- Bitcoin Block Reward Halving Countdown

- What is a block halving event?

- Why was this done?

- Predictable monetary supply

- Who controls the issuance of Bitcoin?

- Past halving event dates

- Past halving price performance

- How to buy Bitcoin?

- What is the Bitcoin Mining Block Reward?

- How is the Block Reward Determined?

- Importance of the Block Reward

- What Happens when the Block Reward Becomes Small?

- Do Reward Halvings Affect the Bitcoin Price?

- How do Block Reward Halvings Affect Miners?

- Future Block Reward Halvings

- Block Reward History

- Recommended posts

- Block Reward

- What Is a Block Reward

- Key Takeaways

- Understanding Block Reward

- How Does Bitcoin Mining Work?

- What Is Bitcoin Mining?

- Key Takeaways

- A New Gold Rush

- How to Mine Bitcoins

- «So after all that work of verifying transactions, I might still not get any bitcoin for it?»

- «What do you mean, ‘the right answer to a numeric problem’?»

- Mining and Bitcoin Circulation

- How Much a Miner Earns

- What Do I Need To Mine Bitcoins?

- The «Explain It Like I’m Five» Version

- What Is a «64-Digit Hexadecimal Number»?

- So, what do «64-digit hexadecimal numbers» have to do with Bitcoin mining?

- «So how do I guess at the target hash?»

- «How do I maximize my chances of guessing the target hash before anyone else does?»

- «How do I decide whether Bitcoin will be profitable for me?»

- What Are Coin Mining Pools?

- «I’ve done the math. Forget mining. Is there a less onerous way to profit from cryptocurrencies?»

- Is Bitcoin Mining Legal?

- Risks of Mining

Bitcoin Block Reward Halving Countdown

What is a block halving event?

As part of Bitcoin’s coin issuance, miners are rewarded a certain amount of bitcoins whenever a block is produced (approximately every 10 minutes). When Bitcoin first started, 50 Bitcoins per block were given as a reward to miners. After every 210,000 blocks are mined (approximately every 4 years), the block reward halves and will keep on halving until the block reward per block becomes 0 (approximately by year 2140). As of now, the block reward is 6.25 coins per block and will decrease to 3.125 coins per block post halving.

Why was this done?

Bitcoin was designed as a deflationary currency. Like gold, the premise is that over time, the issuance of bitcoins will decrease and thus become scarcer over time. As bitcoins become scarcer and if demand for them increases over time, Bitcoin can be used as a hedge against inflation as the price, guided by price equilibrium is bound to increase. On the flip side, fiat currencies (like the US dollar), inflate over time as its monetary supply increases, leading to a decrease in purchasing power. This is known as monetary debasement by inflation. A simple example would be to compare housing prices decades ago to now and you’ll notice that they’ve increased over time!

