- Is Bitcoin a Currency or an Asset? Not Everyone Agrees.

- Even those invested in the cryptocurrency don’t necessarily agree on a definition.

- Цена Bitcoin Asset ( BTA )

- Ссылки Bitcoin Asset

- Контракты Bitcoin Asset

- Bitcoin Asset Chart

- Цена BTA в реальном времени

- Bitcoin: An Asset, Currency Or Collectible?

- Bitcoin Is An Asset, Not A Currency

Is Bitcoin a Currency or an Asset? Not Everyone Agrees.

Even those invested in the cryptocurrency don’t necessarily agree on a definition.

The emergence of cryptocurrencies like Bitcoin (CRYPTO:BTC) sparked an ongoing debate. Is the virtual currency backed by blockchain an asset? Or is it a payment system akin to the U.S. dollar? Either way, the fact that both Square (NYSE:SQ) and PayPal (NASDAQ:PYPL) have recently entered the Bitcoin fray shows that cryptocurrency is entering the mainstream.

On this clip from Motley Fool Live, recorded on Feb. 8, «The Wrap» host Jason Hall, Fool analyst Auri Hughes, and Fool.com contributor Danny Vena compare and contrast cryptocurrency to fiat currency and discuss whether it should rightly be called an asset.

Danny Vena: There’s a comment here by Blue Phire P-H-I-R-E, says, «Over. Tesla (NASDAQ:TSLA) will have way more than $5 billion in BTC. Danny, no offense.» It moved. «No offense, but you sound like [Warren] Buffet when you talk about Bitcoin.» Wow, that is the best left-handed compliment I’ve gotten in a while. [laughs]

Jason Hall: I want to push back on Blue Phire’s statement about fiat not having any underlying assets backing it up.

Absolutely not true especially with the U.S. dollar. It has the entire backing of the federal United States government backing it up and the United States Federal Government has the cash flows of the GDP of the most powerful, wealthiest country on the earth. That’s not nothing at all.

But at the end of the day, your underlying point is absolutely true. This is something that is the bottom line with whatever it is, whether it’s gold or Bitcoin or fiat, money is something that everybody agrees is money and it’s worth what everybody agrees it’s worth. The pushback on Bitcoin and other cryptos is their lack of utility to use as currency.

I think it’s a mistake really to call them currency at this point, to continue calling them currency because they’re crypto assets. It’s an asset. It’s not something that people use for transactional purposes on a regular basis. Because when it comes to currency, you want something that’s going to predictably hold its value.

When we talk about crypto prices going up, that’s inflation when we’re talking about money, when it loses value, that deflation. We don’t use the same terms to describe Bitcoin that we use to describe dollars. We have to consider that too.

Abi says, «On Tesla, I think [calling it] investing in Bitcoin is not right, it’s just another way to hold cash. You would never say Tesla is investing in the US dollar. But that is the same as what you are saying. Either way, holding Bitcoin is way smarter than holding US dollars right now.»

Yeah. Okay, that’s easy to say when it’s doing this, [shows a chart with the price of Bitcoin climbing] but you know what? Dollars don’t do that.

This is an investment. It’s not a holding. Cash holds its value, the value of cash for a company is that it’s going to hold that predictable value and not do this.

It’s easy to say holding Bitcoin right now is smart because it’s just going up, right? The risk is, if Tesla’s planning to deploy that Bitcoin into some sort of capital investment at some point. If Bitcoin decides to lose value for some reason, and we saw it was over $40,000 at the beginning of January. It fell 25%, it fell almost $30,000 again.

Danny Vena: The U.S. dollar is never going to do that.

Auri Hughes: Yeah.

Jason Hall: Go ahead, Auri.

Auri Hughes: I would just keep in mind, I think you’ve hit some really appropriate points. I’m not necessarily impressed, because it’s just you buying an asset and sitting on it. But you’re not strategically making a decision to expand your company or take your company in a different direction. I think this is more sensational, it’s a headline, it’s interesting. Bitcoin is innovative, we’re all still learning about it, but it’s not a strategic decision to expand your business or venture into something else. I don’t necessarily see this as a way to create value for shareholders. But it’s definitely interesting.

Jason Hall: Yeah, I want to be clear too, I’m not a Bitcoin bear. To Auri’s point and something other folks have said, it doesn’t generate cash flows, so that makes it hard to value. Also, there’s not a clear utility path, which makes it hard to really value. That’s my position on it.

Источник

Цена Bitcoin Asset ( BTA )

0.00001579 BTC 2.27 %

0.000237 ETH 2.27 %

Ссылки Bitcoin Asset

Ссылки

Проводники

Сообщество

Контракты Bitcoin Asset

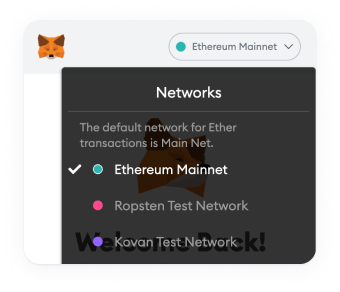

Пожалуйста, измените сеть кошелька

Измените сеть кошелька в приложении MetaMask, чтобы добавить этот контракт.

