- Liquid vs. Illiquid Crypto Markets and Bitcoin

- Table of Contents

- The Importance of Liquidity in the Crypto Market

- What Factors Impact the Liquidity of Cryptocurrencies?

- Trading Volume

- Trading Platforms

- Regulation

- Acceptance and Popularity

- Liquidity: It Matters

- Glassnode: инвесторы массово выводят биткоины с централизованных бирж

- 78% of the Bitcoin Supply is Not Liquid

- Rafael Schultze-Kraft

- Rafael Schultze-Kraft

- Quantifying Bitcoin Liquidity

- Results

- Conclusion

Liquid vs. Illiquid Crypto Markets and Bitcoin

Liquidity is one of the most important factors in trading in cryptocurrencies — so what does it mean when a market is illiquid?

Table of Contents

The liquidity of an asset’s market is one of the most important concepts — perhaps alongside market capitalization — to consider when trading or investing in financial markets.В

Liquidity can be described as the degree to which a tradable asset can be easily converted into cash or other assets without affecting the market price. In short, liquidity is a measure of how easily an asset can be bought or sold on the open market.

The concept of liquidity is important to traders and investors because it determines whether they will be able to enter or exit trades at their desired positions, or suffer price volatility caused by elements such as slippage. This is true for both cryptocurrencies like Bitcoin AND traditional financial assets that have been traded for years.

Cash is regarded as the most liquid asset as it can be easily converted into any other asset, anytime. Assets such as real estate or rare art are said to be illiquid as they cannot be easily bought or sold.

The Importance of Liquidity in the Crypto Market

The cryptocurrency market — whose success is highly dependent on the performance of Bitcoin — has been in existence for a little over a decade. This is a much shorter period of time compared to other established markets that have been around for decades, if not centuries.

Despite the relatively short time frame of the crypto industry, there are now nearly 8,000 cryptocurrencies traded in over 34,000 markets. What does this mean for the market’s liquidity, or lack thereof?

In the context of digital assets, liquidity refers to the degree of ease in converting a cryptocurrency into cash or other tradable assets. However, not all assets are created, marketed or accepted by the public equally.

Some cryptocurrencies are popular. Others are not. Well-known and large-market cap cryptocurrencies such as Bitcoin and Ethereum enjoy high liquidity as they are traded on the majority of the exchanges in the world.

The importance of high liquidity includes fair asset prices, market stability, technical analysis accuracy and quicker transactions.

What Factors Impact the Liquidity of Cryptocurrencies?

The main factors that affect the liquidity of Bitcoin or other cryptocurrencies are the following:

Trading Volume

Cryptocurrency trading volume can provide a good indication of how liquid a cryptocurrency’s market is. The trading volume details the number of that particular cryptocurrency that has been bought and sold on trading platforms in a given period, usually 24 hours. The trading volume of an asset signifies the market interest in the specific cryptocurrency.

Bitcoin has a higher trading volume because:

- Many people are interested in buying or selling the assetВ

- Most of the altcoins — all cryptocurrencies that aren’t Bitcoin — are traded against Bitcoin.

- Because of its large market capitalization, many institutional investors are buying Bitcoin in bulk. The billion dollar purchases of Bitcoin by established powerhouses such as PayPal, Square, Grayscale Investments, MicroStrategy, either for long-term investments or as products to sell to their customers, have made Bitcoin markets the best and safest game in town over the last few months.В

This is dramatically different in Altcoinland. Smaller altcoins with lower trading volumes constantly face liquidity challenges that often result in market manipulation, which hurts smaller investors and pushes them out. This in turn leads some of these smaller projects and exchanges to engage in wash trading, the act of artificially engaging in trades to inflate the trading volume and create an illusion of higher liquidity and manipulate the market. As early investors or team members often accumulate a large chunk of the circulating market supply, they have the ability to move the price by suddenly dumping their shares on an unsuspecting market, thereby shorting the price and rebuying at a lower value as the market tanks to this sudden oversupply.В

Trading Platforms

An exchange is a platform where cryptocurrencies are bought and sold. A popular and well-protected exchange is likely to attract more traders, leading to more revenue, more liquid trading pools and better security and this has been one of the major reasons why trusted and established exchanges like Binance and Coinbase continue to thrive while smaller exchanges falter, dragged down by hacking attacks on similarly sized peers. The increase in trading volume for these exchanges translate to higher revenue. Bigger exchanges are a source of high liquidity due to the large trading volumes.