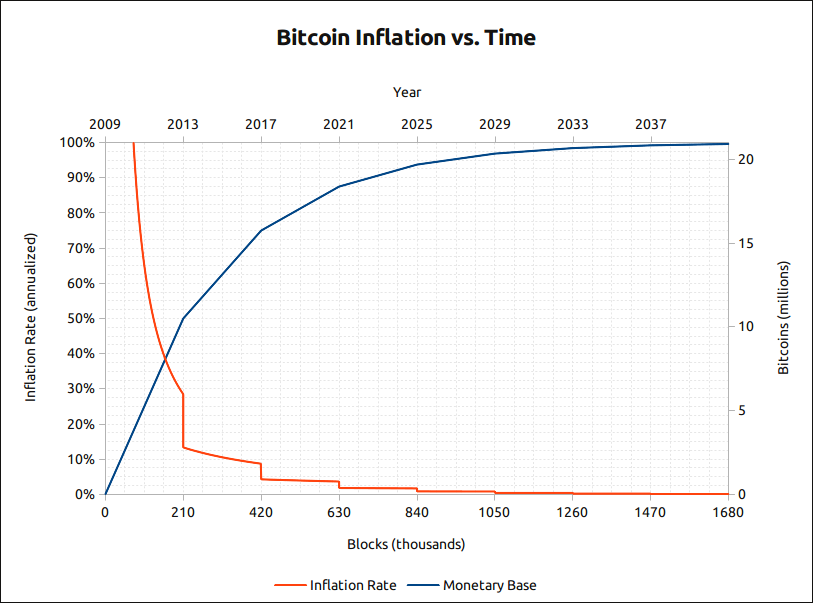

Predictable monetary supply

Since we know Bitcoin’s issuance over time, people can rely on programmed/controlled supply. This is helpful to understand what the current inflation rate of Bitcoin is, what the future inflation rate will be at a specific point in time, how many Bitcoins are in circulation and how many remain left to be mined.

Who controls the issuance of Bitcoin?

The network itself controls the issuance of Bitcoins, derived by consensus through all Bitcoin participants. Ever since Bitcoin was first designed, the following consensus rules exist to this day:

- 21,000,000 Bitcoins to ever be produced

- Target of 10-minute block intervals

- Halving event occurring every 210,000 blocks (approximately every 4 years)

- Block reward which starts at 50 and halves continually every halving event until it reaches 0 (approximately by year 2140)

Any change to these parameters requires all Bitcoin participants to agree by consensus to approve the change.

Past halving event dates

- The first halving event occurred on the 28th of November, 2012 (UTC) at block height 210,000

- The second halving event occurred on the 9th of July, 2016 (UTC) at block height 420,000

- The third halving event occurred on the 11th of May, 2020 (UTC) at block height 630,000

Past halving price performance

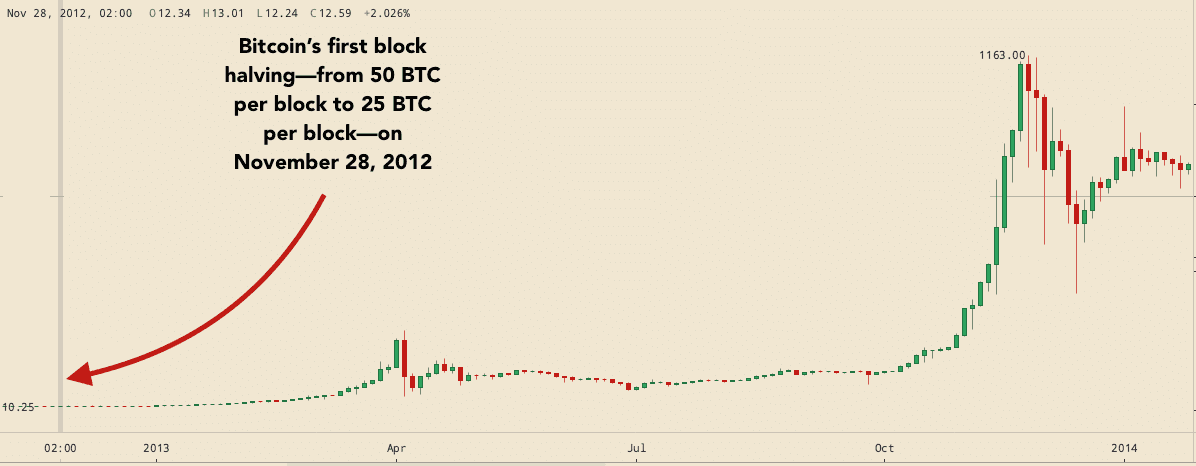

It is always a debate on what Bitcoin will do in terms of pricing for a halving event. Some people believe that the halving is already priced in by the market and thus there’s no expectation for the price to do anything. Others believe that due to price equilibrium, a halving of supply should cause an increase in price if demand for Bitcoins is equal or greater than what it was before the halving event. Below is a chart showing past price performance of the two halving events:

How to buy Bitcoin?

Coinbase is one of the largest cryptocurrency exchange in the world, serving over 102 countries, 30 million+ customers and over 150 billion in trading volume. Funds are protected by insurance and secure storage. You can also earn up to $158 worth of cryptocurrencies. Click below to find out more:

Источник

What is the Bitcoin Mining Block Reward?

