- Bitcoin is a hedge against the cashless society

- When cash is gone, where will you turn to transact with a basic level of privacy? What money do you hold when negative interest rates start eating away at your bank account?

- Why do countries go cashless?

- Problems of the cashless society

- Bitcoin as a hedge against the cashless society

- Dispelling the Myth That Bitcoin Proponents Want a Cashless Society

- Bitcoin cryptocurrency nwo cashless society

- Free Bitcoin Life

- Will Cryptocurrencies Prosper In A Cashless Society?

- What Does a Cashless Society Mean?

- Why A Cashless Society?

- A cashless society comes with serious problems

- Will Cryptocurrencies Prosper In a Cashless Society?

- Venezuela is an example where cryptocurrencies prosper

- Conclusion

Bitcoin is a hedge against the cashless society

When cash is gone, where will you turn to transact with a basic level of privacy? What money do you hold when negative interest rates start eating away at your bank account?

Feb 12, 2019 · 5 min read

T he rise of digital payments and the move towards a cashless society are often seen as the same, but there is an important difference between them.

Digital payments like Paypal, Venmo, domestic-, and international bank transfers are convenient for people and businesses to transact with. They represent fintech innovation to consumers by the market. Faster, cheaper, and more efficient forms of digital payments are uncontroversial and largely an engineering and marketing challenge.

They don’t, however, re m ove every need for cash. Cash has unique properties that digital payments have not. As physical coins and notes, it can be exchanged peer-to-peer without a middleman. Its ownership is transferred simply by handing it over. The absence of an intermediary ensures that transfers are permissionless, censorship-resistant and, most importantly, private.

Digital payments solutions do not utilize physical cash but also do not prevent anyone from continuing to use cash if they want. It is an alternative payment method to cash but is not antithetical to it. Indeed, in almost all modern societies, there coexists both a large digital economy and a large cash economy.

We will argue that the elimination of cash, even if most payments are already digital, will make society more vulnerable to surveillance, financial control, and authoritarianism.

Why do countries go cashless?

In a cashless society, the government seeks to discourage or even criminalize the holding and using of cash itself. In Sweden, it happened largely without coercion. In India, the government demonetized the 500 and 1,000 Rupee denominations of notes.

Different countries can have different incentives to push for a cashless society. In China, digital payments are primarily a tool of social control and serve as a backbone for China’s social credit system. And they are making progress on it: 96% of cash payments in 2012 have turned into only 15% in 2019.

Over in Europe, central bankers are enthralled by the idea of negative interest rates. A recent IMF report states that:

“Severe recessions have historically required 3–6 percentage points cut in policy rates. If another crisis happens, few countries would have that kind of room for monetary policy to respond.”

Negative interest rates were traditionally hard to implement because cash served as a lower bound. In a cashless society, this lower bound would disappear. In a severe recession, the CB could drop the policy rate to, say, -4% to make consumption and investment more attractive relative to saving.

Recently, central banks have started to brush everyone who prefers cash with the label of a criminal. They do that by separating the uses of cash into legitimate and illegitimate. People “abroad” can hold cash “legitimately” to replace an unstable or inflationary currency. Now domestically, the only beneficiaries of an anonymity-providing currency are

“those engaged in tax evasion, money laundering and the financing of terrorism, and those wishing to store the proceeds from crime and the means to commit further crimes.”

Indeed, the use of cash in larger denominations has become so stigmatized in the US and Europe that withdrawing or carrying above a certain amount requires explicit government permission.

Problems of the cashless society

A society without cash has no ability to transact value without the omnipresence of government actors. By going cashless, societies double down on the properties of digital payments but lose all access to the unique properties of cash.

If every payment is intermediated, it becomes impossible to pay someone for anything without there being a record somewhere. It eliminates privacy and places the government as the third party in every financial event.

Governments claim that a cashless society enables them to protect citizens from criminals. The specters of terrorism and organized crime are often cited at this point. But this makes the naive assumption that governments itself can never become evil.

Because all transactions require the consent of an intermediary, they can easily be censored and funds confiscated. It might not be happening right now, but a good monetary system should be robust to changes in political moods. A cashless monetary system is less resistant to both the tyranny of the majority and shifts towards authoritarianism.

Cash may not be the right tool for the majority of transactions, but the elimination of it removes an important choice, and safeguard against government abuse, for the people.

Bitcoin as a hedge against the cashless society

When cash is gone, where will you turn to transact with a basic level of privacy? What money do you hold when negative interest rates start eating away at your bank account?

Traditionally, it has been impossible for the private market to come up with solutions for these basic human demands. The state doesn’t like competition to their own fiat currency and made sure to quickly shut down all attempts of other monies to enter the market.

Bitcoin could change that. Decentralized and digital in nature, it no longer has the central point of failure that made previous “private monies” vulnerable. And it is modeled to marry the two forms of money — physical cash and digital payments — into an entirely new breed: digital cash. It can be transacted peer-to-peer, is permissionless, does not censor people or transactions, and has a reasonable level of privacy (if one knows how to use it).