Regulation

Some countries such as India or China have previously adopted a hostile stance against cryptocurrency trading or dealing with digital assets. On the other hand, countries such as Portugal have ruled that trading cryptocurrencies is tax-free. Many people will flock to countries where the regulation is favorable for them to buy, store, or hold cryptocurrencies. As a result, the liquidity is higher in jurisdictions where trading is accepted than where it is subject to stringent regulations.

Acceptance and Popularity

The success of a cryptocurrency lives and dies by its acceptance and popularity with the crypto community. With tens of thousands of crypto assets now competing for the attention of investors, many brilliantly conceived but inadequately promoted projects live on smaller exchanges, unable to make the jump to the industry big leagues unless they pay an exorbitant listing fee or can demonstrate a huge community following that they can bring to an exchange’s books. This is the reason why crypto projects often spend most of their funds for marketing purposes.В

Liquidity: It Matters

Traders and investors are encouraged to trade markets with a higher degree of liquidity. This ensures that they can enter and exit their trades without facing difficulties. The cryptocurrency market is notorious for its volatility, which makes liquidity an important factor. Traders have to exit their positions quickly or else price swings could affect their trading strategies. Therefore, more prudent traders will almost certainly avoid trading in less liquid crypto assets.В

However, this volatility is not a bad thing for the investor seeking high risk for high reward, as in this dramatic fluctuation in price (as seen for example on DeFi markets) hide exponential returns on investment that the Bitcoin market simply cannot offer, despite its dramatic surge to a new all-time high price in December 2020.В

Ultimately, it depends on investors and their risk appetite to decide whether a liquid or illiquid market is a bad thing. Beauty comes in many forms — and it is in the eye of the beholder and all that.

This article contains links to third-party websites or other content for information purposes only (“Third-Party Sites”). The Third-Party Sites are not under the control of CoinMarketCap, and CoinMarketCap is not responsible for the content of any Third-Party Site, including without limitation any link contained in a Third-Party Site, or any changes or updates to a Third-Party Site. CoinMarketCap is providing these links to you only as a convenience, and the inclusion of any link does not imply endorsement, approval or recommendation by CoinMarketCap of the site or any association with its operators. This article is intended to be used and must be used for informational purposes only. It is important to do your own research and analysis before making any material decisions related to any of the products or services described. This article is not intended as, and shall not be construed as, financial advice. The views and opinions expressed in this article are the author’s [company’s] own and do not necessarily reflect those of CoinMarketCap.