The Bitcoin block reward refers to the new bitcoins distributed by the network to miners for each successfully solved block.

How is the Block Reward Determined?

Satoshi Nakamoto, Bitcoin’s creator, set the block reward schedule when he created Bitcoin. It is one of Bitcoin’s central rules and cannot be changed without agreement between the entire Bitcoin network.

The block reward started at 50 BTC in block #1 and halves every 210,000 blocks. This means every block up until block #210,000 rewards 50 BTC, while block 210,001 rewards 25. Since blocks are mined on average every 10 minutes, 144 blocks are mined per day on average. At 144 blocks per day, 210,000 blocks take on average four years to mine.

Total circulation will be 21,000,000 coins. It’ll be distributed to network nodes when they make blocks, with the amount cut in half every 4 years. first 4 years: 10,500,000 coins next 4 years: 5,250,000 coins next 4 years: 2,625,000 coins next 4 years: 1,312,500 coins etc… — Satoshi Nakamoto

Importance of the Block Reward

The block reward is the only way that new bitcoins are created on the network. Satoshi explained this in an early email post in 2009:

Coins have to get initially distributed somehow, and a constant rate seems like the best formula.

The block reward creates an incentive for miners to add hash power to the network. The block reward is what miners try to get using their ASICs, which make up the entirety of the Bitcoin network hash rate.

ASICs are expensive, and have high electricity costs. Miners are profitable when their hardware and electricity costs to mine one bitcoin are lower than the price of one bitcoin. This means miners can mine bitcoins and sell them for a profit.

The more hash power a miner or mining pool has, the greater the chance is that the miner or pool has to mine a block. As miners add more hash rate, more security is provided to the network. The block reward acts as a subsidy and incentive for miners until transaction fees can pay the miners enough money to secure the network.

What Happens when the Block Reward Becomes Small?

As mentioned earlier, Bitcoin users must pay a fee when sending a transaction on the network. Right now, these fees are small since there aren’t many Bitcoin users. Eventually, these transactions fees will become larger and will help make up for the decreasing block reward.

In a few decades when the reward gets too small, the transaction fee will become the main compensation for nodes. I’m sure that in 20 years there will either be very large transaction volume or no volume. — Satoshi Nakamoto

Do Reward Halvings Affect the Bitcoin Price?

It is impossible to determine whether or not block reward halvings affect Bitcoin’s price.

As with any commodity, a decrease in supply paired with no change in demand generally leads to higher price. Bitcoin is unique, however, since the block reward schedule is public. All Bitcoin users and miners know the approximate date of each halving, meaning the Bitcoin price may not be affected when the halving happens.

Bitcoin’s first block halving happened on November 28, 2012. The block reward dropped from 50 bitcoins per block to 25 per block. The price later climbed to $260 per BTC in April 2013, followed by $1,163 per BTC in November 2013. It is unclear, however, whether these price rises were directly related to the block reward halving.

How do Block Reward Halvings Affect Miners?

Block reward halvings cut miners’ earnings in half, assuming the same Bitcoin price before and after the halving. Since approximate block halving dates are known, most miners take block reward halvings into account before they happen.

Block reward halvings also decrease supply, which as discussed above may cause Bitcoin’s price to increase. A Bitcoin price increase can help offset the block reward halving.

Future Block Reward Halvings

Countdowns like Bitcoin Block Half and Bitcoin Clock can be used to guess future block halving dates.

