- How do Bitcoin Mining Fees Work?

- Transaction Fees

- Stuck Transaction?

- Fee Collection by Miners

- Recap

- Bitcoin Fee Calculator & Estimator

- Learn about bitcoin fees.

- Why are the fee estimations so high?

- Why are Bitcoin fees so high?

- Why do some low-fee paying transactions appear early in the mempool?

- Do you have historical data?

- How did you build this?

- Do Bitcoin Fees Change By Country?

- How Do Bitcoin Fees Affect Taxes?

- A Lowdown on Bitcoin Fees

- A brief history of Bitcoin fees

- The economics behind Bitcoin fees

- What drives transaction fees?

- The future of Bitcoin fees

- Explaining bitcoin transaction fees

How do Bitcoin Mining Fees Work?

Miners provide an important service: network security. A large network hash rate keeps Bitcoin safe from attacks by bad actors.

Miners need an incentive to pay for electricity and hardware costs. ASIC mining hardware keeps Bitcoin secure through proof of work. Right now, miners are paid through a combination of Bitcoin’s block reward and transaction fees.

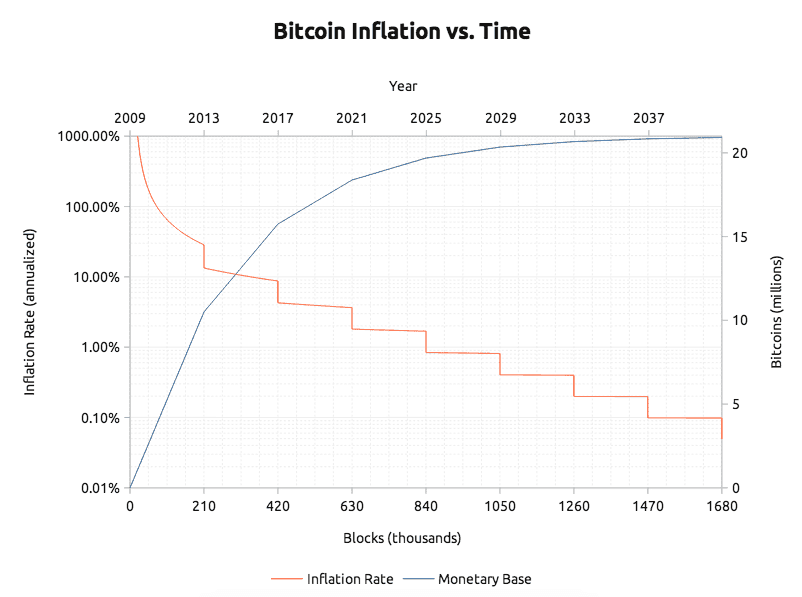

Bitcoin’s block reward is still large and provides the majority of miners’ earnings. The block reward started at 50 bitcoins per block. Currently, it is 25 bitcoins per block. In July 2016 it will drop to 12.5 bitcoins per block.

Transaction Fees

Once the majority of bitcoins have been mined, the block reward will become an insignificant percentage of miners’ overall earnings. Instead, mining fees–paid by users who transact on the network–will make up the majority of miners’ earnings.

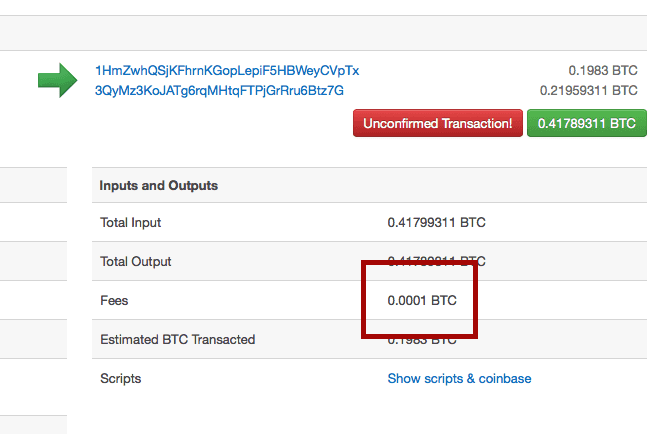

Mining fees are paid each time a user sends a transaction on the network. In the example below, a user sent 0.21959311 BTC and included a 0.0001 BTC fee.

