs Included are only exchanges supported by TradingView: * Binance * Bitstamp * Bittrex * Coinbase * Gemini * itBit * Bitfinex * Kraken * Poloniex * BitMEX Excluded low volume exchanges (not in CMC Top): * CEX . IO * Coinfloor Excluded exchange due to volume.

request for jangseohee: added option for different exchanges, added option to remove data before X point and after Y point in time using candle numbers.

A simple indicator that illustrates where close price is in comparison to an MA. Just click the configure box and type in the EMA you want to monitor. The default is the 8 EMA . To read the indictor: — Green Line — Close price is above the EMA — Red Line — Close price is below the EMA . If you wish to have this indicator customised, please do not hesitate to.

Crypto Multi Exchange Volume (CMEV) aggregates and plots trading volumes for supported cryptoasset pairs over multiple different cryptoasset exchanges. For developers looking for more information and for those who want to compile their own version of CMEV, please check out my GitHub (jakobpredin/crypto-multi-exchange-volume). Configuration CMEV comes with two.

This indicator allows you to overlay candles of a different exchange over the top of your primary exchange. For example, you might be curious how Oanda’s prices compare to FXCM’s in realtime. You can see from the example that generally, the other exchanges swing a little further than FXCM (note this is the 1 minute chart for clarity). You can use this if you are.

Источник