Block Reward History

| Date reached | Block | BTC/block | Year (estimate) | BTC Added | End % of Limit |

|---|---|---|---|---|---|

| 1/3/09 | 0 | 50 | 2009 | 2625000 | 12.50% |

| 4/22/10 | 52500 | 50 | 2010 | 2625000 | 25.00% |

| 1/28/11 | 105000 | 50 | 2011 | 2625000 | 37.50% |

| 12/14/11 | 157500 | 50 | 2012 | 2625000 | 50.00% |

| 11/28/12 | 210000 | 25 | 2013 | 1312500 | 56.25% |

| 10/9/13 | 262500 | 25 | 2014 | 1312500 | 62.50% |

| 8/11/14 | 315000 | 25 | 2015 | 1312500 | 68.75% |

| 7/29/15 | 367500 | 25 | 2016 | 1312500 | 75.00% |

| 420000 | 12.5 | 2017 | 656250 | 78.13% | |

| 472500 | 12.5 | 2018 | 656250 | 81.25% | |

| 525000 | 12.5 | 2019 | 656250 | 84.38% | |

| 577500 | 12.5 | 2020 | 656250 | 87.50% | |

| 630000 | 6.25 | 2021 | 328125 | 89.06% | |

| 682500 | 6.25 | 2022 | 328125 | 90.63% | |

| 735000 | 6.25 | 2023 | 328125 | 92.19% | |

| 787500 | 6.25 | 2024 | 328125 | 93.75% |

Recommended posts

Bitcoin Mining™® © 2011-2021 Hesiod Services LLC | Terms | Privacy

Источник

Block Reward

Jake Frankenfield is an experienced writer on a wide range of business news topics and his work has been featured on Investopedia and The New York Times among others.

What Is a Block Reward

Bitcoin block reward refers to the new bitcoins that are awarded by the blockchain network to eligible cryptocurrency miners for each block they mine successfully.

Key Takeaways

- A block reward refers to the number of bitcoins you get if you successfully mine a block of the currency.

- The amount of the reward halves every 210,000 blocks, or roughly every four years.

- The amount is expected to hit zero around 2140.

Understanding Block Reward

Each bitcoin block is around 1 MB in size and is used to store the bitcoin transaction information. For example, when A sends money to B, this transaction information is stored on a block.

Miners who use mining devices to find new blocks are rewarded for their efforts through block rewards. Other cryptocurrencies have a similar mechanism for rewarding miners with blocks of the respective blockchain. The winning miner claims a block reward by adding it as a first transaction on the block.

At inception, each bitcoin block reward was worth 50 BTC. The block reward is halved after the discovery of every 210,000 blocks, which takes around four years to complete. As of February 2019, one block reward was worth 12.5 BTC.

Working on the principle of a standard cryptocurrency economy with declining bitcoins awarded as block rewards, fewer new bitcoins will be available over time, and that will keep bitcoin prices high. After 64 iterations of halving the block reward, it will eventually become zero.

Источник

How Does Bitcoin Mining Work?

What Is Bitcoin Mining?

Bitcoin mining is the process by which new bitcoins are entered into circulation, but it is also a critical component of the maintenance and development of the blockchain ledger. It is performed using very sophisticated computers that solve extremely complex computational math problems.

Cryptocurrency mining is painstaking, costly, and only sporadically rewarding. Nonetheless, mining has a magnetic appeal for many investors interested in cryptocurrency because of the fact that miners are rewarded for their work with crypto tokens. This may be because entrepreneurial types see mining as pennies from heaven, like California gold prospectors in 1849. And if you are technologically inclined, why not do it?

However, before you invest the time and equipment, read this explainer to see whether mining is really for you. We will focus primarily on Bitcoin (throughout, we’ll use «Bitcoin» when referring to the network or the cryptocurrency as a concept, and «bitcoin» when we’re referring to a quantity of individual tokens).

Key Takeaways

- By mining, you can earn cryptocurrency without having to put down money for it.

- Bitcoin miners receive Bitcoin as a reward for completing «blocks» of verified transactions, which are added to the blockchain.

- Mining rewards are paid to the miner who discovers a solution to a complex hashing puzzle first, and the probability that a participant will be the one to discover the solution is related to the portion of the total mining power on the network.

- You need either a GPU (graphics processing unit) or an application-specific integrated circuit (ASIC) in order to set up a mining rig.