Источник

Glassnode: инвесторы массово выводят биткоины с централизованных бирж

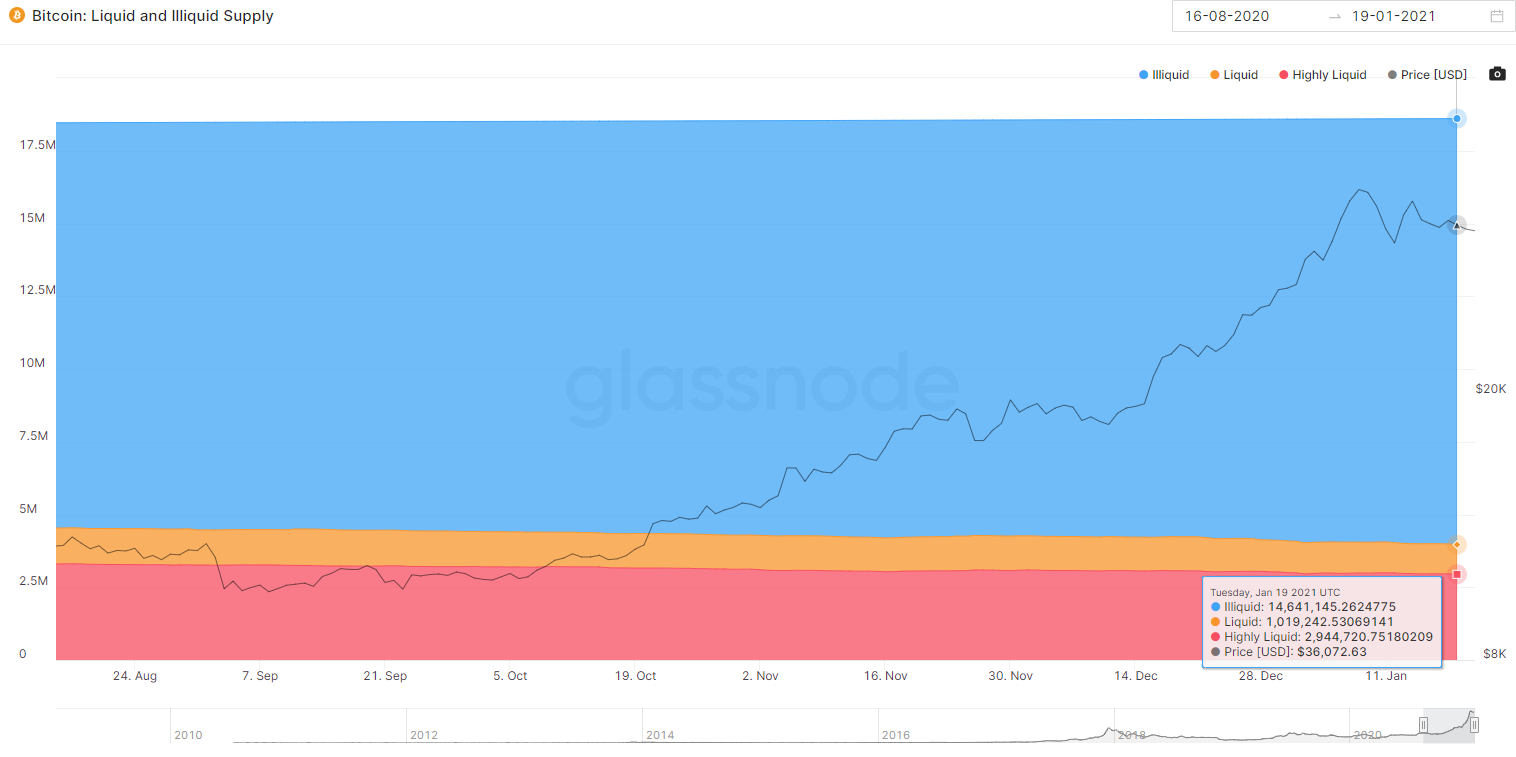

На фоне роста цены биткоина инвесторы продолжили перемещать криптовалюту в долгосрочные хранилища. За прошлый месяц с ликвидных кошельков вывели 270 000 BTC. Об этом свидетельствуют данные аналитической компании Glassnode.

Эксперты заметили, что ликвидное предложение биткоина стабильно снижалось в течение последних девяти месяцев. На момент написания показатель составляет 21,3% от общего числа монет в обращении. 78,7% из 18,6 млн выпущенных BTC находится в «неликвидных» кошельках.

This $BTC chart might be more important than the price chart: bitcoin supply is being withdrawn from exchanges at an all-time-high pace.

Historically, bull cycles have ended AFTER liquid supply change flips positive (🟡)

That flip has not happened yet.

«Этот график биткоина важнее графика цены. Криптовалюту выводят с бирж рекордными темпами. Исторически бычьи циклы заканчивались с увеличением ликвидности. Но пока этого не произошло», — написал аналитик Люк Мартин.

