- 17 Blockchain Companies Boosting the Real Estate Industry

- Blockchain Real Estate

- PropertyClub

- ManageGo

- RealBlocks

- Meridio

- SMARTRealty

- Reasi

- Propy

- Slice

- Harbor

- The Bee Token

- ShelterZoom

- NetObjex

- StreetWire

- CPROP

- Imbrex

- The Crypto Realty Group

- The Lending Coin

- Buy Bitcoin, Not Real Estate

- Real Estate as Malinvestment

- Real Estate versus Bitcoin

17 Blockchain Companies Boosting the Real Estate Industry

Vacation rental houses. Parking spots. Even dream homes. Before long, they’ll all be purchased on a blockchain. In fact, blockchain-based real estate is already gaining popularity as a way for buyers, sellers and investors to interact with each other and learn about properties.

But why is blockchain poised to give the real estate industry such a significant leg up? First and foremost, by leveraging Distributed Ledger Technology (DLT), it increases trust through greater transparency. And in real-estate, trust — of a website, an agent, a listing — is imperative. Blockchain also expedites contract processes, saves time and reduces costs.

Blockchain Real Estate

Because the daily rate of real estate transactions is so immense, a common database of leases and purchases is more necessary than ever. Blockchain can provide that. Upgrading the traditional Multiple Listing Service (MLS) database to a blockchain-based would create a far more transparent ledger system where brokers and agents could see the entire transaction history of a property.

To read more about other applications for blockchain, click here.

Besides helping the traditional real-estate industry, blockchain is also being adopted by the burgeoning property-sharing sector. Below are 17 companies that use the increasingly popular technology to boost business.

PropertyClub

Location: New York, N.Y.

How it’s using blockchain in real estate: PropertyClub is a real estate platform that uses blockchain to refine the way people market, search for, buy, sell and invest in properties. Using smart contracts, the company conducts real estate transactions digitally using cryptocurrencies like Bitcoin or its own PropertyClub Coin (PCC).

ManageGo

Location: New York

How it’s using blockchain in real estate: ManageGo is leveraging blockchain for rental property owners. The ledger-backed software helps property managers and owners process payments, thoroughly complete credit background checks and manage maintenance ticketing. DLT is helping owners get a more transparent, thorough view of payment history and renter backgrounds.

RealBlocks

Location: New York

How it’s using blockchain in real estate: RealBlocks uses blockchain to create new avenues for real estate investing. Its platform lets investors buy fractional interest rather than entire portfolios or assets. Through tokenization that’s applied using blockchain technology, RealBlocks helps reduce fees, speed up processes and provide liquidity options.

Meridio

Location: New York, N.Y.

How it’s using blockchain in real estate: Meridio allows commercial property owners to sell digital shares of their real estate. The company’s platform connects individual and corporate investors with property owners who are looking to liquidate portions of their ownership.

SMARTRealty

Location: Seattle

How it using blockchain in real estate: SMARTRealty uses smart real estate contracts to enact and maintain property purchase and rental agreements. Whether it’s paying rent, establishing mortgages or purchasing a home, the company’s smart contracts help to establish protocols that, if not met, immediately dissolve a contract.

Reasi

Location: Santa Monica, Calif.

How it’s using blockchain in real estate: Reasi is the first end-to-end real estate transaction platform featuring secure and seamless escrow. Instead of relying on third parties, real estate agents can use Reasi’s blockchain-based escrow platform to expedite the real estate buying and selling processes.

Propy

Location: Palo Alto, Calif.

How it’s using blockchain in real estate: Propy is a real estate marketplace that uses smart contracts to enact international property transactions. The company’s platform enables buyers, sellers and agents to use a series of smart contracts that help speed up the real estate process — one that is often hindered by international legalities.

Slice

Location: West Hollywood, Calif.

How it’s using blockchain in real estate: Slice gives smaller investors a chance to invest in commercial real estate. Like Meridio, real estate owners can gain access to a large pool of international investors through the company’s ledger technology.

Harbor

Location: San Francisco

How it’s using blockchain in real estate: Harbor is a compliance platform for tokenizing private securities, including real estate. The company is tokenizing real estate assets, including funds, private REIT’s, building ownership and land in order to increase liquidity and transparency of the market.

The Bee Token

Location: San Francisco

How it’s using blockchain in real estate: The Bee Token is taking a different approach to traditional real estate with its blockchain-based home sharing platform. Conceptually similar to Airbnb but with a big blockchain twist, the Bee Token enables homeowners to rent out their entire house or individual rooms in exchange for cryptocurrency.