A New Gold Rush

The primary draw for many mining is the prospect of being rewarded with Bitcoin. That said, you certainly don’t have to be a miner to own cryptocurrency tokens. You can also buy cryptocurrencies using fiat currency; you can trade it on an exchange like Bitstamp using another crypto (as an example, using Ethereum or NEO to buy Bitcoin); you even can earn it by shopping, publishing blog posts on platforms that pay users in cryptocurrency, or even set up interest-earning crypto accounts.

An example of a crypto blog platform is Steemit, which is kind of like Medium except that users can reward bloggers by paying them in a proprietary cryptocurrency called STEEM. STEEM can then be traded elsewhere for Bitcoin.

The Bitcoin reward that miners receive is an incentive that motivates people to assist in the primary purpose of mining: to legitimize and monitor Bitcoin transactions, ensuring their validity. Because these responsibilities are spread among many users all over the world, Bitcoin is a «decentralized» cryptocurrency, or one that does not rely on any central authority like a central bank or government to oversee its regulation.

How to Mine Bitcoins

Miners are getting paid for their work as auditors. They are doing the work of verifying the legitimacy of Bitcoin transactions. This convention is meant to keep Bitcoin users honest and was conceived by Bitcoin’s founder, Satoshi Nakamoto. By verifying transactions, miners are helping to prevent the «double-spending problem.»

Double spending is a scenario in which a Bitcoin owner illicitly spends the same bitcoin twice. With physical currency, this isn’t an issue: once you hand someone a $20 bill to buy a bottle of vodka, you no longer have it, so there’s no danger you could use that same $20 bill to buy lotto tickets next door. While there is the possibility of counterfeit cash being made, it is not exactly the same as literally spending the same dollar twice. With digital currency, however, as the Investopedia dictionary explains, «there is a risk that the holder could make a copy of the digital token and send it to a merchant or another party while retaining the original.»

Let’s say you had one legitimate $20 bill and one counterfeit of that same $20. If you were to try to spend both the real bill and the fake one, someone that took the trouble of looking at both of the bills’ serial numbers would see that they were the same number, and thus one of them had to be false. What a Bitcoin miner does is analogous to that—they check transactions to make sure that users have not illegitimately tried to spend the same bitcoin twice. This isn’t a perfect analogy—we’ll explain in more detail below.

Once miners have verified 1 MB (megabyte) worth of Bitcoin transactions, known as a «block,» those miners are eligible to be rewarded with a quantity of bitcoin (more about the bitcoin reward below as well). The 1 MB limit was set by Satoshi Nakamoto, and is a matter of controversy, as some miners believe the block size should be increased to accommodate more data, which would effectively mean that the bitcoin network could process and verify transactions more quickly.

Note that verifying 1 MB worth of transactions makes a coin miner eligible to earn bitcoin—not everyone who verifies transactions will get paid out.

1MB of transactions can theoretically be as small as one transaction (though this is not at all common) or several thousand. It depends on how much data the transactions take up.

«So after all that work of verifying transactions, I might still not get any bitcoin for it?»

That is correct.

To earn bitcoins, you need to meet two conditions. One is a matter of effort; one is a matter of luck.

1) You have to verify

1MB worth of transactions. This is the easy part.

2) You have to be the first miner to arrive at the right answer, or closest answer, to a numeric problem. This process is also known as proof of work.

«What do you mean, ‘the right answer to a numeric problem’?»

The good news: No advanced math or computation is involved. You may have heard that miners are solving difficult mathematical problems—that’s not exactly true. What they’re actually doing is trying to be the first miner to come up with a 64-digit hexadecimal number (a «hash») that is less than or equal to the target hash. It’s basically guesswork.

The bad news: It’s guesswork, but with the total number of possible guesses for each of these problems being on the order of trillions, it’s incredibly arduous work. In order to solve a problem first, miners need a lot of computing power. To mine successfully, you need to have a high «hash rate,» which is measured in terms of megahashes per second (MH/s), gigahashes per second (GH/s), and terahashes per second (TH/s).

That is a great many hashes.

If you want to estimate how much bitcoin you could mine with your mining rig’s hash rate, the site Cryptocompare offers a helpful calculator.