We are still early into the Bitcoin-experiment, but with the cashless society looming on the horizon, we more than ever need it to succeed. Its fixed monetary policy already makes it a hedge against high inflation (that is increasingly used in places with collapsing fiat currencies like Venezuela). But, equally importantly, Bitcoin is a hedge against the demonetization of cash and the rise of the cashless society.

If you want to get notified of future articles, sign up to our mailing list.

Источник

Dispelling the Myth That Bitcoin Proponents Want a Cashless Society

Bitcoin and a great number of other cryptocurrencies are electronic versions of currency. Many people falsely assume that crypto proponents are for a cashless society and this is certainly not the case.

If we removed the central banks’ printing fiasco and the inflationary practices from cash, we all know that cash is great for anonymity and fungibility. But the nation-states and central banking cabal are in charge of the fiat game and the monetary system today does come with serious manipulation and inflation.

Most crypto supporters, just because they support an electronic currency, do not support the removal of cash money. But there is little anyone can do to stop the government from going cashless.

Now we all know that cash is great (besides the inflationary aspects), but we also know that cryptocurrencies are even better. Crypto transactions like bitcoin (BTC) do not have to be electronic every time someone transacts.

With cryptos like bitcoin, we can create all kinds of bearer bond instruments. A digital asset can be hidden in mnemonic phrase and most seeds are based on 12, 18, or 24-word phrases that are tied to their private key(s).

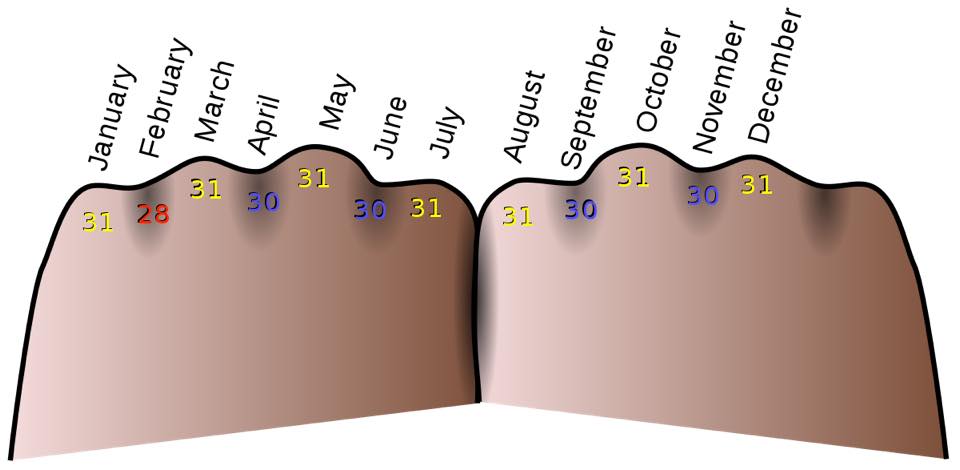

The use of mnemonics, or ‘memoria technica,’ is derived from the era of the ancient Greeks when Aristotle and Plato philosophized about certain types of logic. The photo below is a depiction of the Knuckle mnemonic, which represents the number of days in each month of the Gregorian Calendar.

Any amount of crypto, like a billion dollars worth of crypto assets, for instance, can be stored in a mnemonic.

This means you can keep a billion dollars hidden in a book, or even by memory if you have a decent photographic memory. Bitcoin can be printed on paper, metal, plastic, and people can create all types of cash instruments.

Now just like gold, a bundle of cash can be quite cumbersome to carry. You cannot travel lightly with a billion dollars worth of cash in a few bags. You also have to be vigilant, protective, and someone can take your bundles of cash like a mugger or even law enforcement. For instance, the U.S. agency Homeland Security seized $2 billion in cash from travelers during the course of six years at U.S. airports.

But think about what I just said. You can store any amount of money on a piece of paper. On a small square of aluminum. You can write down 12-words on a piece of paper and hand a family member tens of thousands of dollars— no questions asked.

No need for the duffle bags of loot, you can simply leverage a mnemonic or a piece of paper.

Hiding crypto is extremely easy and someone can even do it by leveraging steganographic tools. Literally hiding a million dollars in plain sight. Steganography is the art of concealing images, messages, files, or videos. The practice of obscuring messages in this fashion was first recorded in 440 BC.

So in many ways, cryptocurrencies are an advanced form of cash and you are just not aware of all the possibilities if you think crypto people are “anti-cash.” This is simply not true.

To a great degree, digital currencies are simply a better form of money and many people just haven’t figured that out yet. And that’s ok we have plenty of time to teach and they have plenty of time to listen. But it’s simply not true that crypto advocates are helping the global elite create a cashless society. Digital currency supporters can create all kinds of free market-based cash instruments with ease.

What do you think about the fact that cryptocurrency supporters can easily create bearer bond instruments? Let us know in the comments below.

Источник

Bitcoin cryptocurrency nwo cashless society

Before you leave. Please would you be so kind answering this single question?

How long have you been following Bitcoin or any other Cryptocurrency?