Bitcoin Asset Chart

Please wait, we are loading chart data

Цена BTA в реальном времени

Bitcoin Asset цена сегодня составляет ₽42.62 RUB с суточным объемом торгов отсутствует . Bitcoin Asset снизилась на 2.27 за последние 24 часа. Текущий рейтинг CoinMarketCap — #5378 с рыночной капитализацией отсутствует. Циркулирующее предложение недоступно и макс. предложение 5,000,000 BTA монет.

We are now in the brink of new technology and a new connected world between provider, developer, customer, and exchanger.

All in one in DeFi protocol! Here we are to improvise the current protocol by introducing BTA (Bitcoin Asset Protocol) a completely decentralized web where users are in fully control with higher speed and fewer transaction fees.

Not only creating the advanced protocol, with BTA will help even more developers to build dapp on our user-friendly BTA blockchain ecosystem.

Источник

Bitcoin: An Asset, Currency Or Collectible?

LONDON, ENGLAND — OCTOBER 23: A visual representation of the digital Cryptocurrency, Bitcoin on . [+] October 23, 2017 in London, England. Cryptocurrencies including Bitcoin, Ethereum, and Lightcoin have seen unprecedented growth in 2017, despite remaining extremely volatile. While digital currencies across the board have divided opinion between financial institutions, and now have a market cap of around 175 Billion USD, the crypto sector coninues to grow, as it sees wider mainstreem adoption. (Photo by Dan Kitwood/Getty Images)

For a digital asset that began its life in 2009 and began the year trading around $1,000, the fact that Bitcoin is set to break the $10,000 ceiling is certainly impressive. Other than the many celebrations that will surely follow this milestone, interspersed with a mix of investor remorse or Casandra’s calling this the digital twin of Tulip Mania, many questions remain about the advantages and disadvantages of digital assets. Crypto numismatists who have been collecting Bitcoins are surely happy these days.

Investors and early adopters like these assets because they are untethered from the regular economy where fiat currencies, more traditional forms of exchange and value transfer reign the day. It is not without a sense of irony that part of Bitcoin’s rapid ascent this year is owed to the fact that traditional economy players are now paying close attention to this asset class. While some of this attention remains negative, profoundly confused or ambivalent, such as China and South Korea banning initial coin offerings (ICOs), along with ongoing attempts to regulate a fundamentally decentralized platform. Add to these negative views Jamie Dimon’s full-throated attack on Bitcoin including the threat of terminating any JP Morgan employee caught trading in the digital asset, and the unwelcome news levied against digital assets continues to mount. With each puff of hot air, however, as if in open revolt to traditional economic order, Bitcoin continues to defy the odds taking investors to stratospheric heights where the air begins to thin and bubbles traditionally deflate.

And yet the appreciation in Bitcoin’s value is buoyed in no small measure by serious institutions, like the CME Group, which is going long on the digital asset class. CME’s announcement that they will soon offer futures trading on Bitcoin marks a serious development and coming of age for digital assets. Herein lies the irony for an asset that is completely untethered and ungoverned by traditionally centralized structures. The fact that Bitcoin is gaining its greatest appreciation the more it plugs into the traditional economy, says a lot about its strengths, weaknesses and limitations. Against this backdrop, questions remain as to whether Bitcoin is an asset, currency or a collectible. Perhaps more permanently, 2017 may very well mark the year when digital assets, in the otherwise fleeting world of investor interest, gained their permanence.

One of the principal advantages of digital assets is the fact that they are largely uncorrelated to the market. This creates an interesting opportunity for investment diversification, with the caveat that these instruments are not readily liquid, and their convertibility is far from universal. An additional advantage is the high volatility, which counterintuitively results in more aggressive risk-reward trade-offs in investment portfolios. Bitcoin’s implied volatility, higher than any other asset class, is the stuff roller coaster rides are made of and may make even seasoned high-speed traders flinch. Similarly, the relatively low barrier to entry, when compared to more sophisticated asset classes, which require heavier purchasing power because they are much harder to fractionalize, makes digital assets compelling for their ability to democratize asset ownership and wealth creation. All of this, however, presupposes that they are tethered to the real economy and transferable in many more ways than they are currently. For example, an announcement that Amazon will accept Bitcoin as a form of payment (which requires more stable valuation) would go a long way in legitimizing this asset as a currency. The fact that it needs legitimacy at all in the eyes of its staunchest proponents is something of an insult to the genius that underpins this innovation, which is its scarcity by design with no more than 21 million Bitcoins to be digitally minted.

