- Explaining bitcoin transaction fees

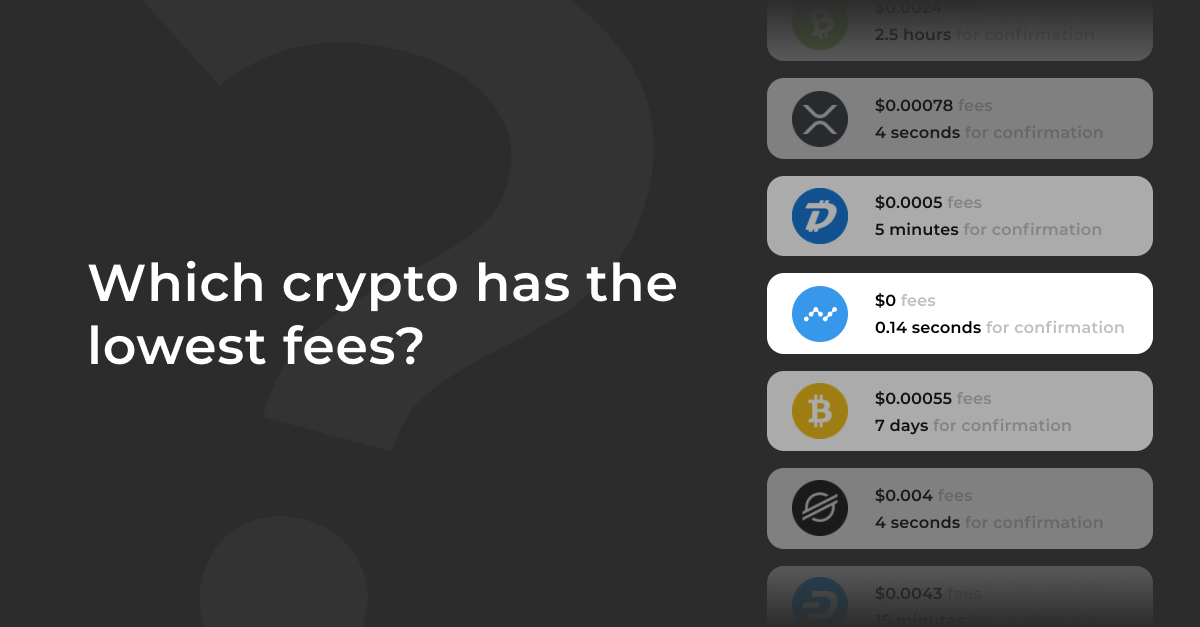

- Crypto fee comparison — what is the lowest fee cryptocurrency?

- # 1. Nano: $0 fees, 0.14 seconds for confirmation

- # 2. Digibyte: $0.0005 fee, 5 minutes to confirm

- # 3. Bitcoin SV: $0.00055 fee, 7 days to confirm.

- # 4. XRP: $0.00078 fee, 4 seconds to confirm.

- # 5. Bitcoin Cash: $0.0024 fee, 2.5 hours to confirm.

- # 6. Stellar: $0.004 fee, 4 seconds to confirm.

- # 7. Dash: $0.0043 fee, 15 minutes to confirm.

- # 8. Litecoin: $0.041 fee, 30 minutes to confirm.

- # 9. Monero: $0.0696 fee, 30 minutes to confirm.

- # 10. Doge: $0.239 fee, 20 minutes to confirm.

- Final thoughts

- Transaction commission

- Contents

- Description [ edit ]

- Reference Implementation [ edit ]

- Sending transactions [ edit ]

- Inclusion in blocks [ edit ]

- Transaction relaying [ edit ]

- Transaction settings [ edit ]

- Technical details [ edit ]

- Fee Plotting Sites [ edit ]

Explaining bitcoin transaction fees

Every bitcoin transaction must be added to the blockchain, the official public ledger of all bitcoin transactions, in order to be considered successfully completed or valid. The work of validating transactions and adding them to the blockchain is done by miners, powerful computers that make up and connect to the network. Miners spend vast amounts of computing power and energy doing this for a financial reward: with every block (a collection of transactions not exceeding 1 MB in size) added to the blockchain comes a bounty called a block reward (currently 6.25 BTC), as well as all fees sent with the transactions that were included in the block.