Mining and Bitcoin Circulation

In addition to lining the pockets of miners and supporting the Bitcoin ecosystem, mining serves another vital purpose: It is the only way to release new cryptocurrency into circulation. In other words, miners are basically «minting» currency. For example, as of Nov. 2020, there were around 18.5 million bitcoins in circulation.

Aside from the coins minted via the genesis block (the very first block, which was created by founder Satoshi Nakamoto), every single one of those bitcoins came into being because of miners. In the absence of miners, Bitcoin as a network would still exist and be usable, but there would never be any additional bitcoin. There will eventually come a time when Bitcoin mining ends; per the Bitcoin Protocol, the total number of bitcoins will be capped at 21 million.

However, because the rate of bitcoin «mined» is reduced over time, the final bitcoin won’t be circulated until around the year 2140. This does not mean that transactions will cease to be verified. Miners will continue to verify transactions and will be paid in fees for doing so in order to keep the integrity of Bitcoin’s network.

Aside from the short-term Bitcoin payoff, being a coin miner can give you «voting» power when changes are proposed in the Bitcoin network protocol. In other words, miners have a degree of influence on the decision-making process on such matters as forking.

How Much a Miner Earns

The rewards for Bitcoin mining are reduced by half every four years. When bitcoin was first mined in 2009, mining one block would earn you 50 BTC. In 2012, this was halved to 25 BTC. By 2016, this was halved again to 12.5 BTC. On May 11, 2020, the reward halved again to 6.25 BTC. In November of 2020, the price of Bitcoin was about $17,900 per bitcoin, which means you’d earn $111,875 (6.25 x 17,900) for completing a block. Not a bad incentive to solve that complex hash problem detailed above, it might seem.

If you want to keep track of precisely when these halvings will occur, you can consult the Bitcoin Clock, which updates this information in real-time. Interestingly, the market price of Bitcoin has, throughout its history, tended to correspond closely to the reduction of new coins entered into circulation. This lowering inflation rate increased scarcity and historically the price has risen with it.

If you are interested in seeing how many blocks have been mined thus far, there are several sites, including Blockchain.info, that will give you that information in real-time.

What Do I Need To Mine Bitcoins?

Although early on in Bitcoin’s history individuals may have been able to compete for blocks with a regular at-home computer, this is no longer the case. The reason for this is that the difficulty of mining Bitcoin changes over time.

In order to ensure the smooth functioning of the blockchain and its ability to process and verify transactions, the Bitcoin network aims to have one block produced every 10 minutes or so. However, if there are one million mining rigs competing to solve the hash problem, they’ll likely reach a solution faster than a scenario in which 10 mining rigs are working on the same problem. For that reason, Bitcoin is designed to evaluate and adjust the difficulty of mining every 2,016 blocks, or roughly every two weeks.

When there is more computing power collectively working to mine for bitcoins, the difficulty level of mining increases in order to keep block production at a stable rate. Less computing power means the difficulty level decreases. To get a sense of just how much computing power is involved, when Bitcoin launched in 2009 the initial difficulty level was one. As of Nov. 2019, it is more than 13 trillion.

All of this is to say that, in order to mine competitively, miners must now invest in powerful computer equipment like a GPU (graphics processing unit) or, more realistically, an application-specific integrated circuit (ASIC). These can run from $500 to the tens of thousands. Some miners—particularly Ethereum miners—buy individual graphics cards (GPUs) as a low-cost way to cobble together mining operations.

The photo below is a makeshift, homemade mining machine. The graphics cards are those rectangular blocks with whirring fans. Note the sandwich twist-ties holding the graphics cards to the metal pole. This is probably not the most efficient way to mine, and as you can guess, many miners are in it as much for the fun and challenge as for the money.

The «Explain It Like I’m Five» Version

The ins and outs of Bitcoin mining can be difficult to understand as is. Consider this illustrative example of how the hash problem works: I tell three friends that I’m thinking of a number between one and 100, and I write that number on a piece of paper and seal it in an envelope. My friends don’t have to guess the exact number; they just have to be the first person to guess any number that is less than or equal to the number I am thinking of. And there is no limit to how many guesses they get.