The disadvantages of this asset class are the fact that they are all digitally correlated and subject to high degrees of individual and group social engineering. For example, a great deal of the theft or loss of digital assets typically results from people locking themselves out of their digital wallets, losing their encrypted keys (or access) or people gaining unwanted access, after which point the assets are easily transferred and hard to track down. In short, like so many cyber threats, the loss or theft of digital assets often lies between the keyboard and the chair. This type of theft or mysterious disappearance and the fact that no regulatory regime or risk transfer mechanism currently exists to systemically offset this risk is one of the principal deterrents to broadening the adoption of digital currencies. A digital equivalent of the Federal Deposit Insurance Corporation (FDIC), which universally protects depositors and shores up the banking system from 1930-style bank runs, would help build trust in digital assets. For this reason, many established financial institutions and a growing number of insurers are turning their attention to Blockchain, the distributed ledger that underpins Bitcoin’s rise to prominence. For many, Blockchain is the killer app and Bitcoin is the first major use case of this foundational technology. Neither Blockchain nor Bitcoin are free of negative externalities or limitations.

While it appears Bitcoin is winning the standards war on which digital asset will rule the day, this despite internecine fighting, a standards war continues to rage on digital assets and their utility. Herein lies the domain of a great deal of experimentation and value creation, where CME’s move to offer futures trading is but one example of how virtual assets are meeting the real world. The more traditional players and crypto enthusiasts push the bounds of interoperability, the more it seems Bitcoin’s implied value will rise. Contrary to popular belief that Bitcoin and its users thrive in the shadows, some entrepreneurs in this space, like Gabriel Abed, a Barbadian tech entrepreneur and co-founder of Bitt, are rushing to work with central banks. This move will help bridge the technological divide and the need for legitimacy, oversight and, perhaps most importantly, interoperability between digital assets and the real world. As these enduring linkages are formed, it is reasonable to expect the world of low-friction value transfer will create a new economic order while minting a few Blockchain Billionaires along the way.

Источник

Bitcoin Is An Asset, Not A Currency

Tweet This

This illustration shows a Bitcoin sign in Hong Kong. (Photo credit: ANTHONY WALLACE/AFP/Getty . [+] Images)

Over the past year and a half Bitcoin has been on a spectacular run, rising in value 140% in 2016 and now an additional 49% in just the past month. This surge in value has invigorated Bitcoin backers convinced this boost in value makes Bitcoin a more credible currency, that it is a sign of the cryptocurrency’s strength. Yet the wild swings, both up and down, in the value of Bitcoin do not make it a more plausible substitute currency; they make it a speculative asset, a get-rich-quick scheme.

The most important feature of a currency is that it be a stable store of value. This credo, ably explained by Steve Forbes here (among many places), is vital for a developing country economy to attract the investment it needs. Even in developed countries, as John Tamny explained here on Forbes.com, a stable currency value is the key to investment because those who invest are expecting a stream of future earnings to earn back their investment plus some profit. Instability in currency values mean that an investor cannot accurately predict the value of those future earnings. This uncertainty makes investments less valuable; thus, less investment happens.

Over the past month the value of a Bitcoin has experienced an average daily change of 2% in value, sometimes down but mostly up. For comparison, over the same month, the exchange rate between the euro and the U.S. dollar had an average daily change of less than 1% and only changed 3% over the entire month. While Bitcoin was rising 49% in the past 30 days, it had seven days where its value changed by over 3%, more than the value of the dollar changed in the entire month. People don’t want investments or debts denominated in a currency whose value can change by 50% in a month.

Another basic feature of a currency, beyond being a stable store of value, is to facilitate transactions. Barter’s big drawback is it is inconvenient. It’s hard to make change and you must find two people who want to exchange goods; three or four way trades get complicated. Currency solves those problems meaning I can buy groceries without having to sell economic services to the supermarket. This convenience is why people moved from barter to currencies (and then from metal to paper, from paper to plastic, and from plastic to electronic bits).

Yet, to protect the security of the blockchain that makes cryptocurrencies like Bitcoin so secure, processing of Bitcoin transactions is very slow. In fact, because of a limit on the number of transactions which can be completed in a day, it sometimes takes days to complete a simple transaction. Resistance to changing these rules from people who mostly like the anonymity and untraceability of Bitcoin mean that Bitcoin cannot become a widely-used currency. Its very security negates its value in everyday use.

Given these drawbacks, the only reasons to own Bitcoins are not to use them as a currency, but to either speculate on their asset value or use them to shield transactions from others. Without a stable value Bitcoin cannot truly be a currency. Rather it is a commodity asset that one trades, like gold or silver, in hopes that its value will rise and yield a trading profit. There is nothing wrong with speculation; the actions of speculators help to add market liquidity and to determine the market value of assets. However, usually the asset being valued also has an actual underlying use: you can invest in gold or use it to make jewelry or electronic components. Bitcoins have no uses other than allowing people to hide wealth, conceal (often illegal) transactions, and make and lose money by trading them.

Clearly, from the popularity of Bitcoin, those limited uses still have quite a bit of value to a nontrivial number of people. I have no objection to these people’s use of Bitcoin for those purposes. However, people should stop expecting it to become a currency that ordinary people use for ordinary transactions. It is destined to stay in its niche as a way to hide things or speculate. A currency, Bitcoin is not, nor shall it be.

Источник