Glassnode признает биткоин-кошелек неликвидным, если за время существования с него выведено менее 25% активов. Соответственно, высоколиквидными считаются кошельки, сохранившие менее 25% поступивших монет.

Динамика ликвидного и неликвидного предложения биткоина. Данные: Glassnode.

Статистика Glassnode показывает, что 61% (2,38 млн ВТС) из 3,9 млн высоколиквидных ВТС находится на централизованных биржах. Показатель неуклонно снижается — по данным CryptoQuant, с июля биржевые балансы сократились на 13,8%.

Также растет интерес к первой криптовалюте со стороны институционалов. Согласно Bitcoin Treasuries, сейчас киты владеют более 1,2 млн ВТС — 6,5% от всех выпущенных биткоинов.

В прошлом году институциональные инвесторы приобрели более 1 млн ВТС. Среди них Grayscale Investments (600 000 BTC), MicroStrategy (70 470 BTC), Ruffer Investments (45 000 BTC) и Square (4709 BTC).

Напомним, в обзоре Ruffer Investments говорится, что биткоин находится в начале институционального принятия.

Ранее аналитики из JPMorgan заявили, что институционалы стали воспринимать биткоин как альтернативу золоту.

Подписывайтесь на новости ForkLog в Telegram: ForkLog Feed — вся лента новостей, ForkLog — самые важные новости и опросы.

Источник

78% of the Bitcoin Supply is Not Liquid

Quantifying the amount of liquid and illiquid BTC supply and its relationship to Bitcoin’s price.

Rafael Schultze-Kraft

Twitter: @n3ocortex | Data scientist | Machine learner | Python maximalist | Swing Hodler. Co-founder and CTO @ www.glassnode.com

More posts by Rafael Schultze-Kraft.

Rafael Schultze-Kraft

TL;DR We analyse Bitcoin entities and classify them into one of three liquidity categories: highly liquid, liquid, and illiquid. Our methodology suggests that currently 14.5 million BTC (78% of the circulating Bitcoin supply) is held by illiquid entities. Our analyses show a clear relationship between Bitcoin liquidity and the BTC market. The metrics introduced here are live on Glassnode Studio.

The amount of available BTC at any given point in time is preprogrammed according to Bitcoin’s design. With 88.5% of the total supply already mined, at the time of writing, the circulating supply of Bitcoin is

However, the number of bitcoins actually available for buying and selling, is much lower. Not only can we expect that a substantial amount of mined BTC is lost forever (we estimate this number to be

3M BTC), but as Bitcoin continues to become more and more a Store of Value and investors increasingly HODL making use of it as a safe haven asset to store wealth, the actual «liquid» Bitcoin supply can be expected to be considerably lower.

Quantifying Bitcoin’s liquidity is essential to understand its market. If many bitcoins are illiquid, a supply-side crisis emerges – which has a weakening effect on BTC’s selling pressure in the market. Or put differently: A sustained rise of illiquid bitcoins is an indication of strong investor hodling sentiment and a potential bullish signal.

Quantifying Bitcoin Liquidity

In order to quantify the state of Bitcoin liquidity, we focus on Bitcoin entities. Entities are individuals or institutions that control a set of addresses in the Bitcoin network. Since it is the entities that control the supply, it is their behavior that determines whether their BTC contributes to the total liquidity or not.

For example, consider long-term investors who keep their BTC locked in a cold wallet with the intention of holding it for long periods of time: Their BTC is practically removed from the liquid portion of the Bitcoin supply that is in circulation and accessible for trading. In contrast, exchanges with constant in- and outflows directly contribute to the pool of liquid supply.

As a measure of an entity’s liquidity, we use the ratio of the cumulative outflows and cumulative inflows over the entity’s lifespan. This ratio yields a number L between zero and one, with larger values indicating higher liquidity. Liquidity is therefore the extent to which an entity spends the assets it receives. Illiquid entities are those that hoard coins in anticipation of a long-term BTC price appreciation.