For this reason, miners have a financial incentive to prioritize the validation of transactions that include a higher fee. For someone looking to send funds and get a quick confirmation, the appropriate fee to include can vary greatly, depending on a number of factors. While the fee does not depend on the amount you’re sending, it does depend on network conditions at the time and the data size of your transaction.

Because a block on the bitcoin blockchain can only contain up to 1 MB of information, there is a limited number of transactions that can be included in any given block. During times of congestion, when a large number of users are sending funds, there can be more transactions awaiting confirmation than there is space in a block.

When a user decides to send funds and the transaction is broadcast, it initially goes into what is called the memory pool (mempool for short) before being included into a block. It is from this mempool that miners choose which transactions to include, prioritizing the ones with higher fees. If the mempool is full, the fee market may turn into a competition: users will compete to get their transactions into the next block by including higher and higher fees. Eventually, the market will reach a maximum equilibrium fee that users are willing to pay and the miners will work through the entire mempool in order. At this point, once traffic has decreased, the equilibrium fee will go back down.

Again due to the fact that a block on the bitcoin blockchain can contain no more than 1 MB of information, transaction size is an important consideration for miners. Smaller transactions are easier to validate; larger transactions take more work, and take up more space in the block. For this reason, miners prefer to include smaller transactions. A larger transaction will require a larger fee to be included in the next block.

There is no simple way to calculate a transaction size by hand. Your Blockchain.com Wallet will automatically do this for you, and suggest an appropriate fee.

Fees in the Blockchain.com Wallet

Blockchain.com Wallet users will always have options when it comes to bitcoin transaction fees. Our wallet uses dynamic fees , meaning that the wallet will calculate the appropriate fee for your transaction taking into account current network conditions and transaction size.

You can choose between a Priority fee and a Regular fee. The Priority fee is calculated to get your transaction included in a block within the hour. The Regular fee is lower, and is for users who can afford to be a bit more patient; a confirmation for a transaction that includes a Regular fee will typically take a bit more than an hour.

Advanced users can set custom fees for their transaction in units of satoshi per byte (sat/b) by pressing Customize Fee and entering an amount. Please note that setting too low a fee may cause your transaction to remain unconfirmed for a long time and possibly be rejected. Customize your transaction fee at your own risk.

If you want to take a deeper dive into bitcoin transaction fees, this blog post provides a comprehensive overview of what fees are and how they work, and this one elaborates on some frequently asked questions. If you have an unconfirmed transaction, you can learn more about what this means here .

Источник

Crypto fee comparison — what is the lowest fee cryptocurrency?

With the recent increase in fees for both Bitcoin and Ethereum, this is a question coming by more recently. So let’s dive right in.

To first cross off the top cryptocurrencies — Bitcoin’s average transaction fee is $25.47 as of writing, with a “near finality time” of 58 minutes before your transaction is considered fully confirmed. Ethereum fares slightly better with a $24.48 average transaction fee, and a 6 minute near finality time.

So with these two out of the running, let’s look at what the actual lowest fee cryptocurrencies are.

# 1. Nano: $0 fees, 0.14 seconds for confirmation

As no one who is in crypto will be surprised to hear, Nano takes the cake here. Nano is a cryptocurrency with zero fees, relying on Open Representative Voting for consensus and security. To be clear, the zero fees are not due to some temporary subsidy — zero fees are built into the protocol. In addition to having the lowest fees, Nano also wins out in the time it takes to confirm a transaction clocking in at 0.14 seconds. Yes, that’s sub-second, for irreversible, full confirmation by a decentralised network. Because transactions can never be reversed in Nano and because its consensus mechanism is so secure, even exchanges consider it confirmed after that first second. To top it off, Nano has no inflation, so your holdings aren’t being constantly diluted as in many other cryptocurrencies.

# 2. Digibyte: $0.0005 fee, 5 minutes to confirm

Clocking in as a good second is Digibyte (DGB). Digibyte is a PoW coin, but uses a combination of 5 different mining algorithms compared to Bitcoin’s one. This helps avoid centralization in mining. Its fees are quite low, while its confirmation time is relatively long on the exchanges where it’s listed because while a new block is mined every 15 seconds in DGB, exchanges require 20 confirmations before considering it settled. That being said, DGB does still have 8% inflation, meaning that while fees are low, your holdings will become worth less over time.