Fees incentivize miners to include transactions in a block. Once a transaction has been included in a block it is confirmed. Unconfirmed transactions sit in something called the mempool until they are confirmed.

Since miners want to maximize income, they will include transactions that include higher fees.

Stuck Transaction?

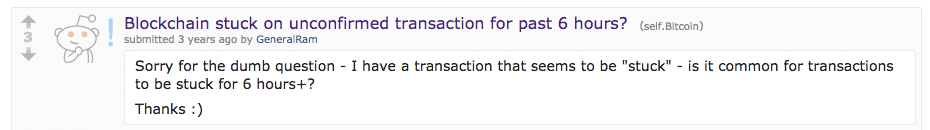

Transactions sent with low fees may get stuck in the mempool. Posts about stuck transactions like the one below are published many times per day on Bitcoin message boards.

New users often don’t know to include a sufficient fee in order to ensure quick confirmation. Transactions sent with proper fee amounts are confirmed in about 10 minutes.

21’s fee tool will help you include the right fee amount when sending your transaction.

Fee Collection by Miners

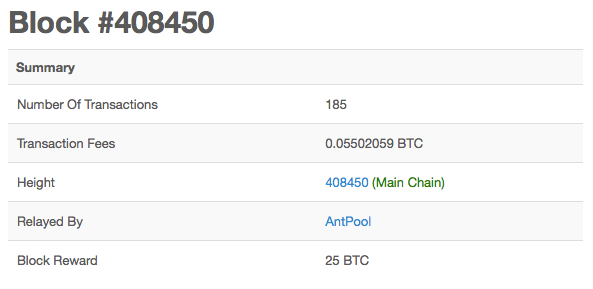

The miner or mining pool that includes a transaction in a block collects the transaction fee.

In the example above, Antpool mined block #408450. This block included 185 transactions with a total of 0.05502059 BTC in transaction fees.

The total reward for this block is the block reward plus the total amount of transaction fees: 0.05502059 BTC + 25 BTC = 25.05502059 BTC. The transaction fees for this block were just 0.2% of the total reward.

The example block above is just one of many. It’s clear, however, that in the future transaction fees must rise in order to compensate for the decreasing block reward.

Recap

Bitcoin is sometimes advertised as a way to make cheap payments, which makes mining fees confusing at first.

In reality, mining fees are needed and incentivize miners to secure the network. Without miners, the network could be attacked and would be vulnerable to 51% attacks.

Mining fees also represent users’ willingness to pay to use Bitcoin. If someone is willing to pay $5 to send one Bitcoin transaction, it is clear that Bitcoin is providing a valuable service.

Источник

Bitcoin Fee Calculator & Estimator

Learn about bitcoin fees.

Bitcoin is made up of blocks. Blocks are a set of transactions, and currently restricted to be less than or equal to 1,000,000 bytes and designed so that on average only 1 block per

10 minutes can be created. The groups the create blocks are known as bitcoin miners. These miners can pick which ever transactions they want in the block they create.

Bitcoin miners get paid all the transaction fees in the block they mine. So as such, it is in their interest to maximize the amount of money they make when they create a block. So what they do is pick the 1,000,000 bytes of transactions that results them getting paid the most money.

From a bitcoin miner perspective, they don’t care of the value of a transaction, but just the size (amount of bytes), because they are only allowed to create blocks of 1,000,000 bytes or less. So miners don’t consider the absolute fee a transaction has, but rather, the fee per byte.

Why are the fee estimations so high?

Eye-balling it, sometimes it looks like the fee estimates are super high. The reason for that is because they use 95% confidence. If a block was found now maybe you’d only need 20 satoshi/byte, but it might be an hour before the next block and in the subsequent time a large amount of new transactions come in.

Sometimes you don’t need such high confidence (e.g. it’s not important, or you have a way of fee bumping), so you can get away with much lower fees.

Why are Bitcoin fees so high?

Sometimes fees are high when there is a lot of demand for blockspace due to new investors coming in. Remember that there can be only so many transactions per block. And there is a sort of auction that occurs to determine who’s transactions make it in and who’s don’t. If there are a lot of people who really need to get into the next block, they will pay for the privilege. Wait for demand to die down and fees will be almost 0.

Fees have been coming down since large exchanges like Coinbase have been batching payments.

Why do some low-fee paying transactions appear early in the mempool?