Hence, a HODLer that never sells (i.e. spends their bitcoin on-chain) has L = 0 . On the other hand, a very active entity which buys and sells BTC on a regular basis, such as an exchange, has an asymptotic value of L

Note that an entity which sells its entire position will have a value of L = 1 . However, since its supply becomes zero (because the entity spent its entire stack), it won’t contribute to the analysis.

We emphasize that «in-house» transfers are not included in our calculation of L. In-house (or internal) transfers are bitcoins moved/transferred within addresses controlled by the same entity. Taking this into account gives a more accurate picture of the actual liquidity, as a single entity cannot artificially bump its L solely via internal transfers. An example is the movement of large amounts of BTC within an exchange – this happens when new cold wallets are created or funds are reshuffled internally.

We define three different liquidity categories. An entity is considered to be:

- illiquid if: L

- liquid if: 0.25 ≤ L

- highly liquid if: L ≥ 0.75

However, as we have already discussed in our previous work on «Quantifying Short-Term and Long-Term Holder Bitcoin Supply», such sharp classification thresholds can give rise to artifacts in the resulting data when important entities suddenly cross the threshold. While related approaches have been put forward, we use a superior methodology by employing weights from logistic functions with midpoints centered around the thresholds (Figure 1) to attribute the liquidity classes to each entity, and obtain a smooth transition between liquidity categories.

By distributing an entity’s supply into the three liquidity buckets according to these weights, we obtain the amount of illiquid, liquid, and highly liquid BTC supply. For instance, if an entity has spent 25% of all BTC it has received over the course of its lifespan, the amount they hold will contribute 50% to the liquid and 50% to the illiquid bucket.

Results

Quantifying the entire circulating Bitcoin supply with the above methodology, we end up with the following figure:

At the time of writing the numbers are:

- Illiquid supply: 14.5 million BTC

- Liquid supply: 1.2 million BTC

- Highly liquid supply: 3 million BTC

That means that around 78% of the circulating Bitcoin supply is considered illiquid.

Only 4.2 million BTC (22%) are currently in constant circulation and available for buying and selling.

It’s worth looking at how this trend has evolved in the past. Looking at the change of supply in each categoy from the beginning of the year, we can see a clear upwards trend of Bitcoin illiquidity. This is indicates that the present bull market is driven by the staggering amount of illiquidity.

More than 1 million BTC has become illiquid in the course of 2020.

Liquidity as measured through our methodology has a clear relationship with the BTC market. Looking at the cumulative change of liquid vs. illiquid BTC since 2017 (Figure 4), shows that illiquid supply tends to decrease during bear markets, and increase during bull markets (and vice versa for the liquid supply). Note in the graph below the orange liquid supply curve contains both the liquid and highly liquid portions as defined above.

Another way to look at this is through the relative growth (%) of liquid and illiquid supply, and how it relates to the growth of the total circulating supply (Figure 5) . Note how the liquid portion of the supply has been in a constant downwards trends since 9 months, decreasing its growth from 30% to 12% (measured since 2017).

Currently we are at a stage in which the illiquid supply is growing more than the total circulating supply. An pattern we have similarly observed during the bull run of 2017.

Conclusion

We introduce a new methodology in order to quantify the amount of illiquid Bitcoin – and therefore the liquidity available for trading at any given point in time.

Our analysis shows that currently 78% of the circulating Bitcoin supply (14.5 million BTC) can be classified as being illiquid. A trend that has been increasing over the course of 2020 and paints a potential bullish picture for Bitcoin in the upcoming months, as less BTC are available in the network to be bought.

Understanding Bitcoin liquidity is an important macro signal that demonstrably has a clear relationship with the BTC’s price.

Liquidity metrics here are live in Glassnode Studio as of today.

- Follow us and reach out on Twitter

- Join our Telegram channel

- For on–chain metrics and activity graphs, visit Glassnode Studio

- For automated alerts on core on–chain metrics and activity on exchanges, visit our Glassnode Alerts Twitter

Источник