# 3. Bitcoin SV: $0.00055 fee, 7 days to confirm.

Bitcoin SV (BSV) is a bit of an odd one out. Being a fork of Bitcoin Cash, Bitcoin SV increased the block size to be able to process more transactions. In terms of fees, this seems to have worked out since a $0.00055 fee is relatively low. However, the chain is seen as so insecure and open to being 51% attacked that many exchanges have delisted it. Before delisting, it required a whopping 1008 confirmations at 10 minutes per block, for a settlement time of 7 full days. There’s also about 3% inflation to contend with, diluting your BSV holdings.

# 4. XRP: $0.00078 fee, 4 seconds to confirm.

XRP is the coin that everyone loves to hate. The wider crypto community sees it as a centralized coin, and it’s currently charged by the SEC with conducting an unregistered securities offering. All that being said, it does offer a low-fee option at an average $0.00078 fee, and takes only 4 seconds to be considered confirmed by an exchange. The worst aspect of XRP is that its supply is still being diluted massively, with about half of all XRP still in escrow to be distributed by a for-profit company.

# 5. Bitcoin Cash: $0.0024 fee, 2.5 hours to confirm.

A fork of Bitcoin, Bitcoin Cash (BCH) aims to be the true vision of Bitcoin, being peer to peer digital cash. Fees on BCH are obviously much lower than on Bitcoin, owing to BCH being able to handle more transactions in a single block. BCH accomplishes this by having larger, variable blocks (starting at 8MB, versus BTC’s fixed 1MB). Bitcoin Cash’s downside is that the security of the chain is seen as low. Kraken requires 15 confirmations or 150 minutes to consider a deposit confirmed, while Crypto51 sees the 51% attack cost for BCH as just $8500 an hour.

# 6. Stellar: $0.004 fee, 4 seconds to confirm.

Stellar is like XRP in many ways. Transactions are cheap and fast, though costs will go up if Stellar’s price increases. Stellar is more of a platform, allowing, for example, stablecoins to be used on the network. There are some worries over its supply, with approximately 20 billion “Lumens” still in the hands of the Stellar Development Foundation, and over the low amount of validators (nodes) being run. All that being said, Stellar is one of the few cryptos that Kraken accepts with a single confirmation.

# 7. Dash: $0.0043 fee, 15 minutes to confirm.

Dash is yet another coin in this list that is a fork of Bitcoin. Started as a privacy coin, Dash nowadays positions itself more as a general medium of exchange. As opposed to Bitcoin’s proof of work protocol, Dash uses proof of stake with “Masternodes” and a treasury, causing people to be worried that the early movers get most of the mining rewards, leading to further centralization overtime. However, Dash’s fees are quite low at $0.0043 on average, though it does take 15 minutes to be considered confirmed by Kraken.

# 8. Litecoin: $0.041 fee, 30 minutes to confirm.

Yet another fork of Bitcoin, Litecoin was one of the first cryptocurrencies after Bitcoin. Its biggest change was 2.5 minute blocks (compared to Bitcoin’s 10 minute blocks) allowing it to scale slightly better, and to keep fees lower. At $0.041 average fee it’s still not exactly cheap though, and Kraken requires 12 confirmations (30 minutes) before they feel safe enough to accept your deposit.

# 9. Monero: $0.0696 fee, 30 minutes to confirm.

An odd coin, Monero doesn’t focus on being a regular cryptocurrency, but focuses on privacy. The community has the cypherpunk ethos of full privacy for everyone, and is okay with sacrificing some speed and fees to accomplish this, meaning you’ll have to wait at least 30 minutes for Kraken to accept your deposit. The focus on privacy has some clear advantages, but has also caused some exchanges to delist Monero. It’s an exciting project, but no one would use it as the lowest fee option.