Let’s say I’m thinking of the number 19. If Friend A guesses 21, they lose because of 21>19. If Friend B guesses 16 and Friend C guesses 12, then they’ve both theoretically arrived at viable answers, because of 16

What Is a «64-Digit Hexadecimal Number»?

Well, here is an example of such a number:

The number above has 64 digits. Easy enough to understand so far. As you probably noticed, that number consists not just of numbers, but also letters of the alphabet. Why is that?

To understand what these letters are doing in the middle of numbers, let’s unpack the word «hexadecimal.»

As you know, we use the «decimal» system, which means it is base 10. This, in turn, means that every digit of a multi-digit number has 10 possibilities, zero through nine.

«Hexadecimal,» on the other hand, means base 16, as «hex» is derived from the Greek word for six and «deca» is derived from the Greek word for 10. In a hexadecimal system, each digit has 16 possibilities. But our numeric system only offers 10 ways of representing numbers (zero through nine). That’s why you have to stick letters in, specifically letters a, b, c, d, e, and f.

If you are mining Bitcoin, you do not need to calculate the total value of that 64-digit number (the hash). I repeat: You do not need to calculate the total value of a hash.

So, what do «64-digit hexadecimal numbers» have to do with Bitcoin mining?

Remember that ELI5 analogy, where I wrote the number 19 on a piece of paper and put it in a sealed envelope?

In Bitcoin mining terms, that metaphorical undisclosed number in the envelope is called the target hash.

What miners are doing with those huge computers and dozens of cooling fans is guessing at the target hash. Miners make these guesses by randomly generating as many «nonces» as possible, as fast as possible. A nonce is short for «number only used once,» and the nonce is the key to generating these 64-bit hexadecimal numbers I keep talking about. In Bitcoin mining, a nonce is 32 bits in size—much smaller than the hash, which is 256 bits. The first miner whose nonce generates a hash that is less than or equal to the target hash is awarded credit for completing that block and is awarded the spoils of 6.25 BTC.

In theory, you could achieve the same goal by rolling a 16-sided die 64 times to arrive at random numbers, but why on earth would you want to do that?

The screenshot below, taken from the site Blockchain.info, might help you put all this information together at a glance. You are looking at a summary of everything that happened when block #490163 was mined. The nonce that generated the «winning» hash was 731511405. The target hash is shown on top. The term «Relayed by Antpool» refers to the fact that this particular block was completed by AntPool, one of the more successful mining pools (more about mining pools below).

As you see here, their contribution to the Bitcoin community is that they confirmed 1768 transactions for this block. If you really want to see all 1768 of those transactions for this block, go to this page and scroll down to the heading «Transactions.»

«So how do I guess at the target hash?»

All target hashes begin with zeros—at least eight zeros and up to 63 zeros.

There is no minimum target, but there is a maximum target set by the Bitcoin Protocol. No target can be greater than this number:

Here are some examples of randomized hashes and the criteria for whether they will lead to success for the miner:

«How do I maximize my chances of guessing the target hash before anyone else does?»

You’d have to get a fast mining rig, or, more realistically, join a mining pool—a group of coin miners who combine their computing power and split the mined Bitcoin. Mining pools are comparable to those Powerball clubs whose members buy lottery tickets en masse and agree to share any winnings. A disproportionately large number of blocks are mined by pools rather than by individual miners.

In other words, it’s literally just a numbers game. You cannot guess the pattern or make a prediction based on previous target hashes. The difficulty level of the most recent block at the time of writing is about 17.59 trillion, meaning that the chance of any given nonce producing a hash below the target is one in 17.59 trillion. Not great odds if you’re working on your own, even with a tremendously powerful mining rig.

«How do I decide whether Bitcoin will be profitable for me?»

Not only do miners have to factor in the costs associated with expensive equipment necessary to stand a chance of solving a hash problem. They must also consider the significant amount of electrical power mining rigs utilize in generating vast quantities of nonces in search of the solution. All told, Bitcoin mining is largely unprofitable for most individual miners as of this writing. The site Cryptocompare offers a helpful calculator that allows you to plug in numbers such as your hash speed and electricity costs to estimate the costs and benefits.