It’s because a high-fee paying transaction depends on it, and reprioritizes it. i.e. the only way for the miner to get the money from the «good» transaction, is include a «bad» one first. It’s known as Child-Pays-For-Parent (CPFP), but note that some old versions of bitcoin core, and bitcoin unlimited don’t support it (and leave those transactions for smarter miner software).

Do you have historical data?

How did you build this?

The fee estimates are simply generated by calling estimatesmartfee $n on bitcoin core (0.16.0). The chart is generated by dumping the mempool and doing some smart sorting.

Do Bitcoin Fees Change By Country?

No, Bitcoin fees do not change by country. So whether you’re in the US, Canada, UK, Europe, New York or anywhere else, you’ll be paying the same as users across the globe.

How Do Bitcoin Fees Affect Taxes?

You’ll have to consult a tax adviser, but a fee is likely just a normal spend of Bitcoin or use tax software.

A Lowdown on Bitcoin Fees

The Bitcoin website lists fast peer-to-peer transactions, worldwide payments, and low processing fees as the most important features of the cryptocurrency. Not surprisingly, Bitcoin has become extremely popular as a way to send money digitally across the globe as it solves critical problems faced by transactions executed in fiat currencies.

In fact, the number of Bitcoin transactions has been consistently rising this year. The third quarter saw 20 million Bitcoin transactions being executed, up from 17.6 million during the second quarter. What’s more, the number of Bitcoin transactions has increased at the rate of at least 5% month-over-month since February 2018.

This growth can be attributed to the drop in the average transaction fees on the Bitcoin network, which was earlier proving to be a hindrance in the way of the adoption of this cryptocurrency.

A brief history of Bitcoin fees

CNBC reported in December 2017 that users were paying $28 on an average to transact using Bitcoin. There was one Twitter user who claimed that he had to incur $16 worth of fees to send $25 worth of Bitcoin from one address to another, while another journalist had to spend $15 to send $100 worth of Bitcoin from a digital wallet to a hardware wallet. In fact, the average Bitcoin transaction fee had shot up to $55 in the third week of December last year, according to BitInfoCharts

However, the average Bitcoin transaction fee has come down rapidly since then. BitInfoCharts reveals that the average Bitcoin transaction fee had dropped to just $0.50 in the first half of November 2018, which is probably why users are transacting more in Bitcoin to send and receive payments across the globe. But what has caused such a massive drop in the average Bitcoin transaction fees? To find out, we will first have to understand why Bitcoin fees are charged.

The economics behind Bitcoin fees

A Bitcoin transaction has to be added to the Blockchain in order to be successfully completed. However, for a transaction to be added to the Blockchain, it first needs to be validated by miners who solve a complex mathematical problem to verify the transaction. These miners spend a lot of computing power and energy when verifying a block of transactions from the Bitcoin Mempool (short for memory pool), which contains unconfirmed transactions waiting to be added to a block for confirmation.

Now, miners need to be incentivized for the time, effort, and resources that they are putting in to validate the unconfirmed transactions. As a result, they are given a fee of 12.5 BTC to successfully mine a block, but this is just one of the incentives on offer. Miners also earn a transaction fee that’s selected by the sender in a Bitcoin transaction for their effort as they play a critical role in keeping the network secure.

What drives transaction fees?

Each block of transactions on the Blockchain cannot contain more than 1 megabyte of information, so miners can only include a limited number of transactions in each block. This is why miners prioritize those transactions where they have the potential to earn higher transaction fees.

So, if the mempool is full, users looking to get their transactions through will compete on fees. They will push up the fee in a bid to get their transaction included into the next block that’s set to be mined. So, the Mempool bottleneck plays an important role in determining the transaction fee, though this isn’t the only aspect affecting this metric.

The transaction size also has a role to play in the fee determination. As miners can only include select transactions within the 1 megabyte block, they prefer selecting small transaction sizes because they are easier to confirm. Transactions occupying more space, on the other hand, need more work for validation so they need to carry a higher fee in order to be included in the next block.

So, there are two factors determining transaction fees — network congestion and transaction size — and they also play a critical role in the time taken for a transaction to be confirmed. For instance, if a user sends a transaction with very low fees attached to it and the Bitcoin Mempool is full, then miners won’t prefer picking that transaction because of the low incentive involved. In such cases, it could take several hours for the transaction to be confirmed.