# 10. Doge: $0.239 fee, 20 minutes to confirm.

Many fees, much wow. Despite being a great meme, Doge clearly isn’t meant to be an actual payment cryptocurrency. It’s $0.239 average fees put it at the higher end of transaction fees, while it would also take 20 minutes before an exchange feels secure enough to consider your deposit valid. This was never the point of Doge though, with its 10% inflation indefinitely it was always meant to be a joke coin. At that, it has succeeded brilliantly, with the Shiba Inu as its very recognizable prime barker.

Honorary mention but excluded:

Avalanche. At the time of writing, Avalanche was having problems on its mainnet causing it to stop completely. As I write this, there hasn’t been a transaction validated in 6 hours. Supposedly it’s very fast, but right now there are still issues.

IOTA. While IOTA promises feeless (though this is unclear lately) and quick transactions, up to now IOTA can only function using a central coordinator. It is not yet a decentralised network, and it’s hard to test its true speed. It has a 79% confirmation rate within 10 minutes, with transactions dropped occasionally.

Final thoughts

In the end, my comparison confirmed what I had expected beforehand, which is that Nano is both the fastest cryptocurrency, and has the lowest fees. I’ve written an article about Nano earlier, so if you want to confirm for yourself that it really is that fast, head over there to see people using it and to see how you can try it out for free yourself.

Thanks for reading, comments and feedback much welcome.

Источник

Transaction commission

Enjoyed the article? Share:

Cryptocurrency Transaction Fees (Transaction Commission) can be included in any transaction in the Bitcoin network [1] .

Contents

Description [ edit ]

Currently a large amount of transactions is processed in a way that commission isn’t necessary. At the same time in case if transaction has a lot of entry points (e.g. it carries large amounts of data) a small commission is not uncommon.

Any miner can be the one who processes the transaction and earns the commission fee. When the network finds a new block it includes all information about transactions including their commission. Thus any user of group of users who find that block will gain both the reward for the block and the commission fees for every transaction included in it.

Including commission in a transaction is a voluntary decision but a user who finds a block can attach any transactions he wants to the said block. That way transactions with 0 commission have the lowest priority when transactions with even the minimal possible commission (

0.0001 BTC at the current moment) have standard priority and will more probably be included in the block [2] .

In the future along with lowering of reward for each block the main source of miners’ income will become commission for transactions. Even when block reward will disappear altogether there will still be point in mining because users will gain commission for all the transactions when they find a block.

Traditionally, the sender pays the full Bitcoin network fee; deducting the fee from the amount received by the recipient will often be considered an incomplete payment, although some wallets have a «sender-pays-fee» feature where the miner fee is deduced from send amount.

Transaction fees are voluntary on the part of the person making the bitcoin transaction, as the person attempting to make a transaction can include any fee or none at all in the transaction. On the other hand, nobody mining new bitcoins necessarily needs to accept the transactions and include them in the new block being created. The transaction fee is therefore an incentive on the part of the bitcoin transactor to make sure that a particular transaction will get included into a block [3] .

Because of deep technical reasons, bitcoin block space is a scarce commodity, getting a transaction mined can be seen as purchasing a portion of it. The price of block space is set by supply and demand, although in the real world the supply of space for transactions is extremely noisy, because more becomes available (and has to be immediately consumed or it’s lost forever) every time a block is mined, and block mined is an intentionally random process, that randomness being essential for bitcoin’s operation. Demand is random and cyclical. Random because each transaction is generated individually so the total amount is noisy (although that averages out to be somewhat smooth at scale) and has both daily and weekly cycles, with more transactions done during the day than at night. Demand can also be affected by speculative movements in the exchange rate. Bram Cohen blog post with helpful background to the market for block space;

Therefore the market for block space asks users to make a tradeoff between confirmation time and cost. Users with high time requirements may pay a higher than average miner fee to be confirmed quickly, while more patent users under less time pressure can save money by being prepared to wait longer.

Reference Implementation [ edit ]

The following sections describe the behavior of the reference implementation as of version 0.12.0. Earlier versions treated fees differently, as do other popular implementations (including possible later versions).