What Are Coin Mining Pools?

Mining rewards are paid to the miner who discovers a solution to the puzzle first, and the probability that a participant will be the one to discover the solution is equal to the portion of the total mining power on the network.

Participants with a small percentage of the mining power stand a very small chance of discovering the next block on their own. For instance, a mining card that one could purchase for a couple of thousand dollars would represent less than 0.001% of the network’s mining power. With such a small chance at finding the next block, it could be a long time before that miner finds a block, and the difficulty going up makes things even worse. The miner may never recoup their investment. The answer to this problem is mining pools.

Mining pools are operated by third parties and coordinate groups of miners. By working together in a pool and sharing the payouts among all participants, miners can get a steady flow of bitcoin starting the day they activate their miners. Statistics on some of the mining pools can be seen on Blockchain.info.

«I’ve done the math. Forget mining. Is there a less onerous way to profit from cryptocurrencies?»

As mentioned above, the easiest way to acquire Bitcoin is to simply buy it on one of the many exchanges. Alternately, you can always leverage the «pickaxe strategy.» This is based on the old saw that during the 1849 California gold rush, the smart investment was not to pan for gold, but rather to make the pickaxes used for mining.

To put it in modern terms, invest in the companies that manufacture those pickaxes. In a cryptocurrency context, the pickaxe equivalent would be a company that manufactures equipment used for Bitcoin mining. You may consider looking into companies that make ASICs equipment or GPUs instead, for example.

Is Bitcoin Mining Legal?

The legality of Bitcoin mining depends entirely on your geographic location. The concept of Bitcoin can threaten the dominance of fiat currencies and government control over the financial markets. For this reason, Bitcoin is completely illegal in certain places.

Bitcoin ownership and mining are legal in more countries than not. Some examples of places where it is illegal are Algeria, Egypt, Morocco, Bolivia, Ecuador, Nepal, and Pakistan. Overall, Bitcoin use and mining are legal across much of the globe.

Risks of Mining

The risks of mining are often that of financial risk and a regulatory one. As mentioned, Bitcoin mining, and mining in general, is a financial risk. One could go through all the effort of purchasing hundreds or thousands of dollars worth of mining equipment only to have no return on their investment. That said, this risk can be mitigated by joining mining pools. If you are considering mining and live in an area that it is prohibited you should reconsider. It may also be a good idea to research your countries regulation and overall sentiment towards cryptocurrency before investing in mining equipment.

One additional potential risk from the growth of Bitcoin mining (and other proof-of-work systems as well) is the increasing energy usage required by the computer systems running the mining algorithms. While microchip efficiency has increased dramatically for ASIC chips, the growth of the network itself is outpacing technological progress. As a result, there are concerns about the environmental impact and carbon footprint of Bitcoin mining.

There are, however, efforts to mitigate this negative externality by seeking cleaner and green energy sources for mining operations (such as geo-thermal or solar), as well as utilizing carbon offset credits. Switching to less energy-intensive consensus mechanisms like proof-of-stake (PoS), which Ethereum is planning to do, is another strategy; however, PoS comes with its own set of drawbacks and inefficiencies.

Источник

:max_bytes(150000):strip_icc()/dotdash_Final_How_Does_Bitcoin_Mining_Work_Dec_2020-01-bd91c1773e5d4320b9b0e3cee1ecc4fd.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_How_Does_Bitcoin_Mining_Work_Dec_2020-02-5e922571968a41a29c1b01f5a15c2496.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_How_Does_Bitcoin_Mining_Work_Dec_2020-03-0a1fdb34570c49c4b56042e43d7559b3.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_How_Does_Bitcoin_Mining_Work_Dec_2020-04-2d73080ca35e4e3bab0455cac17026de.jpg)

:max_bytes(150000):strip_icc()/image51-d8924573410e4d2eb57df671690baf3a.png)