However, if a user is willing to pay a higher transaction fee, then the first confirmation could arrive in 10 minutes, which is the time taken to mine a block. The Bitcoin community requires six such confirmations for a transaction to be completely validated. This means that if there’s no network congestion and the fee attached is high, then the transaction should be successfully processed in an hour.

The future of Bitcoin fees

Earlier we saw that Bitcoin fees have dropped rapidly over the past year, spurring a growth in the number of transactions. This can be attributed to the smaller Bitcoin Mempool size. However, in case the number of unconfirmed transactions increases at a faster pace than the rate at which new blocks are mined, there will be network congestion. This is when the average Bitcoin transaction fees will go up.

This is the scalability problem faced by Bitcoin thanks to the limited number of nodes. However, the community is coming up with ways to circumnavigate this issue so that numerous transactions are executed quickly with low fees. Earlier this year, a user was able to carry out 42 transactions using the Lightning Network and spent just 4.9 cents in transaction costs.

The Lightning Network is a second-layer payment protocol on top of the Bitcoin blockchain that’s capable of conducting a high volume of transactions at speed by reducing the on-chain load. As such, there’s a good chance that the average Bitcoin transaction fees will remain low going forward thanks to the development of such payment protocols, thereby boosting the adoption of this cryptocurrency as a means of digital payments.

Источник

Explaining bitcoin transaction fees

Every bitcoin transaction must be added to the blockchain, the official public ledger of all bitcoin transactions, in order to be considered successfully completed or valid. The work of validating transactions and adding them to the blockchain is done by miners, powerful computers that make up and connect to the network. Miners spend vast amounts of computing power and energy doing this for a financial reward: with every block (a collection of transactions not exceeding 1 MB in size) added to the blockchain comes a bounty called a block reward (currently 6.25 BTC), as well as all fees sent with the transactions that were included in the block.

For this reason, miners have a financial incentive to prioritize the validation of transactions that include a higher fee. For someone looking to send funds and get a quick confirmation, the appropriate fee to include can vary greatly, depending on a number of factors. While the fee does not depend on the amount you’re sending, it does depend on network conditions at the time and the data size of your transaction.

Because a block on the bitcoin blockchain can only contain up to 1 MB of information, there is a limited number of transactions that can be included in any given block. During times of congestion, when a large number of users are sending funds, there can be more transactions awaiting confirmation than there is space in a block.

When a user decides to send funds and the transaction is broadcast, it initially goes into what is called the memory pool (mempool for short) before being included into a block. It is from this mempool that miners choose which transactions to include, prioritizing the ones with higher fees. If the mempool is full, the fee market may turn into a competition: users will compete to get their transactions into the next block by including higher and higher fees. Eventually, the market will reach a maximum equilibrium fee that users are willing to pay and the miners will work through the entire mempool in order. At this point, once traffic has decreased, the equilibrium fee will go back down.

Again due to the fact that a block on the bitcoin blockchain can contain no more than 1 MB of information, transaction size is an important consideration for miners. Smaller transactions are easier to validate; larger transactions take more work, and take up more space in the block. For this reason, miners prefer to include smaller transactions. A larger transaction will require a larger fee to be included in the next block.

There is no simple way to calculate a transaction size by hand. Your Blockchain.com Wallet will automatically do this for you, and suggest an appropriate fee.

Fees in the Blockchain.com Wallet

Blockchain.com Wallet users will always have options when it comes to bitcoin transaction fees. Our wallet uses dynamic fees , meaning that the wallet will calculate the appropriate fee for your transaction taking into account current network conditions and transaction size.

You can choose between a Priority fee and a Regular fee. The Priority fee is calculated to get your transaction included in a block within the hour. The Regular fee is lower, and is for users who can afford to be a bit more patient; a confirmation for a transaction that includes a Regular fee will typically take a bit more than an hour.

Advanced users can set custom fees for their transaction in units of satoshi per byte (sat/b) by pressing Customize Fee and entering an amount. Please note that setting too low a fee may cause your transaction to remain unconfirmed for a long time and possibly be rejected. Customize your transaction fee at your own risk.

If you want to take a deeper dive into bitcoin transaction fees, this blog post provides a comprehensive overview of what fees are and how they work, and this one elaborates on some frequently asked questions. If you have an unconfirmed transaction, you can learn more about what this means here .

Источник