Sending transactions [ edit ]

Transaction with 0 commission can be successfully sent if following conditions are met:

- Its size is lower than 1000 bytes [4]

- Its exit points have value of 0.01 BTC or higher

- Its priority is high enough

In other cases the transaction will be rounded down to 1000 bytes and the commission of 0.0001 BTC will be added. For every following 1000 bytes in that transaction another 0.0001 BTC of commission will be added.

Thus for a transaction of 750 bytes the commission will be 0.0001 BTC and for a transaction of 1001 bytes it will be 0.0002 BTC. Standard Bitcoin wallets always ask their users for approval of commission and if user declines it the transaction can be cancelled. At the current moment an average transaction amounts to roughly 500 bytes which corresponds to a commission of 0.0001 BTC.

Users can decide to pay a predefined fee rate by setting `-paytxfee= ;`(or `settxfee ` rpc during runtime). A value of `n=0` signals Bitcoin Core to use floating fees. By default, Bitcoin Core will use floating fees.

Based on past transaction data, floating fees approximate the fees required to get into the `m`th block from now. This is configurable with `-txconfirmtarget= ` (default: `2`).

Sometimes, it is not possible to give good estimates, or an estimate at all. Therefore, a fallback value can be set with `-fallbackfee= ;` (default: `0.0002` BTC/kB).

At all times, Bitcoin Core will cap fees at `-maxtxfee= ;` (default: 0.10) BTC.

Furthermore, Bitcoin Core will never create transactions smaller than the current minimum relay fee.

Finally, a user can set the minimum fee rate for all transactions, which defaults to 1000 satoshis per kB.

Note that a typical transaction is 500 bytes.

Inclusion in blocks [ edit ]

In this part of the article the current principle of inclusion of transactions into blocks will be discussed. This setting is flexible for every miner if they want to have blocks of lower or higher size that include lower or higher amount of transactions accordingly.

30 000 bytes are reserved for highest priority transactions and they don’t depend on commission in any way. After that all transactions with lower than highest priority are added to the block. The higher the commission the higher the priority. A block’s maximum size is 300 000 bytes. Transactions that weren’t included in their blocks will remain in miners’ memory storage and can be included in next blocks.

Then transactions that pay a fee of at least 0.00001 BTC/kb are added to the block, highest-fee-per-kilobyte transactions first, until the block is not more than 750,000 bytes big.

The remaining transactions remain in the miner’s «memory pool», and may be included in later blocks if their priority or fee is large enough.

For Bitcoin Core 0.12.0 zero bytes relay-and-mining-priority-transactions in the block are set aside for the highest priority transactions. Transactions are added highest-priority-first to this section of the block.

Transaction relaying [ edit ]

The reference implementation’s rules for relaying transactions across the peer-to-peer network are very similar to the rules for sending transactions, as a value of 0.00001 BTC is used to determine whether or not a transaction is considered «Free». However, the rule that all outputs must be 0.01 BTC or larger does not apply. To prevent «penny-flooding» denial-of-service attacks on the network, the reference implementation caps the number of free transactions it will relay to other nodes to (by default) 15 thousand bytes per minute.

Transaction settings [ edit ]

| Settings | Default value (unit) |

|---|---|

| paytxfee | 0.0000 (BTC) |

| limitfreerelay | 15 (thousand bytes per minute) |

| mintxfee | 0.0001 (BTC) |

| blockmaxsize | 300000 (bytes) |

| blockminsize | 0 (bytes) |

| blockprioritysize | 30000 (bytes) |

Technical details [ edit ]

Transaction priority is calculated as following:

In order to avoid limitation the transaction’s priority has to be no less than 57,600,000. Limit is written in code as COIN * 144 / 250 which implies that transaction has a «coin» with the age of one day (144 is estimated number of blocks mined per day) and the size of transaction is 250 bytes.

Let’s provide an example of a transaction that has 2 entry points one of which is 5 BTC with 10 approvals and the other one is 2 BTC with 2 approvals. Transaction’s size is 500 bytes and thus its priority is equal to

(500000000 * 10 + 200000000 * 3) / 500 = 11,200,000

Fee Plotting Sites [ edit ]

As of May 2016, the following sites seem to plot the required fee, in satoshi per (kilo)byte, required to get a transaction mined in a certain number of blocks. Note that all these algorithms work in terms of probabilities.

Источник