ShelterZoom

Location: New York

How it’s using blockchain in real estate: ShelterZoom uses blockchain to manage all aspects of the real estate offer and acceptance process. The secure online platform records every action along the path to closing on a real estate deal to ensure an immutable financial record.

NetObjex

Location: Irvine, Calif.

How it’s using blockchain in real estate: NetObjex is a blockchain developer that uses ledger technology in a variety of industries, but primarily real estate. The company has helped multiple real estate companies implement smart contracts and IoT technology.

StreetWire

Location: New York

How it’s using blockchain in real estate: StreetWire creates secure transaction solutions for the real estate industry through a data provider-controlled encrypted ledger. Its platform facilitates faster and more transparent property transactions.

CPROP

Location: New York

How it’s using blockchain in real estate: CryptoProperties or CPROP builds blockchain data applications that focus on identifying new opportunities, reducing risk and pinpointing issues in the real estate industry. CPROP’s technology is applied to multiple real estate areas, including brokerage transactions, investment management, property development, finance and insurance.

Imbrex

Location: New York

How it’s using blockchain in real estate: A listing platform that decentralizes and encrypts data using blockchain, Imbrex connects buyers with listing agents directly and uses digital tokens instead of money to create more transparency and minimize obstacles in the buying/selling process.

The Crypto Realty Group

Location: El Seguno, Calif.

How it’s using blockchain in real estate: The Crypto Realty Group is a consulting firm that works with crypto escrow and financial consulting companies to helps clients buy and sell residential, commercial, local and international real estate using cryptocurrency.

The Lending Coin

Location: Boise, Idaho

How it’s u sing blockchain in real estate: The Lending Coin provides peer-to-peer real estate financing through blockchain. The company offers fractional real estate interests, and the use of blockchain ensures that all transactions are transparent and trackable.

Images via Shutterstock and social media

Источник

Buy Bitcoin, Not Real Estate

Real estate is how ordinary people have stored value and ultimately accumulated wealth. Indeed, post World War II societies all but demanded access to credit through politics, and governments responded with in-kind favors to keep power. Compounding of easy, loose money spurred decades of growth in housing construction, materials, land, and requisite financial products. This, in turn, triggered the Business Cycle, and the basis for entire economies was exposed as theft and fraud. Bitcoin might be the chance to starve parasitical redistributive governments, ushering in an entire new way to build equity.

Real Estate as Malinvestment

The dean of the Austrian School of Economics, Ludwig von Mises, wrote extensively of malinvestment. Though kept alive in fringe American paleoconservative circles, and as libertarianism’s cult favorite economist, the notion hadn’t gained much popular traction until the US Great Recession of 2008.

My guess is he’s poised to make another appearance in the coming years.

Malinvestment starts the Business Cycle, that boom and bust you’re probably all too familiar with, according to Austrian theory. Central banks are its main culprit. Their monopoly of the money supply has created what is called fiat currency: a paper or digital money backed only by the full faith and credit of a given government. It is without restraint other than inflationary pressure, which governments for over a century have battled using central banks.

Inflation acts as debasement, enabling more tickets or digits to circulate than might otherwise under a sound or tight money, and it is a chance for politicians to promise goodies such as housing guarantees. The trade-off is to keep dollars, pesos, and won flowing enough to produce a wealth effect but not so much that government units of exchange become useless.

Central banks can then artificially slow the rate of fiat through the price of money, interest rates. It’s a faucet, controlling the flow.

Malinvestment is the inevitable result. Even with the myriad of tools available in our present age, you’d think someone crazy if they told you they could predict economic production levels, adequate investment allocations, research and development, etc. Yet that is what a central bank essentially does.

By socializing housing’s risk through mortgage guarantees, while privatizing profit, central banks signaled to property speculators, land holders, construction companies and equipment providers, brokers and investment funds that this industry was a “winner.” It created a classic moral hazard. Producers then dedicated resources and time toward housing because customers on the retail side were armed with hundreds of thousands of dollars in risk-free incentives.

It was simply a matter of time before markers were called on outstanding loans of credit, and creative financial instruments, which would have never existed otherwise, were revealed as hustles to take advantage of political cynicism.

As is now well understood, the US economy, the world’s reserve currency, collapsed in short order. Like dominoes clacking, people abandoned newly constructed homes, construction workers filed for unemployment insurance, entire housing neighborhoods ghosted, bankruptcies flooded federal courts for relief, foreclosures swept the world, and the globe’s biggest banks were added to welfare rolls, the dole. In a private, free economy malinvestment is a cruel mistress, unforgiving. In our modern central banking economies, it literally pays to match government folly absurdity for absurdity. They’ll bail you out.