Free Bitcoin Life

Will Cryptocurrencies Prosper In A Cashless Society?

This article will examine the possibility of a cashless society where cryptocurrencies are being used. Furthermore, the pros and cons of a cashless society.

As the world moves towards cashless means of payments and connected societies, the main question is whether virtual currencies can prosper in a cashless society. There are several countries around the world, such as India and Sweden, that are banning cash transactions. In fact, in these countries, individuals are using electronic means of payments on a daily basis.

Although cryptocurrencies have been growing as well, they are far from reaching mass adoption. Taking this into account, we will explain in this article what is a cashless society, and whether digital assets can prosper in these societies.

What Does a Cashless Society Mean?

Cashless societies are those in which most of the transactions are processed by different electronic means rather than cash. These electronic means include smartphones, credit and debit cards or bank transfers.

In these countries, coins and physical banknotes are not needed to pay for goods and services. Additionally, digital solutions are preferred by the parties involved in a transaction. Individuals in these countries are taught about how to use money in a non-physical way and through electronic solutions.

Why A Cashless Society?

There are several pros and cons to having a cashless society. For example, considering people do not have to carry cash in their pockets, criminality tends to fall. It is not the same to steal a credit card or a blocked smartphone than anonymous and untrackable cash.

In addition to it, banks, families and financial institutions reduce the costs of storing money and taking care of it. It is not the same to have cash stored in a safety box than in a fully digitized account.

Also, by having a cashless society, tourists do not have to be worried about finding an exchange where to buy or sell their currency. This is certainly useful considering there are several applications and solutions that help individuals reduce the commissions of currency exchange while using credit or debit cards.

At the same time, it is also more difficult for corrupted government officials to accept illegal funds or bribes. This is certainly helpful in many corrupt countries. Nonetheless, this doesn’t mean that corruption will disappear.

A cashless society comes with serious problems

Furthermore, there are some disadvantages to cashless societies. In the first place, elderly people who aren’t that tech-savvy will be forced to use digital transactions. Also, these people could be easily tricked by ‘hackers’ or other individuals with bad intentions. Another problem all people to deal with is giving up your privacy, which wasn’t an issue when there was cash money. Furthermore, in this digital age personal data of customers is seen as ‘the new oil’ that bigger corporations are willing to pay lots of money for. Be in control of your own data is therefore needed when society emerges to a cashless variant. The tweet below gives a proper explanation of why cryptocurrencies are needed in a cashless society:

The best explanation of why we need bitcoin in single minute. pic.twitter.com/nWYdYgFPbL

Will Cryptocurrencies Prosper In a Cashless Society?

Virtual currencies lose many of their advantages in cashless societies. Why would a person decide to use virtual currencies when their systems already work properly? Well, one of the reasons is related to having more privacy and control over their funds.

In cashless societies, governments have larger control over citizens and individuals. They know what they buy, when and how. At the same time, companies have a lot of valuable personal and private data regarding what people do. This is where cryptocurrencies could prosper in a cashless society.

Cryptocurrencies, despite operating many of them with open blockchain networks, offer users the possibility to have more privacy over the things they do. This is certainly important. They can still enjoy an easy-to-use system and technology that is fast but that helps them protect their privacy.

Countries like China and India are pushing for a strong digitalization to increase tax collection, and control their populations. Indeed, Venezuela has done the same thing – almost pushed by massively high inflation rates – and it uses all the information that it got from citizens to continue with its repression.

Venezuela is an example where cryptocurrencies prosper

Indeed, Venezuela is a good example of how a cashless society could help cryptocurrencies prosper. Venezuela is one of the places in the world where digital assets are used on a daily basis to pay for goods and services. Its population got used to handling electronic means of payments and they applied this knowledge to use digital assets.

Correspondingly, cryptos do not only protect privacy. Instead, they could also expand in cashless societies due to the fact that these populations are already used to electronic means of payments. Moving from a society that is not used to cashless payment systems, may create an extra barrier for users.

Virtual currencies have another advantage over traditional payment systems. Firstly, users can always pay with virtual currencies, because they are available 24 hours a day. Also, there will be no network outages, such as the one credit or debit cards could experience. Finally, all these things together would certainly lower the barrier for cryptocurrencies to take off as a widely accepted method.

Conclusion

Cryptocurrencies could eventually expand in a cashless society where the government is taking away freedoms from users and individuals. People in Sweden, with few problems and issues with its currency, may find it not so useful despite having privacy advantages over government-backed electronic means of payments.

Privacy and freedom are the two most important words to take into account to understand whether it is possible for cryptocurrencies to prosper in a cashless society. For virtual currencies to expand in a cashless society it will certainly depend on the whole economy and the particularities of the country. However, one thing is clear, teaching people how to use electronic systems to process payments is certainly going to be an advantage for cryptocurrencies to prosper.

Disclosure: This post could contain affiliate links. This means I may make a small commission if you make a purchase. This doesn’t cost you any more but it does help me to continue publishing cool and actual content about Bitcoin & Crypto – Thank you for your support!

Источник