Malinvestment’s keen insight is not the bust, but the blowing up of the bubble or boom. Understand boom times are suspect in a central bank economy, and much of modern economics comes into focus.

It was around this time too Satoshi Nakamoto’s white paper was released in response. Getting out from under the petty machinations of politicians and the whims of their constituents might be finally achievable with the advent of bitcoin.

Real Estate versus Bitcoin

Real estate’s historic appreciation might be a chimera, an illusion, as a store of value. It might be the case real estate in a voluntary, organically free economy could be rather inexpensive and without much fuss with regard to equity.

It’s hard to know without running history’s tape backwards, having no recourse to coercive malinvestment and redistributive policies. We are where we are.

Paul Moore, in a column for Bigger Pockets, completely ignores theory and history as recent as nine years ago, and asserts “I’m particularly passionate about multi-family real estate.” In a post riddled with appeals to authority, anecdotes, and half-truths, he ‘bravely’ comes down on the side of real estate in my proposed debate.

Bitcoin is rank speculation, he argues, insisting it is sexy while investment, the adult way to wealth, should now and forever be boring. He also attributes a bitcoin price fall in November to Jamie Dimon. How Mr. Moore could know this to be the cause isn’t exactly explained, but that doesn’t stop him from rhetorically asking if some yahoo’s statements could ever move real estate markets in such a way. Um, 2008 called, Mr. Moore, and would love to chat.

Nevertheless he continues, “I wanted to know exactly how multi-family stacks up against the other asset classes,” he wrote. “The numbers say that multifamily and retail are: 3x better than the S&P 500, […] 9x better than NASDAQ, 4x better than private equity,” and so on. The rest of his assessment of bitcoin as an investment is hacky and stale, sprinkling words like scam and lottery to leave a decided impression before any real consideration. Oh, and he has charts.

Bitcoin has had close to a decade to burst, but instead has managed to remain resilient, and has advantages over real estate in terms of the future of wealth accumulation. Investors can buy it in fractions. Barriers to entry in the housing market are notorious, but all bitcoin takes is a smart-ish phone.

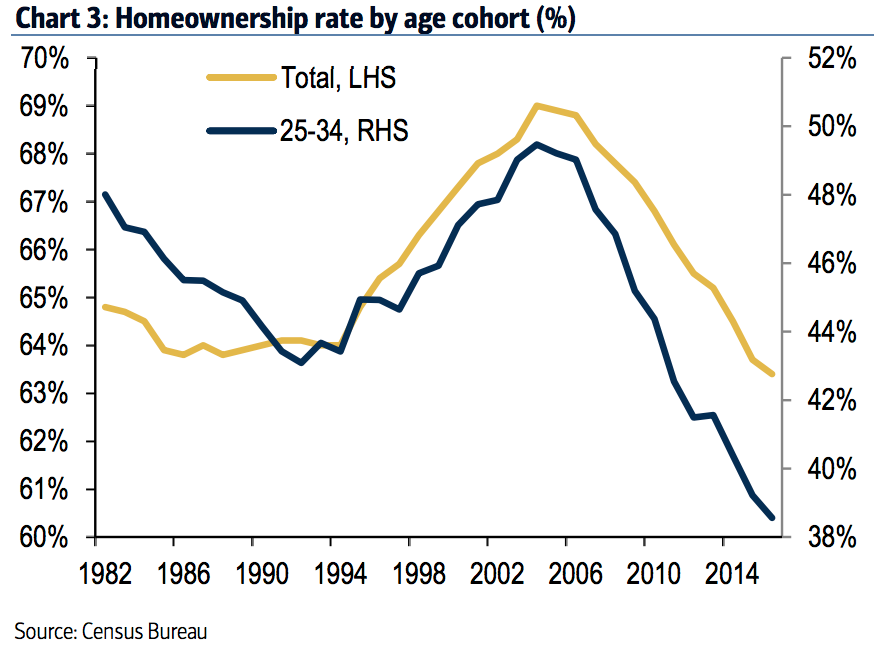

Indeed, future investors have been raised on real estate kool-aid: they’ve learned to spend rather than save, as fiat economies demand due to inflation, and now cannot afford the down-payment anyway. The average home price has been blown up to such an extent, even if they were savers they’d be out of luck. In fact, bitcoin’s relative ease of purchase and lack of central control apparently appeal to the next investment generation ahead of even government-boosted stocks.

And as a result, the future seems crypto: free from government machinations, borderless, permissionless. It might even end up bringing housing prices down, closer to reality.

Are you buying bitcoin or real estate? Tell us in the comments.

Источник